| FILES |

| Number of PDF archives |

Unlimited |

| Number of slips and receipts per client |

Unlimited |

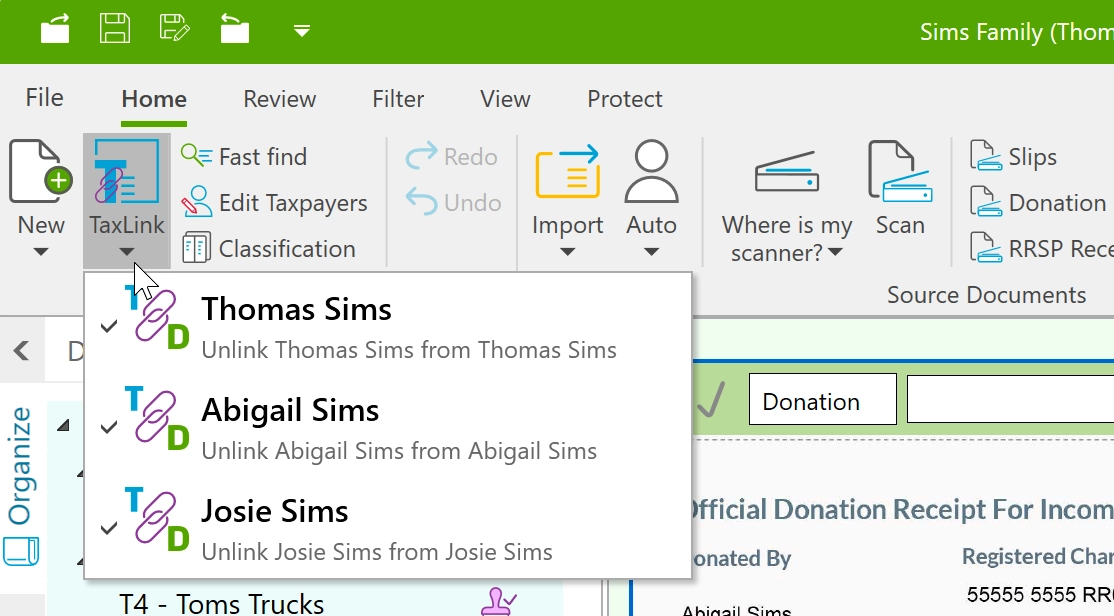

| Linking to tax return types |

T1, T2, T3, T4, T5 |

| Years |

2012 onward |

| SCANNERS |

| TWAIN 2.0 and higher |

|

| Windows Image Acquisition (WIA) |

|

| Alternate scanners via monitored folder |

|

| FORMATS |

| Drag and drop email message with attachments |

|

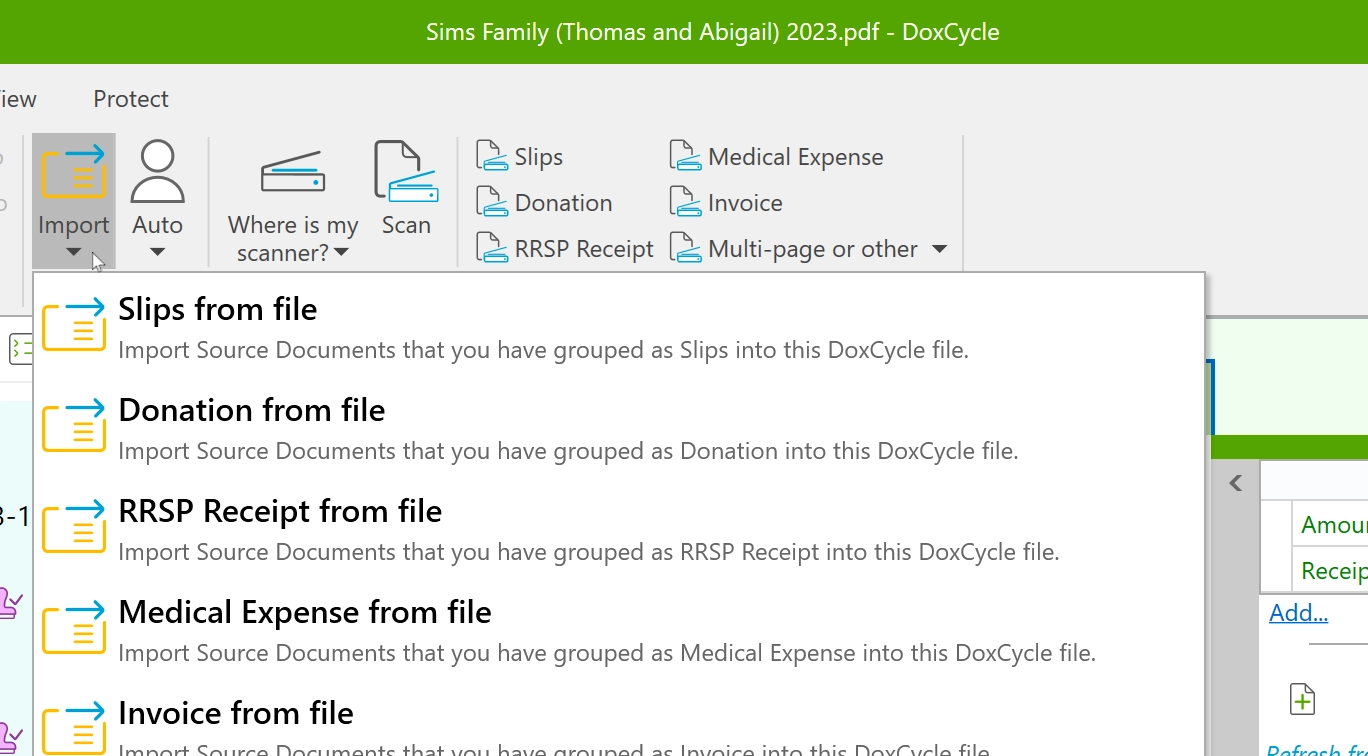

| Import PDF, JPG, PNG, GIF, BMP, TIF |

|

| DOCUMENT TYPES AND CATEGORIES FOR ORGANIZATION |

| Receipts and expenses: charitable donations, child care expenses, medical expenses, professional dues, public transit expenses, RRSP receipts/statements, student loan interest, union dues |

|

| Slips and forms: NR4, NR4-OAS, RC210, RC62, T1A, T1DD, T3, T4, T4A(OAS), T4A(P), T4A, T4A-NR, T4A-RCA, T4E, T4PS, T4RIF, T4RSP, T5, T10, T101, T183, T600, T737-RCA, T1013, T1032, T1043, T1135, T2200, T2202, T2202A, T5003, T5006, T5007, T5008, T5013, TL11A, TL2 |

|

| Invoice, notice of assessment, instalment payments, slip instructions, statements |

|

| Classification assistant for unrecognized documents |

|

| Custom document outlines to suit firm |

|

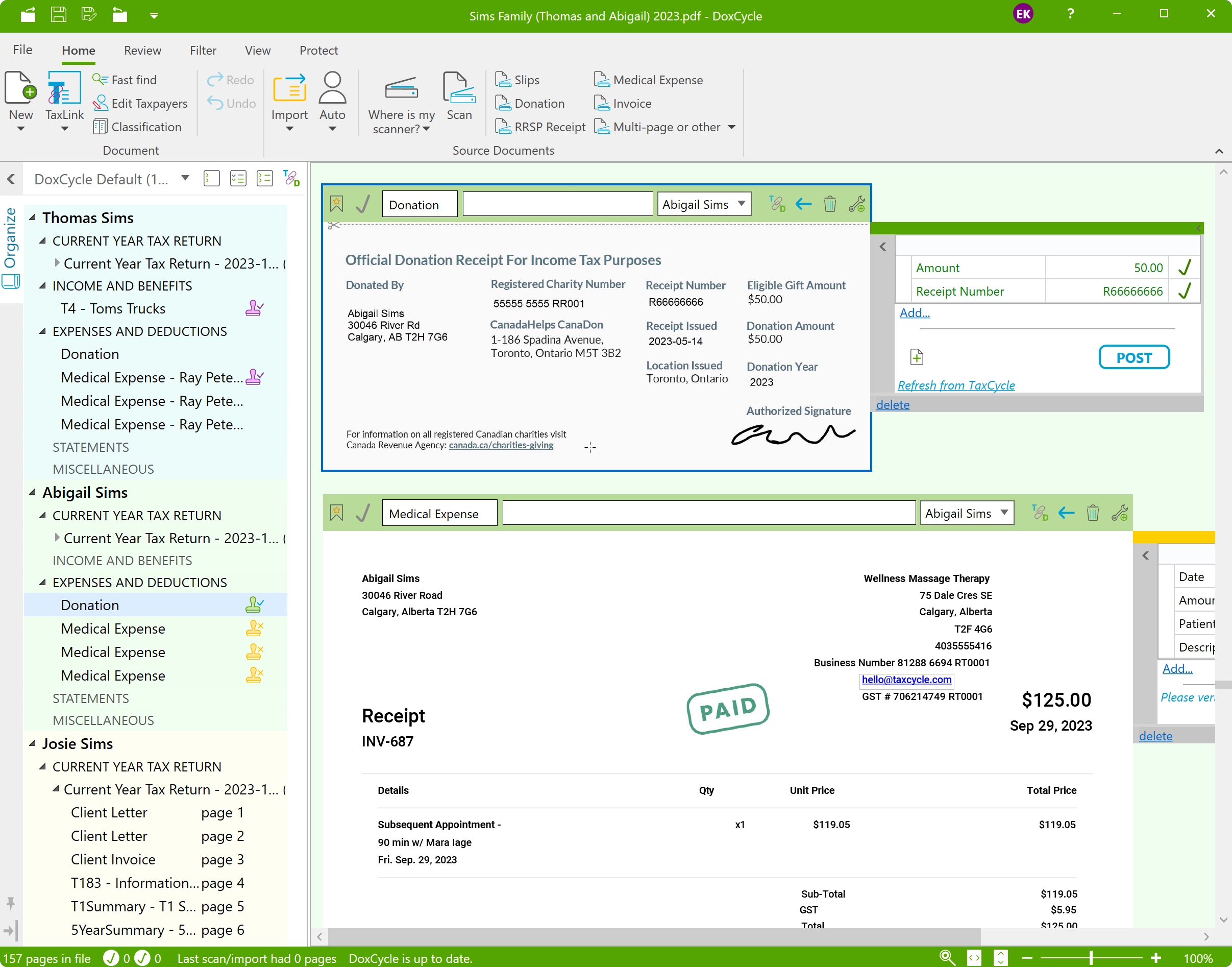

| DATA EXTRACTION |

| Automatically extract data from: T3, T4, T5, T4A(P), T4A(OAS), T4E, T5007, RC62, RC210, medical expenses, donation receipts, RRSP contributions |

|

| Add boxes to other slips for posting: T101, T2202/T2202A, T4A-RCA, T4PS, T4RSP and TL11A |

|

| Post into a new or existing slip |

|

| TAXCYCLE INTEGRATION |

| Post slip data into TaxCycle T1 |

|

| Automatically open corresponding form or slip in TaxCycle |

|

| Create DoxCycle PDF from TaxCycle |

|

| Print completed return back to DoxCycle |

|

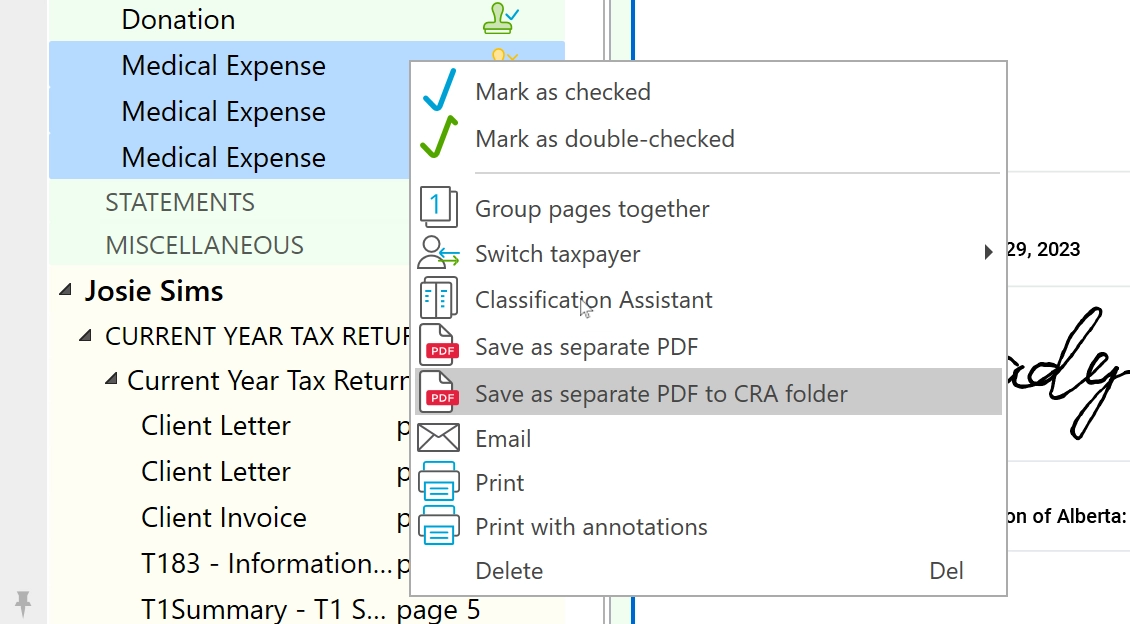

| REVIEW TOOLS |

| Annotations and notes |

|

| Review marks and sign off |

|

| Save separate PDF documents for upload to CRA |

|