Look What You've Done for TaxCycle This Year (2019-20)

Your suggestions and feedback inspired many of the enhancements to TaxCycle over the past year. In case you didn't read each set of release notes in detail, scroll down for the long list of the big and small enhancements you inspired in TaxCycle lately. Thank you for your support!

Electronic Signatures

Even before the Canada Revenue Agency (CRA) temporarily recognized e-signatures as having met the signature requirements on certain forms, we heard from our customers that they wanted e-signatures in TaxCycle. Over the course of the 2019 T1 filing season, we added support for Electronic Signatures with DocuSign® and Signatures in Adobe® Reader to the following forms:

T1

- AuthRep (formerly T1013)

- MR-69 (Québec)

- Engagement letter (ELetter)

- T183 (both the filing and PAD signature fields)

- T1032

- T1135

- T2091

- T1255

- TP-274

- TP-1000 (Québec)

- T1-ADJ

- T1-DD

T2

- AuthRepBus

- AuthRepBusCancel

- T183 (CORP)

- AT4930

- CO-1000 (Québec)

- T106

- T1134

- T1135

- Engagement Letter (ELetter)

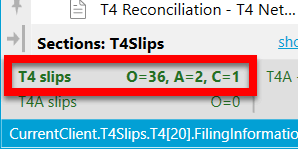

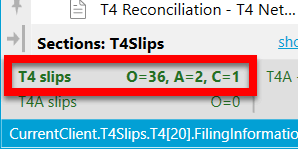

Data Monitors in Slips Returns

The 2020 TaxCycle slips modules (T4/T4A, T5 and T5018) include a new data monitor to display a count of the original (O), amended (A) and cancelled (C) slips.

To add this data monitor to your window:

- Open a 2020 T4/T4A, T5 or T5018 return.

- Right-click in a data monitor cell at the bottom of the window.

- Select Presets.

- Choose T4 slips (or the type of slips you want to monitor).

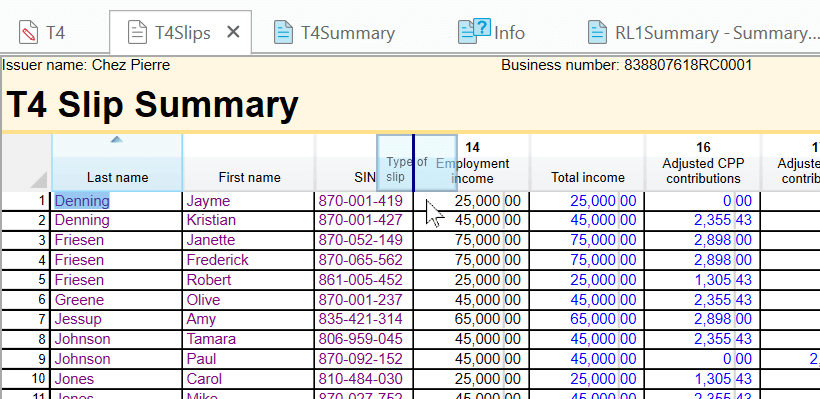

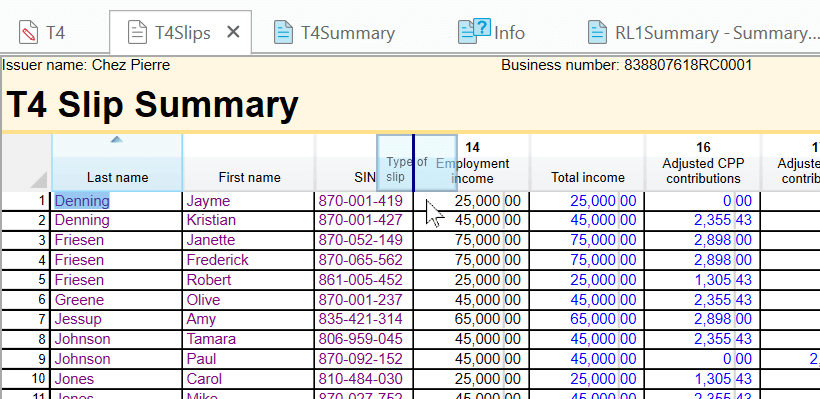

Sorting on Slips Summaries

As we released the new 2020 slips modules, we have upgraded the slips summaries to allow for customizing the display and sorting of columns on the Slips summaries. To learn more about these improved summaries, see the Slips Summary help topic.

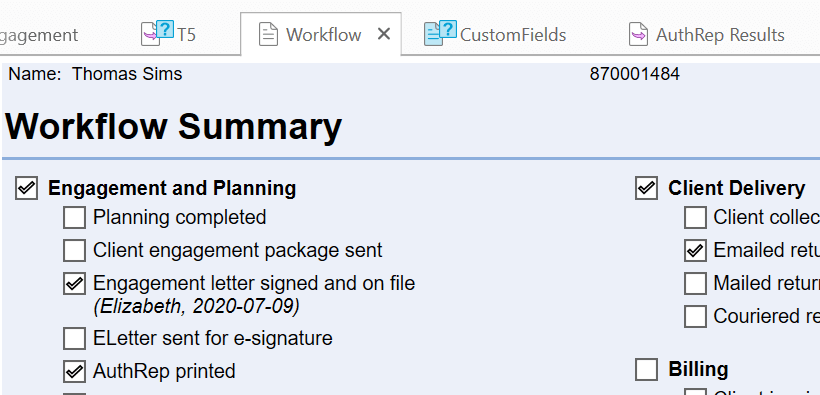

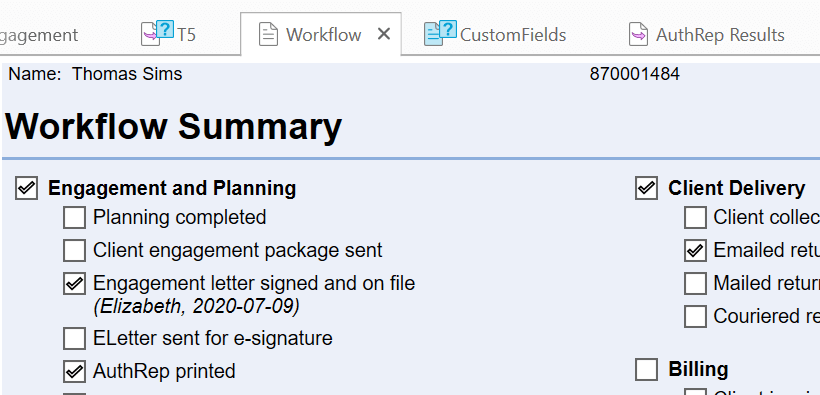

Workflow Summary

The new Workflow summary shows the current status of tasks for your clients. It provides the information that appears in the Workflow sidebar in a printable format.

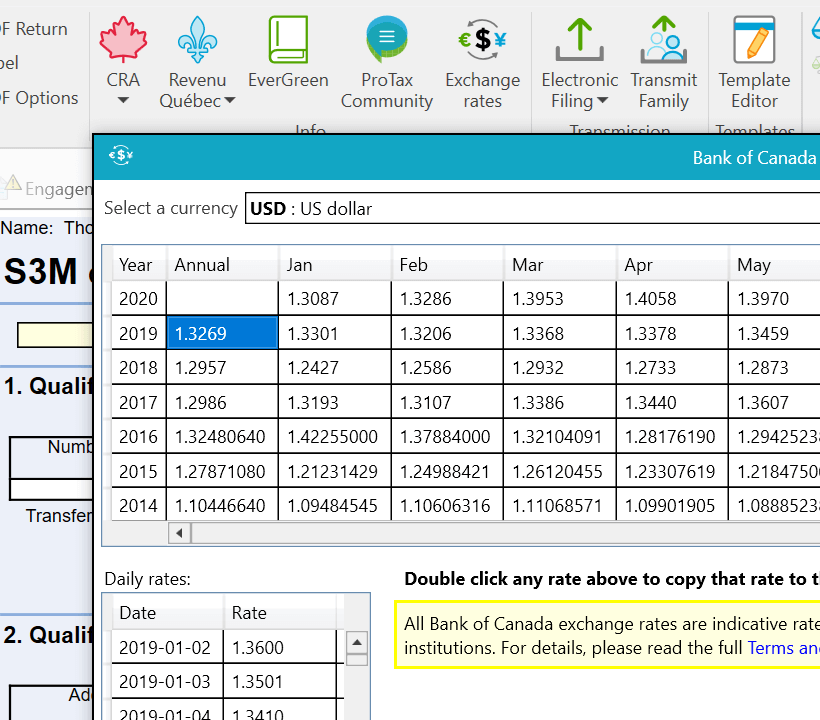

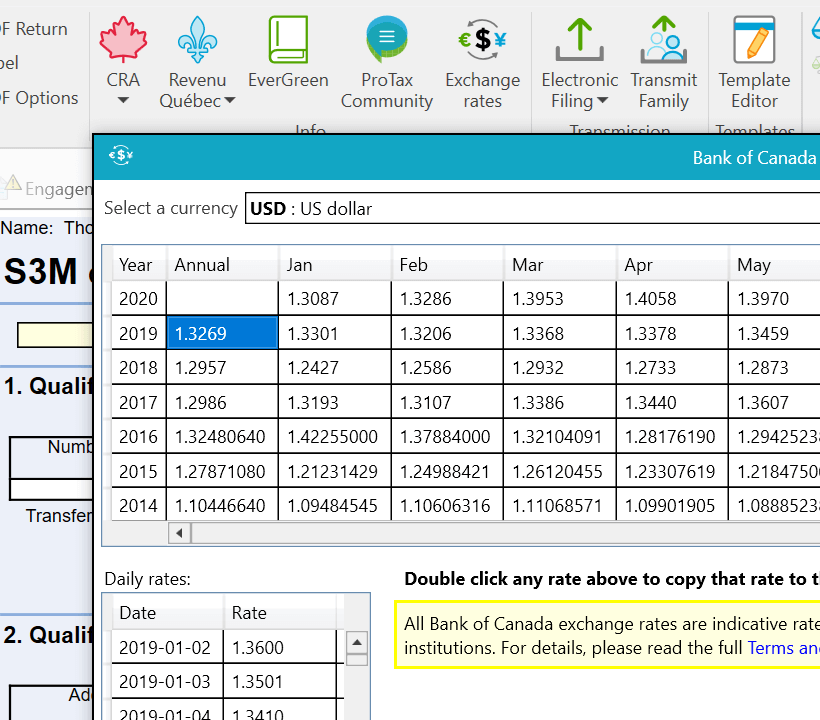

Exchange Rate Tool

This year we added a new tool for viewing and selecting foreign exchange rates on forms such as the S3M. This is available on any form with an exchange rate field in TaxCycle. Place your cursor in the field, then go to the Tools menu and click Exchange Rates. Read the section on this new tool in the Foreign Income and Tax Credits help topic.

TaxCycle T1

- A new Guaranteed Income Supplement (GIS) worksheet to estimate the maximum GIS entitlement for low-income pensioners or those who qualify for an allowance based on the applicable T1 income.

- A new Scenario summary for creating and comparing possible tax situations.

- A new T1 and TP1 Client copy print set for printing both T1 and TP1 returns at the same time.

- New Lock Form and Unlock Form buttons on the Security menu for locking data on the T1 Planner worksheet.

- On the T2125, new review messages for transfers from a T5013 that indicate which parts of the form are applicable in the case of business income from a partnership.

- On the T1 Support Payments worksheet, a new suggestion message is triggered when the description, name, or social insurance number fields are blank.

- A new warning message appears on the T1 Income worksheet and T1 Deductions worksheet when the worksheet contains a description but no amounts.

- A new table on the T746 for entering unused RRSP, PRPP, and SPP contributions in multiple years.

- Form RC151 GST/HST, Credit application for individuals who become new residents of Canada, and new prior year income fields on the Immigrant worksheet to support this form.

- Joint and Family Summaries for Québec residents.

- A New File option to carry forward the Return ID.

- An Interest and Penalty worksheet in 2016 and 2017 (previously only in 2018 and 2019).

- Automatic calculation of a "catch-up" payment on the Instalment worksheet for instalments due based on the signing date of the tax return.

- A new snippet (DQCSummary) for TP1 information in the T1 client letters for deceased taxpayers (DLetter).

- A checklist for Tax on Split Income (TOSI) in the Pre-Season (PreSeason, JPreSeason, FPreSeason) and Post-Season (PostSeason, JPostSeason, FPostSeason) letters.

- In the T1 client letters (CLetter and JLetter), a revised tuition transfer paragraph that shows the federal or provincial credit only when it applies to the return.

TaxCycle T2

- Billing and invoicing for corporate tax returns from TaxCycle T2 and export of invoices to QuickBooks®.

- On the Info worksheet, a new field for entering the GST/HST access number.

- On the T2PaymentDueDateWS, automatic adjustment of due dates to Monday if the date falls on a Saturday or a Sunday.

- On Schedule 7, a new entry in the drop-down menu at lines 405 and 425 to match the partnership name entered on line 200.

- On the Instalment worksheet, the automatic calculation of a "catch-up" payment for instalments due based on the signing date of the tax return.

- A print-friendly version of the Instalment Worksheet (Federal, AT1 and CO-17).

TaxCycle T3

- S1 Manager for recording foreign capital gains.

- The new S9Ben Beneficiary Income Allocation Statement: a printable summary of beneficiary income that appears when you answer "No" to Question 6 on the Schedule 9.

- T3P Employees' Pension Plan Income Tax Return and electronic filing with Internet File Transfer (XML).

- T2000 Calculation of Tax on Agreements to Acquire Shares (section 207.1(5) of the Income Tax Act) and electronic filing with Internet File Transfer (XML).

- T244 Registered Pension Plan Annual Information Return.

- On the T3RCA, a new screen-only check box to Choose to elect under subsection 207.5(2) and enter data in Step 4 rather than automatically completing it.

- Support for foreign rental income on the T776.

- New review messages on the T2125 for transfers from a T5013 that indicate which parts of the form are applicable in the case of business income from a partnership.

- Additional support for the allocation of foreign income expenses to link them from the S9 Allocation Worksheet to the Foreign Tax Credit Worksheet, and corresponding allocations to the T3 Beneficiaries.

TaxCycle T5013

- On the Partner and Partner Interest worksheets, sorting and customizing of the table, similar to the new Slips summaries.

- On the Partner worksheet, a single table for all partner details, with a row for each partner (rather than two tables).

- On the T5013 jacket and slips, a longer name field for corporate partners.

- On the T5013Partner data entry slip, in the Schedule 50 and ACB section, an expandable table for the at-risk lines to allow for other adjustments that affect line 105 Limited partner's at-risk, ending amount.

- On the federal Schedule 50 (S50) and Québec Schedule A (TPA), performance enhancement for when printing, viewing and scrolling through lists with many partners.

- Full versus partial shield handling for Limited Liability Partnerships.

- Additional automation for Adjusted Cost Base (ACB) and at-risk.

- Functionality to create a stub period return in TaxCycle T5013.

TaxCycle T4, T5, T5018

- A new net employment income reconciliation worksheet for T4 slips.

- A new print set in T4 Print options for printing the T2200 and generating separate PDF files for each recipient.

TaxCycle Forms and TaxCycle RL

- NR7-R Application for Refund Part XIII Tax Withheld

- NR301 Declaration of eligibility for benefits (reduced tax) under a tax treaty for a non-resident person

- NR302 Declaration of eligibility for benefits (reduced tax) under a tax treaty for a partnership with non-resident partners

- NR303 Declaration of eligibility for benefits (reduced tax) under a tax treaty for a hybrid entity

- R102-R Regulation 102 Waiver Application

- R105 Regulation 105 Waiver Application

- RC473 Application for Non-Resident Employer Certification

- In TaxCycle RL, a new template for creating childcare expense receipts based on the information on RL-24 slips.

Options and Options Profiles

- New pages for data monitors, favourites and default form tabs in Options Profile (see the Migrating to a New Computer help topic to learn how to add yours).

- In Pricing options, new links for applying price increases to per-item/per-form pricing. Click the Increase prices by 1% and Decrease prices by 1% links to update all the prices in the list.

- In Print options for slips, a new Slip file name field for selecting variables for naming individual slips when using the option to Create one file for each recipient.

- In Print options for slips, generation of separate PDF files a Québec RL slip recipients.

- New Start Screen option to show the prior year as the primary module until the new tax season.

Client Manager

- In the Taxpayer group under Custom filters in Quick Searches sidebar, a new filter for displaying only search results for Non-principal taxpayers.