TaxCycle 14.2.57271.0—T1 and T2 Updates, Competitor Carryforward

This release updates T1 and T2 forms to the latest versions from the Canada Revenue Agency (CRA) and updates competitor carryforward.

To install this version immediately, download the full installer from our website or request a free trial. Once we enable the automatic update for this version, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options. (To deploy auto-update files from your network, see the Auto-Update Files page.)

Release Highlights

T1 Updates

- Updated Schedule 8 and form RC381 to the latest 2024 versions the CRA released to address EFILE errors 90308 and 95031.

- Set the estimate for the BC Climate Action Tax Credit for 2025-26 to zero in the T1 2024 module, following the removal of the federal fuel charge effective April 1, 2025.

- Removed all estimates related to the Canada Carbon Rebate from the T1 2025 module in Preview mode.

T2 and AT1 Updates

- Updated Schedule 4 to the latest version from the CRA.

- Updated Schedule 63 to the latest version from the CRA.

- Updated the AT1 consent form (AT4930) to the latest version, which removes the fax number on page 2.

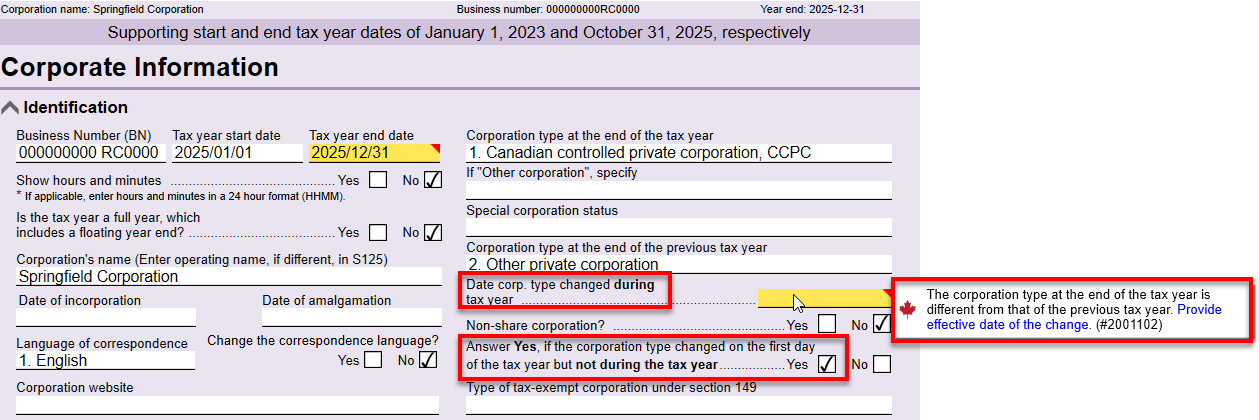

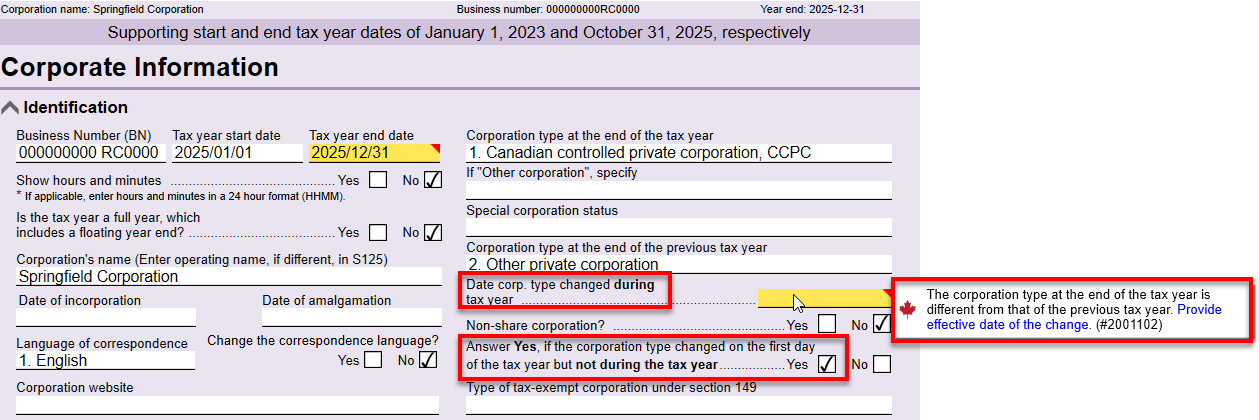

- TaxCycle now displays a review message if a corporation type changes to CCPC on the first day of the corporation’s taxation year, requiring you to enter the effective date of the corporation type change on the Info worksheet. TaxCycle calculates the return as if the corporation was a CCPC throughout the tax year. (Previously, if a corporation changed its type to CCPC on the first day of its tax year, TaxCycle did not show a review message. In addition, the corporation was considered a CCPC through its taxation year for the purposes of ITA 125(1)).

Competitor Carryforward

This release allows you to carry forward 2024 returns from ProFile® to all supported TaxCycle modules (T1, T2, T3, T5013, and slips). It also allows you to carry forward T2 returns from Taxprep® 2025 v1.1 to TaxCycle T2.

All carryforward conversions (excluding T2) are currently under review and will be updated before the next tax season. We recommend that you only carry forward files you need to file immediately.

Class 54 Non-Passenger Vehicles

- T1, T2, T3 and T5013—Class 54 for CCA purposes can now handle the addition of a zero-emission vehicle that is considered a non-passenger vehicle.

- When you add a zero-emission passenger vehicle to the T1 or T3 asset manager worksheet, and the T2 or T5013 S8Asset worksheet, an annual capital cost limit is applied to limit the acquisition amount. However, if the class 54 addition is for a zero-emission non-passenger vehicle, an annual capital cost limit does not apply.

- To accommodate the addition of non-passenger zero-emission vehicles to class 54, we have added a new question about the type of vehicle being added and the type of vehicle being disposed of in the Additions and Dispositions sections of the S8Asset worksheet.

End of Access to AuthRep Web Service

Following a CRA announcement in March, the Authorize a Representative (AuthRep) service for EFILE software is no longer available for individuals as of July 15, 2025. You must now use Represent a Client to obtain access to an individual’s CRA account.

You can still use Auto-fill My Return. However, you must first complete the access step in Represent a Client.

This change does not impact authorization requests for business clients (AuthRepBus). Read this news item to learn more.

Template Updates

- T1 2025—Added sample code for T1-ADJ to the English and French T1 Code template, which shows you how to get data from the T1 adjustments table on the T1-ADJ worksheet. See the sample code in the select() function help topic.