TaxCycle 14.2.56967.0—2025 T1/TP1 Preview Rates and Forms

This release adds the 2025 T1/TP1 module with forms in preview mode and updated rates and calculations for 2025 personal tax returns.

To install this version immediately, download the full installer from our website or request a free trial. Once we enable the automatic update for this version, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options. (To deploy auto-update files from your network, see the Auto-Update Files page.)

Release Highlights

2025 T1/TP1 Preview Rates and Forms

The new TaxCycle T1/TP1 2025 module includes forms in preview mode, along with rates and calculations for 2025 personal tax returns. Use this module for planning and evaluation purposes only.

The government forms you see in the TaxCycle T1/TP1 2025 module are the 2024 forms. The amounts and rates are those already announced or that we have estimated based on information we have at this time, as well as those announced in the federal and provincial/territorial 2025 budgets.

What you need to know:

- You can carry forward 2024 T1/TP1 returns from TaxCycle. Carryforwards from ProFile®, Taxprep® and DT Max® will become available in a subsequent release. All carry forward conversions are currently under review and will be updated before the next tax season. We do not recommend batch carryforward at this time.

- Files you create now will continue to work after the module receives certification from the CRA. EFILE is not available for 2025 tax returns until February 2026.

- The CRA has not yet certified TaxCycle T1/TP1 2025 for electronic or paper-filing. However, you may use it to prepare and file a deceased taxpayer’s 2025 return.

- All forms show a Preview watermark on screen and when printing, except those used for authorization and some summaries.

- If you have already purchased a 2025 TaxCycle license, you may enter a date of death in 2025, or a date of bankruptcy in 2025 and select pre-bankruptcy as the type, to remove the Preview watermark from forms. This allows you to print and paper-file the T1Condensed (the bar code will not show on the form) before we release a filing version next December or January if you need to.

To learn how to create planning files, review the following help topics:

Alberta Bill 39

Alberta’s Financial Statutes Amendment Act, 2025, also known as Bill 39, included the implementation of a new lowest tax bracket of 8% on the first $60,000 of taxable income. It also included a supplement of 2% for the portion of non-refundable amounts exceeding $60,000.

This version of T1 2025 includes the supplement in the calculation of line 58840.

TaxCycle’s optimizations do not currently account for this supplement and will be adjusted in a future release.

End of Access to AuthRep Web Service

The CRA announced in March that the Authorize a Representative (AuthRep) service for EFILE software will no longer be available for individuals as of July 15, 2025. You will need to use Represent a Client to obtain access to an individual’s CRA account.

Starting July 15, 2025, TaxCycle will show a message in the AuthRep box in the Transmit sidebar indicating the service was discontinued by the CRA.

You will still be able to use Auto-fill My Return. However, you must first complete the access step in Represent a Client.

This change will not impact authorization requests for business clients (AuthRepBus).

T2 Updates

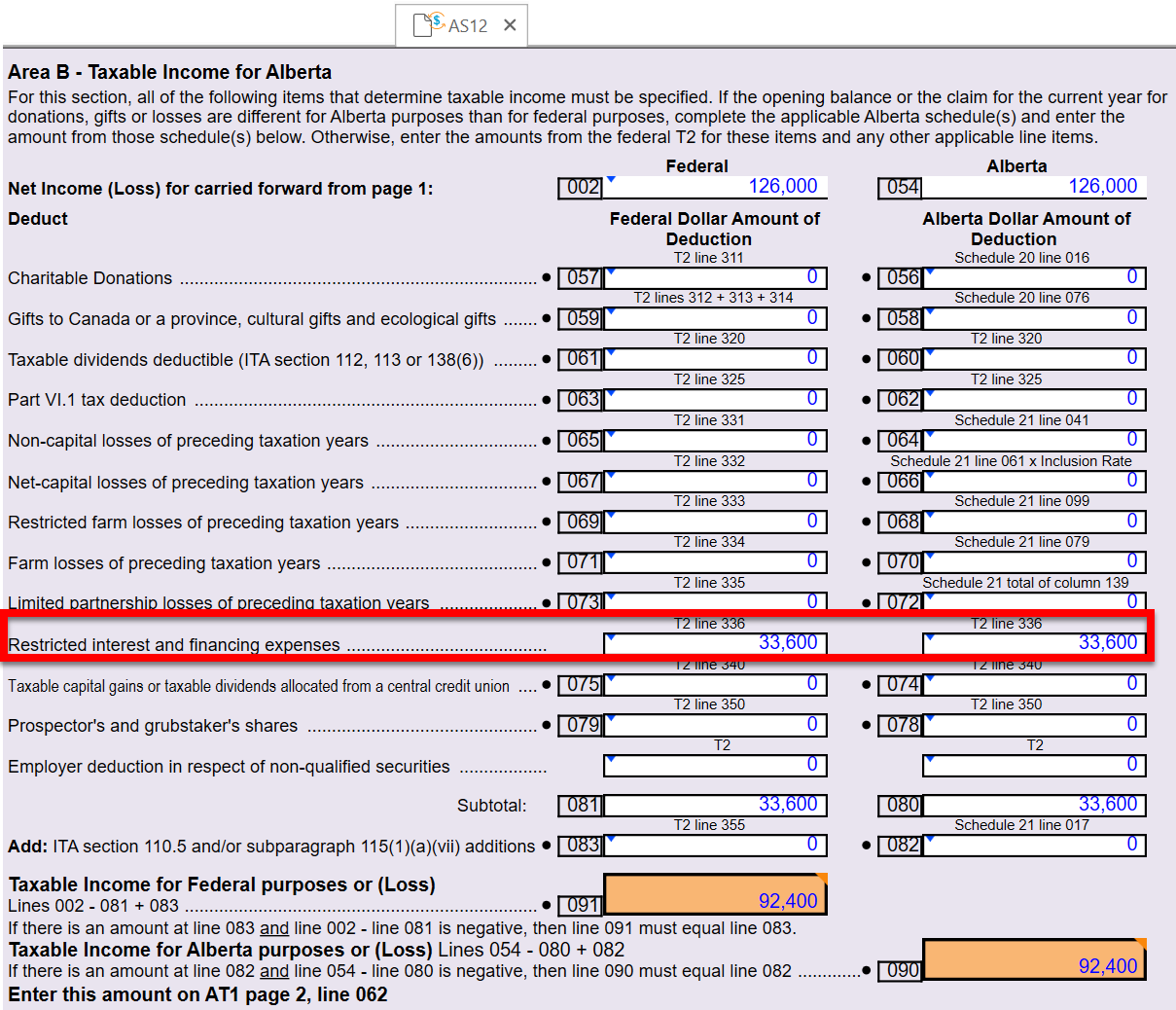

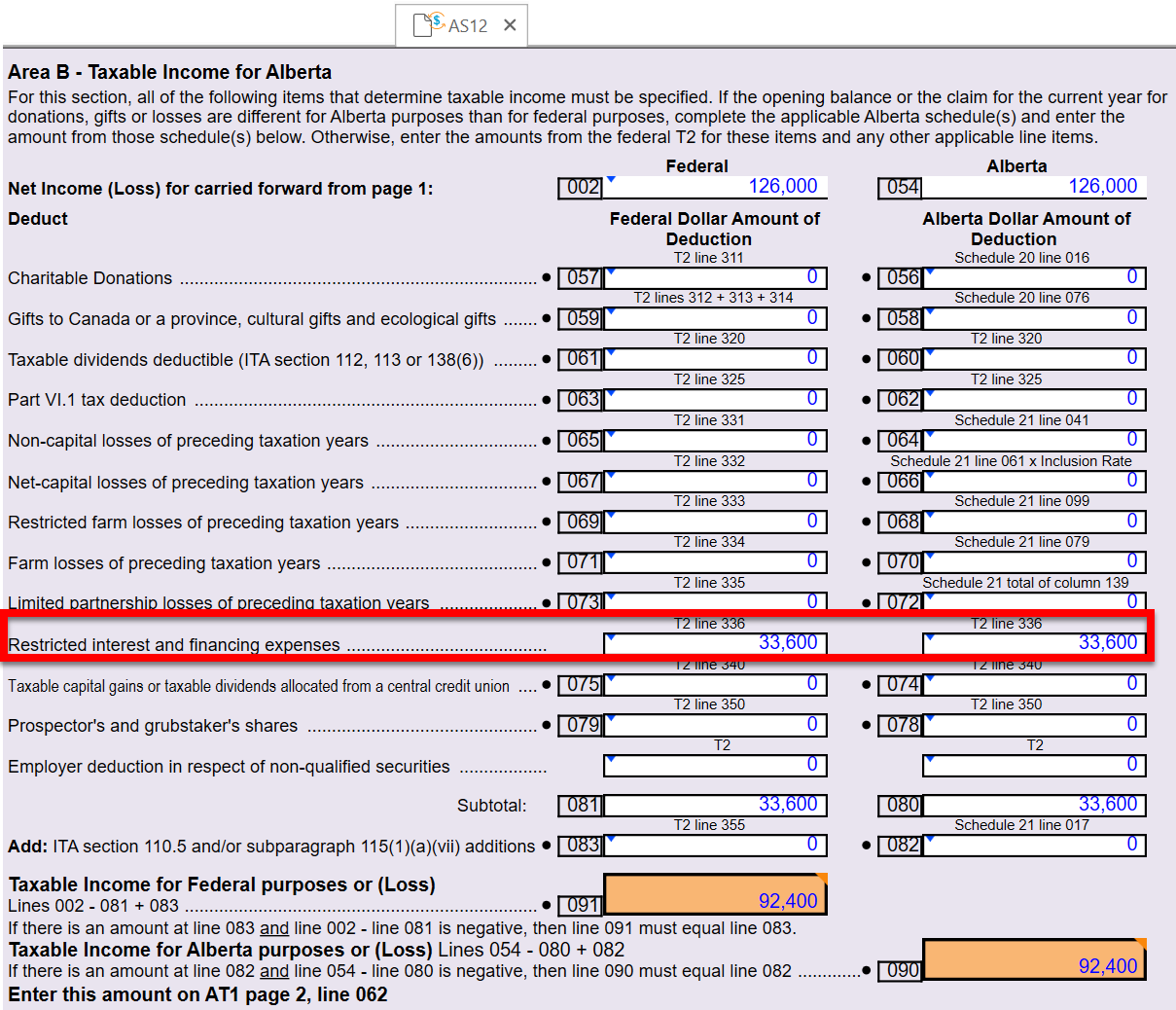

- T2—Added the following new lines to AT1 Schedules 12 and 21 to record restricted interest and financing expenses from line 336 of the T2 jacket.

- Customer Request T2 2025—Added a question about the T3 Bare Trust requirement to the Engagement worksheet.

- T2—TaxCycle now calculates line 111 on the Schedule 130.

Changes in the Template Editor

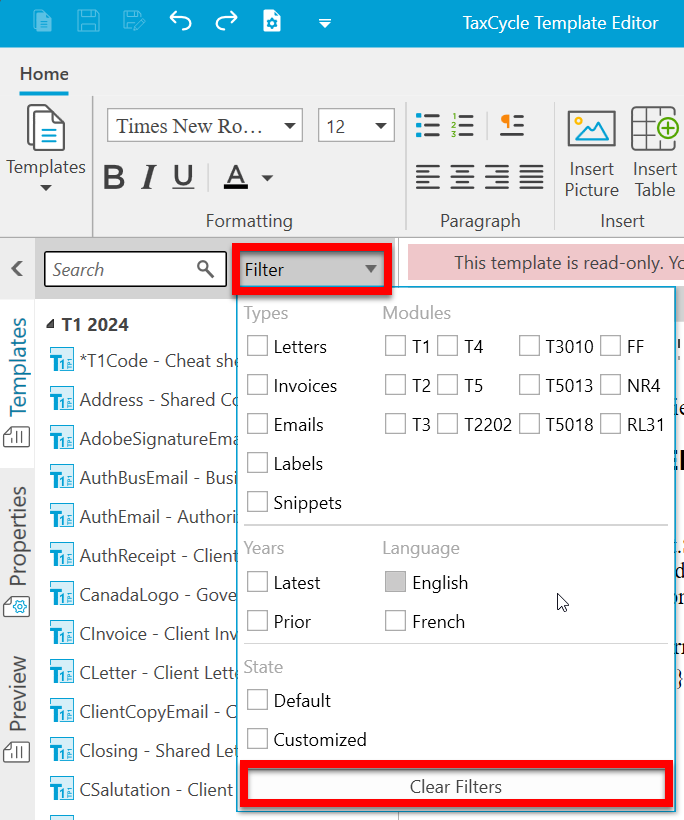

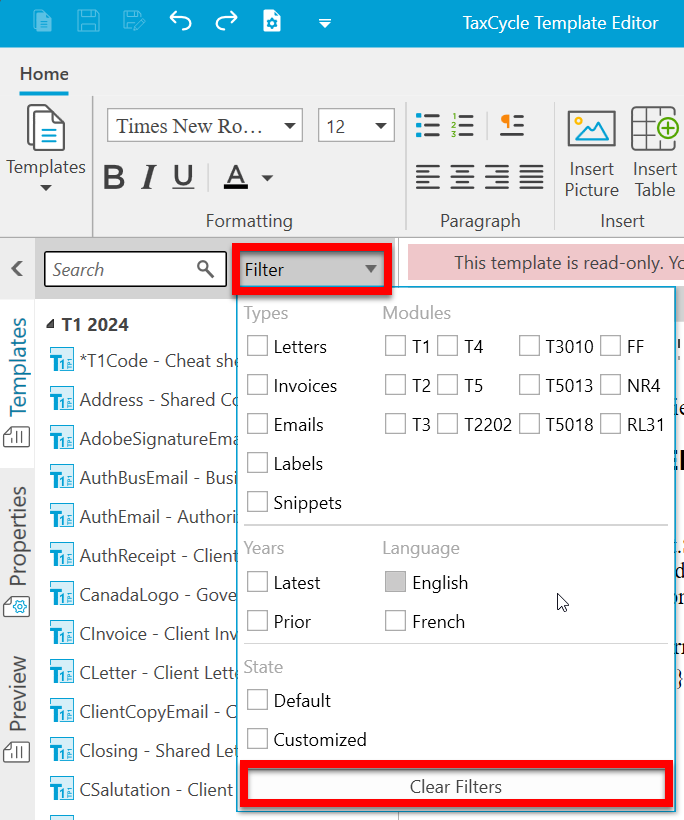

New! Filter Dropdown Menu

You can now apply filters to templates displayed in the Templates sidebar using the new Filter dropdown menu. Select one or more filters to quickly refine the template list by:

- Template types

- TaxCycle modules

- Latest or prior years

- Language

- State (default or customized)

To clear all applied filters and view all templates again, click Clear Filters.

Other Changes

- Customer Reported T1 2024 and 2025—Updated the link to the CRA My Payment page in the client letter (CLetter), joint client letter (JLetter) and deceased letter (DLetter).

- Customer Reported T1 2024 and 2025—Removed the paragraph tags for template code between tables that appear as rows in a larger table from the English and French client letter (CLetter) and joint client letter (JLetter), in order to fix an issue where the Template Editor added spaces when personalizing a letter.

- Customer Request T2 2025—Added a paragraph about online mail to the client letter (CLetter) in English and French.

Resolved Issues