| RETURNS |

| Number of returns |

Unlimited |

| Years |

2012 onward |

| CARRYFORWARDS |

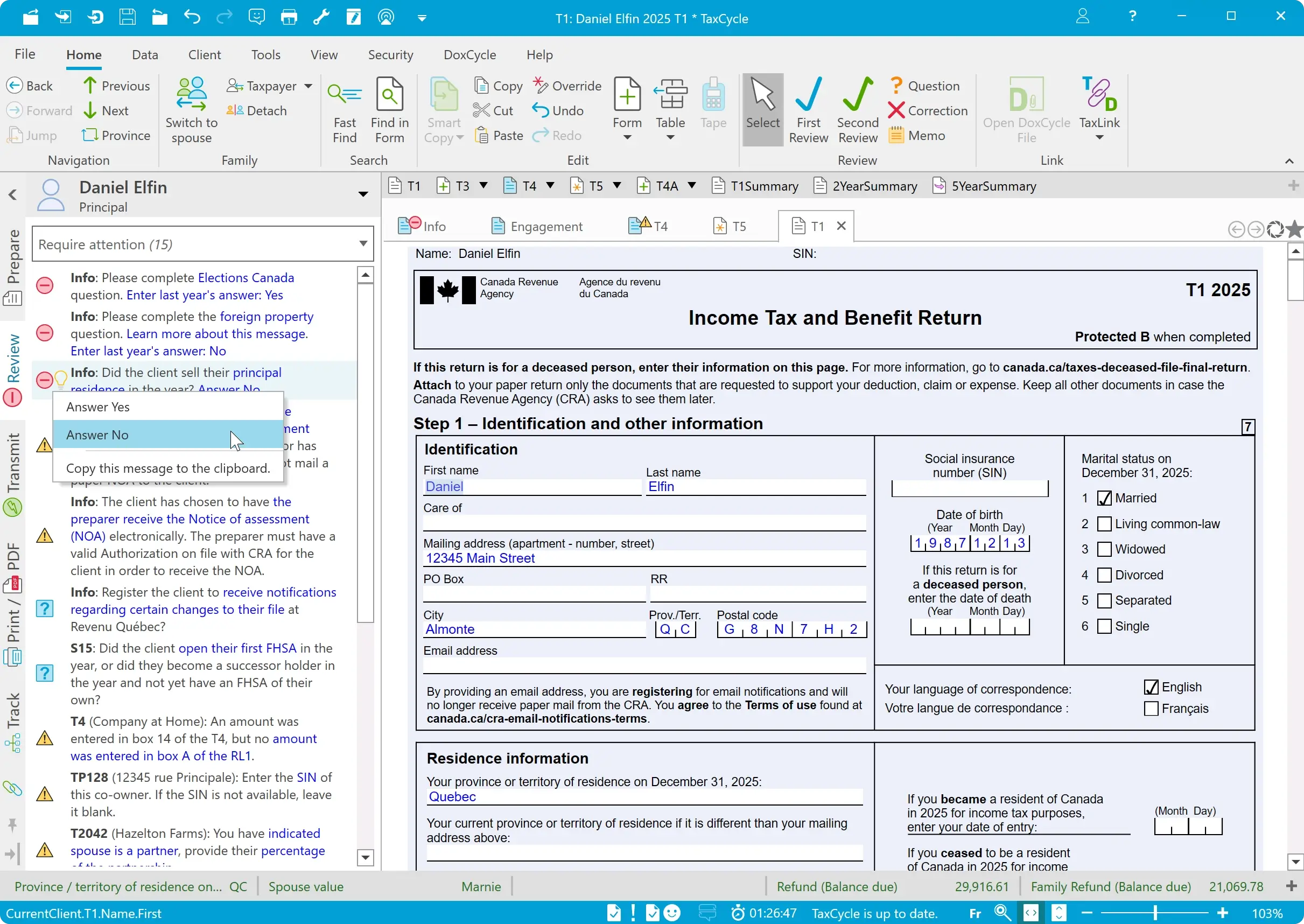

| TaxCycle T1 |

|

| ProFile® T1 |

|

| Cantax® T1 |

|

| Taxprep® T1 |

|

| DT Max® T1 |

|

| Batch carryforward |

|

| ELECTRONIC FILING AND SERVICES |

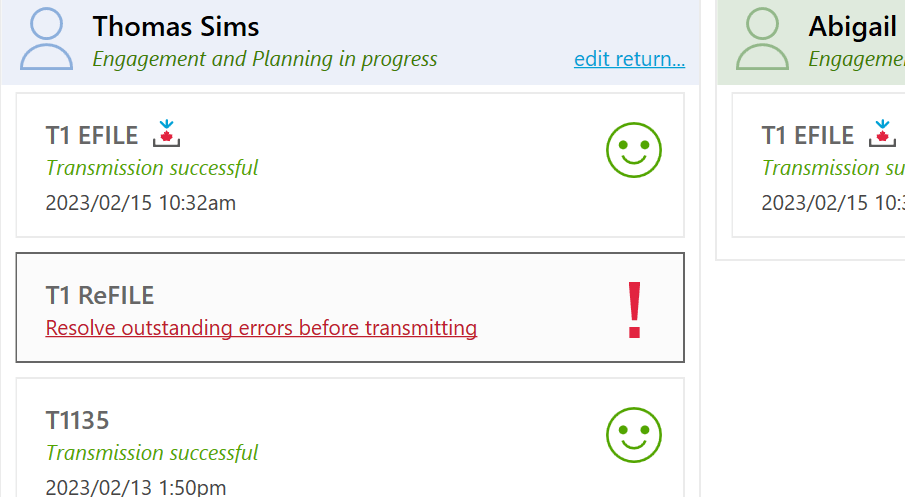

| T1 EFILE |

|

| Electronic submission and cancellation of business authorization requests |

|

| Auto-fill my return (AFR) data download |

|

| Express NOA (notice of assessment) |

|

| T1134 Information Return Relating To Controlled and Not-Controlled Foreign Affiliates |

|

| T1135 Foreign Income Verification Statement electronic filing |

|

| Pre-authorized debit (PAD) requests |

|

| ReFILE of adjusted T1 returns |

|

| ELECTRONIC SIGNATURES (TaxFolder and DocuSign®) |

| T183 Information Return for Electronic Filing of an Individual's Income Tax and Benefit Return |

|

| T185 Electronic Filing of a Pre-authorized Debit Agreement |

|

| T1032 Joint Election to Split Pension Income |

|

| T1135 Foreign Income Verification Statement |

|

| T2091 Designation of a Property as a Principal Residence by an Individual |

|

| T1255 Designation of a Property as a Principal Residence by the Legal Representative of a Deceased Individual |

|

| T1-ADJ T1 Adjustment Request |

|

| T1-DD Direct Deposit Worksheet |

|

| T1 Condensed |

|

| T1A Request for Loss Carryback |

|

| Engagement letters |

|

| Pre- and post-season letters |

|

| RETURN TYPES |

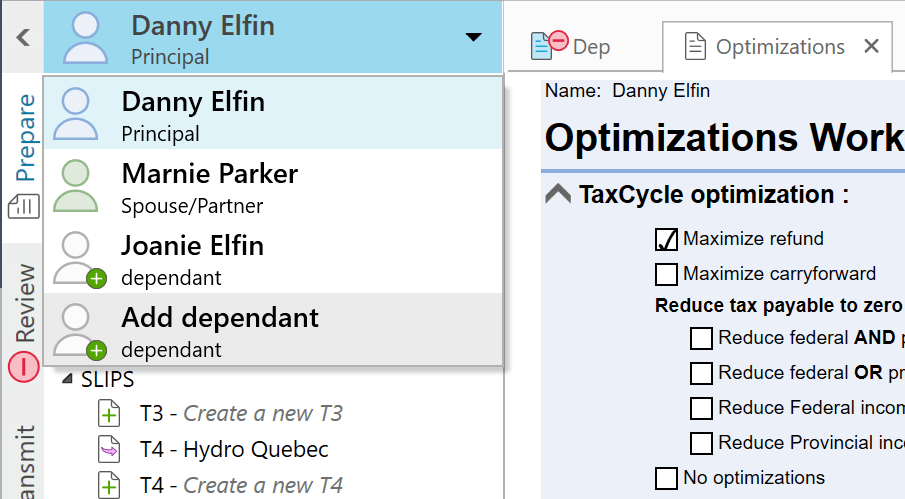

| Coupled taxpayer/spouse returns |

|

| Family/dependant linking |

|

| Non-resident and part-year resident returns |

|

| Returns for deceased taxpayers |

|

| Multiple-jurisdiction tax returns |

|

| Bankruptcy returns |

|

| TAX OPTIMIZATIONS |

| Pension income splitting |

|

| Donations |

|

| Medical expenses |

|

| Transit |

|

| Home buyers' amount |

|

| Student loan interest |

|

| Net-capital losses |

|

| Non-capital losses |

|

| Capital gains deduction |

|

| Unused tuition/books/education transfers |

|

| Working income tax benefit |

|

| DATA INTEGRATION |

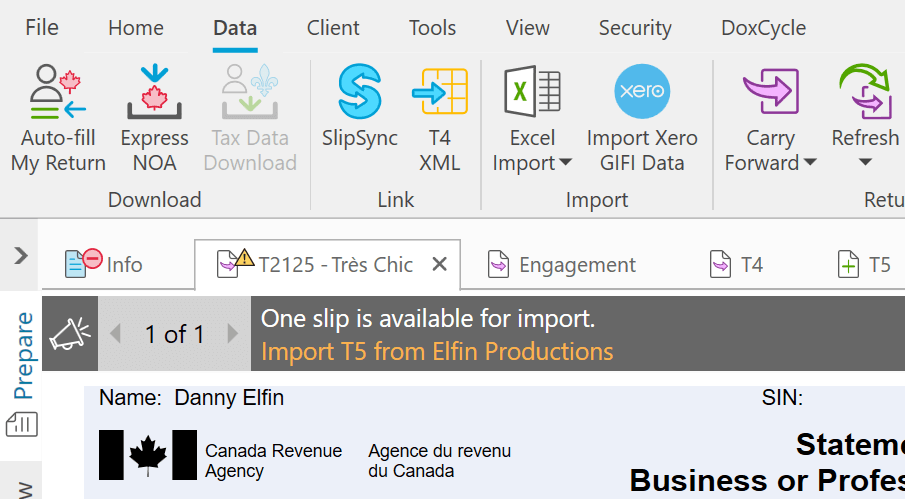

| Import T2125 and T776 data from Xero |

|

| Import slip data from DoxCycle |

|

| Import slip data from TaxCycle T3, T4/T4A and T5 (SlipSync) |

|

| Import data from Excel® |

|

| Create a DoxCycle file from TaxCycle |

|

| Carry forward and create both a TaxCycle and DoxCycle file |

|

| Save a tax return back into a DoxCycle file |

|

| Export invoices to Xero and QuickBooks® |

|

| ELECTRONIC SIGNATURES (TaxFolder and DocuSign®) |

| T183 Information return for electronic filing of an individual's income tax and benefit return |

|

| T185 Electronic filing of a pre-authorized debit agreement |

|

| T1032 Joint election to split pension income |

|

| T1135 Foreign Income Verification Statement |

|

| T2091 Designation of a property as a principal residence by an individual |

|

| T1255 Designation of a property as a principal residence by the legal representative of a deceased individual |

|

| T1-ADJ T1 adjustment request |

|

| T1-DD Direct deposit worksheet |

|

| ELetter – Engagement letter |

|

| FEDERAL/PROVINCIAL SCHEDULES AND FORMS |

| T1 General and T1 Condensed |

|

| Federal schedules 2 through 14 |

|

| Federal schedules and returns for non-residents: A, B, C, D, T1159, T1234 |

|

| Alberta: AB428, ABS2, ABS11, T89 |

|

| British Columbia: BC428, BC479, BCS2, BCS11, BCS12, BCClimateActionCredit, T88, T1014, T1014-1, T1014-2, T1231 |

|

| Manitoba: MB428, MB428A, MB479, MBS2, MBS11, T1005, T1241, T1256, T1256-1, T1256-2, T1299, T4164 |

|

| New Brunswick: NB428, NBS2, NBS11, NBSalesTaxCredit, T1258 |

|

| Newfoundland and Labrador: NL428, NLS2, NLS11, NLIncomeSupp, T1129, T1272, T1279 |

|

| Nova Scotia: NS428, NSS2, NSS11, NSAffordableLivingCredit, T1285, T224, T225 |

|

| Northwest Territories: NT428, NT479, NTS2, NTS11, NTCostOfLivingOffset |

|

| Nunavut: NU428, NU479, NUS1, NUS11, T1317 |

|

| Ontario: ON428, ON428-A, ON479, ON479-A, ONBEN, ONS2, ONS11, ONS12, T1221, ONBusinessCredits, Trillium |

|

| Prince Edward Island: PE428, PES2, PES11, PESalesTaxCredit |

|

| Québec TP1 returns |

Included in Complete Paperless Tax Suite. or sold separately. |

| Québec forms for outside Québec: TP-22 and TP-25 |

|

| Saskatchewan: SK428, SK479, SKS2, SKS11, SKS12, SKLowIncomeTaxCredit, RC360, T1237, T1284 |

|

| Yukon: YT428, YT432, YT479, YTS2, YTS11, YTS14, YTCarbonPriceRebate, T1232 |

|

| T2203 Provincial and Territorial Taxes for Multiple Jurisdictions |

|

| SLIPS |

| ContractPayments – Contract or Government Payments (T5018, T1204, RL-27) |

|

| Foreign – Foreign Income |

|

| RC210 Canada Workers Benefit Advance Payments Statement (CWB) |

|

| RC62 Universal Child Care Benefit Statement (UCCB) |

|

| Resource – Resource Income & Depletion |

|

| T101 Statement of Resource Expenses |

|

| T3 Statement of Trust Income Allocations and Designations |

|

| T4 Statement of Remuneration Paid |

|

| T4A Statement of Pension, Retirement, Annuity and Other Income |

|

| T4A(OAS) Statement of Old Age Security |

|

| T4A(P) Statement of Canada Pension Plan Benefits |

|

| T4A-RCA Statement of Distributions From a Retirement Compensation Arrangement |

|

| T4E Statement of Employment Insurance and Other Benefits |

|

| T4FHSA First Home Savings Account Statement |

|

| T4PS Statement of Employee Profit-Sharing Plan Allocations and Payments |

|

| T4RIF Statement of Income From a Registered Retirement Income Fund |

|

| T4RSP Statement of RRSP Income |

|

| T5 Statement of Investment Income |

|

| T5007 Statement of Benefits |

|

| T5008 Statement of Securities Transactions |

|

| T5013 Statement of Partnership Income/Tax Shelters and Renounced Resource Expenses |

|

| Tuition (T2202/TL11) – Tuition and Education Amounts |

|

| INCOME STATEMENTS |

| T776 Real Estate Rentals, plus related CCA/asset manager worksheets |

|

| T2042 Farming Activities, plus related CCA/asset manager, CEC, farming inventory adjustment and T1139 |

|

| T2121 Fishing Activities, plus related CCA/asset manager, CEC and T1139 |

|

| T2125 Business or Professional Activities, plus related CCA/asset manager, CEC and T1139 |

|

| T1163/T1273 AgriStability Statement A, plus related CCA/asset manager, CEC, farming inventory adjustment and T1139 |

|

| T1164/T1274 AgriStability Statement B |

|

| Asset – Asset Managers |

|

| CCA – Capital Cost Allowance Worksheets |

|

| CCAClaim – Claim Order and Options for Capital Cost Allowance Worksheets |

|

| ResourceWS – Resource Income Statement |

|

| 5 Year Income Statement Summaries |

|

| 2 Year Income Statement Comparative Summaries |

|

| DEDUCTIONS |

| T1M Moving Expenses Deduction |

|

| T657 Calculation of Capital Gains Deduction |

|

| T746 Calculating Your Deduction for Refund of Unused RRSP Contributions |

|

| T777 Statement of Employment Expenses |

|

| T777S Statement of Employment Expenses for Working at Home Due to COVID-19 |

|

| T777WS Employment Expenses Worksheet |

|

| T7772YearComparativeSummary – Employment Expenses 2 Year Comparative Summary |

|

| T7775YearSummary – Employment Expenses 5 Year Summary |

|

| T778 Child Care Expenses Deduction |

|

| T929 Disability Supports Deduction |

|

| T936 Calculation of Cumulative Net Investment Loss (CNIL) |

|

| T1032 Joint Election To Split Pension Income |

|

| T1212 Statement of Deferred Security Options Benefits |

|

| T1223 Clergy Residence Deduction |

|

| T1229 Resource Expenses and Depletion Allowance |

|

| T2017 Summary of Reserves on Dispositions of Capital Property |

|

| T2200 Declaration of Conditions of Employment |

|

| T2200S Declaration of Conditions of Employment for Working at Home Due to COVID-19 |

|

| T2205 Amounts from a Spousal or Common-law Partner RRSP, RRIF, or SPP to Include in Income |

|

| T2222 Northern Residents Deductions |

|

| T5004 Claim for Tax Shelter Loss or Deduction |

|

| TL2 Claim for Meals and Lodging Expenses |

|

| RC267/RC268 Employee Contributions to a United States Retirement Plan |

|

| RC269 Employee Contributions to a Foreign Pension Plan or Social Security Arrangement - Non-United States Plans or Arrangements |

|

| TAX AND CREDITS |

| CPT20 Election to Pay Canada Pension Plan Contributions |

|

| GST370 Employee and Partner GST/HST Rebate Application |

|

| RC151 GST/HST Credit Application for Individuals Who Become Residents of Canada |

|

| RC359 Tax on Excess Employees Profit-Sharing Plan Amounts |

|

| RC381 Inter-Provincial Calculation for CPP and QPP Contributions and Overpayments |

|

| T691 Alternative Minimum Tax (AMT) |

|

| T1170 Capital Gains on Gifts of Certain Capital Property |

|

| T1172 Tax on RESP Income |

|

| T1206 Tax on Split Income (TOSI) |

|

| T2036 Provincial or Territorial Foreign Tax Credit |

|

| T2038 Investment Tax Credit (Individuals) |

|

| T2039 Air Quality Improvement Tax Credit |

|

| T2043 Return of Fuel Charge Proceeds to Farmers Tax Credit |

|

| T2201 Disability Tax Credit Certificate |

|

| T2204 Employee Overpayment of Employment Insurance Premiums |

|

| T2209 Federal Foreign Tax Credits |

|

| FILING AND AUTHORIZATION |

| AuthRepTerms – Authorization Electronic Submission Service - Terms and Conditons of Use |

|

| AuthRepBus – Business Accounts - Authorizing a Representative (previously RC59) |

|

| AuthRepBusResults – History of Submissions and Results |

|

| AuthRepBusCancel – Business Accounts - Cancelling a Representative (previously RC59XCancel) |

|

| CPT30 Election to Stop Contributing to the Canada Pension Plan, or Revocation of a Prior Election |

|

| DC905 Bankruptcy identification form |

|

| NR5 Application by a Non-Resident of Canada for a Reduction in the Amount of Non-Resident Tax Required to be Withheld |

|

| RC66 Canada Child Benefit Application |

|

| RC66-1 Additional Children for the Canada Child Benefit Application |

|

| RC66SCH Status in Canada and Income Information for the Canada Child Benefit Application |

|

| RC71 Statement of Discounting Transaction |

|

| RC72 Notice of the Actual Amount of Refund of Tax |

|

| RC383 Tax-exempt Earned Income Information for a Pooled Registered Pension Plan |

|

| ReFILE – ReFILE Worksheet |

|

| T1A Request for Loss Carryback |

|

| T1ADJ T1 Adjustment Request |

|

| T1B Request to Deduct Federal COVID-19 Benefits Repayment in a Prior Year |

|

| T1OVP Individual Tax Return for RRSP/PRPP Excess Contributions |

|

| T7DRA Tax Return Remittance Voucher |

|

| T90 Income Exempt from tax under the Indian Act |

|

| T183 Information Return for Electronic Filing of an Individual's Income Tax and Benefit Return |

|

| T185 Electronic Filing of a Pre-authorized Debit Agreement |

|

| T1132 Alternative Address Authorization |

|

| T1135 Foreign Income Verification Statement |

|

| T1135Results T1135 EFILE Results |

|

| T1161 List of Properties by an Emigrant of Canada |

|

| T1162A Pre-authorized Payment Plan |

|

| T1198 Statement of Qualifying Retroactive Lump-Sum Payment |

|

| T1243 Deemed Disposition of Property by an Emigrant of Canada |

|

| T1244 Election, Under Subsection 220(4.5) of the Income Tax Act, to Defer the Payment of Tax on Income Relating to the Deemed Disposition of Property |

|

| T1255 Designation of a Property as a Principal Residence by the Legal Representative of a Deceased Individual |

|

| T1261 Application for a Canada Revenue Agency Individual Tax Number (ITN) for non-residents |

|

| T2061A Election by an Emigrant to Report Deemed Dispositions of Taxable Canadian Property and Capital Gains and/or Losses Thereon |

|

| T2091 Designation of a Property as a Principal Residence |

|

| T2091/T1255 WS – Principal Residence Worksheet |

|

| T3012A Tax Deduction Waiver on the Refund of your Unused RRSP, PRPP or SPP Contributions |

|

| TX19 Asking for a Clearance Certificate |

|

| WORKSHEETS |

| Allowable Business Investment Loss (ABIL) |

|

| Accessibility – Home Accessibility Expenses |

|

| AIIPNote – Variables for Accelerated Investment Incentive Property |

|

| Bankruptcy |

|

| Capital Gains/Losses Manager (S3M) |

|

| Canada Child Benefit (CCB) |

|

| Climate – Canada Carbon Rebate (CCR) |

|

| Credits (various credit amounts) |

|

| Custom fields |

|

| Dependant details (Dep) |

|

| Dependant child care/fitness/arts expenses (DepEx) |

|

| Deductions (various deductions) |

|

| Donations |

|

| EFILE results |

|

| EFILE worksheet |

|

| Engagement – Client engagement information |

|

| Express NOA |

|

| Foreign Tax Credit (FTC) |

|

| GIS – Guaranteed Income Supplement |

|

| GST/HST (Goods and Services Tax/Harmonized Sales Tax) |

|

| IEL – Immediate Expensing Limit Agreement Worksheet |

|

| Immigrant/Emigrant |

|

| Info – Personal Information |

|

| Income (various income amounts) |

|

| Instalments |

|

| Medical expenses |

|

| Medical travel expenses |

|

| Motor vehicle expenses |

|

| Net capital losses |

|

| Non-capital losses |

|

| Optimizations |

|

| Pre-authorized debit (PAD) results |

|

| Registered Pension Plan (RPP) deductions |

|

| RRSP contributions |

|

| Next year RRSP deduction limit (RRSPNext) |

|

| Social Benefits Repayment |

|

| Student Loan Interest |

|

| Support Payments |

|

| Workflow Summary |

|

| SUMMARIES |

| 2-year client summary |

|

| 2-year variance summary |

|

| 5-year summary |

|

| 5-year short summary |

|

| 5-year S428 provincial summary |

|

| T1 summary |

|

| T1 short summary |

|

| Auto-fill my return (AFR) summary |

|

| Carry forward summary |

|

| Client data enquiry (SEND) summary |

|

| Dependants credit summary |

|

| Joint summary |

|

| Long joint summary |

|

| Family summary |

|

| Long family summary |

|

| Foreign tax credits summary (FTCSum) |

|

| Pension summary |

|

| Rental/business statement summary (StatementSum) |

|

| Memos summary |

|

| Slips summary |

|

| Scenario summary |

|

| Tapes summary |

|

| T3Rec – T3 AFR reconciliation |

|

| T5008Slips – T5008 Slips Summary |

|

| TEMPLATES AND CLIENT CORRESPONDENCE |

| Client letter (and joint client letter for spouses) |

|

| Shared, customizable letterhead for all T1 letters |

|

| Shared, customizable salutation and closing snippets for all T1 letters |

|

| Cover email templates for electronic signatures and client copies |

|

| Email any template to client |

|

| Engagement letter |

|

| Incomplete slips letter/email (and joint/family incomplete slips) |

|

| Invoice (and joint/family combined invoice) |

|

| Pre-season and post-season letters and checklists (and joint/family combined) |

|

| Billing using timer, schedules and forms |

|

| Mailing labels |

|

| Electronic filing confirmation templates for all transmission types |

|

| File notes |

|

| T7DRA template for pre-printed remittance form |

|