TaxCycle 15.1.60607.0—T1/TP1, T3 and T5013 Filing Versions

The Canada Revenue Agency (CRA) and Revenu Québec have certified TaxCycle T1/TP1 and T3/TP-646 for filing 2025 returns when EFILE systems open on Monday, February 23, 2026. It is also ready for electronic filing of T5013 and paper filing of TP-600 returns for 2025.

To install this version immediately, download the full installer from our website or request a free trial. Once we enable the automatic update for this version, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options. (To deploy auto-update files from your network, see the Auto-Update Files page.)

Release Highlights

T1 2025 Ready for EFILE

The CRA has certified TaxCycle T1 2025 for electronic filing when the systems reopen on February 23, 2026. As of that date, you can use TaxCycle T1 to access the following electronic services:

- T1 EFILE for 2025 initial personal income tax and benefit returns, and past years from 2018 through 2024.

- Auto-fill My Return (AFR) for data from 2016 through 2025 (AFR for 2016 to 2024 only retrieves slip data).

- Pre-authorized debit (PAD) requests for 2025 (PAD only supports paying a balance due on current year returns).

- ReFILE for 2022, 2023, 2024 and 2025 amended T1 returns.

- T1135 EFILE for 2025 and past years from 2018 through 2024.

- T1134 EFILE for 2021, 2022, 2023 and 2024. Transmission of T1134s for 2025 will be available in a future release.

- Business authorization/cancellation requests (AuthRepBus) for 2025.

The following forms still show the Preview watermark due to ongoing work, the business and rental statements being related to the Reaccelerated Investment Incentive Property (RIIP) measures proposed in federal Bill C-15:

- All business and rental statements (T776, T2042, T2121, T2125, T1163, T1273)

- Some forms related to capital gains (T657, T936, T1237, T2017, T2048)

- T2203, Provincial and Territorial Taxes for Multiple Jurisdictions and provincial 428MJ forms

- T777, Statement of Employment Expenses. While this form does not show a preview watermark, the CRA plans to issue a revised form that includes RIIP provisions and asks that you wait to file any T777 that includes a CCA claim for new equipment or vehicles acquired during the year.

All other T1 forms are final.

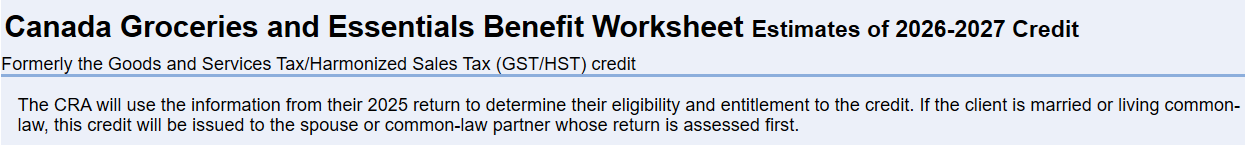

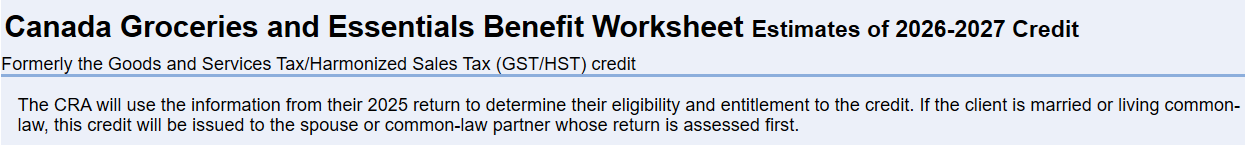

GST/HST Worksheet

We have renamed this form to the Canada Groceries and Essentials Benefit Worksheet and updated the credit estimates for the July 2026-April 2027 payment period to reflect Bill C-19 legislation. The new name now appears on the T1 Summary and 2025 client letter templates.

To learn more, see the Department of Finance news release from February 12, 2026.

TP1 2025 Ready for NetFile

Revenu Québec has certified TaxCycle TP1 2025. You can use TaxCycle TP1 to access the following electronic services:

The following forms still show the Preview watermark due to ongoing work, the business and rental statements being related to the Reaccelerated Investment Incentive Property (RIIP) measures proposed in federal Bill C-15:

TP-22 and TP-25 for when tax is payable to multiple jurisdictions

- TP-22 and TP-25 for when tax is payable to multiple jurisdictions

- All business and rental statements (TP-80, TP-80.AP and TP-128)

- Some forms related to capital gains (TP-726.6 and TP-726.7)

All other TP1 forms are final.

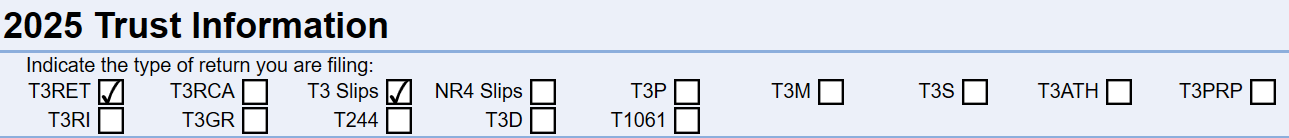

T3 and TP-646 for 2025

TaxCycle T3 is ready for electronic filing of T3 and TP-646 returns for 2025 with the CRA and Revenu Québec.

The following forms still show the Preview watermark due to ongoing work related to the Reaccelerated Investment Incentive Property (RIIP) measures proposed in federal Bill C-15:

- All business and rental statements (T776, T2042, T2121, T2125, T1163, T1273)

- While Québec TP-80, TP-80.AP and TP-128 do not show a Preview watermark, they are not yet final due to ongoing changes.

All other T3/TP-646 forms are final.

New Forms

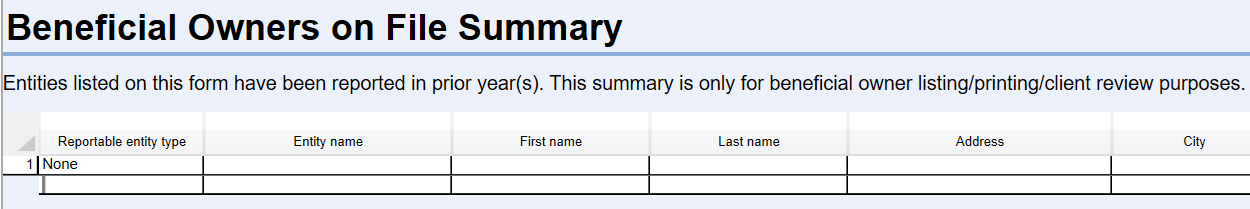

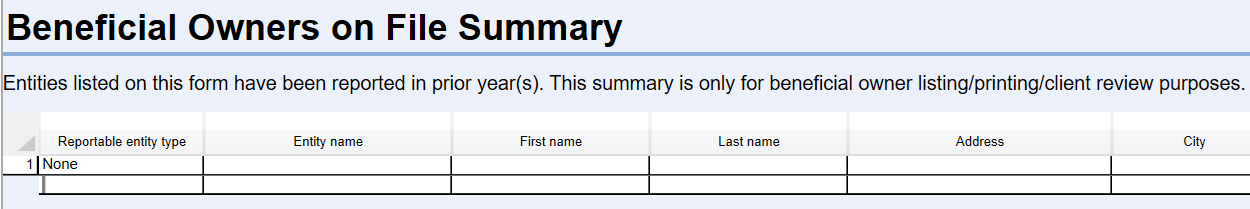

Customer Request Beneficial Owners on File Summary (BeneficialOnFileSummary)

- This is a truncated version of the Beneficial Owners on File (BeneficialOnFile) worksheet with a page-width layout for easier printing and review with clients.

- Use this summary to verify existing beneficial owner names and addresses.

- Any changes or additions to beneficial ownership information must still be made directly on the BeneficialOnFile worksheet or Schedule 15 and not from this summary.

T1294 Manitoba Green Energy Equipment Tax Credit

- This form only appears if the taxpayer is a resident of Manitoba.

TP-80.AP Farming or Fishing Income and Expenses

TP-1079.8.BE Foreign Property Return

- This form is Revenu Québec’s version of the federal T1135 (Foreign Income Verification Statement). TaxCycle automatically completes the TP-1079.8.BE based on the data entered on the T1135.

TP-1129.64 Special Tax Relating to a Registered Education Savings Plan

Updated Forms

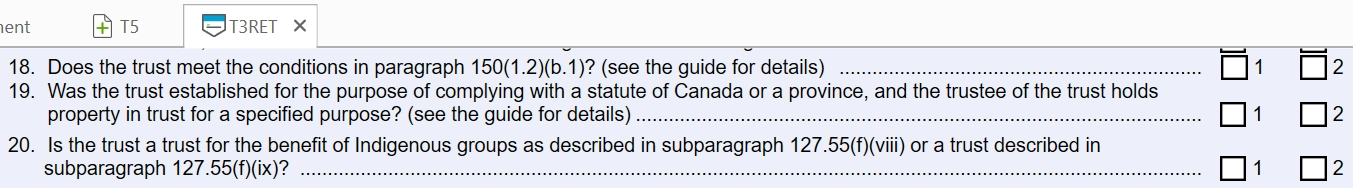

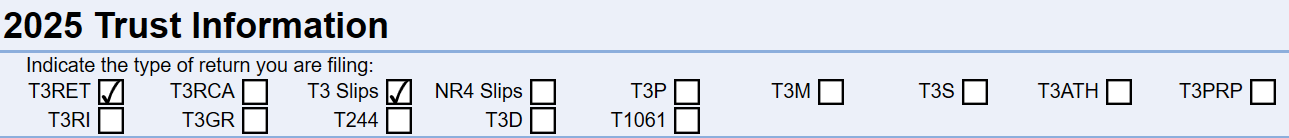

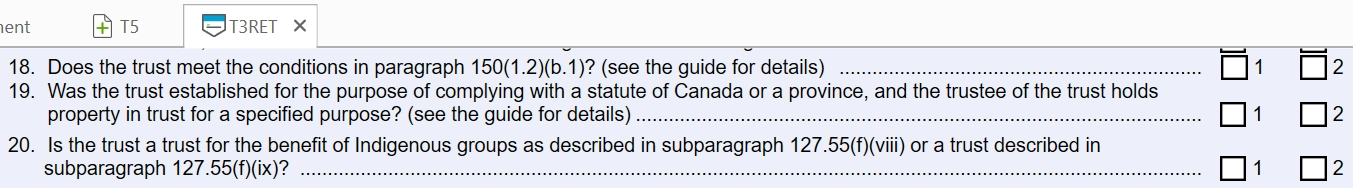

T3RET T3 Trust Income Tax and Information Return

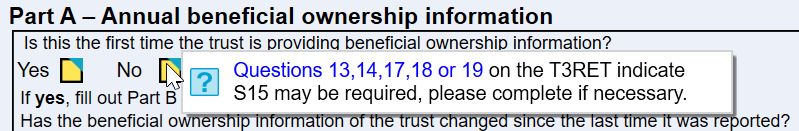

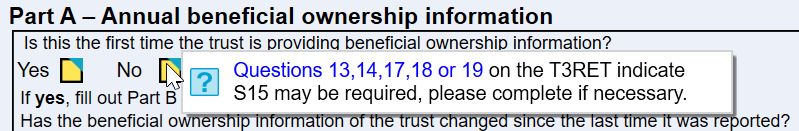

- Added new questions 18, 19 and 20 to the T3RET. These questions also appear on the Info worksheet.

- Added a review message that appears if you answer No to questions 13, 14, 17, 18 or 19 but do not complete Schedule 15.

- If you indicate that beneficial ownership information has not changed in Part A of Schedule 15, you do not need to complete Parts B or C. The CRA carries forward previously reported data for the current tax year.

S12 Minimum Tax

- Added a “screen-only” checkbox to the top of the form for trusts exempt from minimum tax under proposed Income Tax Act changes as detailed in the notes area on S12.

- For trusts subject to minimum tax, TaxCycle automatically determines if calculations apply based on the code and type of trust entered on the Info worksheet and the taxation year. In these cases, the box at the top of S12 does not need to be checked.

Also added questions to the following return types to determine if filing a Schedule 15 is required:

- T3ATH-IND Amateur Athlete Trust Income Tax Return

- T3-RCA Retirement Compensation Arrangement (RCA) Part XI.3 Tax Return

- T1061 Canadian Amateur Athlete Trust Group Information Return

When completing other types of trust returns, make sure to check the boxes at the top of the Info worksheet to activate review messages and calculations for Schedule 15 and other pertinent forms.

T5013 and TP-600 for 2025

TaxCycle T5013 is ready for electronic filing of T5013 and paper filing of TP-600 returns for 2025 with the CRA and Revenu Québec.

New Forms

Schedule 74 Clean Hydrogen Investment Tax Credit

Schedule 76 Clean Technology Manufacturing Investment Tax Credit

Schedule 78 Carbon Capture, Utilization, and Storage Investment Tax Credit

TP-1079.8.BE Foreign Property Return

- This form is Revenu Québec’s version of the federal T1135 (Foreign Income Verification Statement). TaxCycle automatically completes the TP-1079.8.BE based on the data entered on the T1135.

TP-21.4.39 Cryptoasset Return

- Also added a new question about crypto assets in the Québec filing section of the Info worksheet.

Updated Forms

TP-600 Partnership Information Return

We have updated the following forms to the latest version from the CRA:

- T5013FIN

- Schedule 1

- Schedule 6

- Schedule 8

- Schedule 75

- Schedule 130

- Schedule 444

Other Updates

- Customer Request T1—Added a question about Alberta organ and tissue donation to the 2025 pre-season and the 2024 post-season letters (PreSeason, JPreSeason, FPreSeason, PostSeason, JPostSeason, FPostSeason). This question only appears if the taxpayer is a resident of Alberta or if an amount is entered for Alberta on the T2203. TaxCycle automatically checks the related box in the template outline when this question applies.

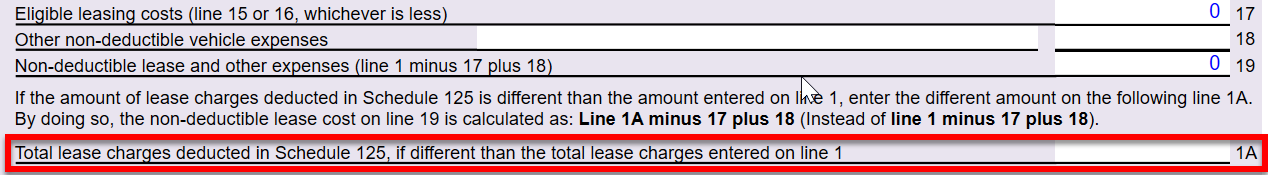

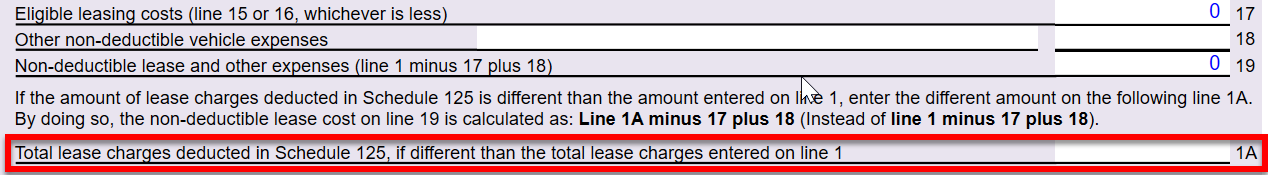

- Customer Request T2—Added new line 1A to Chart 2 on the Motor Vehicle Expense worksheet. This line calculates the total lease charges deducted in Schedule 125 if they differ from the total lease charges entered on line 1.

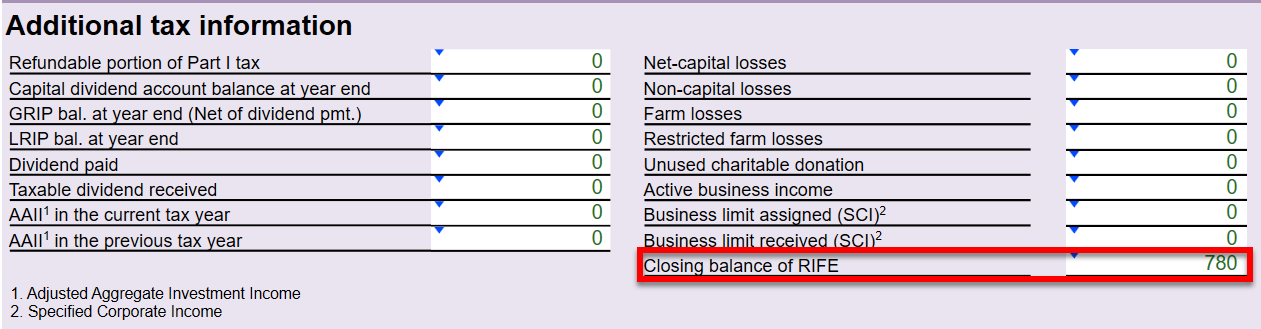

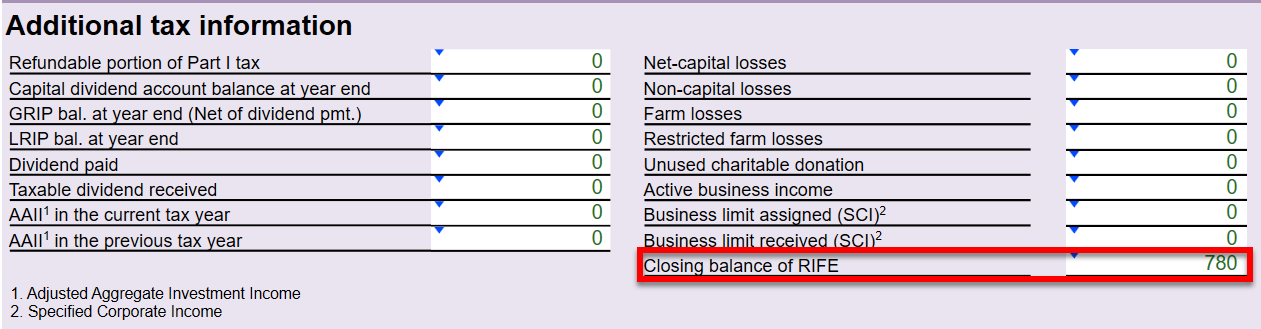

- Customer Request T2—The T2 Summary now includes a field for the closing balance of Restricted interest and financing expenses (RIFE).

- T5013—Removed content about UHT from the Engagement worksheet and templates.

- Forms module—Updated T2057 to the latest version from the CRA.

Resolved Issues

- Customer Reported T1 2025—Corrected the RRSP contribution deadline to March 2, 2026, in the family pre-season (FPreSeason) and the joint pre-season letter (JPreSeason).

- Customer Reported T1—Fixed an issue where “#1” appeared at the end of the list of prior-year slips on the pre-season and post-season letters.

Status of File Carryforwards from 2024 to 2025

As of this release, all 2024 to 2025 carryforwards are up to date.

- T1/TP1—TaxCycle, ProFile®, Taxprep®, Cantax®, DT Max®

- T2/CO-17—Carryforwards from TaxCycle, ProFile®, Taxprep®, Cantax®, DT Max®, creating files with year ends up until May 31, 2026.

- T3/TP-646, RL-16—TaxCycle (Updated carryforwards from ProFile®, Taxprep®, Cantax® and DT Max® coming in the next release.)

- T4, T4A, RL-1/RL-2—TaxCycle, ProFile®, Taxprep®, Cantax®

- T4PS—TaxCycle, ProFile®, Taxprep®, Cantax®

- T4A-RCA—TaxCycle, ProFile®

- T5, RL-3—TaxCycle, ProFile®, Taxprep®, Cantax®

- T5013/TP-600, RL-15—TaxCycle, ProFile®, Taxprep®, Cantax®

- T5018—TaxCycle, ProFile®, Taxprep®, Cantax®

- T2202—ProFile®, Taxprep®

- T3010/TP-985.22—TaxCycle, ProFile®, Taxprep®, Cantax®

- NR4—TaxCycle, ProFile®, Taxprep®, Cantax®

- Forms—TaxCycle, ProFile®, Taxprep®, Cantax®

- RL—TaxCycle, ProFile®, Taxprep®, Cantax®

Status of 2025 Federal Returns and Slips

- T1—You may begin data entry. EFILE opens on February 23, 2026.

- T2—Certified to file tax year ends up to May 31, 2026.

- T3RET—You may begin data entry. EFILE opens on February 23, 2026.

- T3 slips—Ready for filing.

- NR4 (in T3 module)—Ready for filing.

- T4—Ready for filing.

- T4A—Ready for filing.

- T4PS—Ready for filing.

- T4A-RCA—Ready for filing.

- T5—Ready for filing.

- T5013-FIN—Ready for filing.

- T5013 slip summary—Ready for filing.

- T5018—Ready for filing.

- NR4 slips (standalone NR4 module)—Ready for filing.

- T4A-NR slips (in NR4 module)—Ready for filing.

- T3010—Ready for filing.

Status of 2025 Québec Returns and Relevés

- TP1—You may begin data entry. NetFile opens on February 23, 2026.

- TP-646—Ready for filing.

- RL-16—Ready for filing.

- TP-600—Ready for filing.

- RL-15—Ready for filing.

- RL-1—Ready for filing.

- RL-2—Ready for filing.

- RL-3—Ready for filing.

- RL-24—Ready for filing.

- RL-25—Ready for filing.

- RL-31—Ready for filing.

- TP-985.22—Ready for filing.