TaxCycle 11.0.46016.0—Label Printing for Slip Recipients

This release of TaxCycle includes label printing for slip recipients, e-signatures on slip summaries and other changes in preparation for T1 EFILE opening in February.

To install this version immediately, download the full installer from our website or request a free trial. Once we enable the automatic update for this version, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options. (To deploy auto-update files from your network, see the Auto-Update Files page.)

Release Highlights

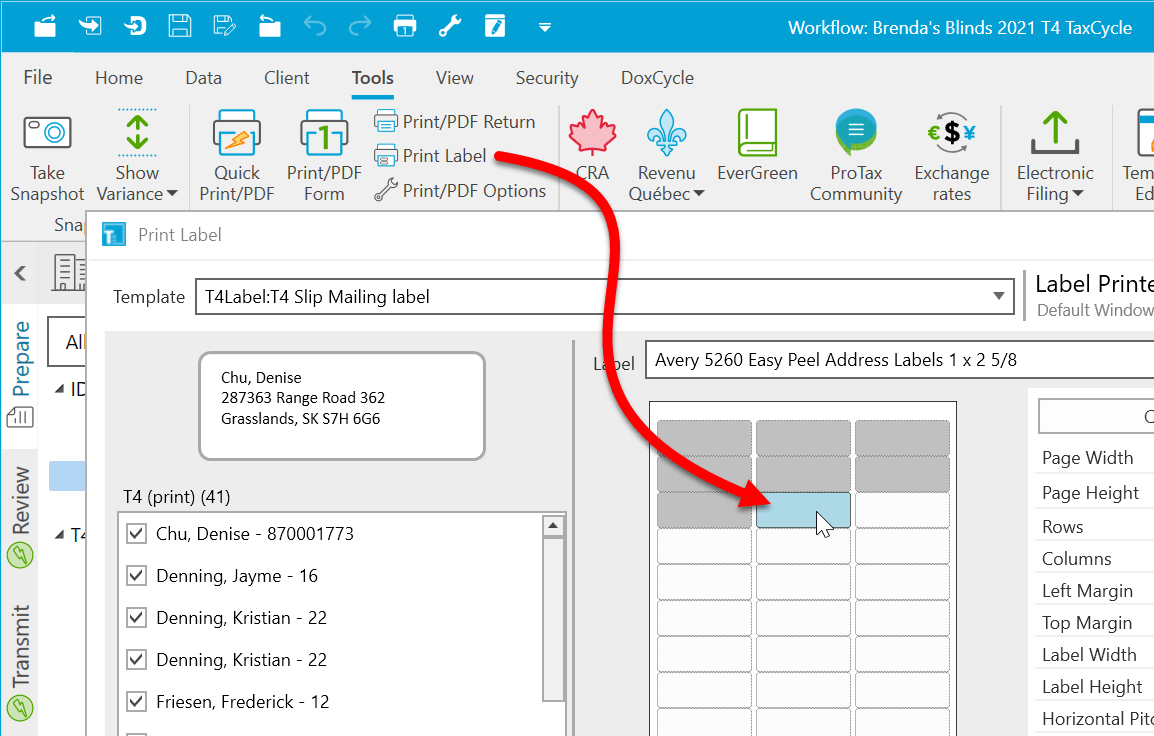

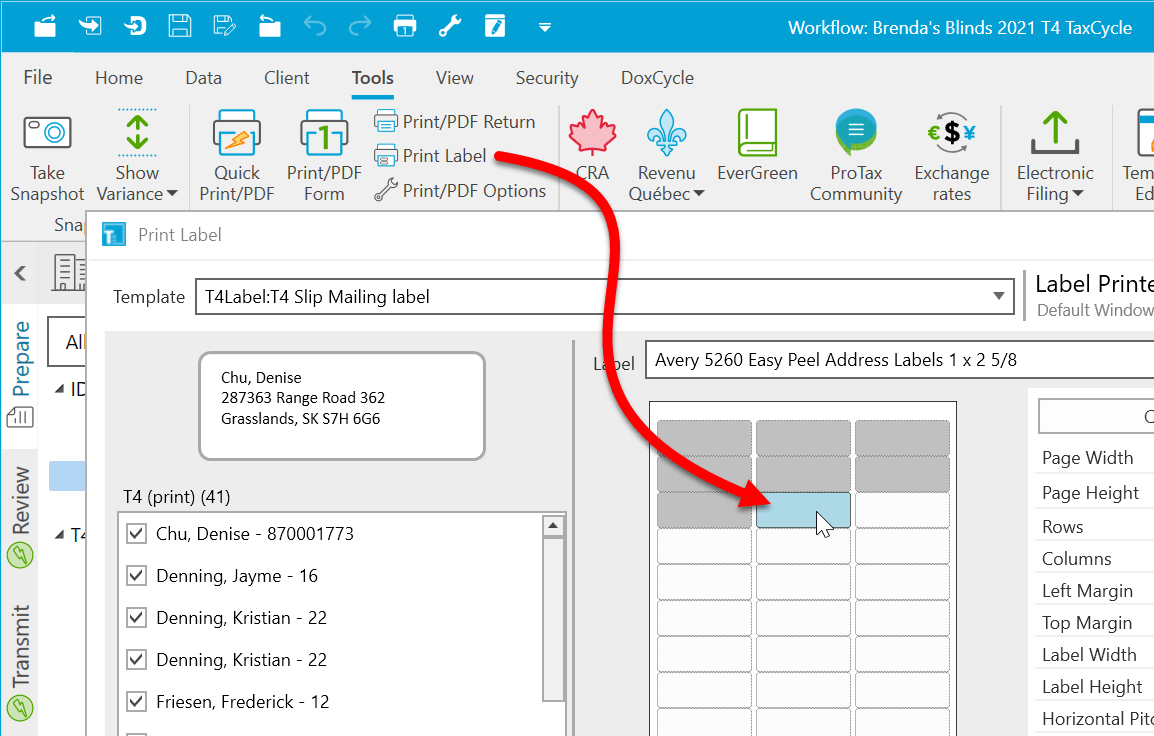

Label Printing for Slips

In response to a recent request on ProTaxCommunity, we've added label printing for individual slips to TaxCycle. Now, if you wish to send multiple slips in a larger envelope, you can quickly print labels for all recipients in a slips return. To learn how to get started, read the Print Labels for Slip Recipients help topic.

E-signatures on T4, T5, NR4 and T5018 Slip Summaries

This release adds support for requesting TaxFolder and DocuSign® e-signatures on the T4, T5, NR4 and T5018 slip summaries.

Electronic Submission of T1 AuthRep

Electronic submission of authorization requests (AuthRep) from TaxCycle T1 for 2021 will require you update to this release in order to transmit authorization requests starting February 7, 2022. All other T1 electronic filing types remain closed until February 21, 2022.

Removal of Preview Watermark From 2021 T1 Forms

With this release, we have removed the Preview watermark from most forms to allow you to mail any returns to CRA or Revenu Québec that are ready and which you do not want to or cannot yet transmit through EFILE.

The following forms still have the Preview watermark due to ongoing work:

- T2203, Provincial and Territorial Taxes for Multiple Jurisdictions

- T2042, Statement of Farming Activities

- AgriStability/AgriInvest forms (T1163/1164 and T1273/1274)

Farming-related forms remain in preview state as we continue work on the new refundable tax credit for the “Return of fuel charge proceeds” to farmers, announced in the December 14, 2021, economic and fiscal update.

Customer-Requested Template Changes

- Updated the section of the Climate Action Incentive (CAI) in the 2021 T1 client letters (CLetter and JLetter).

- Added a paragraph to the T1 client letters to remind residents of Ontario to save receipts from travel expenses in Ontario during 2022. We also added an item to the checklist in the 2021 post-season letters (in the 2021 PostSeasonDocs snippet), and will add a similar item to the 2022 pre-season letter (in the 2022 PreSeasonDocs snippet, once available).

- Removed the reference to sign form TX19 when paper filing a return from the T1 client letters (CLetter and JLetter).

- Added subject lines to the 2021 pre-season and post-season letters and to the 2020 post-season letters in TaxCycle T1.

- Fixed the dates in the supporting documents checklist snippet for 2020 and 2021 post-season letters for TaxCycle T1. (As reported on protaxcommunity.com.)

TaxFolder-Related Changes

This release includes the following enhancements in TaxCycle to coincide with the recent TaxFolder update:

- The view link in the banner above forms sent to TaxFolder no longer shows if the preparer later deletes the request from within TaxFolder.

- To improve performance, secure uploads from TaxCycle to TaxFolder no longer pass through taxfolder.com before going to Amazon S3 storage.

This release adds Québec form LM-1.A-V, Request for Cancellation or Variation of Registration. This form is the equivalent of the federal RC-145.

Resolved Issues

- Improvements made to the process for automatically entering the path to the XML file when filing slips using CRA Internet File Transfer (XML). This change also affects attaching files for e-Courier and other services.

- T5013—Resolved an issue where the slip view for the T5013Partner and RL15Partner refreshed slowly while waiting for the result of a another calculation. It now refreshes instantly.

Status of 2021 Federal Returns and Slips

- T1—You may begin data entry. EFILE opens on February 21, 2022.

- T2—Certified to file tax year ends up to May 31, 2022.

- T3RET—In progress. XML transmission via Internet File Transfer is no longer available. The CRA is in the process of converting the filing system to EFILE. Wait to file 2021 returns and file any remaining prior year returns on paper. Forms will be updated to latest versions later in February, once approved by the CRA.

- T3 slips—In progress. Wait to file 2021 returns.

- NR4 (in T3 module)—In progress. Wait to file 2021 returns.

- T4—Ready for filing.

- T4A—Ready for filing.

- T4PS—Ready for filing.

- T4A-RCA—Ready for filing.

- T5—Ready for filing.

- T5013-FIN—In progress. Wait to file 2021 returns.

- T5013 slip summary—In progress. Wait to file 2021 returns.

- T5018—Ready for filing.

- NR4 slips (standalone NR4 module)—Ready for filing.

- T4A-NR slips (in NR4 module)—Ready for filing.

- T3010—Ready for filing.

Status of 2021 Québec Returns and Relevés

- TP1—You may begin data entry. NetFile opens on February 21, 2022.

- TP-646—In progress. Wait to file 2021 returns. Forms will be updated to the latest versions later in February.

- RL-16—In progress. Wait to file 2021 returns.

- RL-1—Ready for filing.

- RL-2—Ready for filing.

- RL-3—Ready for filing.

- TP-600—In progress. Wait to file 2021 returns.

- RL-15—In progress. Wait to file 2021 returns.

- RL-24—Ready for filing.

- RL-31—Ready for filing.

- TP-985.22—Ready for filing.

Status of File Carryforwards from 2020 to 2021

As of this release, the following 2020 to 2021 carryforwards are up to date. However, we strongly recommend you only perform batch carryforward on tax modules that are ready for filing, as listed below.

Ready for batch carryforward:

- T1/TP1—TaxCycle, ProFile®, Taxprep®, Cantax®, DT Max®

- T2/CO-17—Carryforwards from TaxCycle, ProFile®, Taxprep®, Cantax®, DT Max®, creating files with year ends up until May 31, 2022

- T4, T4A, RL-1/RL-2—TaxCycle, ProFile®, Taxprep®, Cantax®

- T4PS—TaxCycle, ProFile®, Taxprep®, Cantax®

- T4A-RCA—TaxCycle, ProFile®

- T5, RL-3—TaxCycle, ProFile®, Taxprep®, Cantax®

- T2202—ProFile®, Taxprep®

- T5018—TaxCycle, ProFile®, Taxprep®, Cantax®

- T3010/TP-985.22—TaxCycle, ProFile®, Taxprep®, Cantax®

- NR4—TaxCycle, ProFile®, Taxprep®, Cantax®

- Forms—TaxCycle, ProFile®, Taxprep®, Cantax®

- RL—TaxCycle, ProFile®, Taxprep®, Cantax®

Wait for batch carryforward:

- T3/TP-646, RL-16—TaxCycle, ProFile®, Taxprep®, Cantax®, DT Max®

- T5013/TP-600, RL-15—TaxCycle, ProFile®, Taxprep®, Cantax®