TaxCycle 12.0.49042.0—2022 CO-17 Forms

This version of TaxCycle T2 supports the filing of Québec CO-17 returns with new and updated forms.

To install this version immediately, download the full installer from our website or request a free trial. Once we enable the automatic update for this version, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options. (To deploy auto-update files from your network, see the Auto-Update Files page.)

Release Highlights

2022 CO-17 Forms Approved for Filing

Revenu Québec has approved TaxCycle T2 to support the filing of Québec CO-17 returns with new and updated forms for 2022.

New Québec CO-17 Forms

FM-220.3, Property tax refund for forest producers

- Complete this form if a certified forest producer corporation is claiming a property tax refund.

- The property tax refund amount calculated on line 46 is reported in one of lines 440p through 440y in CO-17.

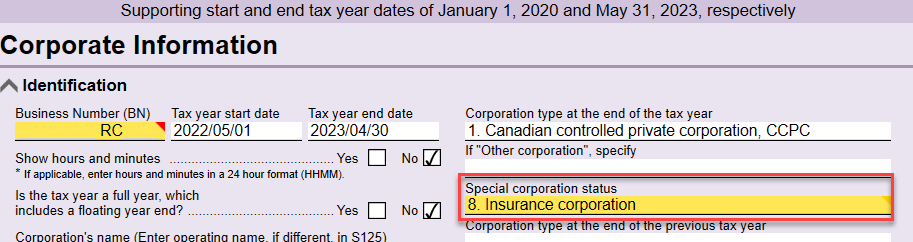

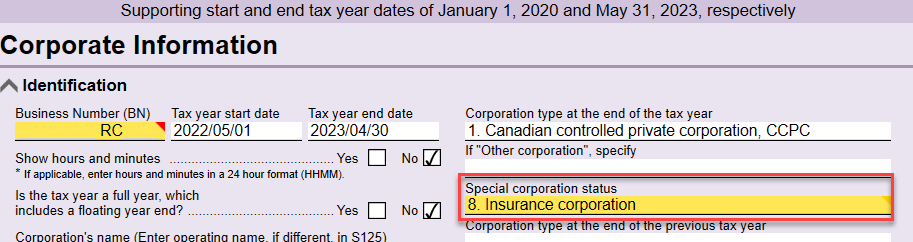

CO-1140, Calculation of the paid-up capital of a financial institution

- Complete this form if a corporation is a financial institution with an establishment in Québec.

- CO-1140 will automatically calculate when you select any of the following Special corporation types on the Info worksheet:

- Authorized foreign bank

- Credit union

- Financial institution

- Investment corporation

- Mortgage investment corporation

- Mutual fund corporation

CO-1140.A, Paid-up capital to be used for purposes other than the calculation of the tax on capital

- Financial institutions and insurance corporations must complete this form to calculate the paid-up capital at the end of a corporation’s previous tax year or, if the tax year is a corporation’s first tax year, at the start of its tax year.

CO-1159.2, Compensation tax for financial institutions

- Prepare this form to calculate compensation tax for financial institutions.

CO-1167, Insurance corporations: Calculation of premiums payable, taxable premiums and tax on capital respecting marine insurance

- All insurance corporations that carry on business in Québec (that is, all insurance corporations that own property in Québec, have an establishment in Québec or exercise any of their corporate rights, powers or objects in Québec) must complete this form.

- Insurance corporations and corporations that administer an uninsured employee benefit plan use this form to calculate the premiums payable or taxable premiums, as well as the capital tax they are required to pay on such premiums.

CO-1175.4, Life insurance corporation: Calculation of the tax on capital

CO-771.R.14, Proportion of business carried on in Québec and elsewhere by an insurance corporation

- Under the Taxation Act, any insurance corporation that had an establishment in Québec and an establishment outside Québec during the taxation year must complete this form to calculate the proportion of the corporation’s business carried on in Québec and the proportion carried on elsewhere.

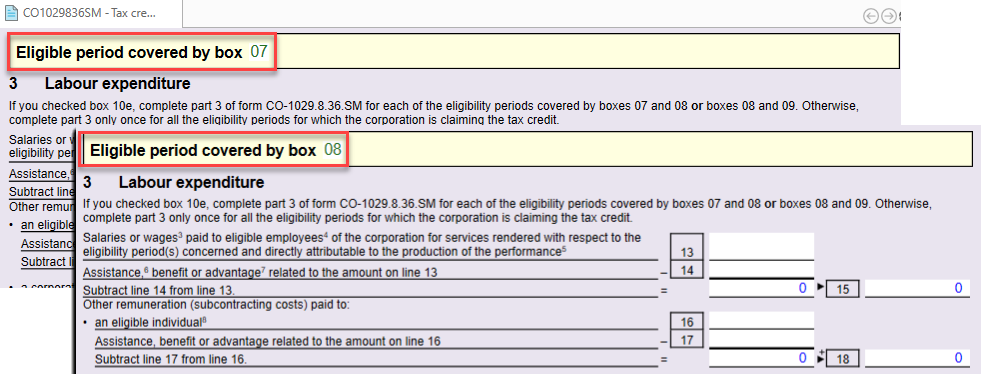

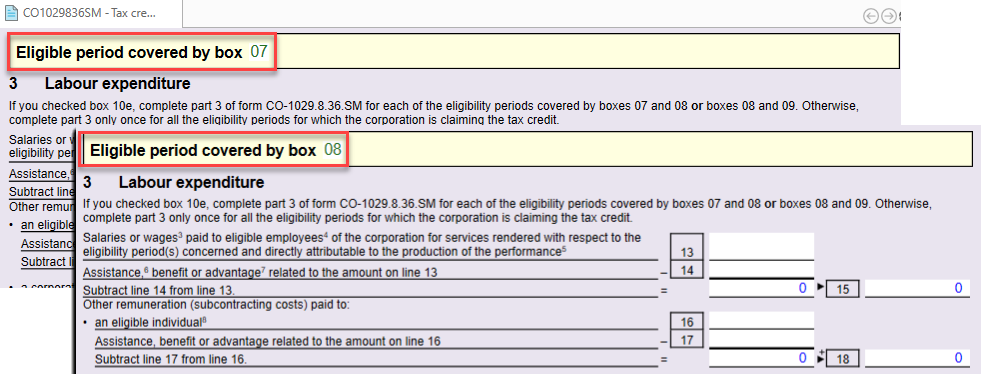

CO-1029.8.36.SM, Tax credit for the production of performances

- Any corporation that wishes to claim the tax credit for the production of performances must complete this form.

- When selecting box 10e and boxes 07/08 or 08/09 in Part 2, TaxCycle displays two instances from parts 3 and 4 for completion.

Updated Québec CO-17 Forms

Unless otherwise indicated, the following forms only contain minor updates.

CO-771.1.3, Associated Corporations’ Agreement Respecting the Allocation of the Business Limit and Calculation of the Business Limit

CO-17, Corporation Income Tax Return

- Line 32 (corporation’s activity) now uses a 6-digit NAICS code instead of a description.

CO-17.SP, Information and Income Tax Return for Non-Profit Corporations

- Line 32 (corporation’s activity) now uses a 6-digit NAICS code instead of a description.

CO-17.A.1, Net Income for Tax Purposes

- Removed lines 28, 57, 110, 127 and 128.

- Added line 54a.

CO-130.A, Capital Cost Allowance

CO-771, Calculation of the Income Tax of a Corporation

- Removed question 05a and section 11.1 relating to manufacturing and processing for corporations with a tax year starting before January 1, 2017.

CO-771.1.3.AJ, Adjusted Business Limit

- Removed section 2.1 (lines 06, 07, 08, and 09) and section 2.2 (lines 11 through 24).

- Removed the CO77113AJ table, calculations and corporate linking from the CGI worksheet.

CO-1029.8.33.13, Tax Credit for the Reporting of Tips

CO-17.B, Adjustment of Income from One or More Partnerships

- Reorganized the reporting for CO-17.B by character of income.

- Removed and replaced old tables with new tables and columns.

- Removed the column related to the Alignment Income Election provision in section 1.

- Removed the sections and references to Qualifying Transitional Income (QTI) reserve.

- Removed the table summarizing characterization of income. It is now incorporated in each of the new and updated sections 3, 4, 5 and 8.

- Partnership income from line 45 of CO-17.B is now included on the new line 54a on the CO-17A.1.

- Taxable capital gains and allowable capital losses from new line 51 of CO-17.B are included on Line R or T as applicable on form CO-17S.232.

CO-17.B.1, Amount to Be Included in the Income of a Corporation That Is a Member of a Partnership

- Redesigned this form, with partnership income now being reported by type of income (Business, Property, Other or Capital Gains/Allowable Capital Losses).

- Added new fields in each section to calculate the amounts previously reported in the Characterization of Income Table.

- Removed the Characterization of Income Table. Amounts are now converted and included in the new Previous Years column that flow to the updated CO-17.B. form.

- Each new federal S71 and S72 now creates a new CO-17.B.1.

CO-17.B.2, Amount to Be Included in the Income of a Corporation That Is a Member of a Multi-Tier Partnership

- Removed this form.

- Multi-tier partnerships reported on the federal S72 are now converted and linked to a new CO-17.B.1.

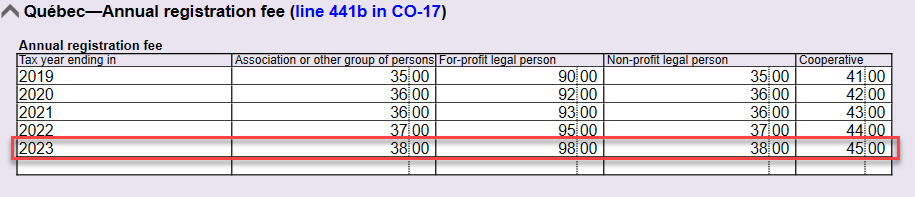

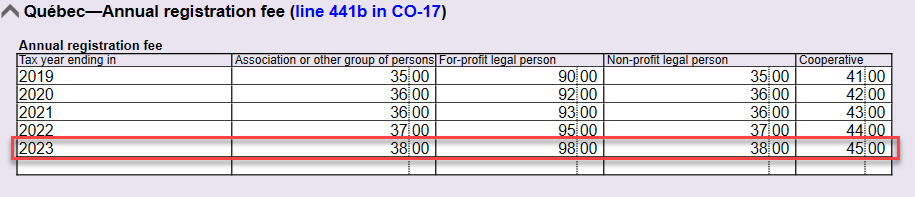

Updated the annual registration fee for line 441b of the CO-17 to reflect the following fees for 2023 on the TaxConstants worksheet:

- $38: Association or other group of persons

- $98: For-profit legal person

- $38: Non-profit legal person

- $45: Cooperative

Customer Requests

- T3 EFILE—Updated NR4, T3P and T2000 slips for electronic filing.

- Client Manager—Added Office ID and P.O. Box Location fields to the Full Data Export report. Also added a P.O. Box Location field to the Contact Information report. See our Excel Export help topic for more information.

- Templates—Added a ClientCopyEmail template to all slips modules.

Resolved Issues

- Customer Reported Resolved an issue where the Client Manager did not properly index federal slips for T4, T5 and T5018 returns.

- Resolved an issue where TaxCycle displayed an error when printing multiple recipient slips to email when using a desktop email client.

- Resolved an issue where TaxCycle generated the following error message when transmitting a CO-17 return using clicSÉQUR: "TaxCycle was unable to read the response from the Revenu Québec. Please try again later."

Status of File Carryforwards from 2021 to 2022

As of this release, the following 2021 to 2022 carryforwards are up to date. However, we strongly recommend you only perform batch carryforward on tax modules that are ready for filing in the list, below. We anticipate the rest of the modules will be finalized later in January.

Ready for batch carryforward:

- T2/CO-17—Carryforwards from TaxCycle, ProFile®, Taxprep®, Cantax®, DT Max®, creating files with year ends up until May 31, 2023

- T4, T4A, RL-1/RL-2—TaxCycle, ProFile®, Taxprep®, Cantax®

- T4PS—TaxCycle, ProFile®, Taxprep®, Cantax®

- T4A-RCA—TaxCycle, ProFile®

- T5, RL-3—TaxCycle, ProFile®, Taxprep®, Cantax®

- T2202—ProFile®, Taxprep®

- T5018—TaxCycle, ProFile®, Taxprep®, Cantax®

- T3010/TP-985.22—TaxCycle, ProFile®, Taxprep®, Cantax®

- NR4—TaxCycle, ProFile®, Taxprep®, Cantax®

- Forms—TaxCycle, ProFile®, Taxprep®, Cantax®

- RL—TaxCycle, ProFile®, Taxprep®, Cantax®

Wait for batch carryforward:

- T1/TP1—TaxCycle, ProFile®, Taxprep®, Cantax®, DT Max®

- T3/TP-646, RL-16—TaxCycle, ProFile®, Taxprep®, Cantax®, DT Max®

- T5013/TP-600, RL-15—TaxCycle, ProFile®, Taxprep®, Cantax®

Status of 2022 Federal Returns and Slips

- T1—Preview of 2022 forms and calculations. You may begin data entry, but you must wait for CRA certification before filing.

- T2—Certified to file tax year ends up to May 31, 2023.

- T3RET—In progress. Wait to file 2022 returns.

- T3 slips—In progress. Wait to file 2022 slips.

- NR4 (in T3 module)—In progress. Wait to file 2022 returns.

- T4—Ready for filing upon system opening on January 9, 2023.

- T4A—Ready for filing upon system opening on January 9, 2023.

- T4PS—Ready for filing upon system opening on January 9, 2023.

- T4A-RCA—Ready for filing upon system opening on January 9, 2023.

- T5—Ready for filing upon system opening on January 9, 2023.

- T5013-FIN—Ready for filing upon system opening on January 9, 2023.

- T5013 slip summary—Ready for filing upon system opening on January 9, 2023.

- T5018—Ready for filing upon system opening on January 9, 2023.

- NR4 slips (standalone NR4 module)—Ready for filing upon system opening on January 9, 2023.

- T4A-NR slips (in NR4 module)—Ready for filing upon system opening on January 9, 2023.

- T3010—Ready for filing.

Status of 2022 Québec Returns and Relevés

- TP1—Preview of 2022 forms and calculations. Please wait for a future update before filing.

- TP-646—In progress. Wait to file 2022 returns.

- RL-16—In progress. Wait to file 2022 returns.

- TP-600—Ready for filing.

- RL-15—Ready for filing.

- RL-1—Ready for filing.

- RL-2—Ready for filing.

- RL-3—Ready for filing.

- RL-24—Ready for filing.

- RL-31—Ready for filing.

- TP-985.22—Ready for filing.