TaxCycle 14.2.56699.0—T2 and AT1 Certification

This certified release of TaxCycle T2 and AT1 extends the supported corporate tax year ends up to October 31, 2025.

To install this version immediately, download the full installer from our website or request a free trial. Once we enable the automatic update for this version, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options. (To deploy auto-update files from your network, see the Auto-Update Files page.)

Release Highlights

T2 and AT1 Filing Date Extension

TaxCycle supports the preparation and filing of federal T2 and Alberta AT1 corporate tax returns with tax year ends up to October 31, 2025.

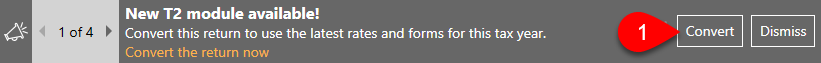

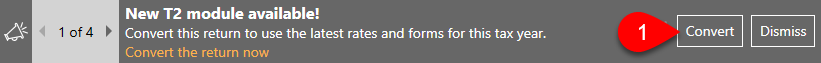

T2 File Conversion Message

When you open an in-progress T2 return, TaxCycle may prompt you to convert it to the new module. This message appears when the status of the T2 return you are working on is other than “Completed” and the corporation’s tax year starts on or after January 1, 2023.

- Click the Convert button or the link to convert the return to the newer module.

- Save the new return. You can choose to delete the old file by answering Yes to the Delete old return question in the dialog box that pops up. Once a file is deleted, it will no longer appear in the Client Manager or in the recent files list.

- The new file extension is .2025T2 and supports returns up to October 31, 2025. To learn more about T2 file name extensions, read the T2 File Name Extensions help topic.

Schedule 76 Clean Technology Manufacturing Investment Tax Credit

- Complete this schedule to calculate the Clean Technology Manufacturing (CTM) Investment Tax Credit (ITC). Complete this form if the corporation is a taxable Canadian corporation (including a taxable Canadian corporation that is a member of a partnership) that has acquired CTM property after December 31, 2023, and before January 1, 2035.

- The calculated amounts from Part 1 line 155 and Part 2 line 245 flow to Schedule 31 Part 24 line 170 and Part 25 Amount 25E, respectively.

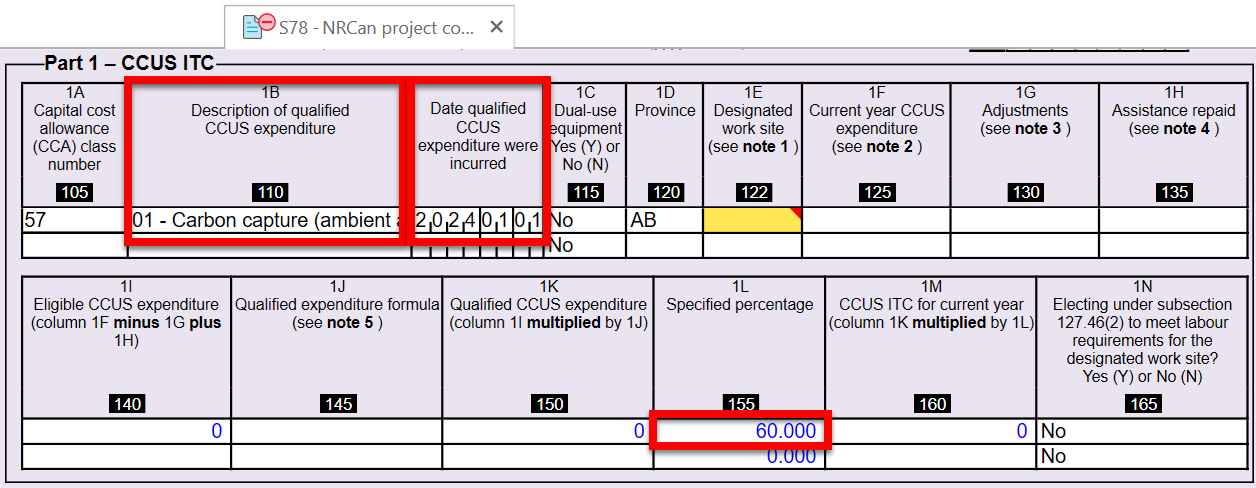

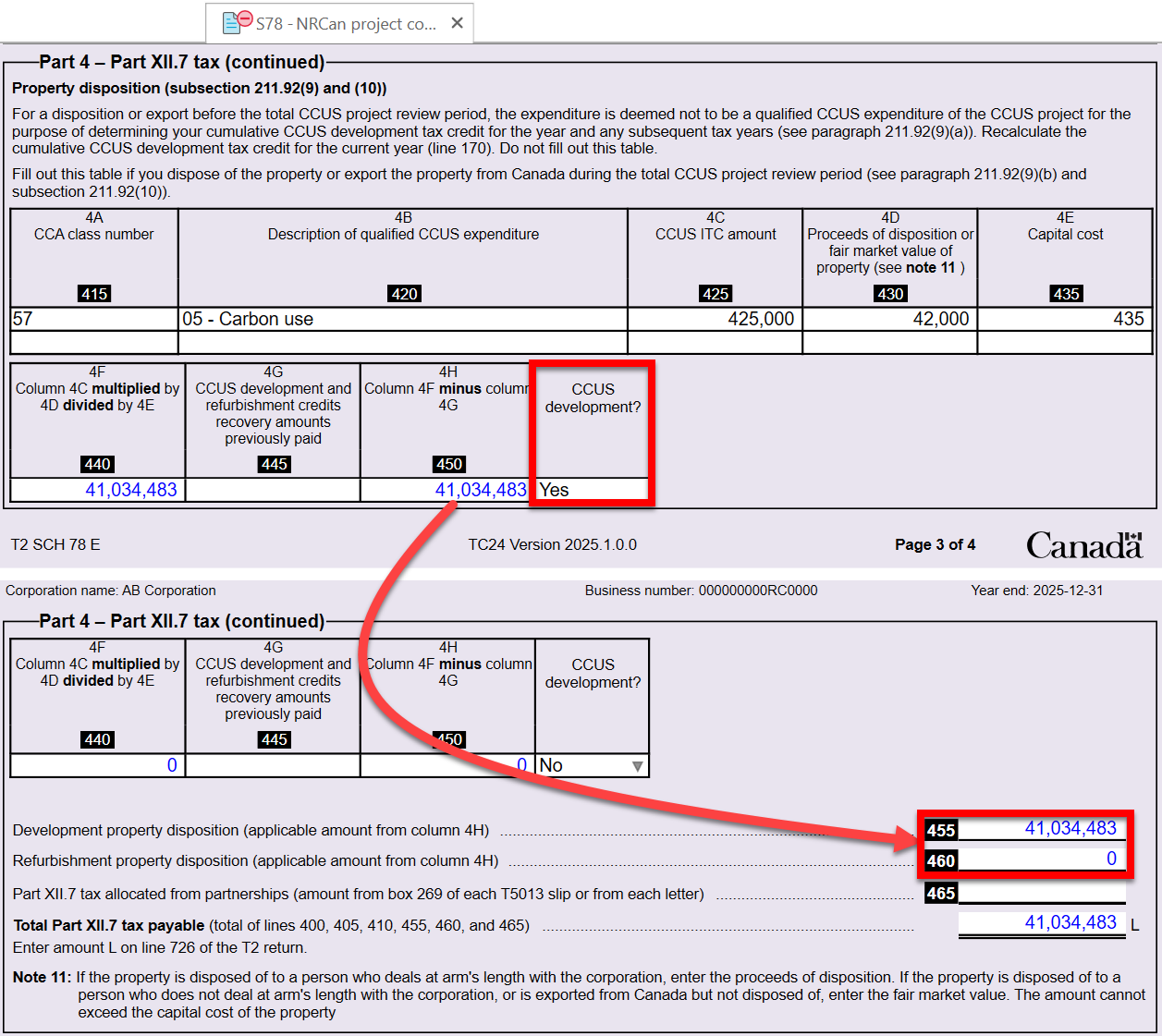

Schedule 78 Carbon Capture, Utilization, and Storage Investment Tax Credit

- Use this schedule to claim the Carbon Capture, Utilization, and Storage (CCUS) Investment Tax Credit (ITC) if the corporation is a taxable Canadian corporation (including a taxable Canadian corporation that is a member of a partnership) that has incurred eligible expenses after 2021 and before 2041.

- A separate Schedule 78 must be filed for each project with a project code by Natural Resources Canada (NRCan) on line 100.

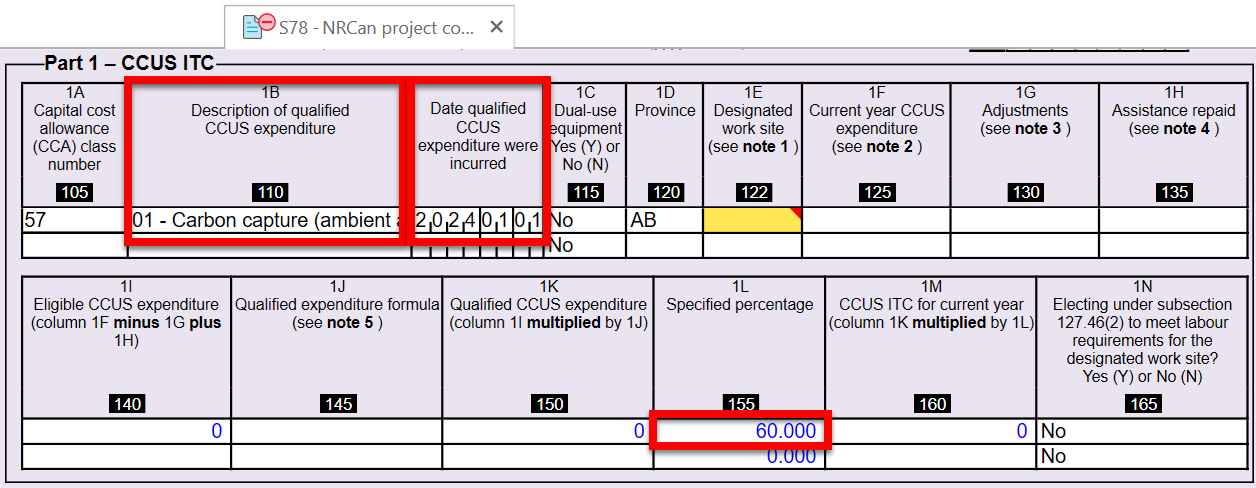

- In the Part 1 table, to assign a specific percentage in column 1L, select the CCUS expenditure type in column 1B and enter the date the qualified CCUS expenditures were incurred.

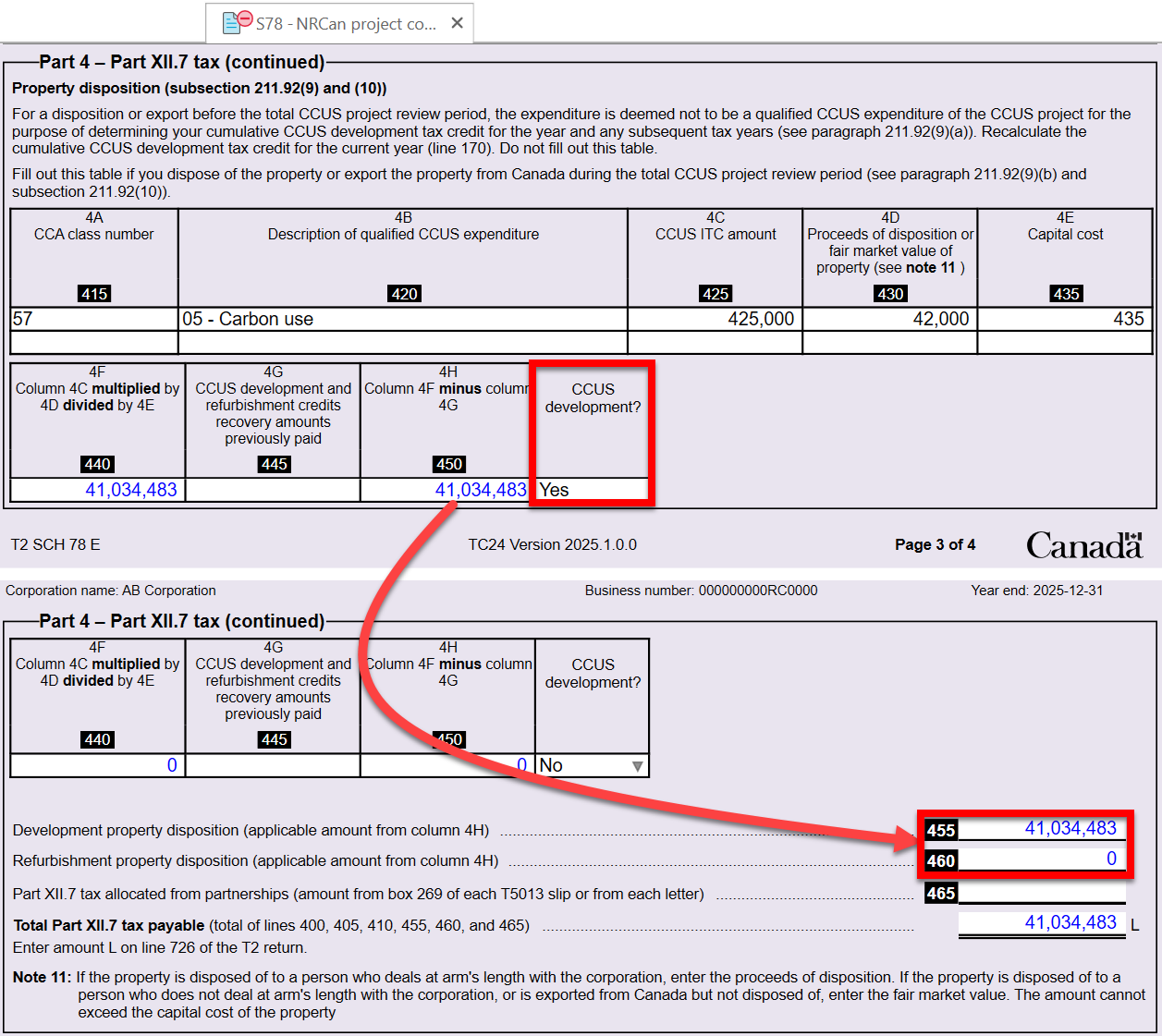

- In the Part 4 table, select Yes or No to indicate if the expenditure is related to CCUS development. If you answer Yes, the amount from column 450 flows to line 455. Otherwise it will flow to line 460.

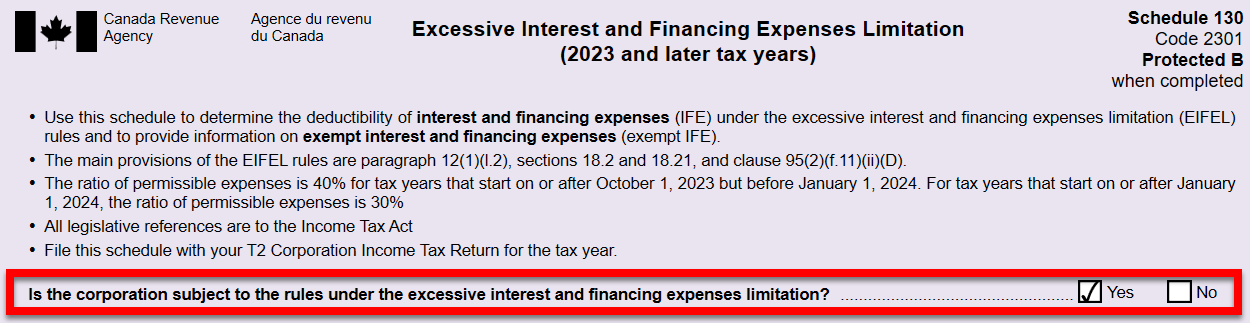

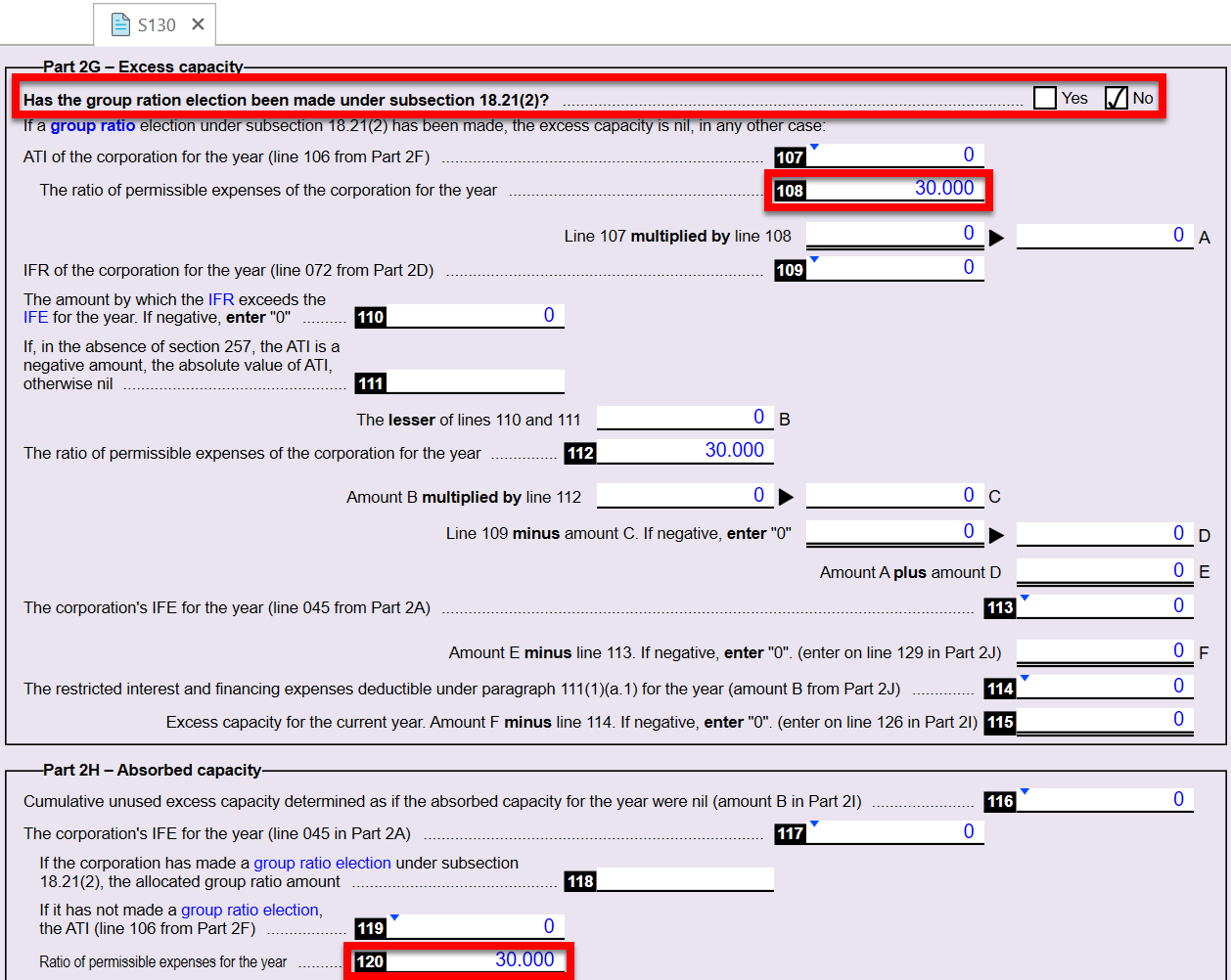

Schedule 130 Excessive Interest and Financing Expenses Limitation

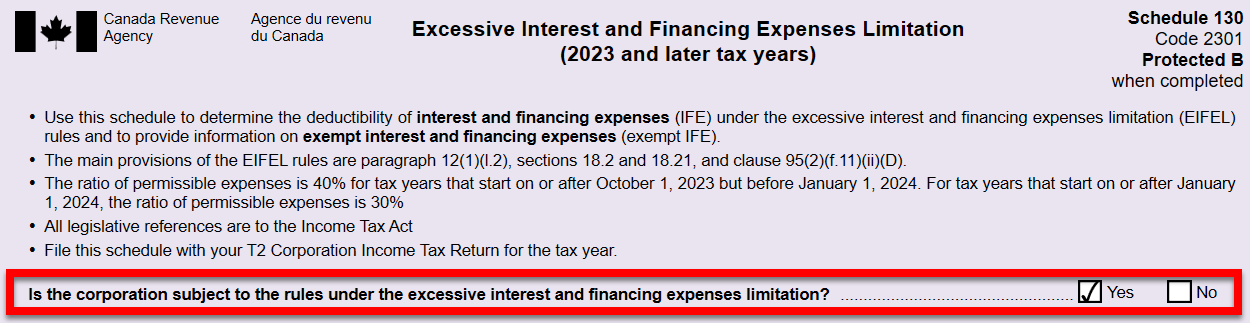

- Use this schedule to determine the deductibility of interest and financing expenses (IFE) under the Excessive interest and financing expenses limitation (EIFEL) rules and to provide information on exempt interest and financing expenses (exempt IFE).

- Before you fill out Schedule 130, determine if the corporation may be subject to the excessive interest and financing expenses limitation and answer Yes to the applicability question at the top of the page. Once you’ve completed the form, TaxCycle will automatically mark it as “used” and transmit it to the CRA if the limitation applies. In addition, box 278 for Schedule 130 on page 3 of the T2 Jacket will automatically be checked.

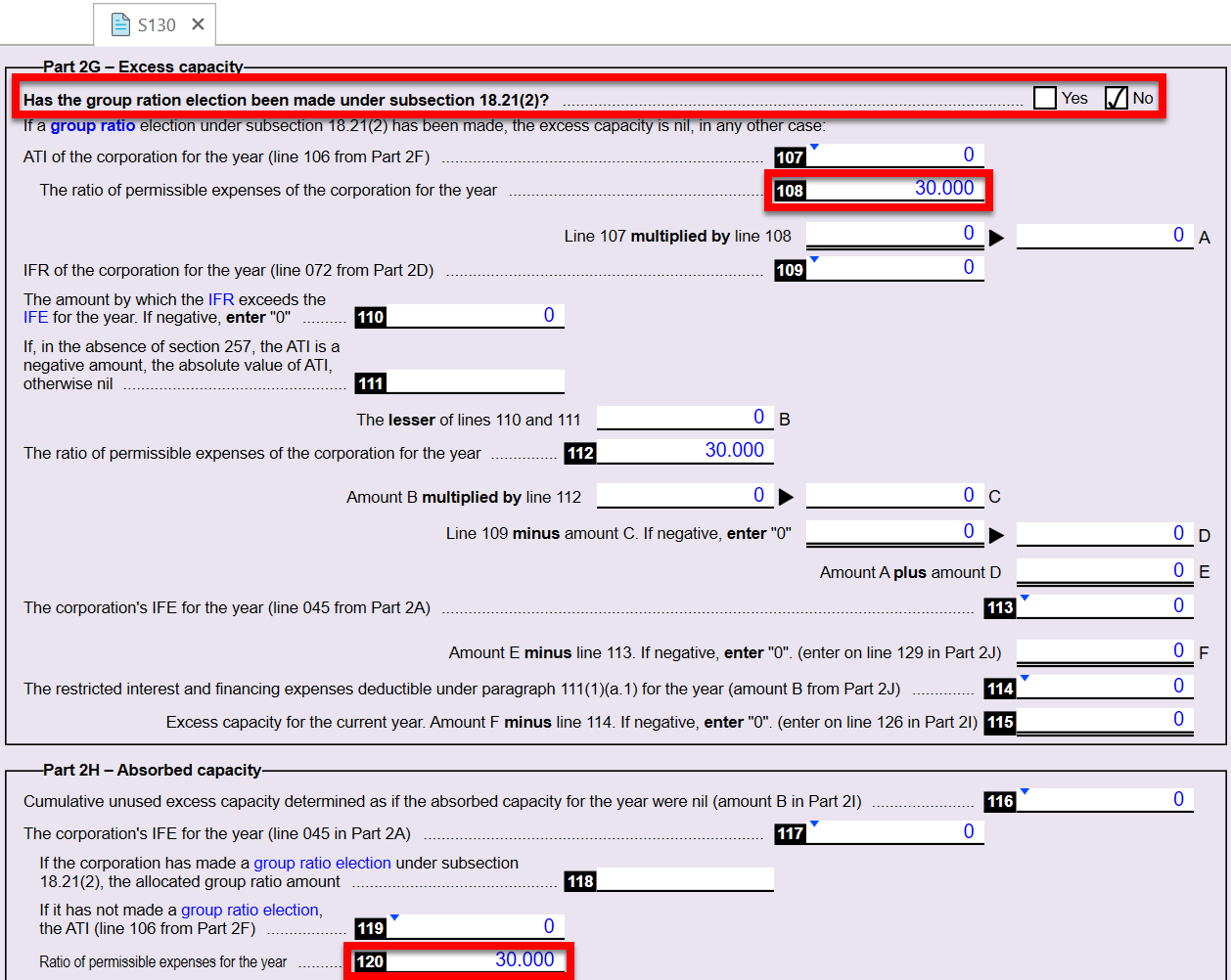

- In Part 2G, if applicable, indicate if an election has been made for the group ratio under subsection 18.21(2) in order to determine the right ratio on line 108 in Part 2G and line 120 in Part 2H.

- Amounts from Schedule 130 will flow to various schedules as follows:

- Part 2L amount B flows to Schedule 1 line 251.

- Part 2N line 158 flows to Schedule 1 line 252.

- Part 2O amount A flows to Schedule 4 Part 8 line 710.

Updated T2 Forms

Info Worksheet

T2 Jacket

- Added new lines 726 (Part XII.7 tax payable from Schedule 78) and 336 (Restricted interest and financing expenses from Schedule 4).

- TaxCycle automatically checks box 278 if Schedule 130 has been completed.

T2 Barcode

- Added a new line to account for new line 726 on the T2 jacket.

Schedule 1 Net Income (Loss) for Income Tax Purposes

- Added new lines 251, 252, 253 and 254 to account for add backs for the excessive interest and financing expenses from Schedule 130.

Schedule 31 Investment Tax Credit - Corporations

- Line 170 in Part 24 now calculates from line 155 in Part 1 of the Schedule 76.

- Line 200 in Part 24 now calculates from the total of all copies of amount A in Part 1 of the Schedule 78.

- Amount 25E in Part 25 now calculates from line 245 in Part 2 of the Schedule 76.

Schedule 35 Taxable Capital Employed in Canada - Large Insurance Corporations

Schedule 322 Prince Edward Island Corporation Tax Calculation

- As per 2025 PEI budget, the calculations in Schedule 322 have been revised.

- The budget proposes to increase the small business threshold to $600,000 (from $500,000) and lower the general corporate tax rate by one percent to 15% (from 16%), effective July 1, 2025.

Schedule 444 Yukon Business Carbon Price Rebate

- The Yukon Business Carbon Price Rebate no longer applies for taxation years ending after March 31, 2025.

- The rate calculations on lines 130 and 500 have been adjusted so when a taxation year ends after March 31, 2025, the rates calculate to zero.

Schedule 569 Ontario Business-Research Institute Tax Credit Contract Information

- Added the following new eligible research institute (ERI) code to line 115:

- 518 The Canadian Institute of Northern Agricultural and Aquaculture Research (CINAAR) Clearview Township

T2 PreValidation

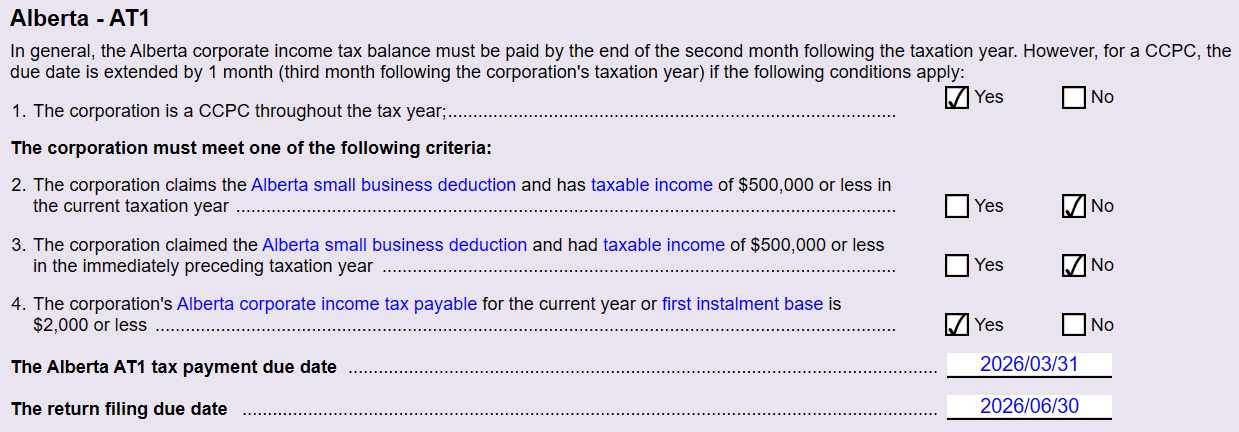

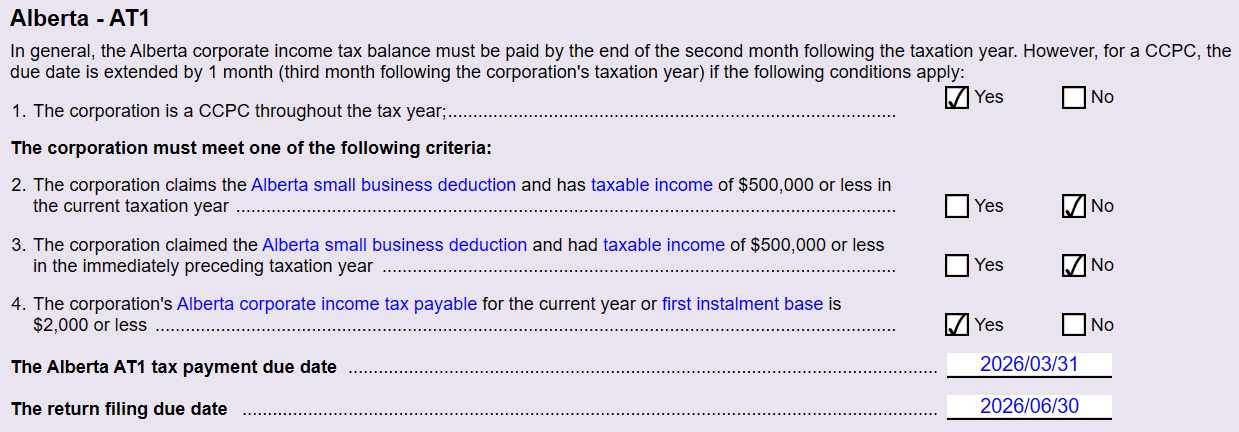

T2PaymentDueDateWS

- Added a new section for Alberta - AT1 that flows to the client letter (CLetter) when completed.

Forms with Minor Updates

- Schedule 6 Summary of Dispositions of Capital Property

- Schedule 56 Part II.2 Tax on Repurchases of Equity

- Schedule 349 Nova Scotia Innovation Equity Tax Credit

- Schedule 350 Nova Scotia Venture Capital Tax Credit

- Schedule 428 British Columbia Training Tax Credit

- Schedule 444 Yukon Business Carbon Price Rebate

- T106 Information Return of Non-Arm’s Length Transactions with Non-Residents

- Created a new combined T2, CO-17 and AT1 print set.

- Revised the T2 Summary, 5YearComp1, 5YearComp, 5YearShort to add aforementioned new lines.

Alberta AT1 Form Changes

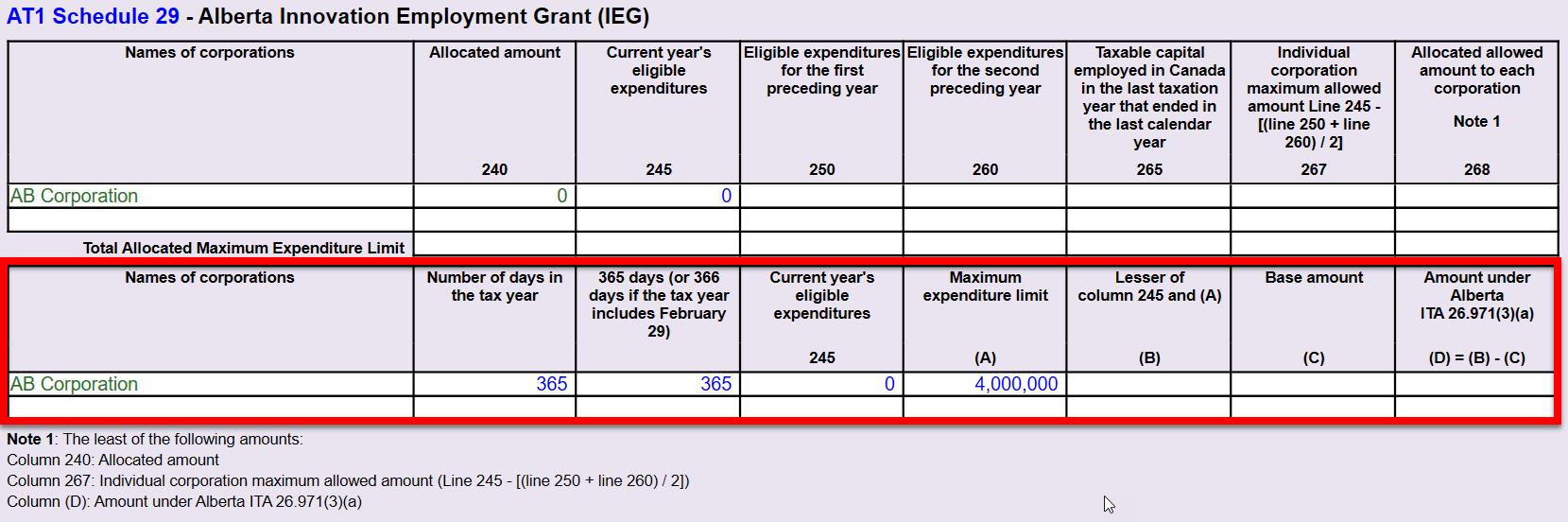

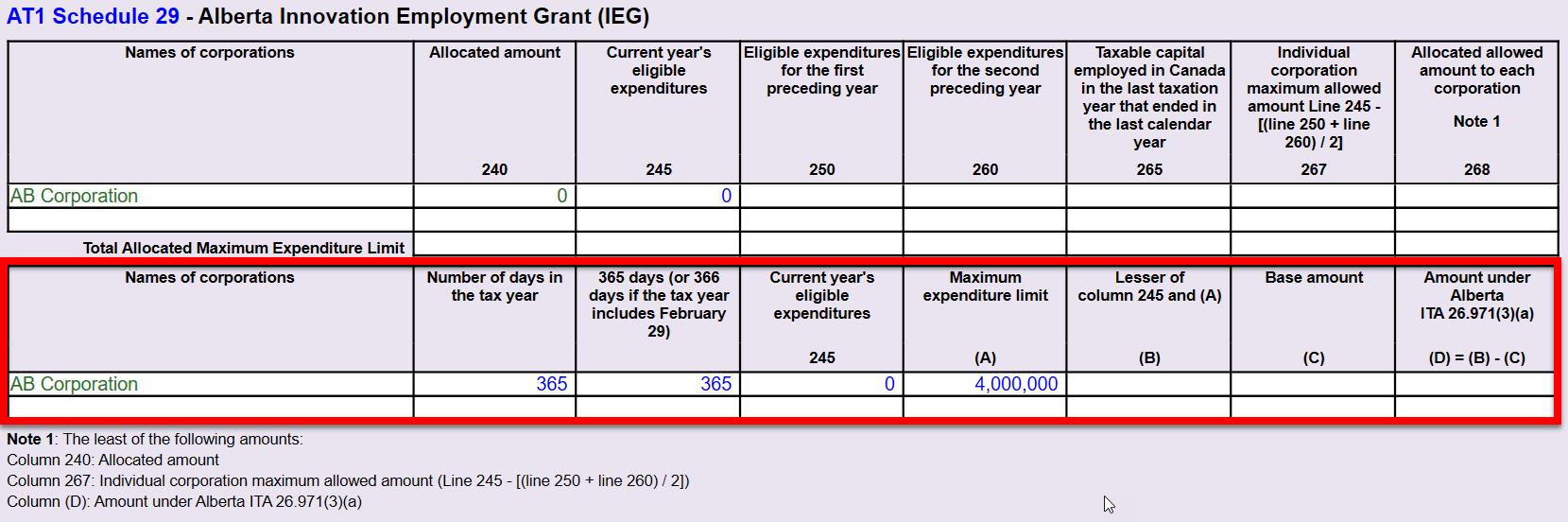

AT1 Schedule 29 (AS29)

- Column 245 (“current year’s eligible expenditures”) for the reporting corporation is now calculated to be line 31 on page 1.

AT1 Schedule 29 on CGI Worksheet

- Added a new section to the AT1 Schedule 29 table on the CGI worksheet.

- Column 268 will now be calculated as the least of columns 240, 267 and column D to comply with subsection 26.971(3)(a) of the Alberta Corporate Tax Act.

Template Changes

- T1 2024—Removed content about the Canada Carbon Rebate and the BC Climate Action Tax Credit from the T1 client letter (CLetter) and joint client letter (JLetter).

Customer Requests

- T2—In T2 Auto-fill, when the difference between the downloaded tax instalment amount paid and the amount on line 840 of the T2 jacket is not greater than $0.99, the mismatch review message will no longer display. See the discussion on protaxcommunity.com for more information.

- TaxCycle Forms—Added new form RC681 Request to Activate Paper Mail for My Business to the Forms module.

Resolved Issues

- Customer Reported T1—Fixed an issue where the Billing worksheet was not picking up foreign slips for invoicing if the slip only included business or rental income.