TaxCycle 12.2.51186.0—T3 Schedule 15, Beneficial Ownership Information of a Trust

This release adds the new Schedule 15, Beneficial Ownership Information of a Trust to TaxCycle T3. It also includes changes to templates and Client Manager indexing.

To install this version immediately, download the full installer from our website or request a free trial. Once we enable the automatic update for this version, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options. (To deploy auto-update files from your network, see the Auto-Update Files page.)

Release Highlights

T3SCH15 Beneficial Ownership Information of a Trust

This version of TaxCycle adds the new Schedule 15, Beneficial Ownership Information of a Trust to the T3 module and includes a new Beneficial ownership information (Beneficial) worksheet to help trusts gather and report beneficial ownership information.

This release is intended for early data entry and planning for the T3 filing season. You cannot EFILE the T3SCH15 until early 2024, when T3 EFILE opens.

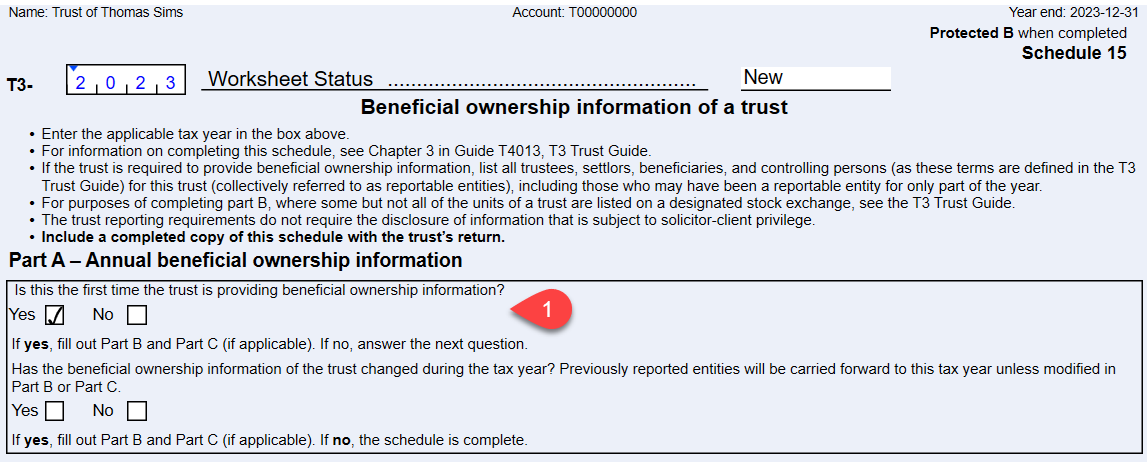

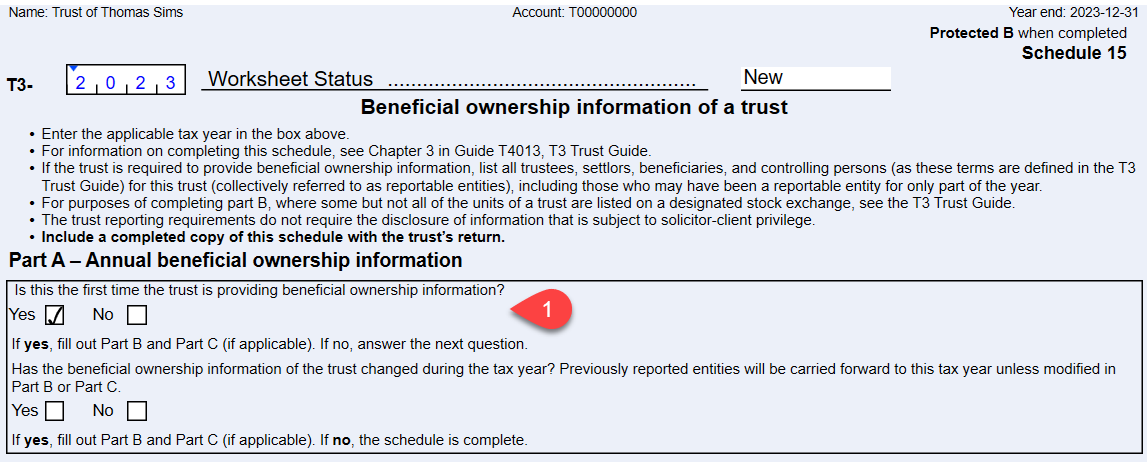

Trusts with a tax year ending on or after December 31, 2023, must file the T3SCH15, even if they have never filed a T3 return before. To support tracking this status, we added a field to the top of the form. By default, it is set to New, as it is the first year reporting for all trusts that have to file this year. In future years, it will indicate whether the S15 is the same as the prior year, was modified or cancelled. Regardless, this field is excluded from the EFILE transmission to the CRA.

To file the Schedule 15:

- Complete Part A—Annual beneficial ownership information of the S15.

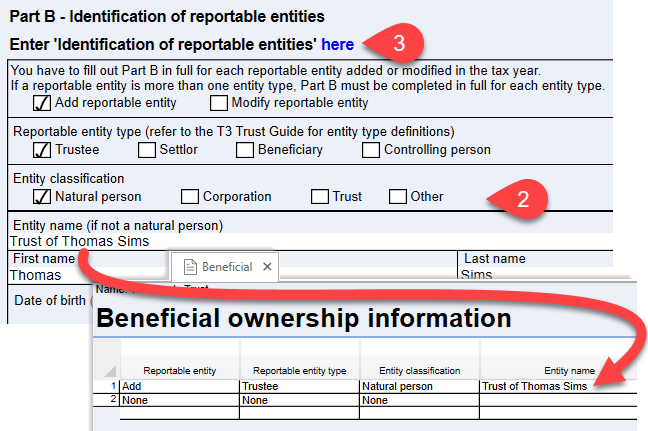

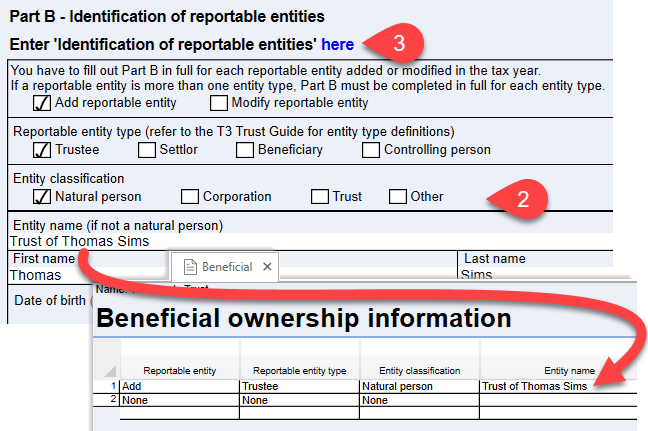

- Complete Part B—Identification of reportable entities of the S15.

- You can also enter the data directly on the Beneficial ownership worksheet (click the here link to be taken to the Beneficial ownership worksheet). Data entered in these fields flows automatically between the S15 and the Beneficial ownership worksheet, so you can adjust the data on either form.

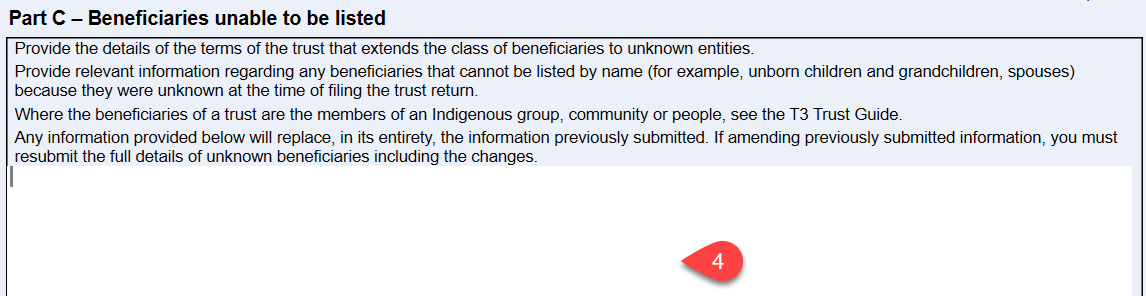

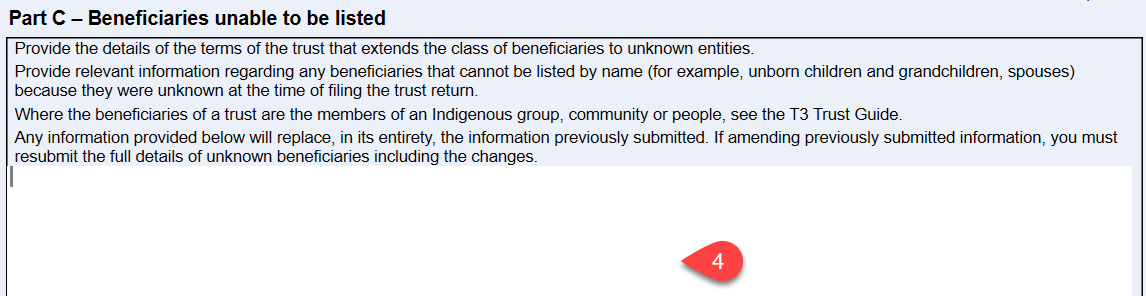

- If required, complete Part C—Beneficiaries unable to be listed on the S15.

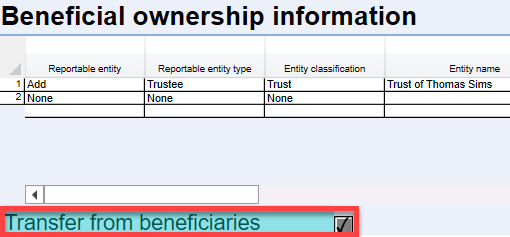

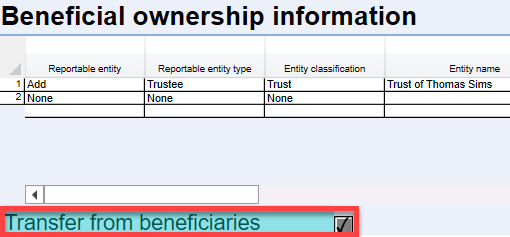

To enter the trust’s beneficial ownership information, you can import data from an Excel template directly into the Beneficial ownership worksheet, or you can transfer the information from the existing Beneficiary worksheet by checking the Transfer from beneficiaries box at the bottom of the Beneficial ownership worksheet. In both cases, you must complete Parts A and C on the S15 first.

If you choose to transfer information from the Beneficiary worksheet, you will need to enter some of the beneficial owner information manually, since not all of the information required for S15 is available on the Beneficiary worksheet.

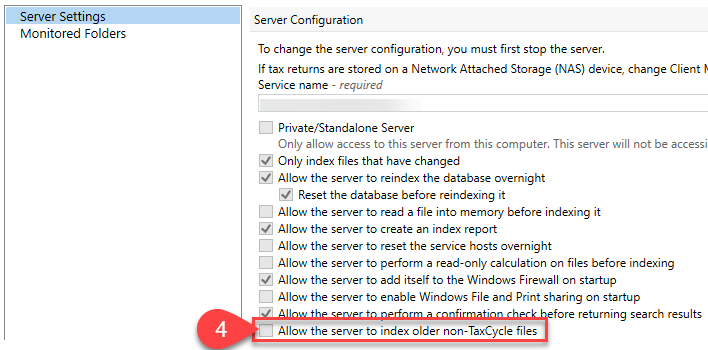

Change to Client Manager Indexing of Competitor Files

This version of TaxCycle updates the Client Manager’s default setting to only index competitor tax returns going back three years. For example, for the 2023 tax year, the Client Manager will only index competitor returns for 2023, 2022 and 2021. This change improves the Client Manager database’s overall performance and search speed.

However, you can still allow the Client Manager server to index older competitor tax returns in TaxCycle Options.

To allow the Client Manager server to index competitor tax returns older than three years:

- From the Start screen, click Options in the blue bar on the left side. If you have a file open, go to the File menu, then click Options.

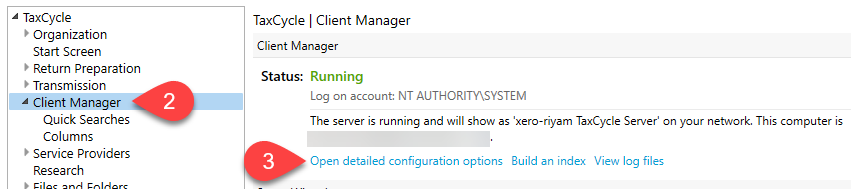

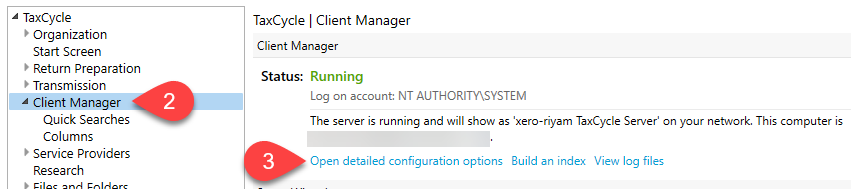

- Expand TaxCycle and then click on Client Manager on the left side of the dialog box.

- On the right side of the window, click on the link to Open detailed configuration options. This opens a new window for the Server Settings page.

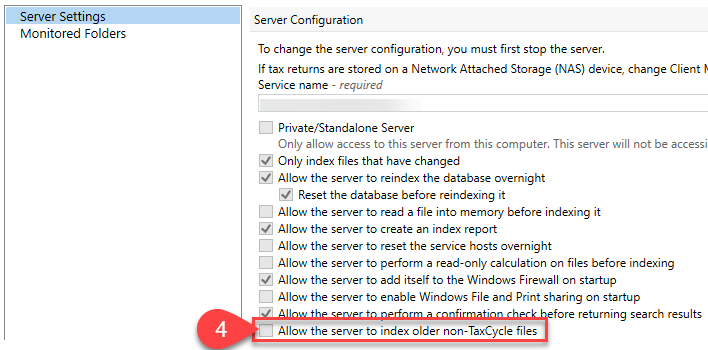

- Under Server Configuration, check the box to Allow the server to index older non-TaxCycle files.

- Click OK.

- Click OK again.

To learn more about this change, read the post Indexing Competitor Returns in the Client Manager.

Template Changes

- Customer Request T1 2022 and 2023—Added a paragraph and form about the Underused Housing Tax (UHT-2900) to the pre-season and post-season letters (PreSeason, PostSeason, JPreSeason, JPostSeason, FPreSeason, FPostSeason).

- Customer Request T1 2023—Updated the pre-season letters (PreSeason, JPreSeason, FPreSeason) to separate out the foreign property section, and renamed the French pre-season letters so they show up together in the template editor sidebar.

- Added a snippet template to English pre-season letters called PreSeasonForeign.

- Added a snippet template to the French pre-season letters called Avant-saisonBiensÉtrangers.

- T1 2022 and 2023—Updated the RRSP contribution deadline to February 29, 2024, in the 2022 and 2023 English and French pre-season letters and the 2022 English and French post-season letters.

- Customer Request T1 2022 and 2023—Updated the Employment Insurance (EI) benefits paragraph in the client letter (CLetter, JLetter) to include a link to the EI benefits for self-employed people page.

- Customer Reported T1 2022 and 2023—Removed references to “you” and “your” where appropriate from the deceased client letter (DLetter).

- Customer Reported T3 2022 and 2023—Fixed a typing error in the payment paragraph of the English client letter (CLetter).

Customer Requests

- T1—Added new fields to the T2202A/TL11A tuition certificates to enter a foreign tuition amount, currency and exchange rate.

- T1—Added electronic signature support to the TP-1.R.

- T2—Added electronic signature support to the T1044.

- TaxCycle Forms—Added Smart Copy/Paste to the UHT-2900 and T1134Sup.

Resolved Issues

- Customer Reported T3—Changed the workflow text for the electronically filed T1135 to say, “T1135 transmitted” instead of “T1135 signed and on file.”

- Customer Reported T5013—Fixed an issue where TaxCycle was not automatically recording the capital gain on the S6M when an asset was disposed of in a class resulting in a capital gain, but other items remained in the class.

- Customer Reported T5013—Added the option to sign off on an invalid email address if a legitimate email address domain fails CRA validation.

- Customer Reported Printer and PDF Output Options—Removed auto-completed workflow tasks from the drop-down menu in the Complete tasks section of the print dialog box.