TaxCycle 11.1.46454.0—Optional Download, Updated CAIP Amounts

This TaxCycle release contains optional enhancements and fixes, including updated Climate Action Incentive Payment (CAIP) amounts. If you prepare returns for Ontario, Manitoba, Saskatchewan or Alberta residents, downloading this version lets you provide your clients with a more accurate estimate of their 2022-23 Climate Action Incentive Payment (CAIP). Install this version if you would like to try a new feature, or if you need a change included in this release.

To install this version immediately, download the full installer from our website or request a free trial. Once we enable the automatic update for this version, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options. (To deploy auto-update files from your network, see the Auto-Update Files page.)

Release Highlights

Quarterly Payments for the Climate Action Incentive

If you prepare returns for Ontario, Manitoba, Saskatchewan or Alberta residents, downloading this version lets you provide your clients with a more accurate estimate of what they will receive. Please read the Quarterly Payments for the Climate Action Incentive (Revised) news item for more information.

T1 Changes

- Updated the Climate Action Incentive Payment (CAIP) amounts for 2022-23. See Climate Action Incentive payment amounts for 2022-23 for more information.

- TaxCycle T1 is certified by CRA for electronically filing the T1134 Information Return Relating To Controlled and Not-Controlled Foreign Affiliates. Please see the T1134 EFILE help topic for instructions.

- Updated the Guaranteed Income Supplement (GIS) amounts to June 30, 2022.

- Added fields to the 2021 Carry Forward Summary (Carry) to help claim unused Ontario tuition and education amounts from 2017. Please read the Ontario Tuition and Education Amounts (ONS11) help topic for details.

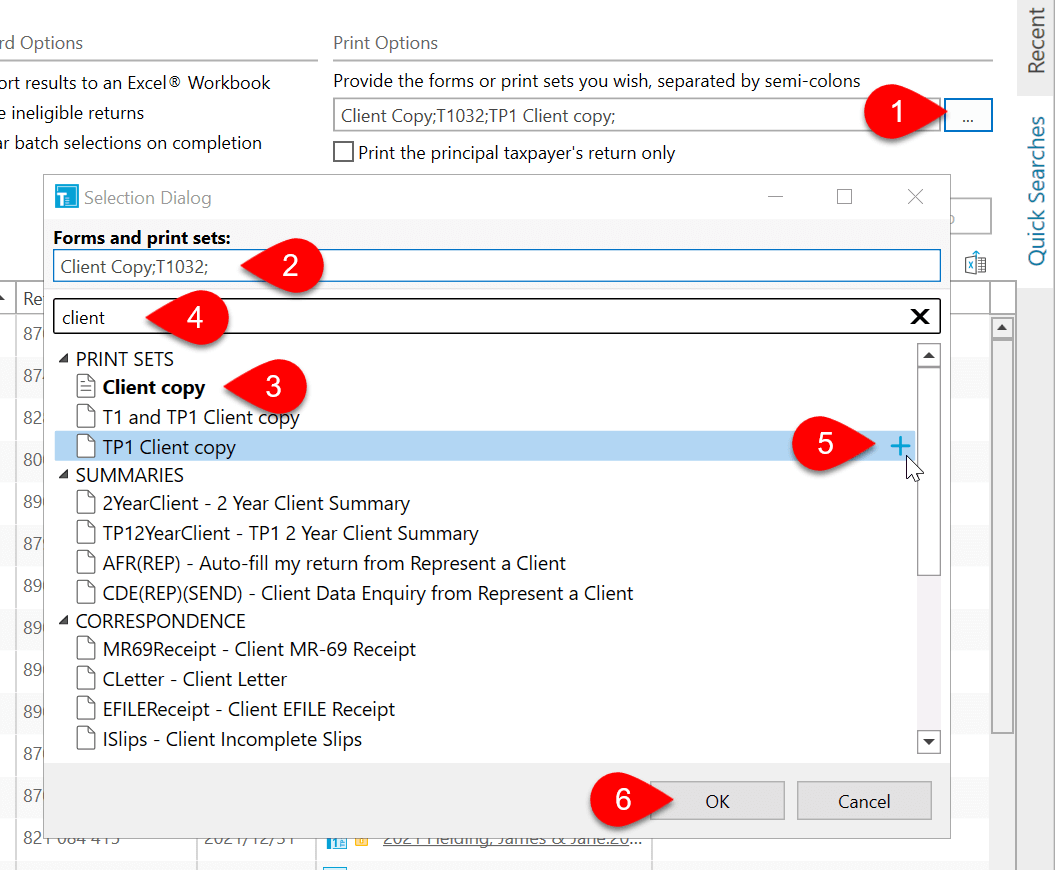

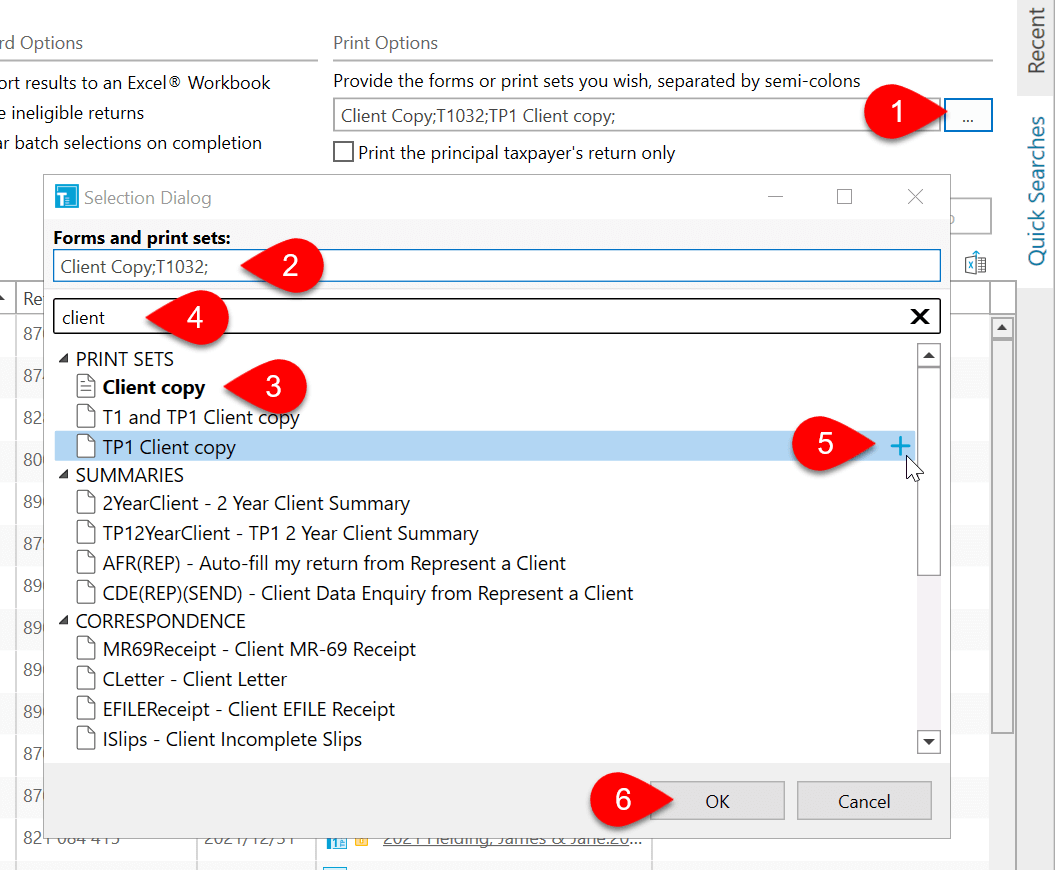

Batch Printing Selection Dialog

This release adds a new tool to help you choose applicable form names and print sets when batch printing.

- Click the ellipsis button to open the Print Selection dialog box.

- The list of forms and print sets selected for batch printing appear at the top of the dialog box.

- Sets or forms already in the list to print appear in bold.

- To find a form or print set in the list, type a keyword.

- To add an item to the list, hover over it and click the plus sign (+) on the right side of the dialog box.

- Click OK to save your changes and return to the batch printing screen.

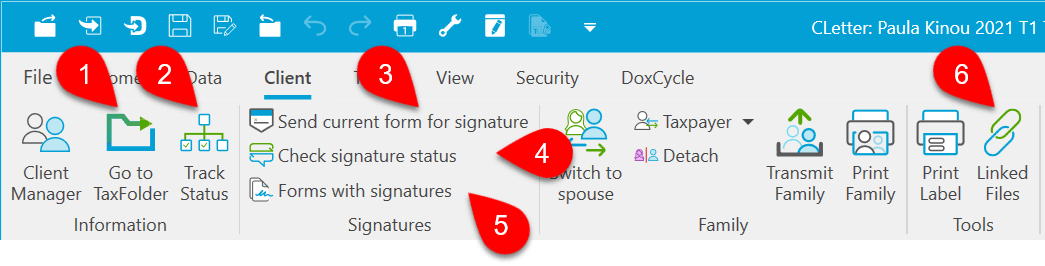

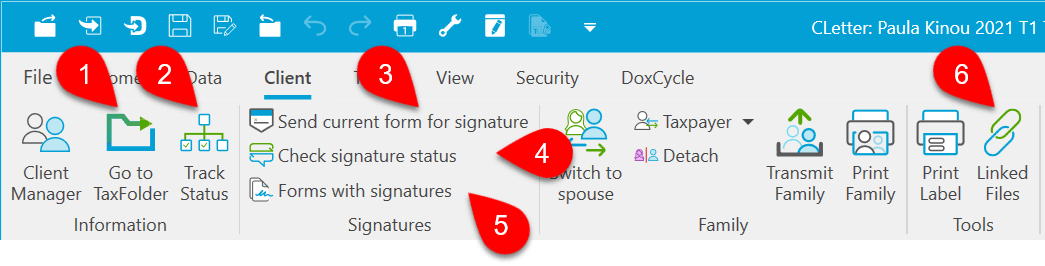

Client Menu

New items on the Client menu allow quick access to TaxFolder and sidebar functions:

- Go to TaxFolder opens a browser and goes to www.taxfolder.com

- Track Status opens the Track sidebar.

- Send current form for signature becomes active if the current form supports electronic signatures. Click it to open the Print Form dialog and select TaxFolder as the e-signature provider.

- Check signature status checks for notifications from TaxFolder or DocuSign®. This is the same as clicking on the Notification Status icon on the status bar.

- Forms with signatures opens the Prepare sidebar and selects the Signatures view to list all the forms with e-signature fields.

- Linked files opens the Link sidebar.

Customer Requests

- TaxFolder—Included the subject line and body of the TaxCycle cover letter email template when selecting the Share Documents check box on the printer/output options.

- T1—Added the carryforward of the legal representative email address and phone number.

- T1 Client and Joint Client Letters—Added a condition to hide the RRSP contribution paragraph for taxpayers who are over 71.

- T1—Clarified the wording of the column headings in the T1135 manager.

- Client Manager—Added a column for “client since” to the Client Contact layout and search options.

- Options—Added a new Start Screen option to control the maximum number of files displayed in the recent files list. Lowering this maximum reduces the number of files TaxCycle scans through on start-up, improving start-up time and responsiveness. If you use a virtual drive, like Google Drive or OneDrive, this reduces the number of files TaxCycle must download and read to display status details in the recent files list.

Resolved Issues

- T5013—Adjusted calculation of adjusted ACB on withdrawal of a partner for a Retired partner to only calculate in the year of retirement.

- T5013—Adjusted calculation of deemed capital gain for partners of a Limited Liability Partnership to include the current year net income.

- T5013—Fixed an issue with the partnership number not formatting correctly on the RL-15 for partners where the partner is a partnership.

- TaxCycle Forms—Fixed an issue on the T2060 where the partner name was not populating on the Schedule A.

- French T1 Client Letter—Corrected the text that displays when the taxpayer has an RRSP amount to carry forward that reduces the contribution room in the coming year.

- French T1 Client Letter—Fixed the position of the field code for opening the Canada Training Credit paragraph.