TaxCycle 13.0.51961.0—2023 Slips Filing and CO-17 Forms

This major TaxCycle release is ready for filing 2023 slips when systems open on January 8, 2024. This version also extends the filing of Québec CO-17 returns with updated forms for 2023 and 2024.

To install this version immediately, download the full installer from our website or request a free trial. Once we enable the automatic update for this version, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options. (To deploy auto-update files from your network, see the Auto-Update Files page.)

Release Highlights

2023 Slips and Relevés Ready for Filing

The following 2023 federal slips and forms are ready for electronic filing with the Canada Revenue Agency (CRA) when systems open on January 8, 2024:

- T4 Statement of Remuneration Paid

- T4A Statement of Pension, Retirement, Annuity, and Other Income

- T5 Statement of Investment Income

- T5018 Statement of Contract Payments

- T2202 Tuition and Enrolment Certificate

- NR4 Statement of Amounts Paid or Credited to Non-Residents of Canada (in TaxCycle NR4 module, not T3 module)

- T4A-NR Payments to Non-Residents for Services Provided in Canada (in TaxCycle NR4)

Important! Before closing the transmission dialog box, make sure TaxCycle has copied the submission number from the CRA into the related field on the dialog box. If not, please manually copy the submission number from the CRA web page and paste it into the field. If you do not do this, you will see a message asking you to confirm with the CRA that they have received the return.

The following 2023 federal slips and forms are ready for paper filing with the CRA:

- T4PS Statement of Employee Profit-Sharing Plan Allocations and Payments

- T4A-RCA Statement of Distributions from a Retirement Compensation Arrangement (RCA)

The following 2023 Québec relevés are ready for filing with Revenu Québec:

- RL-1 Employment and Other Income

- RL-2 Retirement and Annuity Income

- RL-3 Investment Income

- RL-24 Childcare expenses

- RL-31 Information about a leased dwelling

Updated Forms

T4, Statement of Remuneration Paid

- T4—Added new box 45 for employer-offered dental benefits. This field is mandatory for 2023 and subsequent years.

- Also added a default field to the T4 filing information page.

- T4A—Added box 015, which becomes a mandatory field if data is entered in box 16. You will see a review message if you enter an amount in box 16 but do not fill out box 015.

- T4 and T4Summary—Added new boxes 16A and 17A, two additional CPP and QPP boxes that will become applicable for the 2024 slips filing year. You cannot edit these boxes as they are included to reflect the CRA’s latest version of the form, which includes both fields.

Updated CO-17 Forms Approved for Filing

Revenu Québec has approved TaxCycle T2 to support the filing of Québec CO-17 returns with new and updated forms for 2023 and 2024.

COR-17.W, Keying Summary for the Corporation Income Tax Return

- Added lines 44b 1, 44b 2, 44b 3 and 44b 4 to the CO-17 jacket, and removed question 28b. Updated the corresponding fields on the COR-17.W accordingly.

- Added existing line 64 in CO-1029.8.36.IN to the Summary.

CO-17, Corporation Income Tax Return

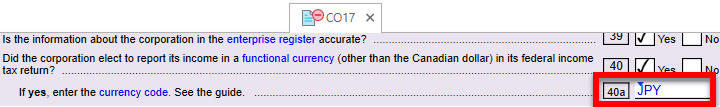

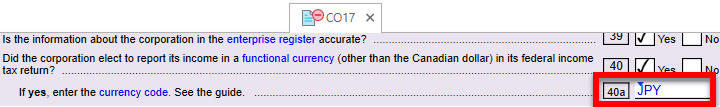

- New! The Japanese yen in the functional currency drop-down menu on the Info worksheet now flows to line 40a of the CO-17.

- Removed question 28b.

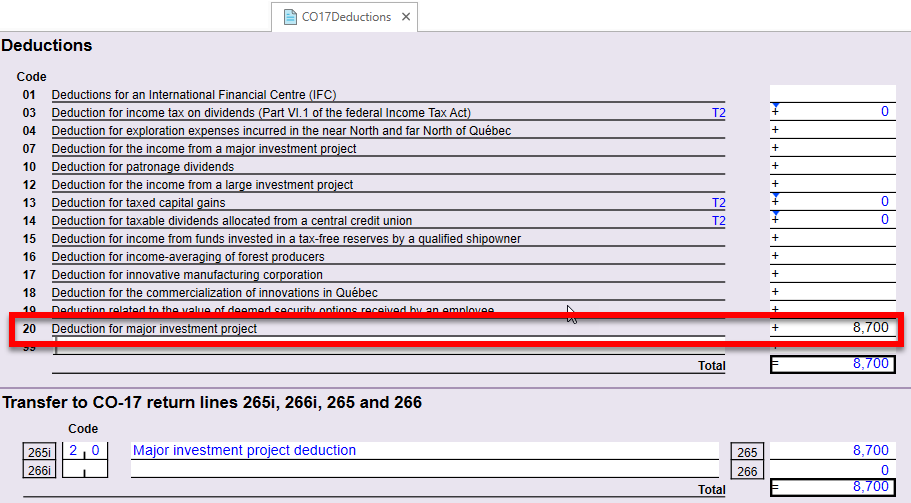

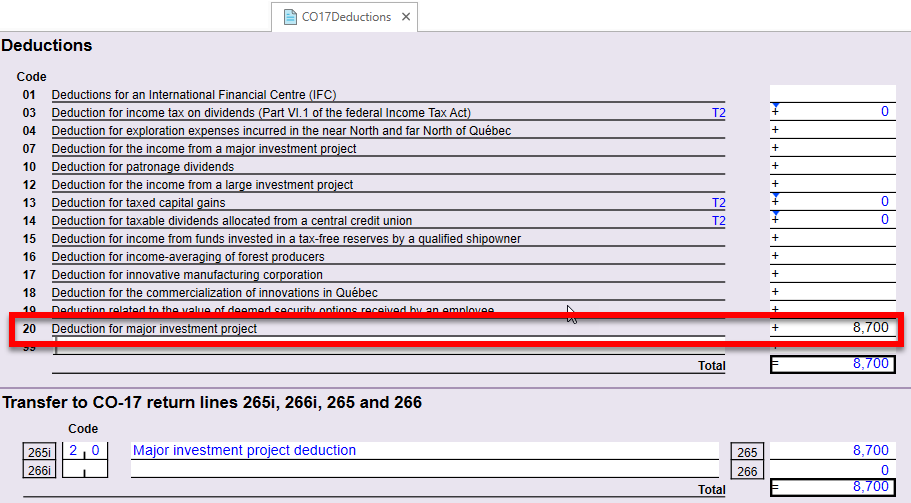

- Added new Code 20 (Deduction for major investment project) to calculate lines 265/266 and 265i/266i on page 3. To select the new code, enter an amount on the CO17Deductions worksheet.

CO-771, Calculation of the Income Tax of a Corporation

- Minor update based on the 2023-12 version of the form.

- The tax rates calculated in sections 11 and 12 remain unchanged.

- Added new Code 20 (Major investment project deduction) to lines 18j and 18pi.

CO-771.2 1.2, Income of a Corporation that is a Member or Designated Member of a Partnership from an Eligible Business Carried on in Canada by the Corporation

- Updated to the 2023-09 version.

- Removed lines 12a and 14a in Part 3.

- Rearranged various parts of the form.

CO-1029.8.33.13, Tax Credit for the Reporting of Tips

- This form remains unchanged. However, various rates have been updated to reflect the calendar year period of 2024 in box 07 in Part 2.

CO-1029.8.36.EM, Tax Credit Relating to Resources

- Updated to the 2023-09 version.

- Removed check boxes 05n and 05o in Part 2 as they are no longer applicable.

- Removed Part 11 (Refundable portion of the temporary increase from a previous year).

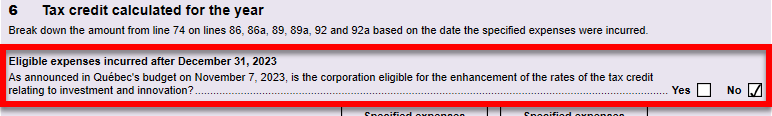

CO-1029.8.36.II, Tax Credit for Investment and Innovation

- Updated to the 2023-09 version.

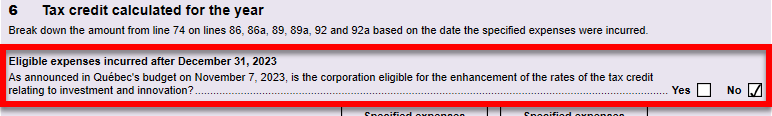

- This version of the form also includes the following changes based on the mini budget that was announced by Québec’s Minister of Finance on November 7, 2023. For more information, see the Government of Québec’s information bulletin on the subject.

- Added a new question in Part 6 to accommodate the budget changes.

- If you answer Yes to the new question, the rates on lines 87, 90 and 93 will use the following enhanced tax credit rates based on the budget:

- Line 87: 25% for specified property acquired to be used mainly in a territory with low economic vitality.

- Line 90: 20% for a specified property acquired to be used mainly in a territory with intermediate economic vitality.

- Line 93: 15% for a specified property acquired to be used mainly in a territory with high economic vitality.

- Part 8.2.1 Refund rate for the taxation year—For a qualified corporation to be able to fully benefit from the refundability of the Tax Credit for Investment and Innovation for a particular tax year, its assets and gross income, applicable for the taxation year, must not exceed $50 million. In addition, a qualified corporation cannot benefit from this tax credit if its assets or gross income for the taxation year are equal to or exceed $100 million.

- Amendments will be made to remove the requirement relating to assets and gross income in order to allow a qualified corporation to benefit from this tax credit regardless of its total taxes for that taxation year.

- When a corporation’s taxation year begins after December 31, 2023, the amount on line 124 will calculate to $0 in order to calculate a 100% refund on line 129 regardless of the asset or gross revenue threshold.

CO-1029.8.36.IN, Tax Credit for Investment

- Removed the check boxes for Eligible expenses incurred on page 1 as they are no longer applicable. The calculations have also been adjusted accordingly.

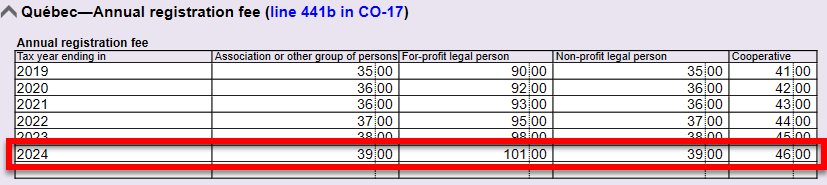

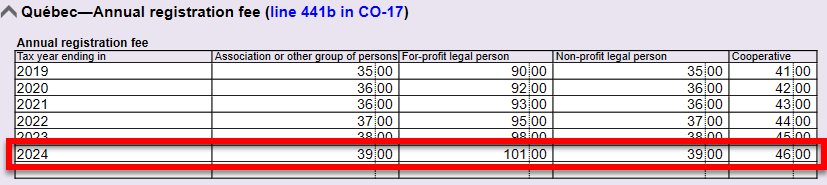

TaxConstants Worksheet

- Updated the TaxConstantsWS with the 2024 annual registration fee to calculate line 441b in the CO-17 jacket.

Minor Updates

The following forms received minor updates:

- CO-1029.8.33.6, Tax Credit for an On-the-Job Training Period

- CO-1029.8.33.CS, Tax Credit for the Retention of Persons with a Severely Limited Capacity for Employment

- FM-220.3, Property Tax Refund for Forest Producers

- CO-156.EN, Agreement Concerning Regional Ceilings Respecting the Additional Deduction for Transportation Costs of Small and Medium-sized Manufacturing Businesses

- CO-156.TR, Additional Deduction for Transporting Costs of Small and Medium-sized Manufacturing Businesses

- CO-156.TZ, Additional Deduction for Transportation Costs of Small and Medium-sized Businesses Located in a Special Remote Area

- TP-1086.R.23.12, Costs Incurred for Work on an Immovable

T2: 2024 Automobile Deduction Limits

TaxCycle T2 now includes the 2024 automobile deduction limits and expense benefit rates announced by the Department of Finance on December 18, 2023. This includes the following changes, which will take effect as of January 1, 2024:

- Schedule 8 and S8AssetManager

- The CCA ceiling for Class 10.1 passenger vehicles has increased to $37,000 for new and used vehicles acquired on or after January 1, 2024.

- The CCA ceiling for Class 54 zero-emission passenger vehicles remains at $61,000 before tax for new and used vehicles.

- Motor Vehicle Worksheet

- Deductible leasing costs have increased to $1,050 for new leases entered on or after January 1, 2024.

- The maximum allowable interest deduction has increased to $350 for new automobile loans entered into on or after January 1, 2024.

T1/TP1 Preview Forms and Calculations for 2023

This release updates the T1 federal and provincial schedules, as well as many other forms, to the latest versions available from the Canada Revenue Agency (CRA). It also updates the TP1 jacket and all schedules to the latest versions available from Revenu Québec.

All forms, other than authorization forms, remain in a preview state and include a preview watermark. We will remove the watermark once we receive approval of the T1 Condensed and bar code from the CRA, as well as a number of final forms, and complete our carryforward and calculation testing. We will likely begin removing the watermarks in mid-January.

Update to this release to try the latest forms and calculation changes to T1 and TP1. You can begin data entry, but you must wait for CRA and Revenu Québec certification before filing. We also strongly recommend waiting to perform any batch carryforward for files to 2023 until those changes are complete.

New Forms

Schedule 12—Multigenerational Home Renovation Tax Credit (MHRTC)

- You can claim this new credit on line 45355 of the T1.

Schedule 15—First Home Savings Account (FHSA) Contributions, Transfers and Activities

- You can claim this deduction on line 20805 of the T1.

- The T4FHSA slip includes both the amount of contributions made in 2023 as well as any amounts that are taxable in the year reported on lines 12905 or 12906 of the T1.

- Québec residents may receive a RL-32 slip for any taxable amounts reported on their TP1 return.

T1356—British Columbia Clean Buildings Tax Credit

- You can claim this credit on form BC479, British Columbia Credits.

T1279—Saskatchewan Mineral Exploration Tax Credit

- You can claim this credit on form SK428, Saskatchewan Tax.

Additions to Forms

Schedule 3—Residential Property Flipping Rule

- Housing units owned for less than 365 consecutive days are subject to the new Residential Property Flipping Rule unless certain life events apply.

- The profit from the sale is fully taxable as business income and is to be reported on form T2125. A loss on the sale is deemed to be nil.

Schedule 6—Advanced Canada Workers Benefit

- In 2023, the CRA may have automatically paid an advance on the Canada Workers Benefit (CWB) to eligible individuals.

- Use this new section to calculate the amount of the advance, which is reported on the RC210 and added to the tax payable for the year on line 41500 of your return.

BC479—B.C. Renter’s Tax Credit

- The new B.C. renter’s tax credit provides $400 to renter individuals and families with an adjusted income of $60,000 or less.

- Individuals and families with an adjusted income greater than $60,000 and less than $80,000 may receive a reduced amount.

Removed Forms

The following forms were removed due to related deductions or credits no longer being available:

- T777S, Statement of Employment Expenses for Working at Home Due to COVID-19

- T2200S, Declaration of Conditions of Employment for Working at Home Due to COVID-19

- T1B, Request to Deduct Federal COVID-19 Benefits Repayment in a Prior Year

- T2039, Air Quality Improvement Tax Credit

- T1 line 47557 remains for 2023 for any credit allocated to the individual from partnerships whose fiscal years started in 2022.

- ONS12, Ontario Seniors’ Home Safety Tax Credit

- SKS12, Saskatchewan Home Renovation Tax Credit

We also removed the Ontario Staycation Tax Credit and Ontario Jobs Training Tax Credit from form ON479, Ontario Credits, as they are no longer applicable.

TaxCycle T3010 Update

T3010, Registered Charity Information Return

- Updated to version 24 to reflect new reporting requirements. As of January 2024, charities filing the T3010 must choose between two versions of the form, depending on when their fiscal period ends.

- Charities filing a return for fiscal periods ending on or before December 30, 2023, must use version 23 of the T3010.

- Charities filing a return for fiscal periods ending on or after December 31, 2023, must use version 24 of the T3010.

- The CRA will not accept returns filed with the wrong version of the T3010 and will respond with a letter explaining how to obtain the correct version of the form on their website. For more information, read the CRA’s page on the T3010 Registered Charity Information Return.

- Added new question 3 to Schedule 1.

- Added the following new lines: 4101, 4102, 4157, 4158, 4576, and 4577.

- Removed lines 4180 and 4505.

T1441, Qualifying Disbursements: Grants to Non-Qualified Donees

- Updated to version 24, which all charities filing the T1441 must now use for all fiscal periods.

- Added a new Schedule 8 to page 2. You must complete this new schedule if you answer Yes to question C17 on the T3010 or the Info worksheet. This question is shared between both forms, meaning if you update it on one form, it will automatically update on the other.

Template Changes

- T3 pre-season letter—Added a paragraph and form about the Underused Housing Tax (UHT-2900) including the filing deadline. The letter was also updated so that the real property section always appears. The Trustee name now displays correctly.

- T3 2023—Added a paragraph to the client letter (CLetter, JLetter) advising that as of January 1, 2024, remittance payments exceeding $10,000 must be paid electronically.

Customer Requests

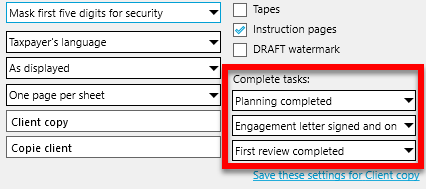

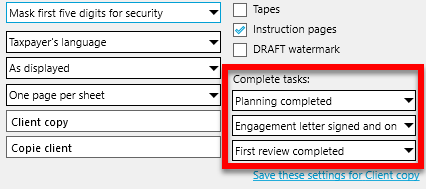

- Print/PDF Options—The workflow items in the Complete tasks drop-down menu in the print configuration dialog box now only show tasks that are manually completed and no longer show automated workflow items.

Resolved Issues

- TaxFolder—Resolved an issue where the signed workflow event did not correctly update when an electronic signature request was resent through TaxCycle and then signed by the client.

- TaxFolder—Fixed an issue where resending an electronic signature request erroneously cleared the signature field status. Added “Re-Sent” text to the field to better communicate the status of the signature request.

- TaxFolder—The history for e-signature tracking now shows the date and time of the signed event.

- TaxCycle T2—Updated the government assistance calculations on the T661 and RD-222 to exclude SR&ED expenditures recorded on Québec’s RD-102.9 and RD-1029.8.6 if the calculated expenditures were incurred by a partnership of which the corporation is a member.

- This adjustment affects T2 returns with completed RD-102.9 and RD-1029.8.6 forms of which the qualified expenditures were incurred by a partnership of which the corporation is a member.

- The affected lines are 429 and 513 on the T661 and line 71 on the RD-222.

Status of File Carryforwards from 2022 to 2023

As of this release, the following 2022 to 2023 carryforwards are up to date. However, we strongly recommend you only perform batch carryforward on tax modules that are ready for filing in the list, below. We anticipate the rest of the modules will be finalized later in January.

Ready for batch carryforward:

- T2/CO-17—Carryforwards from TaxCycle, ProFile®, Taxprep®, Cantax®, DT Max®, creating files with year ends up until May 31, 2024.

- T4, T4A, RL-1/RL-2—TaxCycle, ProFile®, Taxprep®, Cantax®

- T4PS—TaxCycle, ProFile®, Taxprep®, Cantax®

- T4A-RCA—TaxCycle, ProFile®

- T5, RL-3—TaxCycle, ProFile®, Taxprep®, Cantax®

- T2202—ProFile®, Taxprep®

- T5018—TaxCycle, ProFile®, Taxprep®, Cantax®

- T3010/TP-985.22—TaxCycle, ProFile®, Taxprep®, Cantax®

- NR4—TaxCycle, ProFile®, Taxprep®, Cantax®

- Forms—TaxCycle, ProFile®, Taxprep®, Cantax®

- RL—TaxCycle, ProFile®, Taxprep®, Cantax®

Wait for batch carryforward:

- T1/TP1—TaxCycle, ProFile®, Taxprep®, Cantax®, DT Max®

- T3/TP-646, RL-16—TaxCycle, ProFile®, Taxprep®, Cantax®, DT Max®

- T5013/TP-600, RL-15—TaxCycle, ProFile®, Taxprep®, Cantax®

Status of 2023 Federal Returns and Slips

- T1—Preview of 2023 forms and calculations. You may begin data entry, but you must wait for CRA certification before filing.

- T2—Certified to file tax year ends up to May 31, 2024.

- T3RET—In progress. Wait to file 2023 returns.

- T3 slips—In progress. Wait to file 2023 slips.

- NR4 (in T3 module)—In progress. Wait to file 2023 returns.

- T4—Ready for filing upon system opening on January 8, 2024.

- T4A—Ready for filing upon system opening on January 8, 2024.

- T4PS—Ready for filing upon system opening on January 8, 2024.

- T4A-RCA—Ready for filing upon system opening on January 8, 2024.

- T5—Ready for filing upon system opening on January 8, 2024.

- T5013-FIN—In progress. Wait to file 2023 returns.

- T5013 slip summary—In progress. Wait to file 2023 returns.

- T5018—Ready for filing upon system opening on January 8, 2024.

- NR4 slips (standalone NR4 module)—Ready for filing upon system opening on January 8, 2024.

- T4A-NR slips (in NR4 module)—Ready for filing upon system opening on January 8, 2024.

- T3010—Ready for filing.

Status of 2023 Québec Returns and Relevés

- TP1—Preview of 2023 forms and calculations. Please wait for a future update before filing.

- TP-646—In progress. Wait to file 2023 returns.

- RL-16—In progress. Wait to file 2023 returns.

- TP-600—In progress. Wait to file 2023 returns.

- RL-15—In progress. Wait to file 2023 returns.

- RL-1—Ready for filing.

- RL-2—Ready for filing.

- RL-3—Ready for filing.

- RL-24—Ready for filing.

- RL-31—Ready for filing.

- TP-985.22—Ready for filing.