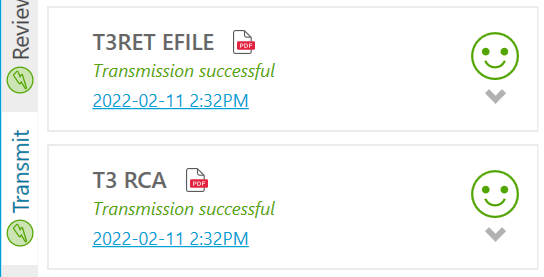

The Canada Revenue Agency (CRA) T3 EFILE system is now open! Please update to the latest version of TaxCycle to begin filing T3RET and T3RCA returns.

TaxCycle supports T3 EFILE for the following return types with fiscal periods ending in 2021 and after:

TaxCycle T3 includes an EFILE worksheet to help you identify any exclusion from electronic filing. For a list of exclusions and detailed instructions, please read the T3 EFILE help topic.

Preparers must complete a form T183TRUST Information Return for Electronic Filing of a Trust Return for each initial T3 return they transmit. The trustee, executor, liquidator or administrator must sign the return prior to transmission. For a detailed instructions, please read the T183TRUST help topic.

You may continue to file T3 and NR4 slips, as well as T2000 and T3P returns, using the CRA Internet File Transfer (XML) website. Québec TP-646 returns may only be filed on paper. RL-16 slips can be filed online through NetFile Québec.

Please also see CRA EFILE for electronic filers page for information about service availability.

As of December 23, 2021, you can no longer electronically file T3RET using the CRA Internet File Transfer (XML) method. If you still need to file a T3RET from a prior year, please file it on paper.