Slips filing season is here. Each year at this time, we receive a lot of questions about the Account Number and Web Access Code (WAC) used for filing with the Canada Revenue Agency (CRA) Internet File Transfer (XML) and where to enter credentials in TaxCycle to transmit Québec RL slips.

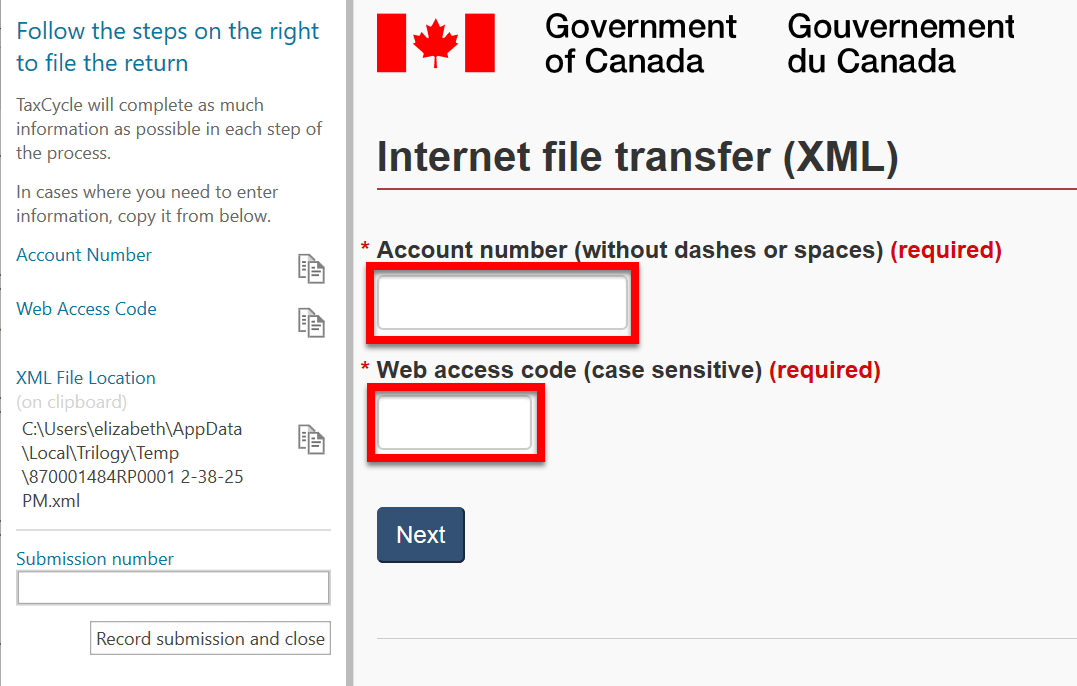

The CRA uses a combination of an Account Number and a Web Access Code (WAC) to allow you to access the system for uploading slips information returns to the CRA. These are used to log in to the transmission website and must be related to one another.

You can use the preparer’s Account Number and WAC, or the slip issuer’s Account number and WAC, provided they are a pair.

If you or your clients don’t have a Web Access Code, you can request one online from the CRA website. Visit the CRA website to request a Web Access Code (WAC).

You will need to provide an account number, a return type and financial information from the last original return filed for the previous tax year. (Or, if no return was filed, the date of registration.)

You can use either your WAC or your client’s WAC to file a return. The key is to always make sure to use an Account Number and Web Access Code that go together. This combination serves as the gatekeeper to let you into the online filing system before you upload files.

The Account Number and WAC you enter in Options are automatically inserted into the CRA web page when you start the filing process. If you want to use your client’s Account Number and WAC, leave these fields blank in Options so that you are asked to complete them upon filing. Then, enter the client’s Account Number and WAC when prompted.

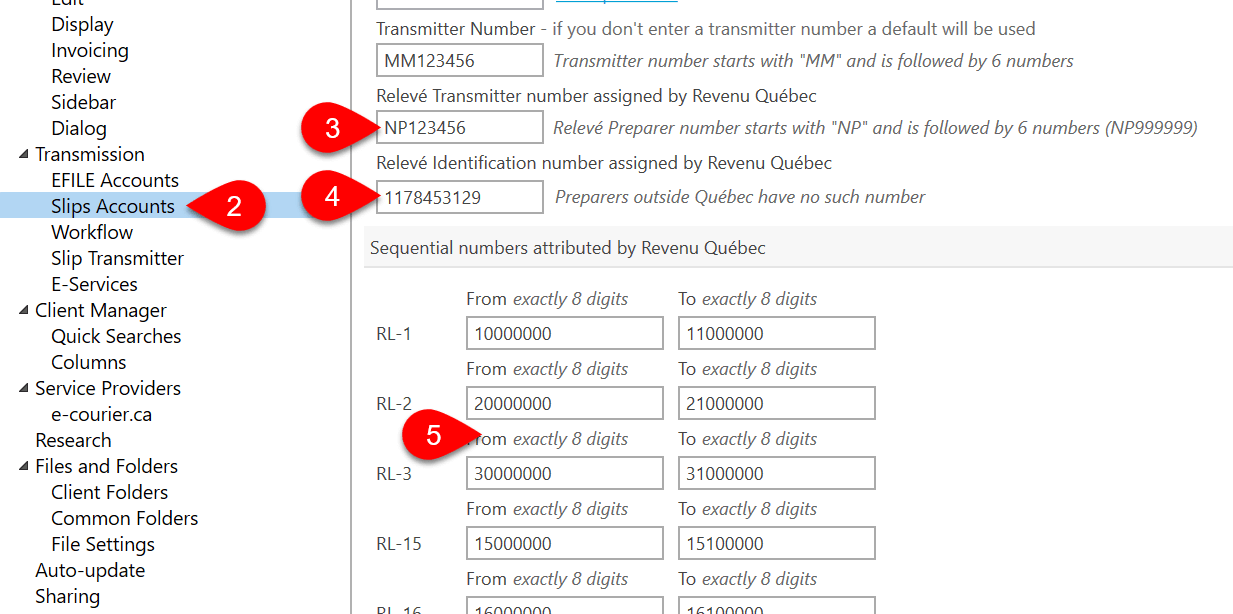

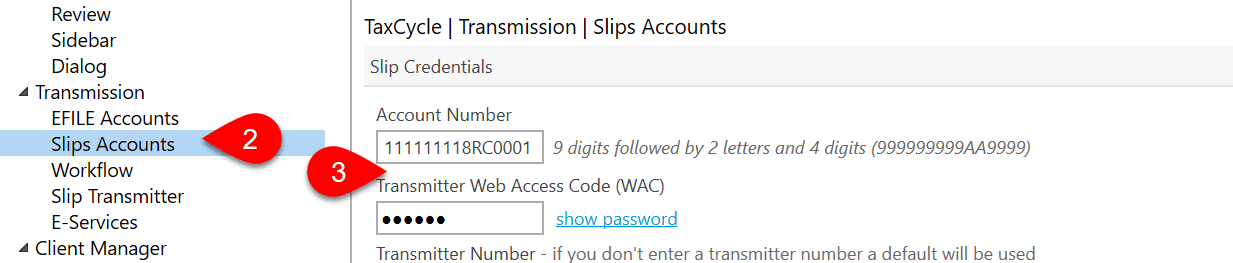

Before you can transmit, you must enter your credentials in TaxCycle Options: