We are aware of an issue where the Canada Revenue Agency (CRA) is rejecting the T2054 Election for a Capital Dividend Under Subsection 83(2) due to a missing or outdated version number footer in TaxCycle T2.

The T2054 in TaxCycle T2 was previously updated to the latest version available from the CRA. However, the T2054 form version number that appears on the bottom left of every page of the T2054 election in the CDA worksheets is either outdated or missing from the page in some cases. For this reason, the CRA is rejecting the T2054 as filed.

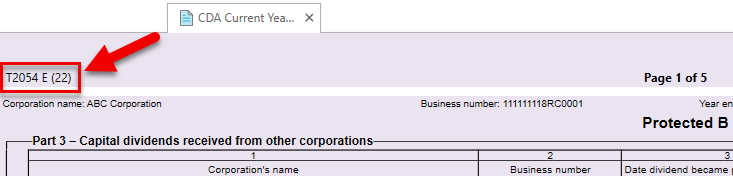

The correct version number of the form, T2054 E (22), appears on the bottom left of the first page of the CDA Current Year WS but is missing from the rest of the pages.

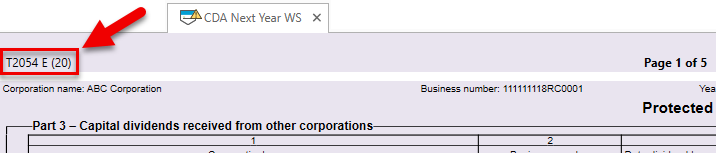

The version number that appears on the CDA Next Year WS is outdated and shows T2054 E (20) instead.

Use the T2054 in the TaxCycle Forms module, or transmit the T2054 using the Special Elections and Returns (SERs) transmission service.

We resolved this issue in the latest TaxCycle release.