On June 22, 2023, Bill C-47 received royal assent, making electronic filing mandatory for T2 returns with tax years starting after 2023.

Previously, when a corporation’s gross revenue exceeded $1 million, the T2 return had to be electronically filed unless the corporation was:

Bill C-47 eliminates the $1 million threshold, making internet filing for T2 returns mandatory regardless of the corporation’s gross revenue. This new rule comes into effect on January 1, 2024, and applies to any T2 returns with a tax year beginning after 2023.

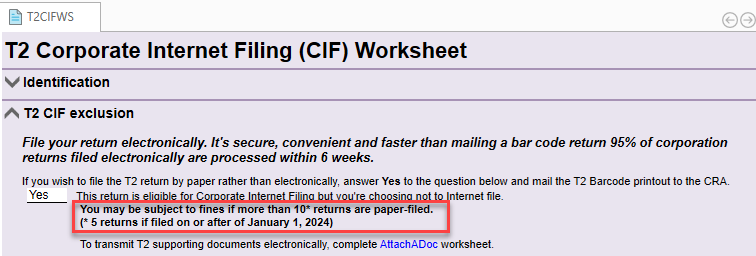

As of January 1, 2024, tax preparers may be subject to fines if they file more than five T2 returns by paper. TaxCycle T2 includes this message on the T2CIF worksheet. See the T2 Paper Filing help topic to learn more.

As of January 1, 2024, businesses may be subject to penalties if they file six or more T1 or T3 returns by paper.

The same rule applies to slips filing, where the threshold was previously fifty returns. As of January 1, 2024, businesses may be subject to penalties if they file six or more information returns (slips) by paper. This applies to NR4, T5018, T4A-NR, T5, T5013, T4A, T4, T3 and T2202 slips.

Refer to the CRA’s tax tips for more information on Mandatory Internet Filing and Penalties.

Starting on January 1, 2024, remittance payments exceeding $10,000 must be paid electronically. Making non-electronic payments of more than $10,000 may result in a penalty. Read How to remit (pay) on the CRA website to learn more.