TaxCycle 12.2.50769.0—T2 Special Elections and Returns (SERs)

This release adds the Special Elections and Returns (SERs) transmission service to TaxCycle T2.

To install this version immediately, download the full installer from our website or request a free trial. Once we enable the automatic update for this version, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options. (To deploy auto-update files from your network, see the Auto-Update Files page.)

Release Highlights

Special Elections and Returns (SERs) Added to TaxCycle T2

TaxCycle T2 is certified by the Canada Revenue Agency (CRA) for the Special Elections and Returns (SERs) and Submit e-Documents (SERsSupport) service, which allows you to electronically file certain special elections and returns along with any supporting documentation to the CRA. (We will also roll this feature out in the TaxCycle Forms module in a future release.)

The following forms are currently available to transmit using the SERs transmission service in TaxCycle T2:

- Schedule 89 (S89), Request for Capital Dividend Account Balance Verification

- T2054, Election for a Capital Dividend Under Subsection 83(2)

Form T217, Election or Revocation of an Election to use the Mark-to-Market Method will be added in a future update.

To learn more about the SERs transmission service, read the Special Elections and Returns (SERs) help topic.

Xero GIFI Import Update

This version of TaxCycle supports Xero’s new API changes for the Xero GIFI Import service.

In order to continue importing Xero GIFI data in TaxCycle, you must reauthenticate your Xero credentials. TaxCycle will prompt you to reauthenticate your Xero credentials if required, or you can manually reauthenticate in TaxCycle options.

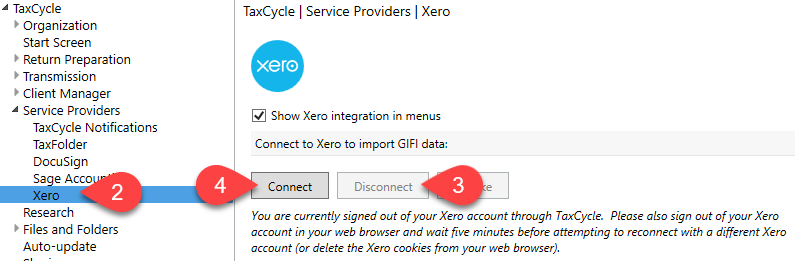

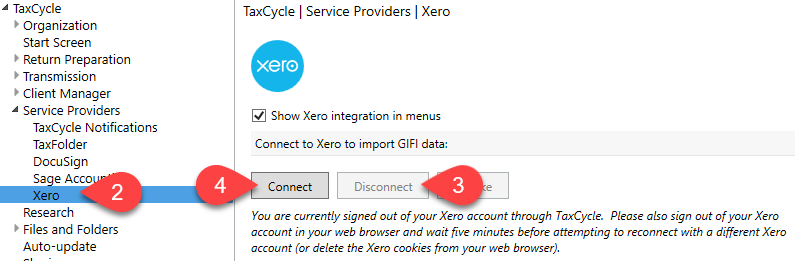

To manually reauthenticate your Xero credentials:

- From the Start screen, click Options in the blue bar on the left side. If you have a file open, go to the File menu, then click Options.

- Under the TaxCycle section, expand Service Providers and click on the Xero page.

- If you have previously connected to Xero, click Disconnect.

- Click Connect.

- Complete the authentication steps and log in using your Xero credentials from your browser.

- Return to TaxCycle and click OK or Apply to save your changes.

Resolved Issues

- Customer Reported T1—Resolved an issue related to EFILE number formats for older tax modules (2017 and 2018).

- T1—Updated the Guaranteed Income Supplement (GIS) amounts for Q3 2023.

- Customer Reported T3 2021, 2022 and 2023—Resolved an issue where the T3-ADJ pulled the wrong adjustment value on line 11080.

- Customer Reported TaxCycle Forms—Updated the UHT-2900 work chart to always show the Partnership and trust related questions. Removed the transfer for the Charity business number (BN).

- Customer Reported T5013—Fixed box 189 so it only transmits the investment tax credit (ITC) code.

- T5013—Updated certification for T1135 EFILE to October 31, 2023.

- Customer Reported T5013—Fixed the automatic transfer of asset disposals from the S8Asset to the S6 Manager (S6M)

- Customer Reported T5013—Fixed the transfer of capital gains to RL-15 where gains are reported on a slip issued to the partnership.