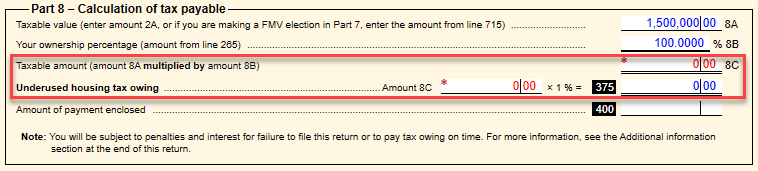

TaxCycle calculates Underused housing tax owing in Part 8 of the UHT-2900 (Underused Housing Tax Return and Election Form) when a qualifying exemption is claimed on the form. If an exemption applies, TaxCycle should calculate the amount of tax owing as 0.

For details on what types of residential properties are subject to the Underused Housing Tax and what types of properties are exempt, see the CRA’s Introduction to the Underused Housing Tax page. You can also reference this comprehensive chart from Video Tax News to determine when a property owner is required to file a UHT return and pay the underused housing tax.

Override the Taxable amount in Part 8 to calculate the tax owing as 0.

This issue was resolved in the latest TaxCycle update.