TaxCycle 15.0.58923.0—Major T2/AT1 Update, 64-bit Upgrade

This release extends the tax year ends for T2 and AT1 returns up to May 31, 2026. It also converts TaxCycle to a 64-bit only application.

To install this version immediately, download the full installer from our website or request a free trial. Once we enable the automatic update for this version, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options. (To deploy auto-update files from your network, see the Auto-Update Files page.)

Release Highlights

64-bit Upgrade

This release converts TaxCycle to a 64-bit only application to ensure better performance and stability.

- TaxCycle now requires a 64-bit operating system (OS) to run.

- If you are running Windows 11, your system is already 64-bit, and no action is required.

- We have updated the recommended and minimum system requirements for running TaxCycle.

Read this Microsoft page for details on 32-bit and 64-bit versions of Windows and instructions on how to upgrade your OS.

T2 and AT1 Extension of Fiscal Year End

This certified release of TaxCycle T2 and AT1 extends the corporate tax year ends up to May 31, 2026.

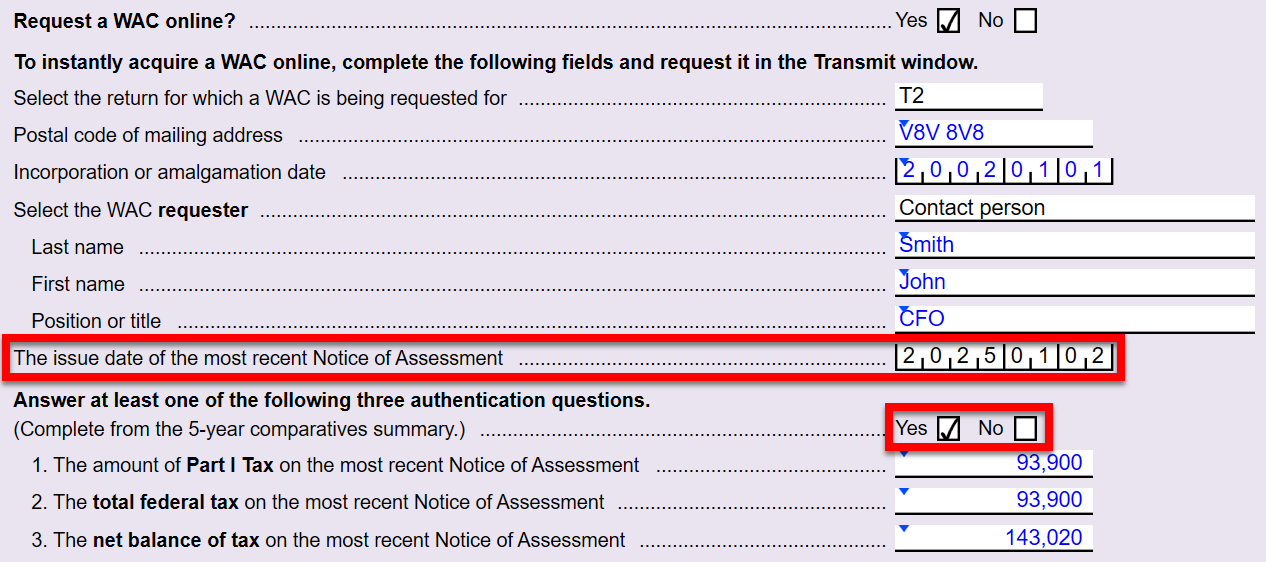

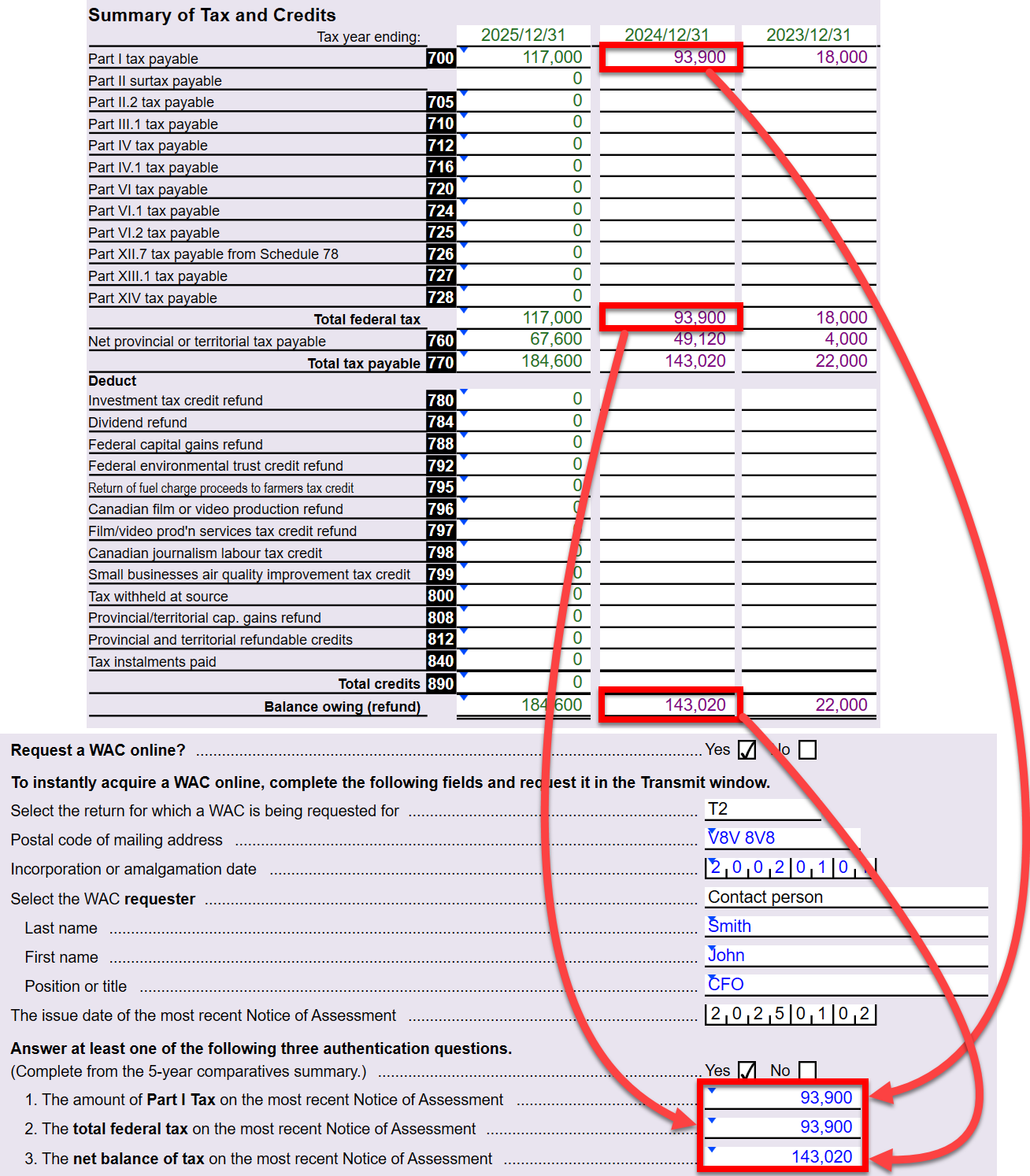

T2 Web Access Code (WAC) Requests—New Requirements for Security Questions

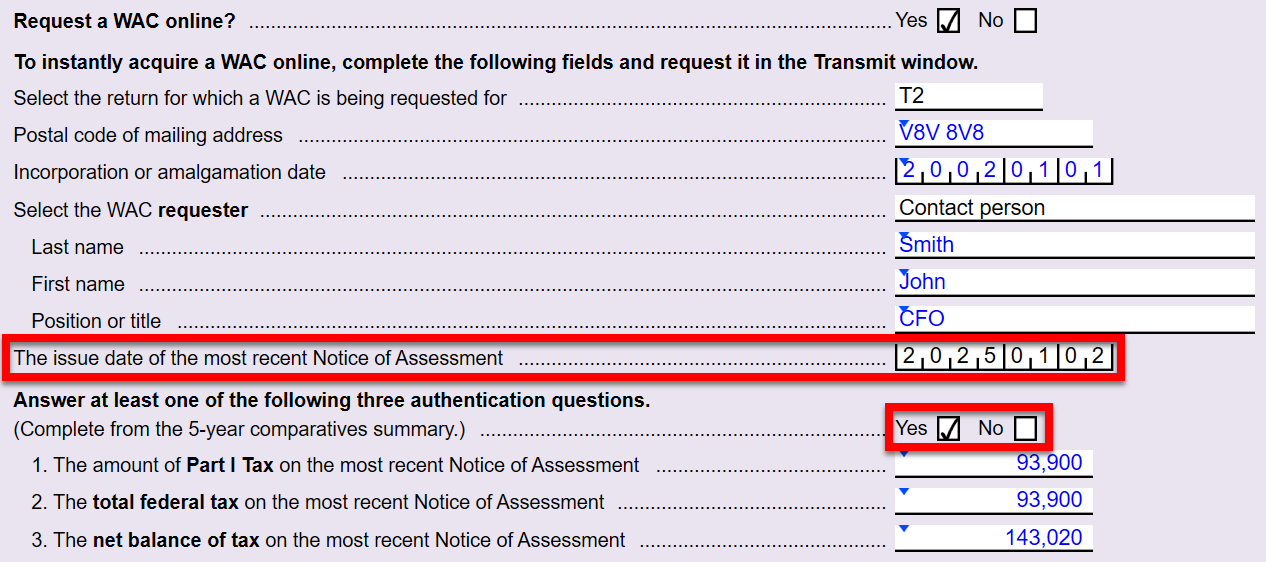

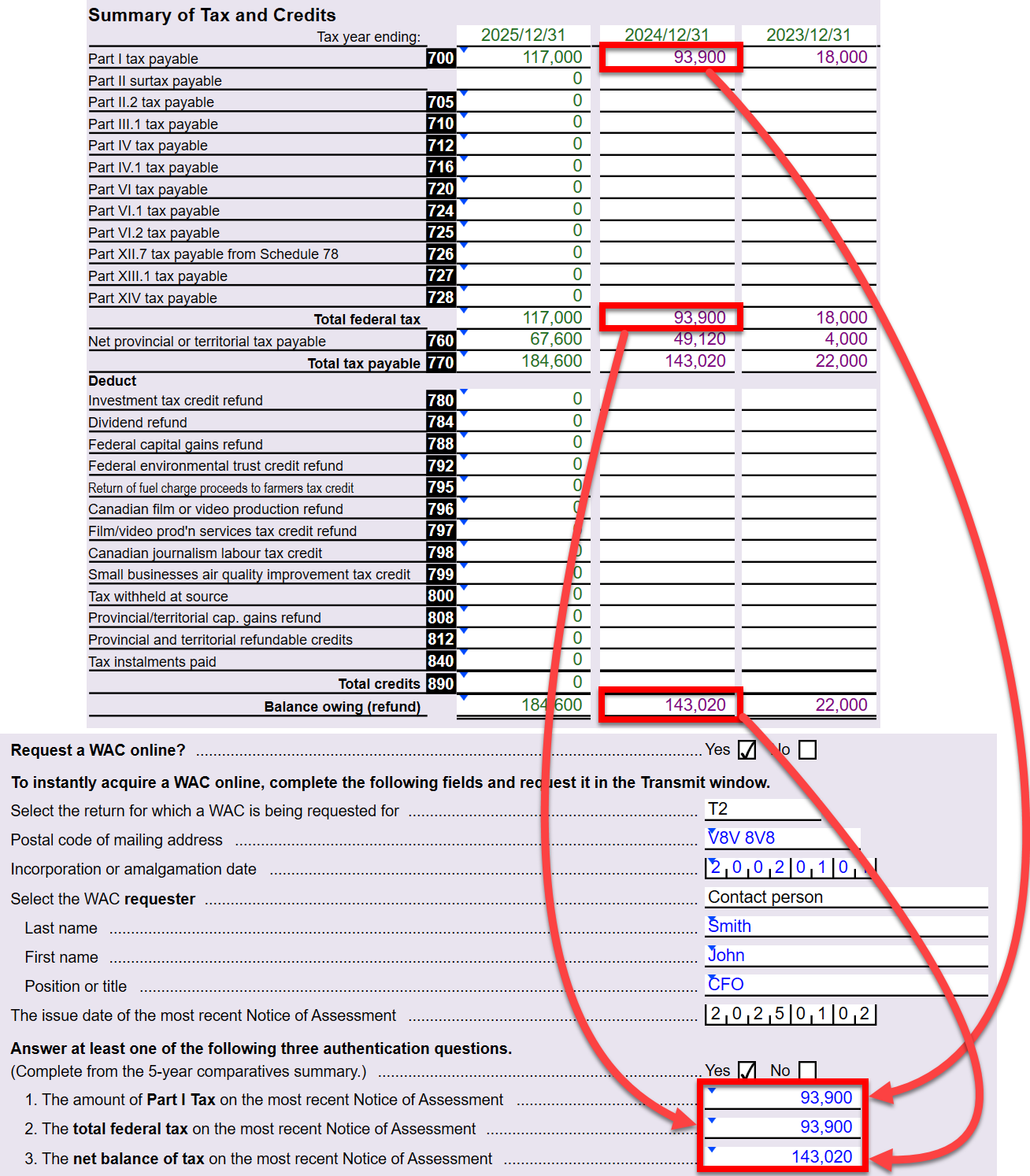

The Canada Revenue Agency (CRA) has added new security questions to the Request a Web Access Code (WAC) service. You must now provide the issue date of the most recent Notice of Assessment (NOA) and one of the following amounts from the latest NOA or Notice of Reassessment (NOR):

- the amount of Part I Tax on the most recent Notice of Assessment

- the total federal tax on the most recent Notice of Assessment

- the net balance of tax on the most recent Notice of Assessment

We have updated the T2 Corporate Internet Filing worksheet (T2CIFWS) to reflect these changes.

When you check the box to Complete from the 5-year comparatives summary, TaxCycle populates the fields for the three authentication questions based on the prior-year amounts in the 5-year summary worksheets. Check the No box to enter the amounts manually.

New corporations filing a T2 return for the first time must request a WAC by calling the Corporation Internet Filing Help Desk. Read the Request a T2 WAC help topic to learn more.

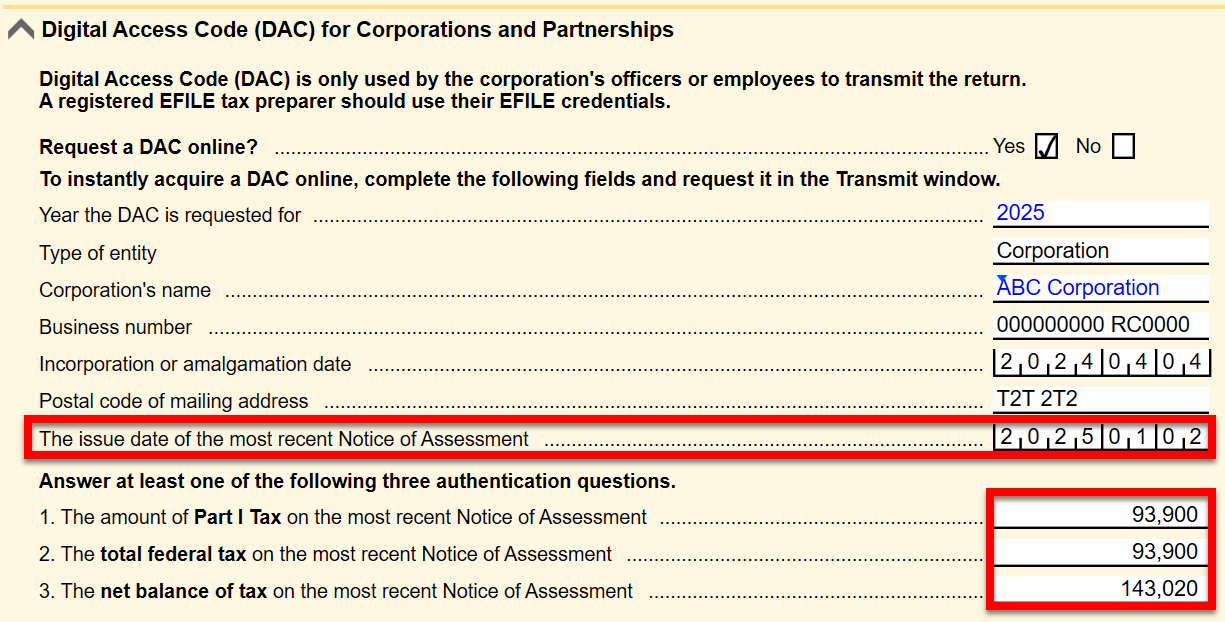

Special Elections and Returns (SERs) in T2 and TaxCycle Forms—New Requirements for Security Questions

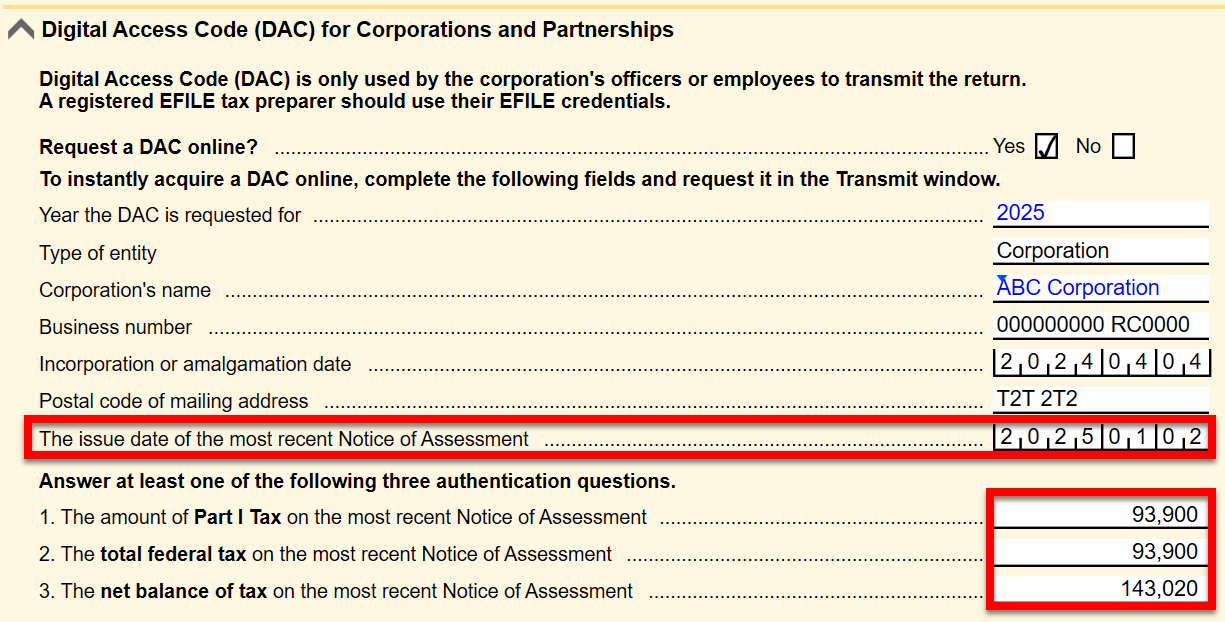

The CRA has added new security questions to the Request a Digital Access Code (DAC) service. You must now provide the issue date of the most recent Notice of Assessment (NOA) and one of the following amounts from the latest NOA or Notice of Reassessment (NOR):

- the amount of Part I Tax on the most recent Notice of Assessment

- the total federal tax on the most recent Notice of Assessment

- the net balance of tax on the most recent Notice of Assessment

We have updated the SERs worksheet in TaxCycle T2 and TaxCycle Forms to reflect these changes.

New T2 Forms

Schedule 74 Clean Hydrogen Investment Tax Credit

- Use this schedule to calculate the Clean Hydrogen Investment Tax Credit (ITC) for a taxable Canadian corporation or a taxable Canadian corporation that is a member of a partnership that acquired eligible clean hydrogen property after March 27, 2023, and before January 1, 2035, that became available for use in respect of a qualified clean hydrogen project during that period.

- Column 750 in the Part 7 table populates based on the average actual carbon intensity rates on line 710 or line 720 as applicable, according to note 14 on page 5.

- The sum of the amounts on line 650 in Part 6 and line 765 in Part 7 is reported in the amount 25C field in Part 25 of Schedule 31.

- The clean hydrogen ITC calculated on line 195 in Part 1 is reported on line 140 in Part 24 of Schedule 31.

Updated T2 Forms

Schedule 5 Tax Calculation Supplementary

- Added new line 281 (Repayment of Ontario made manufacturing investment tax credit). This new line is related to Schedule 572 (Ontario Made Manufacturing Investment Tax Credit). However, S572 does not yet have a line for the repayment calculation. The CRA plans to revise S572 to add a line for the repayment in May 2026.

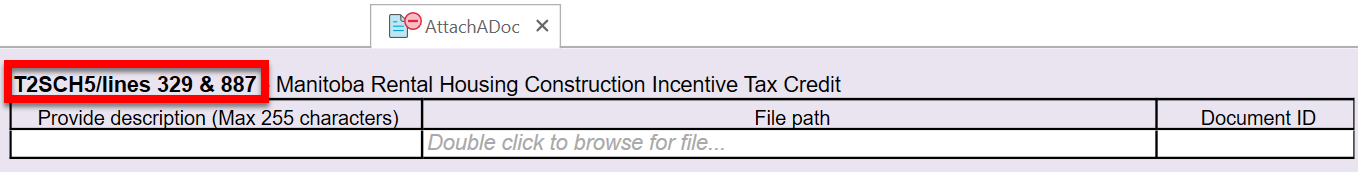

- Added new line 887 (Certificate number) to support the amount on line 329 for the Manitoba rental housing construction incentive tax credit.

- You can now use the Attach-a-doc service in TaxCycle T2 to transmit the certificate to support line 887. Scroll down to learn more.

Schedule 7 Aggregate Investment Income and Income Eligible for the Small Business Deduction

- Removed lines 742 and 744 related to 2018 from Part 2 as they are no longer applicable.

- Revised the descriptions for line 62 in Part 1 and line 49 in Part 3 to include the amount deductible under paragraph 113(1)(c) which can now be entered in Part 1 of Schedule 3. For more information, refer to the notes related to paragraph 113(1)(c) in the Customer Requests section below.

Schedule 31 Investment Tax Credit

- Line 140 in Part 24 and amount 25C in Part 25 now calculate from the new Schedule 74. Previously, these lines were editable fields. If you open a return that contains amounts in these fields, this version of TaxCycle will retain the amounts as overrides.

- Line 140 in Part 24 now calculates from line 195 of Schedule 74.

- Amount 25C now calculates as a sum of lines 650 and 765 from Schedule 74.

Schedule 75 Clean Technology Investment Tax Credit

- Changed the line number for column 1E (Designated work site) in the Part 1 table from 120 to 122.

- Line 106 has replaced line 105 in the Part 1 table. Similarly, line 206 has replaced line 205 in the Part 2 table. Both new columns now include a dropdown list with the following choices:

- 01 - Wind energy conversion systems

- 02 - Small-scale hydroelectric installations

- 03 - Photovoltaic equipment

- 04 - Water-current, tidal, or wave energy equipment

- 05 - Geothermal energy equipment

- 06 - Active solar heating equipment

- 07 - Ground-source heat pump systems

- 08 - Non-road electric vehicle charging equipment

- 09 - Fixed location energy storage equipment

- 10 - Pumped hydroelectric energy storage

- 11 - Hydrogen refuelling equipment for non-road automotive equipment

- 12 - Air-source heat pump systems

- 13 - Concentrated solar energy equipment

- 14 - Small modular nuclear reactor

- 15 - Non-road zero-emission automotive equipment

T661 Scientific Research and Experimental Development (SR&ED) Expenditures Claim

T2 Attach-a-doc

Provincial Form Updates

CO-1029.8.33.13

- Added a review message reminder to complete the following lines if they are applicable, as requested by Revenu Québec:

- 27a (Part 2.3.1)

- 28e (Part 2.3.2)

- 28g (Part 2.3.2)

- 32a (Part 2.4)

- 44a (Part 2.6)

In addition, they asked that line 28e be calculated from line 27b if Part 2.3.2 is applicable. Accordingly, a calculation has been revised for line 28e.

Schedule 322 Prince Edward Island Corporation Tax Calculation

Schedule 346 Nova Scotia Corporation Tax Calculation

Schedule 411 Saskatchewan Corporation Tax Calculation

Schedule 422 (T1196) British Columbia Film and Television Tax Credit

- Added new line 306 (Actual or anticipated production completion date) in Part 2.

- Revised the calculation in Part 8 to apply a basic tax credit rate of either 35% or 40% depending on the start date of principal photography.

Schedule 423 (T1197) British Columbia Production Services Tax Credit

- Added new lines 305 (Major production certificate number) and 306 (Actual or anticipated production completion date) in Part 2.

- Added new Part 10 with four new lines.

Schedule 429 British Columbia Interactive Digital Media Tax Credit

- Added new lines 450, 455, and 495 in Part 4 for the calculation of net eligible salary and wages incurred after August 31, 2025.

- Revised the Part 5 calculation to add pre-September 1, 2025, and post-August 30, 2025, calculations.

Schedule 444 Yukon Business Carbon Price Rebate

Schedule 570 Ontario Regional Opportunities Investment Tax Credit

- The Description of eligible property field is now on line 108 in the Part 1 table and line 208 in the Part 3 table. Both fields have a maximum length of 175 characters.

Alberta AT1 Updates

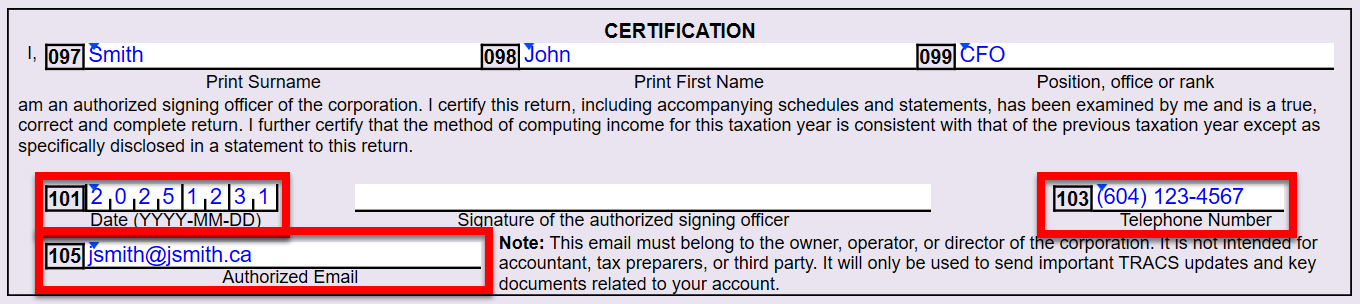

AT1 Jacket

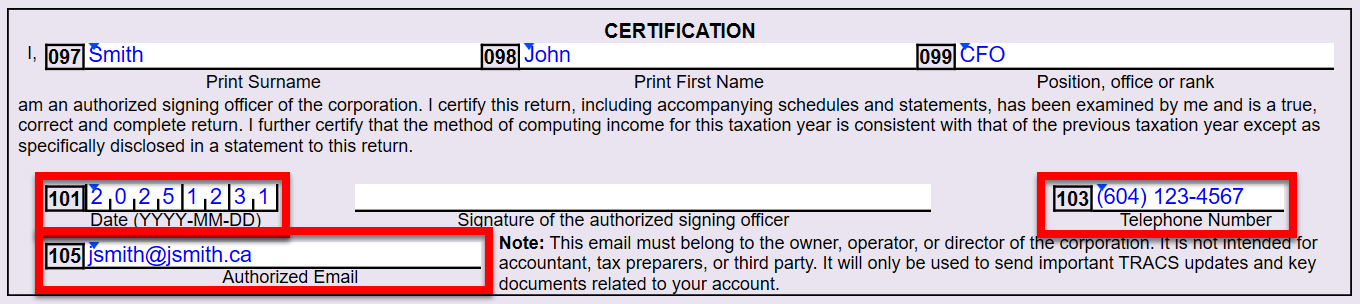

- Added new lines 101 (Date), 103 (Telephone Number) and 105 (Authorized Email) in the certification section of the AT1 return.

Other Module Updates

- T3 2025—Updated line 14120, family tax benefit, on the T3MB to calculate as zero since it was eliminated in the recent Manitoba legislation.

- T5013—Revised the calculation in Part 5 of the T661 (SR&ED Expenditures Claim) to include the 2026 maximum annual pensionable earnings amount of $74,600.

- TaxCycle Forms—Updated forms TP-518, TP-529 and TP-614 to the latest versions.

- TaxCycle Forms—The 2023 Forms module no longer supports Special Elections and Returns transmissions. Use the current year module to transmit SERs.

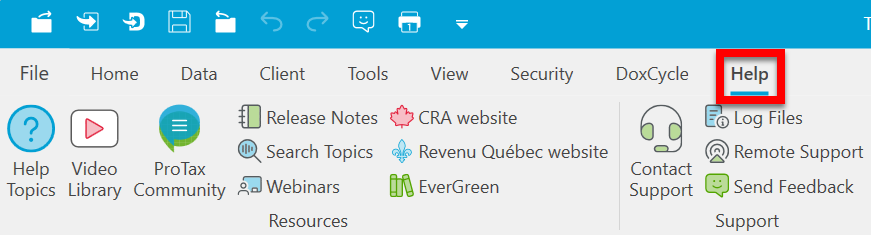

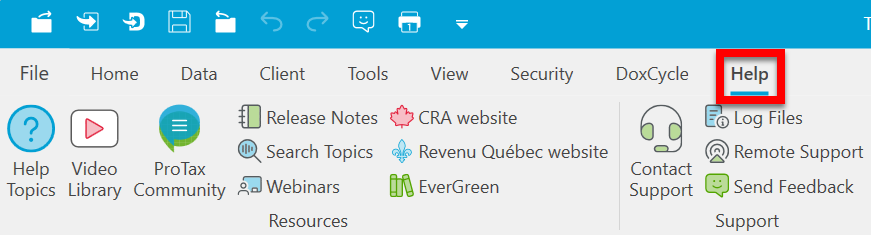

New! Help Menu in the TaxCycle Ribbon

We have added a new Help menu to the TaxCycle ribbon.

- Click the buttons in the ribbon to navigate to useful resources, including help topics, release notes, webinars and more.

- Click the EverGreen research button to access the Knowledge Bureau’s EverGreen Explanatory Notes©.

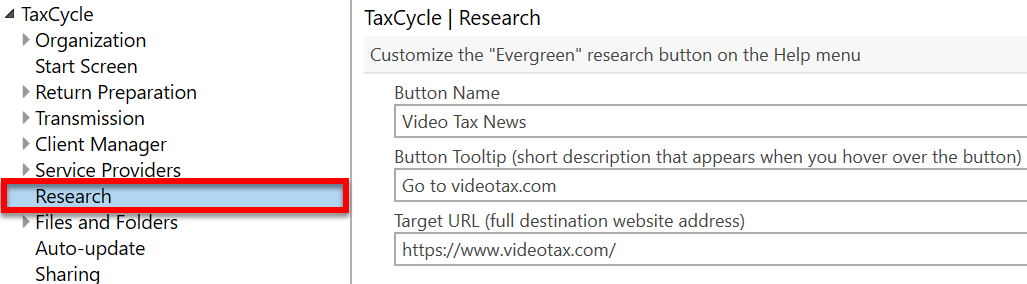

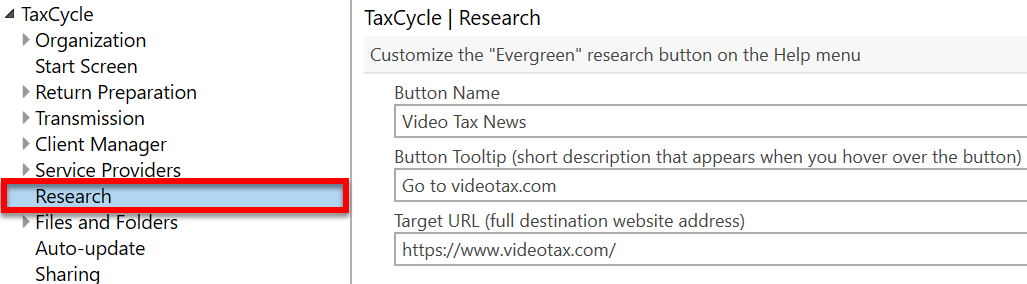

- You can customize the EverGreen button to go to a website of your choosing instead of the default. Customize the Button Name, Button Tooltip and Target URL from the Research menu in TaxCycle Options.

- The buttons in the Support section of the ribbon allow you to contact our support team, view log files, engage in a remote help session and send feedback directly from TaxCycle.

Template Changes

- Customer Request T1 2025—Updated the client letter and joint client letter to confirm the request to the CRA to apply the current-year tax refund to the subsequent year’s instalment account.

- Customer Request T1 2025 and 2024—Added a question about the BC Transplant organ and tissue donation program to the 2025 pre-season and 2024 post-season letters. This question appears for residents of British Columbia.

- T1 2025 and 2024—Added a question about short-term rental income to the 2025 pre-season letter and 2024 post-season letter. This question appears for residents of British Columbia and Ontario with current or prior-year rental income.

- T1 2025 and 2024—Added a question about crypto-assets to the 2025 pre-season and 2024 post-season letters.

- Customer Reported T1 2025—Fixed an issue where the code in the Client MR-69 Receipt was erroneously verifying whether the TP1 return was transmitted.

- Customer Request T2 2025—Added a paragraph about bare trusts to the client letter. The paragraph appears when you check the box on the Engagement worksheet confirming the corporation is required to file a T3 bare trust return.

- Customer Request T2 2025—Added a paragraph for amended returns to the client letter. The paragraph appears when you check the box on the Info worksheet indicating that the T2 return is amended.

- Customer Reported T2 2025—Improved the wording and overall flow of the client letter text for the sake of clarity.

Customer Requests

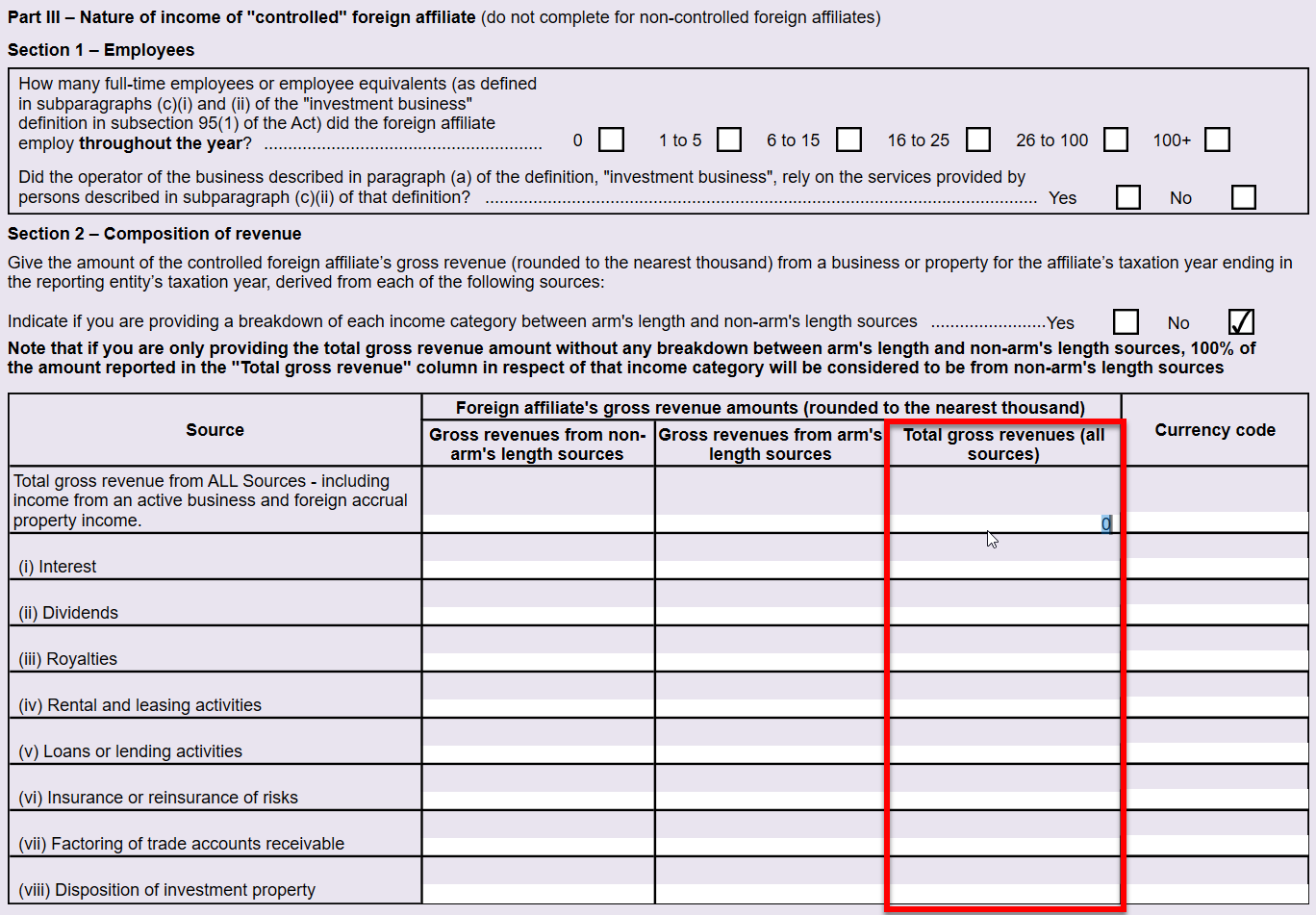

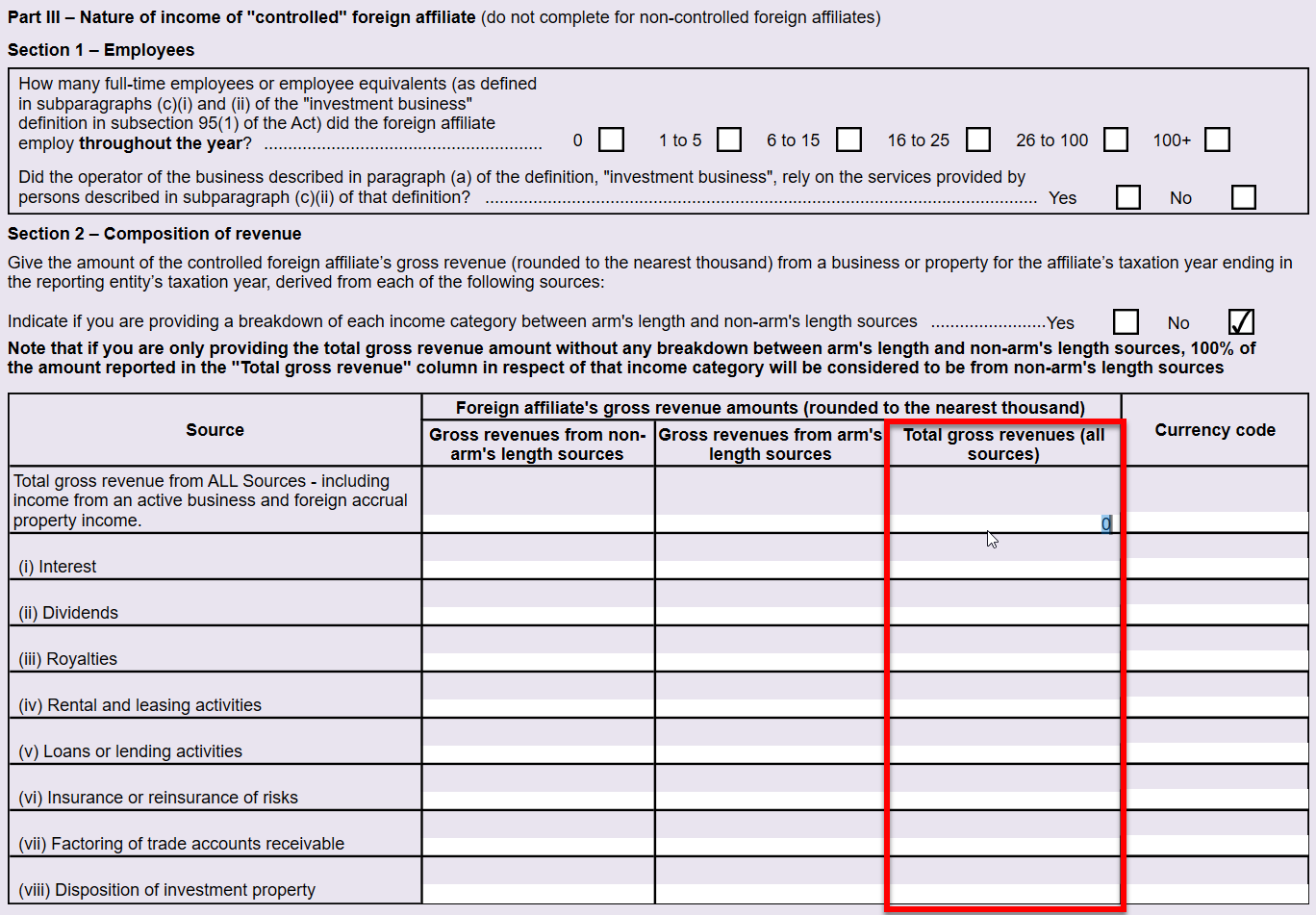

- T1, T2 and T5013 2025—You can now manually enter amounts in the Total gross revenues column (Part III, Section 2) of the T1134 Supplement (T1134Sup) without requiring an override.

- To do this, answer No to the question about the breakdown of income categories.

- If you answer Yes, TaxCycle automatically calculates the total gross revenue as the sum of gross revenues from arm’s length and non-arm’s length sources.

- To transmit a zero value for each source and type when amounts are under a thousand dollars, simply sign off on the message and only select the Currency code, leaving the amount columns blank.

- T2—Added new effective corporate tax rates to the T2 Summary, AT1 Summary and CO-17 Summary as requested in this thread on protaxcommunity.com.

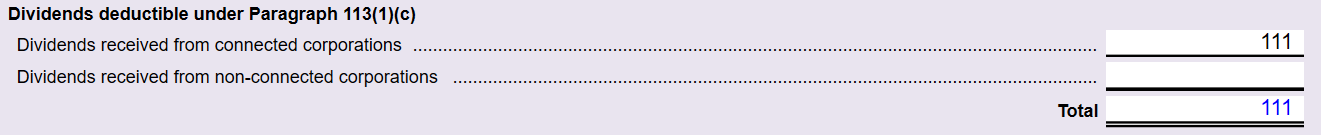

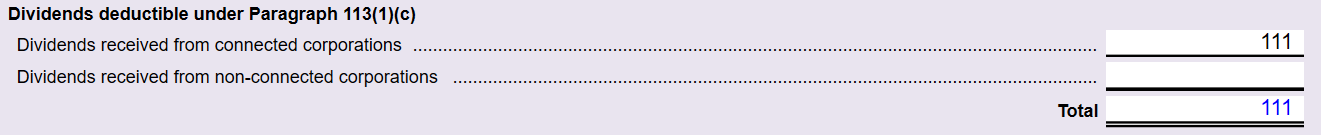

- T2—Added on screen-only fields to Part 1 of Schedule 3, where you can enter deductible dividends under paragraph 113(1)(c). If you complete only these fields and no other fields or sections, S3 remains unused. The purpose of these fields is to calculate a deduction on line 320 of the T2 jacket.

We have adjusted the calculations in the following lines and schedules to include this dividend:

- Line 320 of the T2 jacket

- Lines 62 and 49 of Schedule 7

- Line 715 of S7WS

- Amount 1D on Schedule 4

- Line 210 of Schedule 53

- Line 330 of Schedule 510

- Line 256 of the CO-17 jacket

- Amount B on QC4

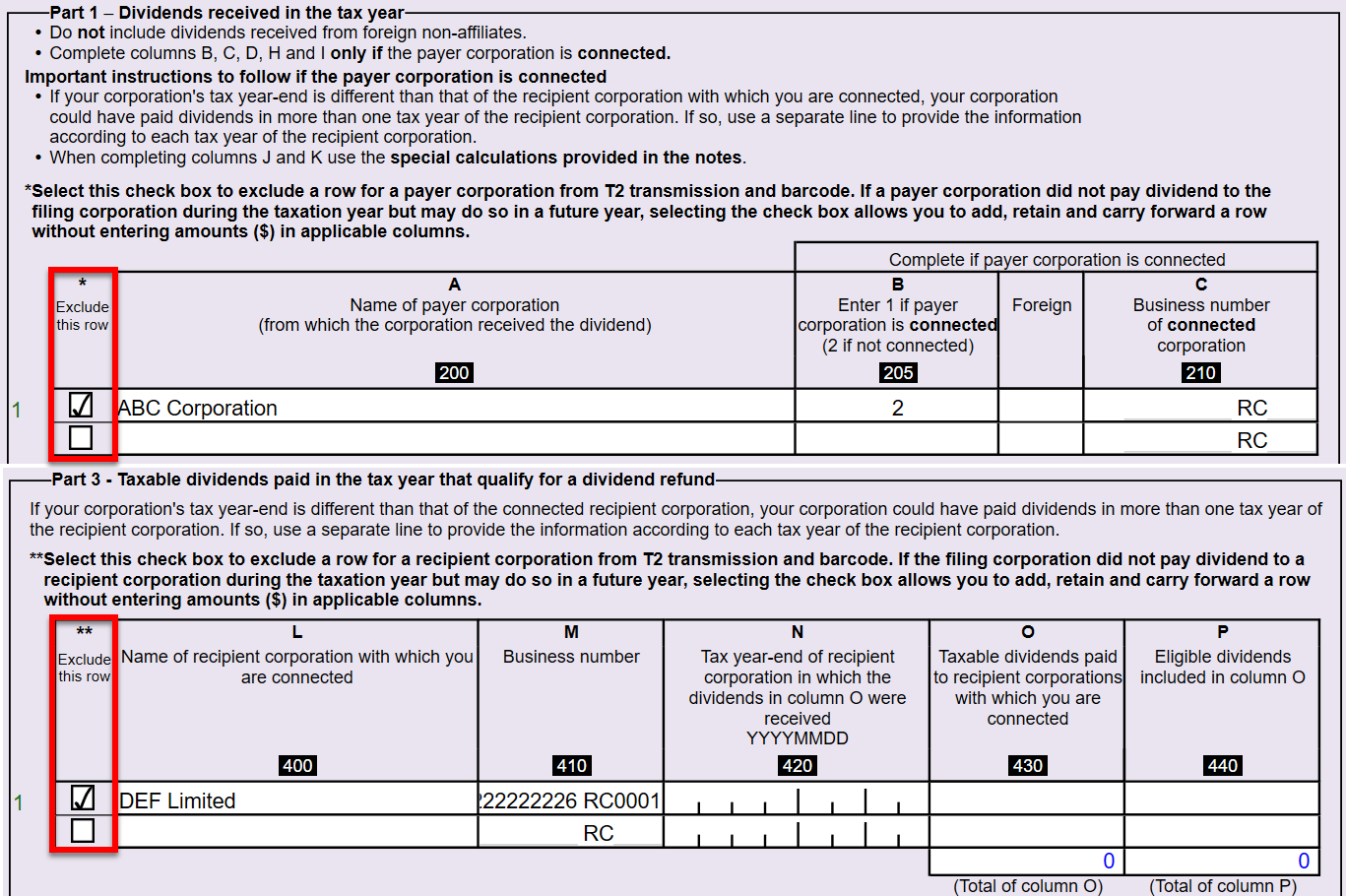

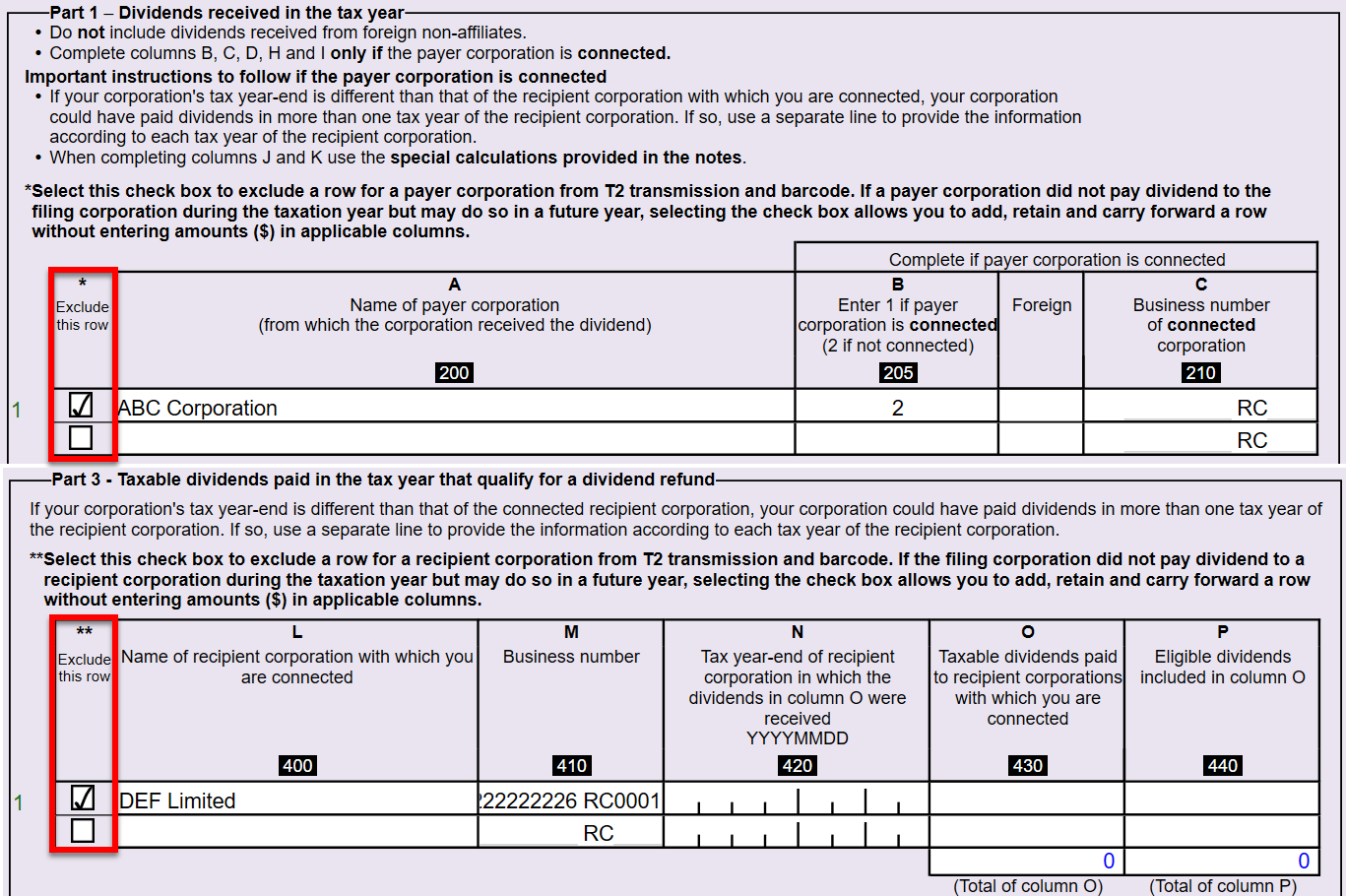

- T2—Added a new check box to the Part 1 and Part 3 tables of Schedule 3, to exclude the payer or recipient corporation row from the T2 data transmitted to the CRA. When you check the box, TaxCycle allows you to retain the corporation’s information (“tombstone data”) for carryforward, even if no dividends were paid or received in the current year. Excluded rows will not be included in the T2 transmission or barcode.

- T2—Added new options to carry forward CCA classes with zero ending UCC to the S8Claim worksheet.

- When you answer Yes to the question, “Carry forward CCA classes with zero ending UCC balances?” a CCA class will carry forward even if the previous year file’s ending UCC for a particular class is zero.

- When you answer Yes to the question, “Carry forward the asset in the additions history table even if the asset is disposed of?” the row in the History of additions table on the S8Asset worksheet will carry forward and retain the information even if the asset has been indicated as “disposed of.”

Resolved Issues

- T2 2025—Fixed a miscalculation on line 111 of Schedule 130. On S130, if the result of amount B plus amount C minus amount D in Part 2F is negative (in the absence of ITA section 257), then the amount on line 111 in Part 2G must be the absolute value of that negative amount.

- Known Issue: Incorrect ACDE and ACOGPE Rates on AT1 Schedule 15