When you enter a trade-in allowance on the S8Asset, TaxCycle incorrectly reduces the class 10.1 capital cost by the amount of the trade-in.

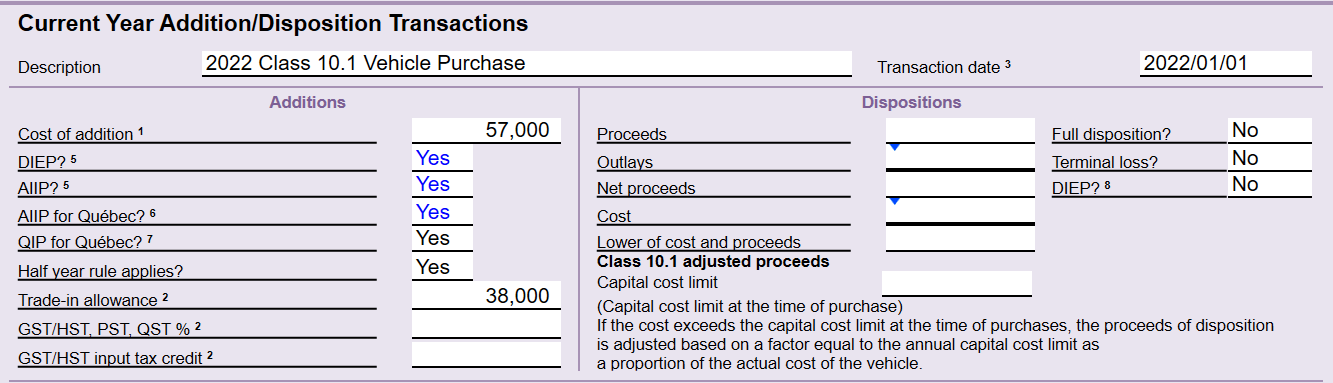

Price of class 10.1 vehicles: $57,000*

Purchase date: January 1, 2022

| Purchase price paid in cash | $19,000 |

| Trade in (payment in kind) | $38,000 |

| Total payment | $57,000 |

* 2022 class 10.1 ceiling amount = $34,000

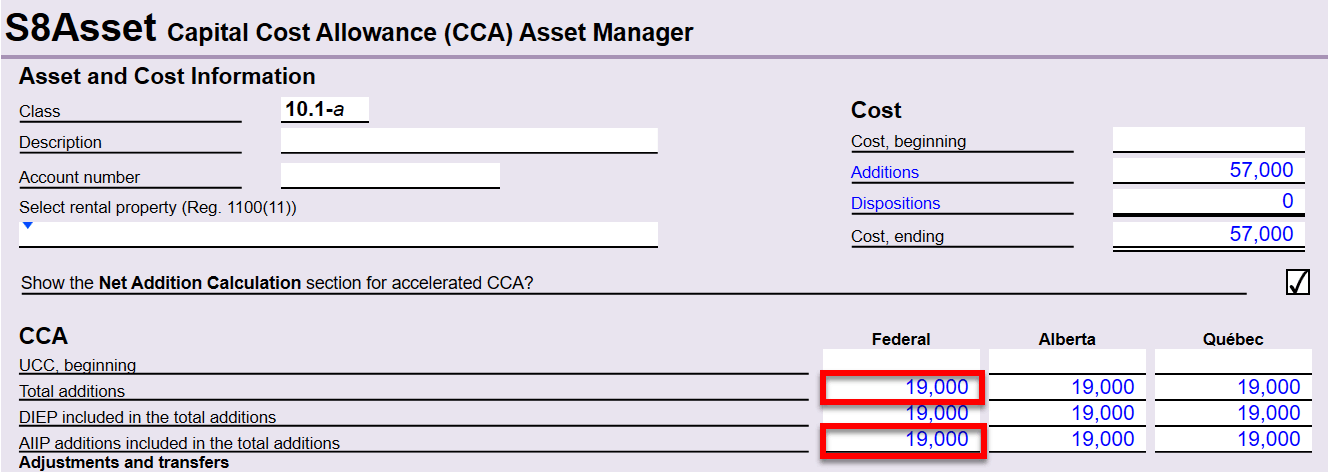

TaxCycle understates the capital cost as $19,000, which also causes an understated CCA claim.

The correct class 10.1 capital cost is $34,000, calculated as the lower of the gross purchase price of $57,000 and the 2022 class 10.1 ceiling amount of $34,000. The vehicle was paid for in cash and in kind. The trade-in is considered a payment in kind and must NOT reduce the capital cost.

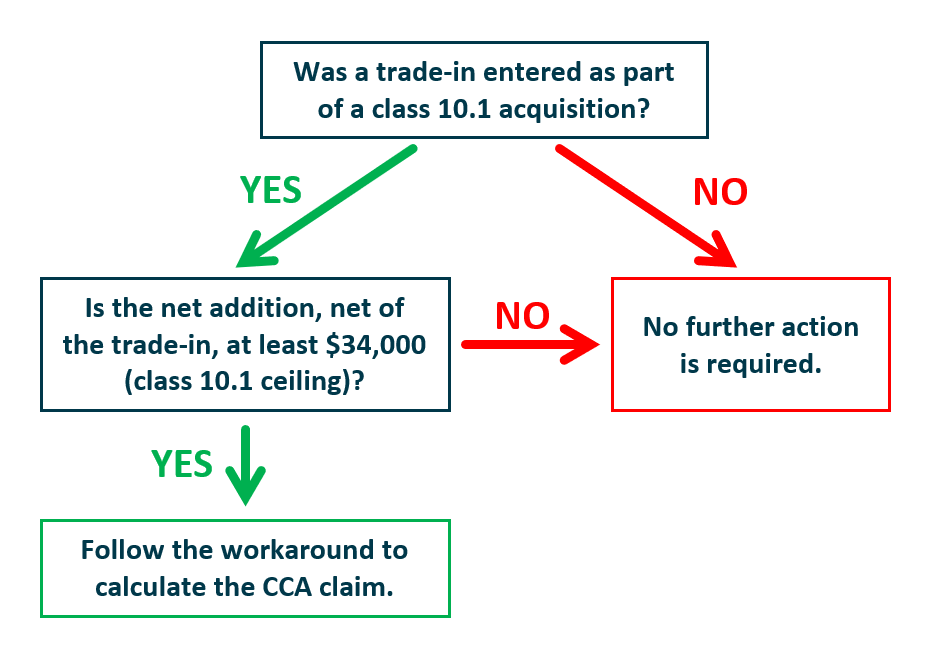

Note: If a class 10.1 acquisition does not involve a trade-in, or if the net capital cost after the trade-in is equal to or greater than the class 10.1 ceiling amount (the 2022 class 10.1 ceiling is $34,000), TaxCycle correctly calculates the capital cost amount.

In the example, the capital cost amount net of trade-in is $19,000 ($57,000 minus $38,000) and is less than the 2022 class 10.1 ceiling of $34,000. Therefore, the calculated class 10.1 capital cost is incorrect.

Alternatively, if the trade-in amount in this example was much lower, such as $7,000, the capital cost amount net of trade-in would be $50,000 ($57,000 minus $7,000), and is at least the class 10.1 ceiling amount or above. Therefore, TaxCycle correctly calculates the class 10.1 addition amount.

Use the following chart to decide whether to use the workaround when claiming class 10.1.

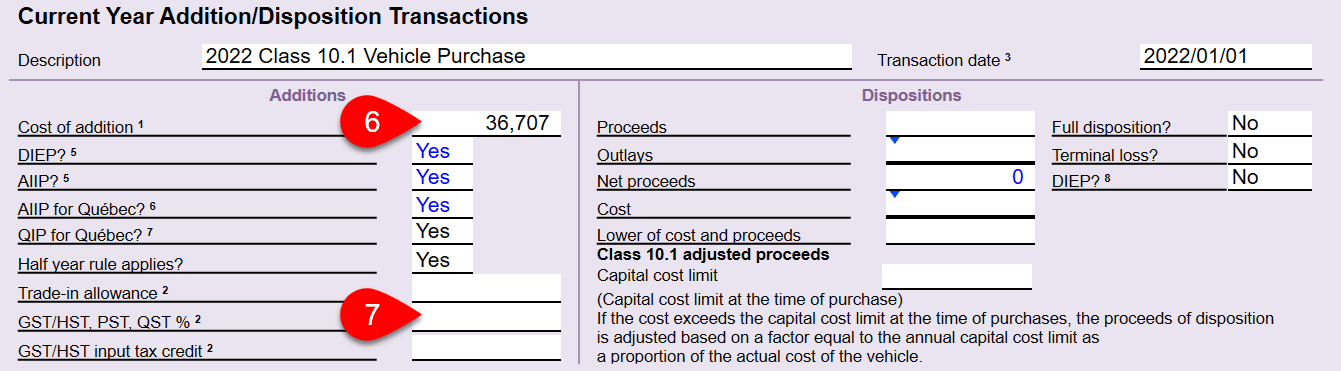

First, calculate the tax to be capitalized as part of the class 10.1 capital cost:

Next, calculate the correct capital cost:

Finally, enter the addition on the S8Asset:

This issue was resolved in the latest TaxCycle update.