TaxCycle 12.0.49161.0—T1/TP1 and T3 Preview, T5013 Immediate Expensing

This version of TaxCycle includes the 2022 forms for both T1/TP1 and T3 and adds immediate expensing calculations to T5013 returns.

To install this version immediately, download the full installer from our website or request a free trial. Once we enable the automatic update for this version, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options. (To deploy auto-update files from your network, see the Auto-Update Files page.)

Release Highlights

This release updates the T1 federal and provincial schedules, as well as many other forms, to the latest versions available from the Canada Revenue Agency (CRA). It also updates the TP1 jacket and all schedules to the latest versions available from Revenu Québec.

With this release, we have removed the Preview watermark from most forms to allow you to mail any returns to CRA or Revenu Québec that are ready and which you do not want to or cannot yet transmit through EFILE. Since EFILE certification with CRA is ongoing, no bar code will appear on the T1 Condensed.

The following forms still show the Preview watermark due to ongoing work:

- T2203, Provincial and Territorial Taxes for Multiple Jurisdictions

- T2038-IND, Investment Tax Credit (Individuals)

- T2039, Air Quality Improvement Tax Credit

- AgriStability/AgriInvest forms (T1163/1164 and T1273/1274)

- T776, Statement of Real Estate Rentals

- T2042, Statement of Farming Activities

- T2121, Statement of Fishing Activities

- T2125, Statement of Business or Professional Activities

For more information, see the T1 Condensed (Paper-Filing) help topic.

Important updates

- T1—Home buyers’ amount (line 31270) increased to $10,000

- T1—Home accessibility expenses (line 31285) maximum increased to $20,000

- T777—Added Labour Mobility Deduction for Tradespeople

- TP1 Schedule J—First stage of enhancements announced in the 2021 budget

- TP-1029.SA—Enhancements announced in the December 8th fiscal update

- Climate Action Incentive—As of July 1st, 2023, the federal fuel charge will apply to Prince Edward Island, Nova Scotia and Newfoundland and Labrador. Residents of Nova Scotia and Newfoundland and Labrador who reside in a small or rural community will have to check the box to get the supplement to the incentive. Our estimates of the incentive will calculate for the payments for July and later.

- MB479 Manitoba Credits—The new Renters tax credit replaces the rent component of the Education Property Tax Credit. A new table must be completed in order to claim the credit, which includes the number of months for which the rent was paid. As for the Education Property Tax Credit, it now requires the number of days that the client was a resident at the address instead of the number of months.

- ON479 Ontario Credits—Added the new Ontario Seniors Care at Home Tax Credit and the Ontario Staycation Tax Credit, the latter of which is only for 2022 and for which it is important that all receipts include the HST number of the accommodation provider.

Forms added

- NS479 Nova Scotia Credits—Children’s Sports and Arts tax credit

- T2039, Air Quality Improvement Tax Credit

- T1B, Request to Deduct Federal COVID-19 Benefits Repayment in a Prior Year

Forms removed

- TP-1029.9 Tax Credit for Taxi Drivers or Taxi Owners

TaxCycle T1/TP1 does not yet contain the calculations to support the immediate expensing of CCA. Work on these calculations is underway and we hope to finalize them in a few weeks. Meanwhile, if you wish to claim immediate expensing, override the amounts on the applicable CCA form or worksheet.

Electronic Submission of T1 AuthRep

Electronic submission of authorization requests (AuthRep) from TaxCycle T1 for 2022 will require you to update to this release in order to transmit authorization requests starting February 6, 2023.

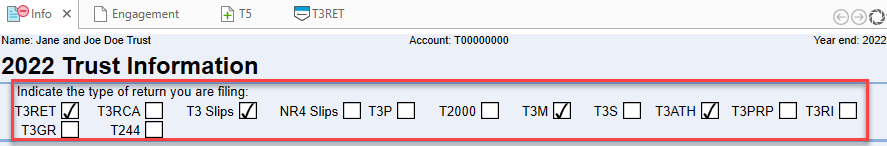

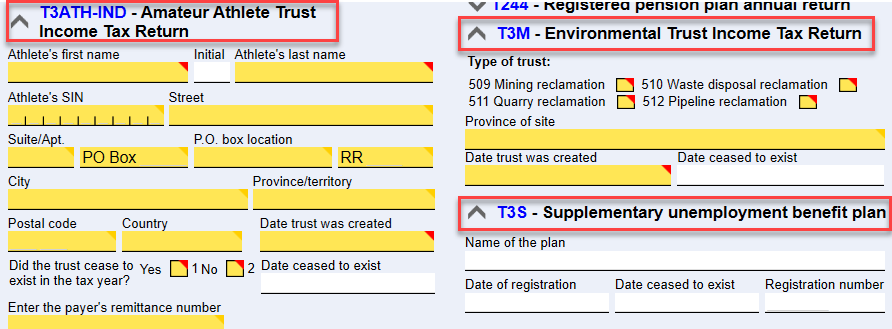

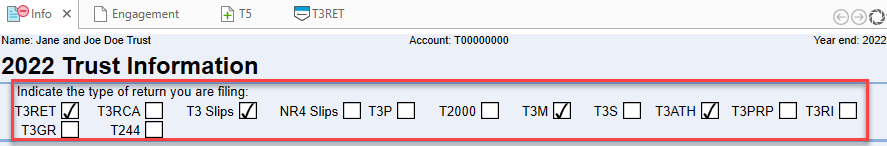

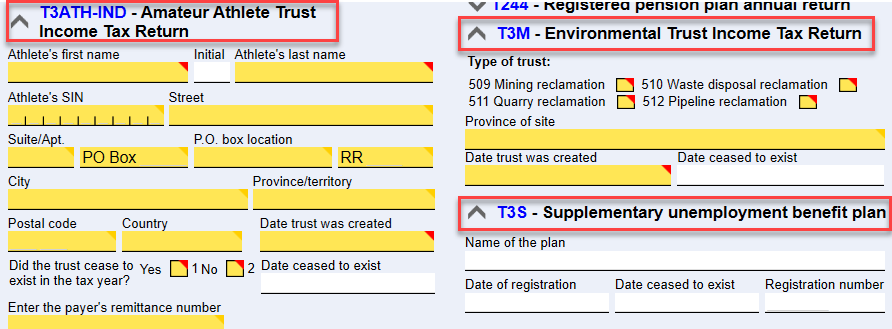

New T3 EFILE for T3ATH-IND, T3M and T3S

TaxCycle now supports T3 EFILE (once systems open) of the following return types with fiscal periods ending in 2022 and after:

- T3ATH-IND, Amateur Athlete Trust Income Tax Return

- T3M, Environmental Trust Income Tax Return

- T3S, Supplementary Unemployment Benefit Plan Income Tax Return

When transmitting these forms, make sure to check the box for the type of return you are filing on the Info worksheet, as this triggers the relevant review messages for the specific return being filed. For detailed instructions, please see the T3 EFILE help topic.

Each of these return types has a collapsible section for you to fill out on the Info worksheet:

New T3 Forms for Paper-Filing Only

We added the following new T3 forms for paper-filing only:

- T3GR, Group Income Tax and Information Return for RRSP, RRIF, RESP, or RDSP Trusts

- T3GR-WS, Worksheet for Part XI.1 Tax on Non-Qualified Property of an RRSP, RRIF, or RESP trust

- T1061, Canadian Amateur Athlete Trust Group Information Return

- T3PRP, T3 Pooled Registered Pension Plan Tax Return

- T3RI, Registered Investment Income Tax Return

- Customer Request T3SIFTWS, SIFT (specified investment flow-through) worksheet specifically for inter-vivos SIFT trusts. For more information, see the T3 SIFT (specified investment flow-through) help topic and CRA's page on SIFT trusts.

T3GR, T1061, T3PRP and T3RI are under consideration for Internet File Transfer (XML) for a future TaxCycle release. The T3GR-WS worksheet is a supporting form for trusts that need to file the T3GR return.

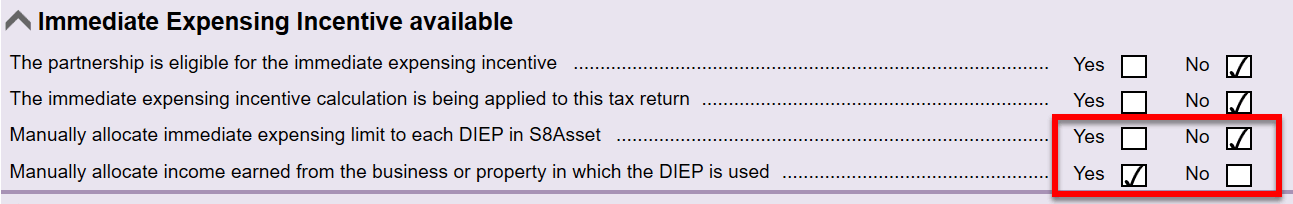

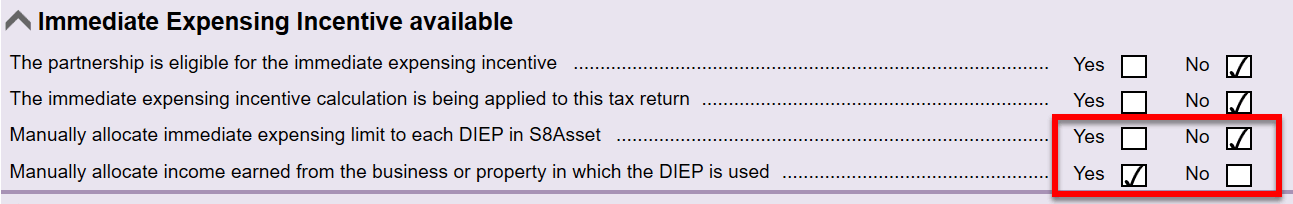

T5013 Immediate Expensing

This version of TaxCycle adds immediate expensing calculations to T5013 returns. The S8Claim contains two additional questions to allow you to manually allocate immediate expensing limit as well as manually enter the income earned from the business or property in which DIEP is used.

For details on how to claim immediate expensing in TaxCycle, read the Immediate Expensing help topic.

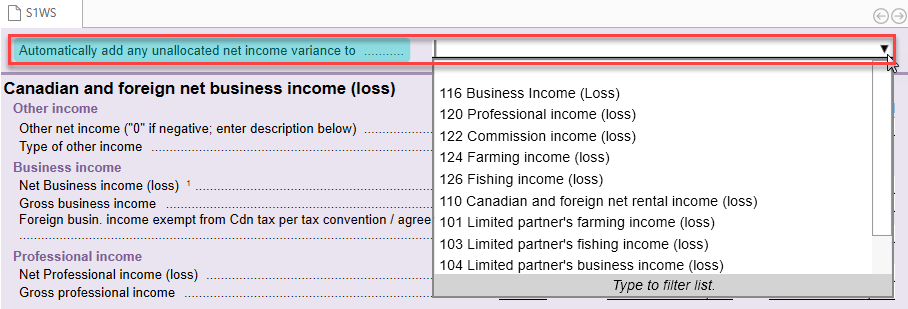

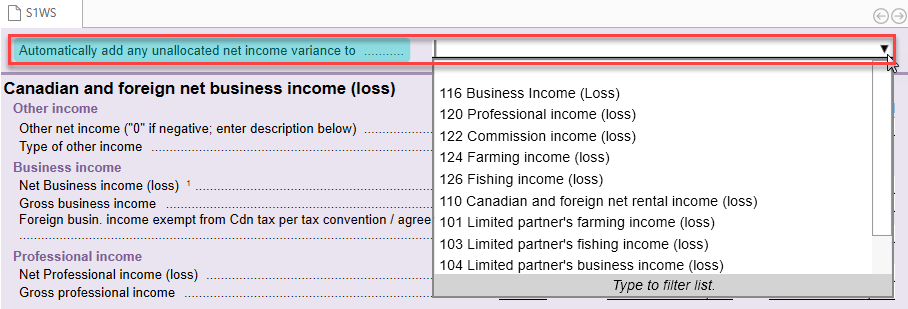

T5013 Automatic Allocation

This version of TaxCycle adds a new drop-down option on the S1WS and TPFWS worksheets to automatically allocate any unallocated net income variance to a specified income line. Once selected, this option adds an adjustment line in the relevant section of the worksheet.

Template Changes

- T1—2022 pre-season and 2021/2022 post-season letters (PreSeason, PostSeason, JPreSeason, JPostSeason, FPreSeason, FPostSeason)

- Customer Request Added a question to the Checklist snippet to ask whether the taxpayer has income that is exempt under the Indian Act.

- Customer Request Added a question to the Checklist snippet to ask whether taxpayers in Ontario or Nunavut consent to sharing their information for the purposes of organ and tissue donation.

- Updated the signature area on the last page to use the same layout as the Engagement letter (ELetter) and include the Legal Representative information if entered on the Info worksheet.

- Customer Reported T1—Fixed a typo in the Deceased Client Letter (DLetter) where the word "CRA" was missing.

- Forms, T2, T3 and T5013—The Engagement letter (ELetter) now uses the "Engagement start" date from the Engagement worksheet to insert the date in the letter. If no date is entered on the Engagement worksheet, the letter will use today's date.

- Added the first() function that looks for the first instance that matches the condition. For example, you can use this function to display a section in a template if there is at least one dependant under the age of 12. It will show the text but will not repeat the text if there is more than one dependant who match the criteria. See the first() help topic for sample code.

Customer Requests

- T3—Added billing and invoicing.

- Added option to show second slip preview on the T5013Partner worksheet when applicable.

Resolved Issues

- Customer Reported Resolved an issue where TaxCycle displayed an error message related to T5013SCH63 (Return of Fuel Charge Proceeds to Farmers Tax Credit) when attempting to transmit T5013 returns from 2021 or prior years.

Status of File Carryforwards from 2021 to 2022

As of this release, all 2021 to 2022 carryforwards are up to date. This includes:

- T1/TP1—TaxCycle, ProFile®, Taxprep®, Cantax®, DT Max®

- T2/CO-17—Carryforwards from TaxCycle, ProFile®, Taxprep®, Cantax®, DT Max®, creating files with year ends up until May 31, 2023

- T3/TP-646, RL-16—TaxCycle, ProFile®, Taxprep®, Cantax®, DT Max®

- T4, T4A, RL-1/RL-2—TaxCycle, ProFile®, Taxprep®, Cantax®

- T4PS—TaxCycle, ProFile®, Taxprep®, Cantax®

- T4A-RCA—TaxCycle, ProFile®

- T5, RL-3—TaxCycle, ProFile®, Taxprep®, Cantax®

- T2202—ProFile®, Taxprep®

- T5013/TP-600, RL-15—TaxCycle, ProFile®, Taxprep®, Cantax®

- T5018—TaxCycle, ProFile®, Taxprep®, Cantax®

- T3010/TP-985.22—TaxCycle, ProFile®, Taxprep®, Cantax®

- NR4—TaxCycle, ProFile®, Taxprep®, Cantax®

- Forms—TaxCycle, ProFile®, Taxprep®, Cantax®

- RL—TaxCycle, ProFile®, Taxprep®, Cantax®

Status of 2022 Federal Returns and Slips

- T1—You may begin data entry. EFILE opens on February 20, 2023

- T2—Certified to file tax year ends up to May 31, 2023

- T3RET—You may begin data entry. EFILE opens on February 20, 2023

- T3 slips—Ready for filing

- NR4 (in T3 module)—Ready for filing

- T4—Ready for filing

- T4A—Ready for filing

- T4PS—Ready for filing

- T4A-RCA—Ready for filing

- T5—Ready for filing

- T5013-FIN—Ready for filing

- T5013 slip summary—Ready for filing

- T5018—Ready for filing

- NR4 slips (standalone NR4 module)—Ready for filing

- T4A-NR slips (in NR4 module)—Ready for filing

- T3010—Ready for filing

Status of 2022 Québec Returns and Relevés

- TP1—You may begin data entry. NetFile opens on February 20, 2023

- TP-646—Ready for filing

- RL-16—Ready for filing

- TP-600—Ready for filing

- RL-15—Ready for filing

- RL-1—Ready for filing

- RL-2—Ready for filing

- RL-3—Ready for filing

- RL-24—Ready for filing

- RL-31—Ready for filing

- TP-985.22—Ready for filing