TaxCycle 11.1.46317.0—2022 Slips Modules (Revised)

This release rolls over T4/T4A, T5, T5018, T2202 and NR4 slips to 2022 and adds final multiple jurisdiction returns forms to TaxCycle T1 2021.

To install this version immediately, download the full installer from our website or request a free trial. Once we enable the automatic update for this version, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options. (To deploy auto-update files from your network, see the Auto-Update Files page.)

Release Highlights

Revisions

We originally released version 11.1.46297.0 on March 17, 2022, with the changes below. Upon enabling the automatic update, we added the following changes:

- Corrected an issue introduced in version 11.1.46297.0 where the estimated Climate Action Incentive Payment (CAIP) appeared on both spouses' worksheets and client letters.

- Resolved an issue where repeating the import of T3 slips from Auto-fill my return (AFR) replaced the name of the issuer with the word Issuer.

- Resolved an issue where modifying the data monitors in a T1 return while a T3 return was open caused the T3 return to show the T1 data monitors (and vice versa).

- The CRA amended Form T2043 to add Note 9 under Chart B for farms that operate in more than one province, at least one of which is in a designated province.

The CRA has approved multiple jurisdiction forms (T2203) in TaxCycle T1. We have removed the Preview watermark from the forms. You may now EFILE T1 returns containing these forms.

All other 2021 T1 forms were final in previous releases.

Other T1 Changes

- Guaranteed Income Supplement (GIS) worksheet

- Removed the one-time payment for seniors (T4 Line 205) from the GIS income test.

- Corrected the exempt income calculation (line 10 in the Income section), where it was incorrectly adding back income when there is a self-employment loss.

- T1A—Added support for electronic signatures.

Rollover of TaxCycle T4/T4A, T5, T2202, T5018 and NR4 to 2022

The new modules for T4/T4A, T5, T2202, T5018 and NR4 allow you to begin data entry for 2022 slips and related Québec RL slips. Please note the following:

- The government forms are the 2021 forms updated to include 2022 indexed amounts and budget changes announced or estimated based on the information we have at this time. A review message appears on the year-end date field and in a bulletin at the top of the forms to remind you of this.

- You can now carry forward 2021 TaxCycle files from these slips modules into 2022. This includes a new carryforward for the T2202 module that brings the information about the educational institution into the new year.

- You can use these modules to file 2022 slips now if you need to. They permit CRA Internet File Transfer (XML) and transmission of RL slips to Revenu Québec.

Added the following forms:

- RC243 Tax-Free Savings Account (TFSA) Return

- TP-1097-V Notice of Disposition or Proposed Disposition of Taxable Québec Property by an Individual

or Corporation Not Resident in Canada

Template Changes

- T1—Simplified the medical expenses paragraph in the client letter templates (CLetter, JLetter and DLetter) to remind taxpayers to retain receipts in case the CRA requests them. See the related thread on protaxcommunity.com for details.

- T1—Improved the wording in the donations carryforward paragraph in client letter templates (CLetter and JLetter), and added an extra condition to hide the Québec donations sentence when not applicable.

- T1—Changed the layout for the table of quarterly Climate Action Incentive Payments (CAIP) in client letter templates (CLetter and JLetter) to match the layout for GST/HST credit payments.

- T2—Removed the RC-59 section from the T2 client letter.

- T3—Removed mention of attaching a cheque to the return when filing and added a mention of making a payment to the CRA online or mailing a cheque to the CRA.

- T3—Added sections to support T1135 EFILE in the client letter.

- Template Editor—Use

{{format (CurrentClient.Info.Residency.ProvinceDec31Field,"text”)}} to display the province of residence with the space in the name. For example, this changes NewBrunswick to New Brunswick.

Customer Request

- T3—Added a date of birth field to T3 beneficiary forms for easier reference when determining when a beneficiary will receive trust amounts.

Resolved Issues

TaxFolder-Related Changes

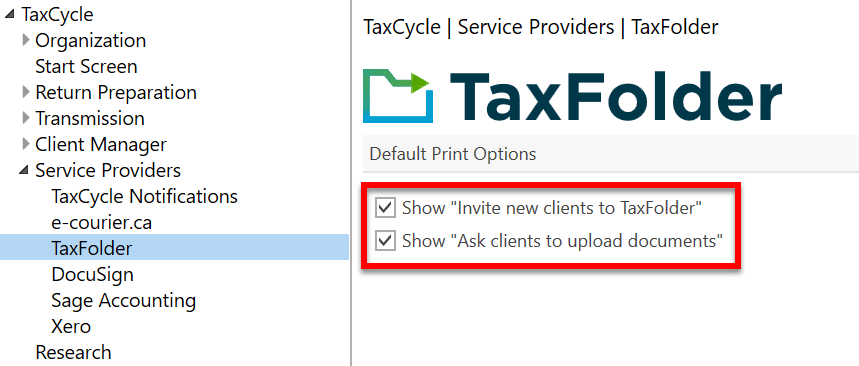

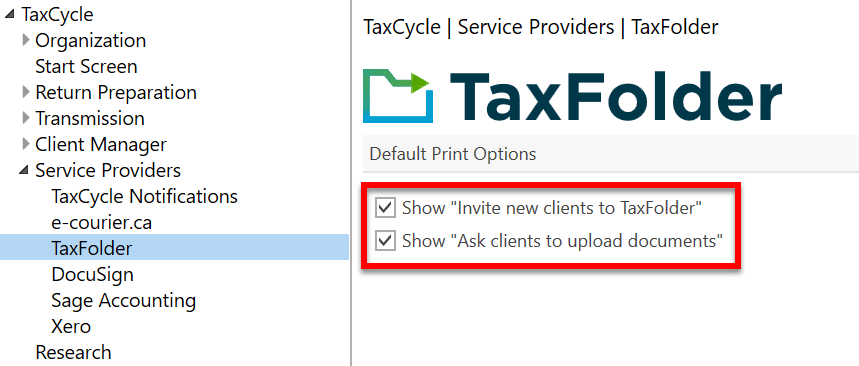

A new TaxFolder page in options allows you to show or hide check boxes on Printer and PDF Output Options.

- By default, both options are enabled (checked), and the Invite new clients to TaxFolder and Ask clients to upload documents check boxes show when printing a PDF to TaxFolder. You can then choose to send these email messages when printing to TaxFolder.

- Disabling (clearing) either of these check boxes in options hides and disables the related check box on the printer/output dialog box. The two related email messages are NEVER sent to your clients.

These new options work with the Notification Settings in TaxFolder. To disable invitation emails for all new clients, regardless of what you set in options or when printing, change the setting in TaxFolder.