TaxCycle 12.1.49577.0—T1 Immediate Expensing (Revised)

This version of TaxCycle adds immediate expensing calculations to T1 returns.

To install this version immediately, download the full installer from our website or request a free trial. Once we enable the automatic update for this version, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options. (To deploy auto-update files from your network, see the Auto-Update Files page.)

Release Highlights

Revisions

We originally released version 12.1.49548.0 on March 24, 2023, with the changes below. On March 28, 2023, we released version 12.1.49577.0 to address the following issues:

- Resolved an issue where TaxCycle would not export invoices to QuickBooks®.

- Fixed the non-eligible dividends field code in the Dividends Paid paragraph of the T2 Client Letter (CLetter).

- Forms Module—Added a UHT worksheet to record and track properties that are subject to the Underused Housing Tax.

- Customer Request Updated T1 Create Forms to include the transfer of the address for Canadian rental properties entered on the T776, and added the transfer for the email and mobile phone number.

This version of TaxCycle adds immediate expensing calculations to T1 returns.

Please note that when you open existing T1 files in this release, immediate expensing calculation is disabled by default to prevent changes to CCA.

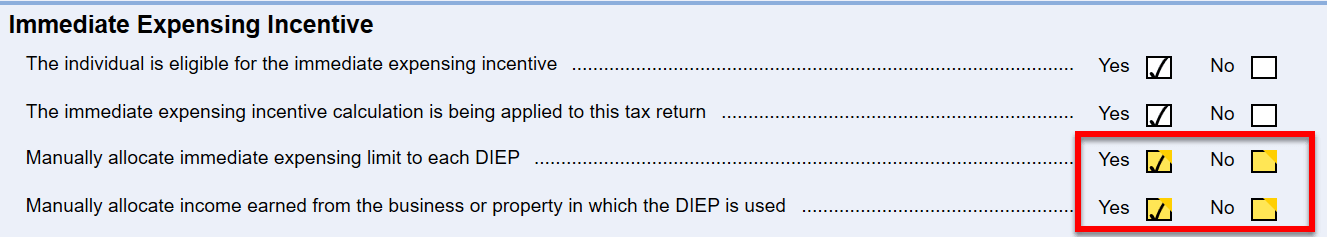

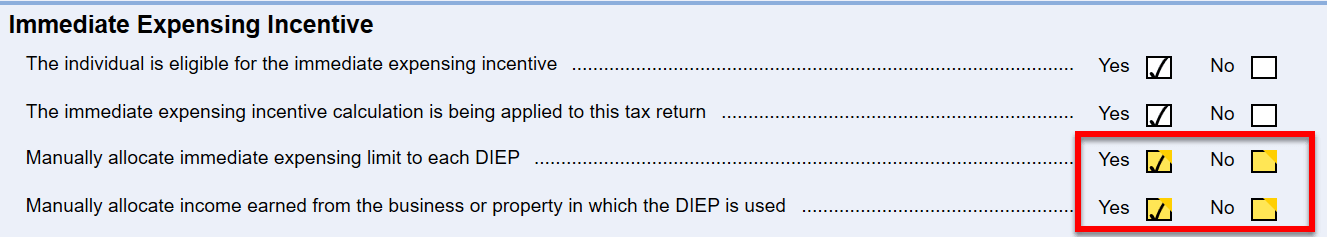

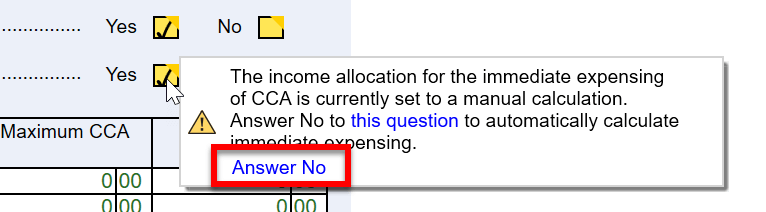

You must answer No to the following two questions on the CCA Claim worksheets to enable immediate expensing calculation.

The default for both questions in TaxCycle T1 2022 is set to Yes, manually allocate. This protects the calculations and CCA claims during the middle of personal tax filing season. (In the 2023 T1 module, we will set the default to No for these questions, similar to the implementation in T2/T5013.)

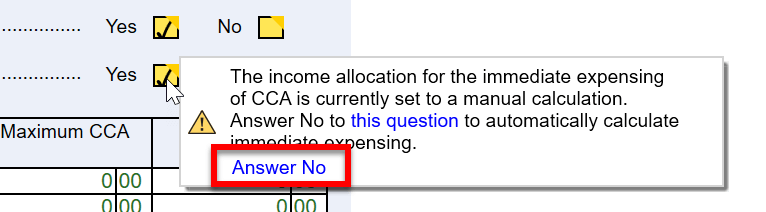

To activate the automatic calculation, answer No to these two questions. You must do this on each income statement in the file. TaxCycle will also remind you to do this in a review message and you can use the Quick Fix solution to automate the claim.

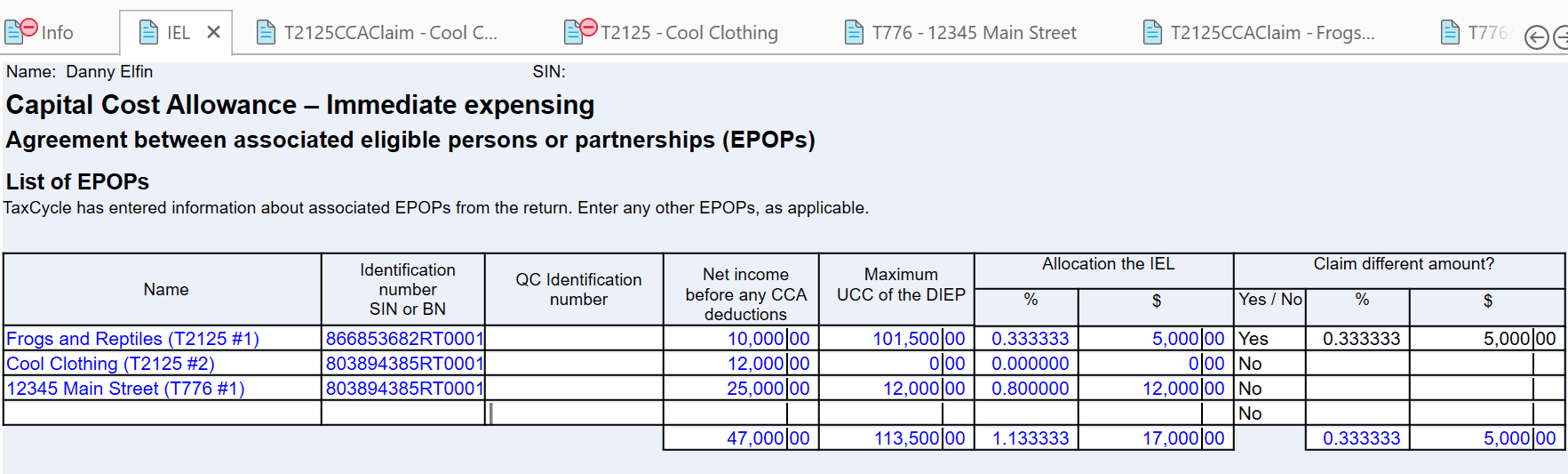

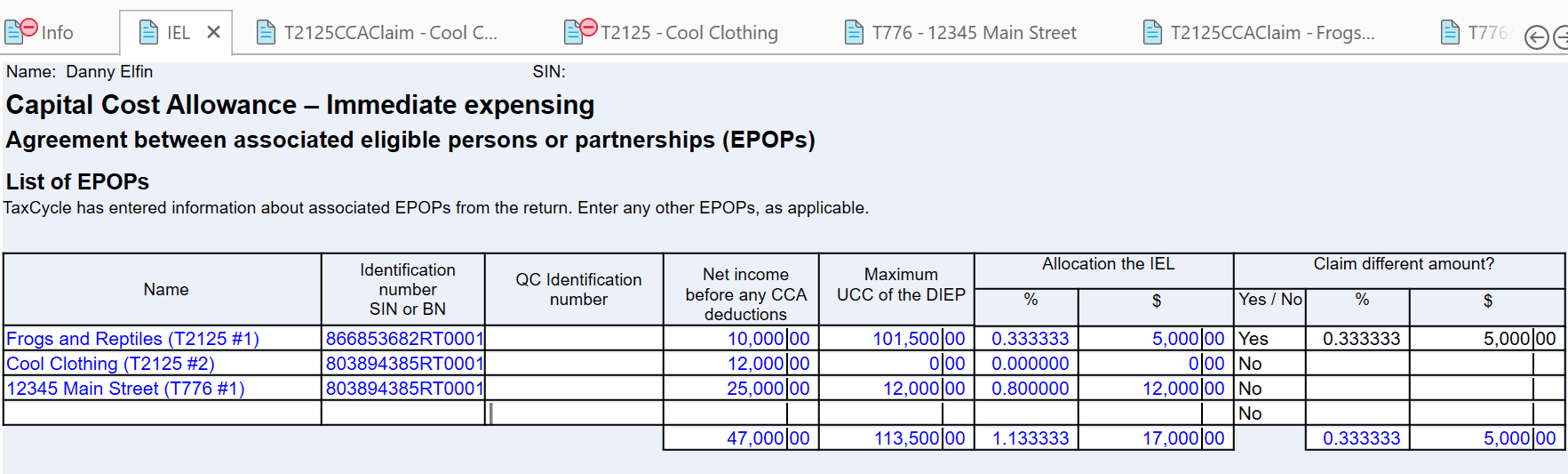

To support the allocation of the $1.5 million limit, TaxCycle T1 now contains an Immediate Expensing Limit (IEL) worksheet. TaxCycle automatically completes a row on each worksheet for each income statement (T776, T2125, etc.) in the return.

Then, based on the answer to the questions on each CCA Claim worksheet, above, TaxCycle will automatically calculate and allocate the IEL. Remember, eligible individuals cannot claim an immediate expensing deduction to create or increase a loss. TaxCycle takes this into account when calculating the allocation.

Québec has separate forms to calculate, allocate and claim immediate expensing. They are forms TP-130.AD and TP-130.EN.

For full details on how to claim immediate expensing in TaxCycle, read the T1 Immediate Expensing help topic.

Other T1 Changes

- Updated form T777, Statement of Employment Expenses to the CRA’s latest version, which limits the calculation of line 39 under “Calculation of labour mobility deduction for an eligible tradesperson” to a maximum of $4000. This may increase the unused amount that you can carry forward to the following year. For more information on deducting employment expenses in TaxCycle T1, read the Employment Expenses (T777 and T777S) help topic.

- Updated the T1 Planner worksheet with currently known or estimated amounts and rates for 2023, including some from recent provincial budgets.

- Updated calculations of estimated BC Family Benefit and Québec Solidarity Tax Credit to include changes announced in recent provincial budgets.

- Added a new UHT Property worksheet to support the filing of the UHT-2900.

- Create Forms from T1, T2 and T3 now includes property information for the UHT Property worksheet where applicable.

- Improved the engagement letter (ELetter) to add references to the Underused Housing Tax and remove references to partnership returns.

- Customer Reported Updated T1261, Application for a Canada Revenue Agency Individual Tax Number (ITN) for Non-Residents to the latest version available from the CRA.

Customer Requests

- T1—Added a paragraph on Québec retirement income transfer to a spouse or partner to the client letters (CLetter and JLetter).

- T1, T2, T5013—Added a reference to the engagement letter (ELetter) clarifying the client's responsibilities under the Underused Housing Tax Act.

- T3—Added recipient ID reference as a selectable description when printing.

- Xero Invoicing—Added a new option to set a Default reference number for Xero invoices created from TaxCycle. The Billing worksheet now includes a field for this reference number, which will also be included on the invoice. You must enable this setting in TaxCycle Options. For more information, see our Xero Invoicing help topic.