The Canada Revenue Agency (CRA) EFILE service closes on January 31, 2025, at 11:59 p.m. ET for annual system maintenance. You will not be able to file most types of returns and forms until the service reopens in late February 2025.

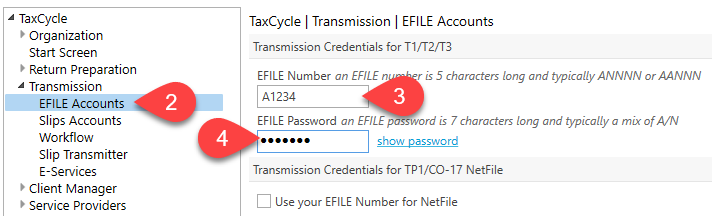

You can still transmit forms to authorize or cancel a representative, foreign reporting forms for corporations (T1135, T1134, and T106) and partnerships (T1135), and T2 returns during the closure if you have renewed your EFILE account, have passed CRA suitability screening, AND have entered your new password in TaxCycle Options.

Renewing or applying for an EFILE account can take up to 30 days so don’t delay if you want to be ready for the system opening in late February. If you do not renew your account before the CRA closes the EFILE system on January 31, 2025, at 11:59 p.m. ET, you will not be able to transmit forms to authorize or cancel a representative or file T2 returns until you pass suitability screening and receive your new password.

The only way to renew your account is online. Go to the CRA’s Yearly Renewal page and click on sign in. You will need your current EFILE number and password. Follow the instructions and click Submit when done. A new password will be provided in the response you’ll receive for completing the instructions. Enter it into TaxCycle’s options right away (see below). Until the system closes on January 31, 2025, this new password will continue to work for the prior-year EFILE services. After the system closes, you will only be able to transmit forms to authorize or cancel a representative, foreign reporting forms for corporations (T1135, T1134, and T106) and partnerships (T1135), and T2 return once you pass CRA suitability screening.

If you’re requesting an account for the first time, go to the CRA’s Apply for EFILE page and click on EFILE Registration Online form under How can I apply. Follow the instructions and click Submit when done.

If you renew on or after October 21, 2024, you must update your EFILE credentials in TaxCycle Options with your newly assigned password. If you DO NOT renew your account on or after October 21, 2024, you may continue to use your current password until January 31, 2025.

The CRA EFILE service will stop accepting transmissions of initial T1 personal income tax and benefit returns for years 2017 to 2023, as well as ReFILE adjustments returns for years 2020 to 2023 at 11:59 p.m. ET on Friday, January 31, 2025.

You must complete the T183 Form for each initial and amended T1 return you transmit. The CRA is revising the T183 for the 2025 filing year, so make sure to review the changes made when completing the form. We will update the T183 in TaxCycle once the revised version is available from the CRA.

To continue to transmit forms to authorize or cancel a representative, foreign reporting forms for corporations (T1135, T1134, and T106) and partnerships (T1135), and file T2 returns after January 31, 2025, you will need to have renewed your EFILE account, passed suitability screening, and updated TaxCycle with your newly assigned password (see above).

EFILE systems will open again in late February 2025.