TaxCycle 13.0.51398.0—Major T2/AT1 Update and 2023 Forms Module (Revised)

This release extends the supported corporate tax year ends for T2 and AT1 returns up to May 31, 2024, and rolls over the Forms module to 2023.

To install this version immediately, download the full installer from our website or request a free trial. Once we enable the automatic update for this version, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options. (To deploy auto-update files from your network, see the Auto-Update Files page.)

Revisions

We originally released version 13.0.51383.0 on November 6, 2023, with the changes below. On November 9, 2023, we released a new version with the following changes:

- Resolved: T1 EFILE transmissions not working for 2017, 2018 and 2019 returns.

- Resolved: TaxLink from TaxCycle to DoxCycle

- Defaulted the immediate expensing questions to No on the T1 CCAClaim worksheets in all new 2023 files. This allows automatic calculations of the immediate expensing limit and income allocation.

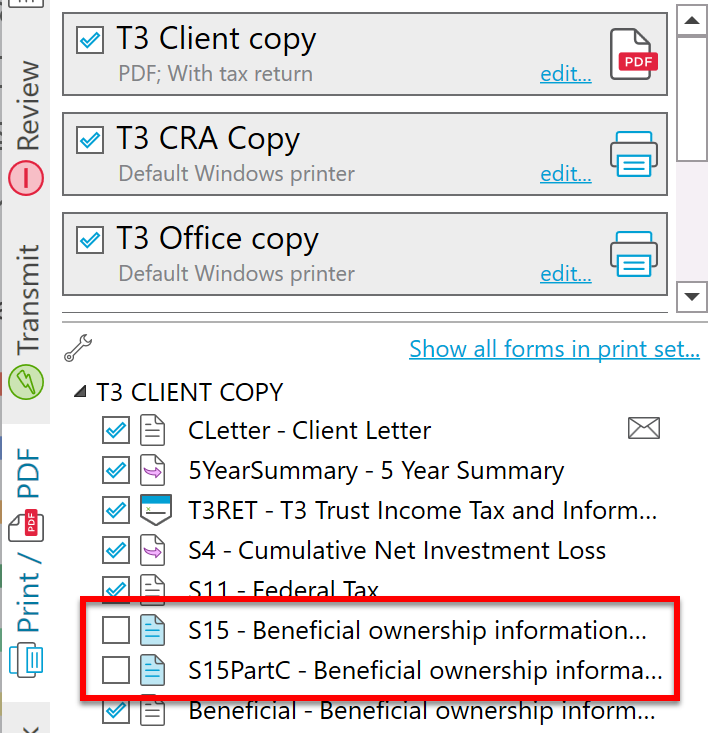

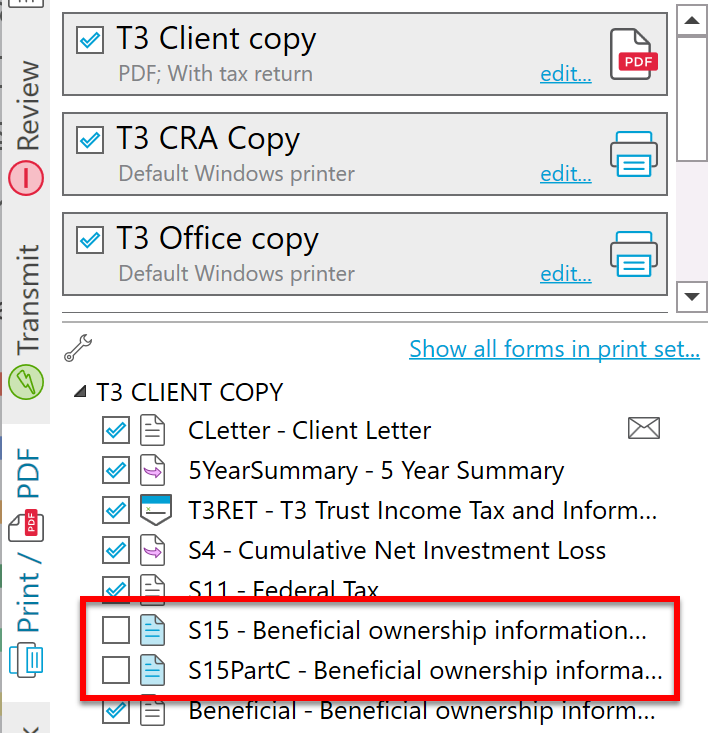

- Split out the T3 S15 into multiple forms in the index to assist in printing when reporting multiple owners, as dynamic parts of the form were causing issues when printing. Part C now appears as a separate form in the Prepare sidebar and when printing. While the new S15PartC should appear in the required print sets by default, we recommend reviewing your print sets to make sure all parts of the S15 print when you need them.

Release Highlights

T2 and AT1 Filing Date Extension

This certified release of TaxCycle T2 and AT1 extends the supported corporate tax year ends up to May 31, 2024.

New! Transmission of T106, T1134 and T1135 using a Web Access Code (WAC) in TaxCycle T2

Up until this release of TaxCycle T2, only those with a registered EFILE number and password were able to electronically file the T106 Information Return of Non-Arm’s Length Transactions with Non-Residents, T1134 Information Return Relating To Controlled and Not-Controlled Foreign Affiliates, and T1135 Foreign Income Verification Statement.

This version of TaxCycle allows you to request a Web Access Code (WAC) from the CRA and use it to electronically transmit the T106, T1134 and T1135. Each form or statement requires its own WAC, all of which you can request in TaxCycle and which you can enter on the T2CIF worksheet (T2CIFWS).

To learn how to request a WAC from the CRA and transmit these forms, read the updated Request a T2 WAC help topic.

We have additionally updated the following help topics to reflect this change:

New T2 Forms

Schedule 310, Newfoundland and Labrador Manufacturing and Processing Investment Tax Credit

- Effective April 7, 2022, the Canada Revenue Agency (CRA) introduced this new 10% manufacturing and processing investment tax credit to encourage the manufacturing and production, fishery, farming, and forestry sectors to invest in capital equipment located in and for use in a business operated in the province.

- The credit is calculated based on the corporation’s capital cost of eligible property.

- In the case of a Canadian-controlled private corporation (CCPC), up to 40% of the credit is refundable.

- You can carry unused credits back to the 3 previous tax years or forward to the following 20 tax years. The unused credits cannot be applied to a tax year that ends before April 7, 2022.

- The S310 includes a non-refundable tax credit carryforward continuity table on the last page of the form to keep track of the 20-year carryforward.

- The non-refundable credit calculated on line 230 of the S310 flows to line 508 of the S5.

- The refundable credit calculated on line 240 of the S310 flows to line 523 of the S5.

Schedule 311, Newfoundland and Labrador Green Technology Tax Credit

- Effective April 7, 2022, the CRA introduced this new 20% green technology tax credit for CCPCs that invest in equipment for green activities such as energy conservation, clean energy generation, and efficient use of fossil fuels.

- The equipment has to be located in and for use in a business operated in the province.

- The credit is calculated based on the corporation’s capital cost of eligible property.

- The maximum credit is $1 million annually, of which 40% is refundable.

- The CGI worksheet now includes the Part 1 agreement table for the S311.

- The non-refundable credit calculated on line 330 of the S311 flows to line 506 of the S5.

- The refundable credit calculated on line 340 of the S311 flows to line 526 of the S5.

Schedule 150, Net Income (loss) for Income Tax Purposes for Life Insurance Companies (2023 and later tax years)

- This new schedule is applicable to T2 returns with tax years beginning after 2022.

- All insurance corporations and fraternal benefit societies carrying on business in Canada are required to complete the S150.

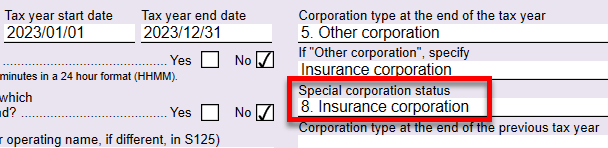

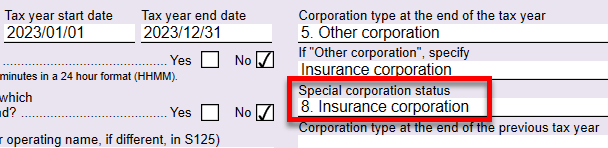

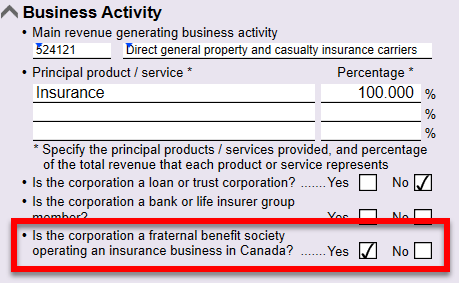

- To indicate that a company is an insurance corporation, select Insurance corporation from the Special corporation status drop-down menu on the Info worksheet.

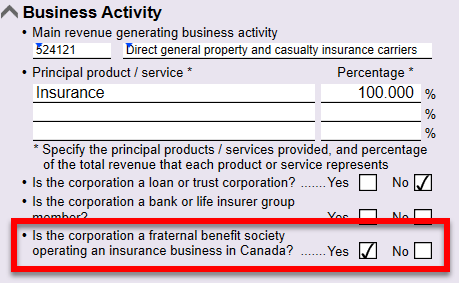

- If the corporation is carrying on business in Canada as a fraternal benefit society, answer Yes to the new question in the Business Activity section of the Info worksheet.

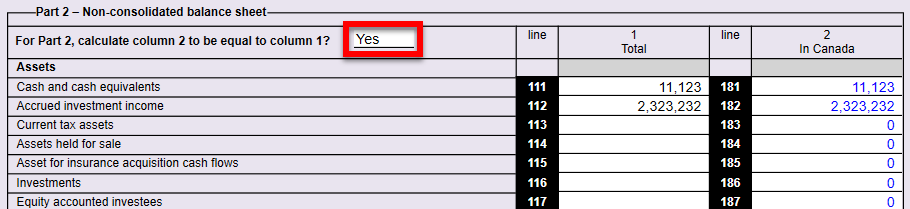

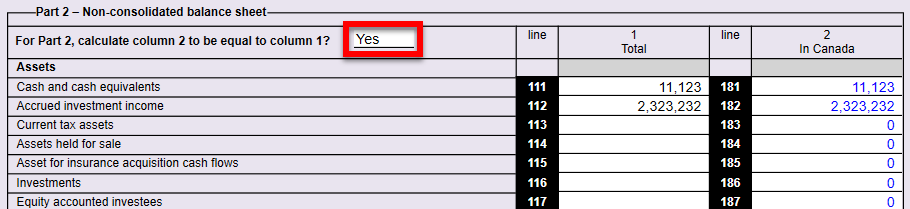

- Part 2 of the S150 contains a Non-consolidated balance sheet table. If the amounts in columns 1 and 2 of the table are the same, answer Yes to the question at the top and TaxCycle will automatically calculate the amounts in column 2 based on the amounts entered in column 1.

- When you complete the S150, the amount on line 110 will flow to Schedule 1 amount A.

Schedule 151, Investment Revenue From Designated Insurance Property for Insurance Companies (2023 and later tax years)

- This new schedule is applicable to T2 returns with tax years beginning after 2022.

- All resident companies and societies operating a life insurance business outside of Canada, and all non-resident companies and societies operating a life insurance business in Canada are required to complete the S150.

- If the amount on line 850 in Part 6 of the S151 is negative, add the absolute value of this amount to the current year excess amount on line 864.

- If the amount on line 850 in Part 6 is positive, the amount flows to line 439 in Part 5 of the S150.

Updated T2 Forms

T2 Bar Code Return

- Added a new line in the Certification section of the T2Barcode for Part VI.2 to reflect line 725 in the T2 jacket.

Corporate Information (Info) Worksheet

- Added the following new question to the T2 Corporate Information (Info) worksheet to determine whether completing the S150 is required: “Is the corporation a fraternal benefit society operating an insurance business in Canada?”

Schedule 1, Net Income (Loss) for Income Tax Purposes

- Customer Request Line 101 of the S1 now includes GIFI code 7010 (Income tax relating to components of other comprehensive income).

Schedule 5, Tax Calculation Supplementary—Corporations

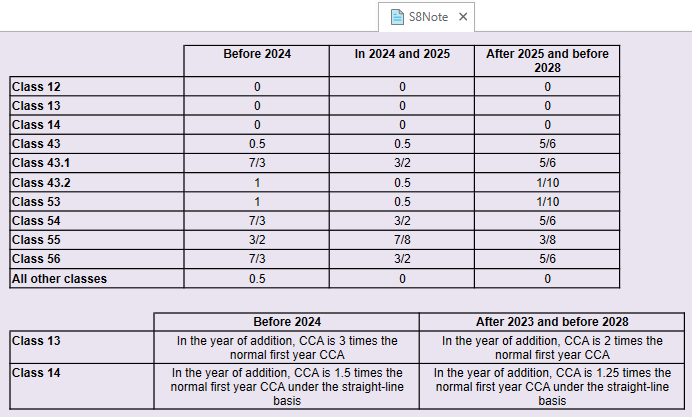

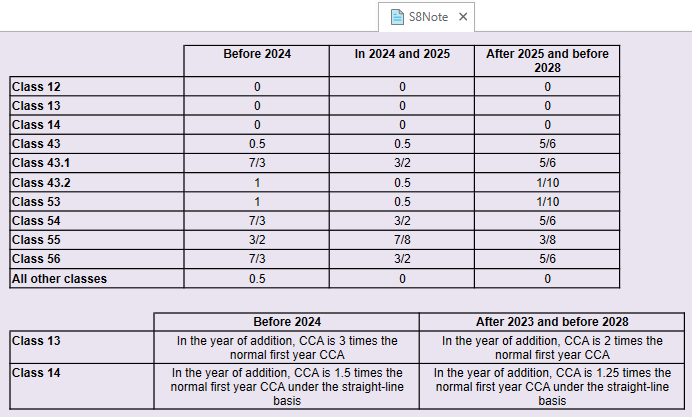

Schedule 8, Capital Cost Allowance (CCA)

- Immediate expensing rules no longer apply to additions after December 31, 2023.

- Added new S8Note to provide information about accelerated investment incentive property (AIIP) calculations for years leading up to 2027 and before 2028.

- CCA calculations have been adjusted to handle AIIP calculations for 2024 to 2028 and subsequent years.

- A transitional rule applies to the Accelerated Incentive Investment (AII) when a corporate tax year begins in 2023 and ends in 2024, or if a corporate tax year begins in 2025 and ends in 2026. A special rule applies to calculate the undepreciated capital cost (UCC) adjustment when a corporate tax year begins in 2023 and ends in 2024, or if a corporate tax year begins in 2025 and ends in 2026. We have added new sections to the S8 to address such situations under subsection 1100(2.01) of the Income Tax Act.

Schedule 17, Credit Union Deductions

- Removed calculations related to the year 2020 in Part 3 (Manitoba) of the S17.

Schedule 35, Taxable Capital Employed in Canada—Large Insurance Corporations

- Added the following new lines to the T35 to comply with International Financial Reporting Standards (IFRS) 17, which introduces new accounting reporting standards for insurance contracts:

- Part 1—Lines 107, 108 and 109.

- Part 2—Lines 207, 208, 209 and 210.

- IFRS 17 applies to insurance corporations with tax years beginning on or after January 1, 2023.

Schedule 38, Part VI Tax on Capital of Financial Institutions

- Added the following new lines to Part 1 of the S38 to comply with IFRS 17 for insurance corporations: lines 151 though 158, 165, and 171.

- Added two new columns (columns 5 and 6) to Table 2 on the last page of the S38.

- The new lines and columns only apply to insurance corporations with tax years beginning on or after January 1, 2023.

Schedule 65, Air Quality Improvement Tax Credit (2022 and later tax years)

- Updated the wording of question 120 in Part 1 of the S65 from “greater than $15 million” to “equal to or greater than $15 million” as per the CRA.

- Question 110 in Part 1 now calculates based on the Special corporation status and the cooperative or credit union question on the Info worksheet.

T666 (S425), British Columbia Scientific Research and Experimental Development Tax Credit

- Removed line 360, capital expenditure related to years prior to 2014, from Part 1 of the T666.

- Removed the column for capital expenditure related to years prior to 2014 from Schedule A on the last page of the T666.

Schedule 429, British Columbia Interactive Digital Media Tax Credit

- Removed question 345 from the eligibility section in Part 3 of the S429.

T183Corp, Information Return for Corporations Filing Electronically

- Added a new field to Part 2 of the form to accommodate line 770 in the T2 jacket.

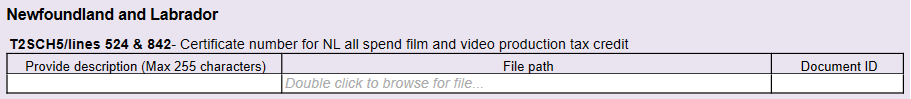

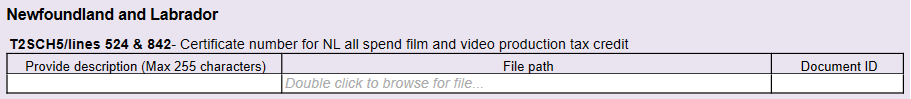

AttachADoc

- Added a new Newfoundland and Labrador section to accommodate new lines 524 and 842 of the T2SCH5. For more information, read the T2 Attach-a-Doc help topic.

Minor Updates

The following forms received minor updates:

- Schedule 125, Income Statement Information

- Schedule 411, Saskatchewan Corporation Tax Calculation

- Schedule 429, British Columbia Interactive Digital Media Tax Credit

- Schedule 500, Ontario Corporation Tax Calculation

- T183Corp, Information Return for Corporations Filing Electronically

- T1044, Non-Profit Organization (NPO) Information Return

- T1134, Information Return Relating To Controlled and Not-Controlled Foreign Affiliates

Alberta AT1 Updates

The following AT1 forms received minor updates:

- AT1 jacket—Removed line 081 (Alberta Scientific Research and Experimental Development [SR&ED] Tax Credit)

- AT1 Schedule 1 (AS1), Alberta Small Business Deduction

- AT1 Schedule 2 (AS2), Alberta Income Allocation Factor

- AT1 Schedule 3 (AS3), Alberta Other Tax Deductions and Credits

- AT1 Schedule 4 (AS4), Alberta Foreign Investment Income Tax Credit

- AT1 Schedule 12 (AS12), Alberta Income/Loss Reconciliation

- AT4930, Alberta Consent Form

We removed the following forms related to the Alberta Scientific Research and Experimental Development (SR&ED) Tax Credit due to the program being eliminated in 2020:

- AS9

- AS9Project

- AS9Supplemental

- AS9Step

We also removed the AS9 section from the CGI worksheet.

Rollover of TaxCycle Forms to 2023

This release rolls over the TaxCycle Forms module to 2023, allowing you to create a 2023 forms collection. Please note the following:

- You can carry forward 2022 TaxCycle Forms files.

- You can create Forms files from other 2023 TaxCycle modules.

- The government forms are the 2023 versions of the forms.

New Forms

- UHT0001, Notice of Objection - Underused Housing Tax Act.

Other Updates

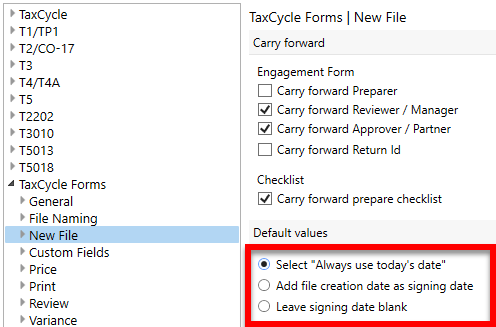

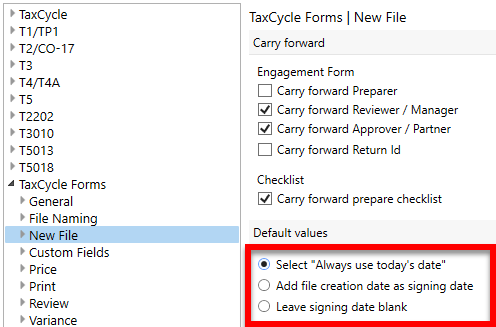

- Customer Request You can now set the signing date on the Info worksheet to default to the current date or leave it blank from TaxCycle Options.

- Customer Request TaxCycle now allows invalid entries for the authorized signer name where the signer was not first entered on the Info worksheet.

- Customer Reported UHT-2900—Fixed an issue where TaxCycle was copying imported Excel data from line 960 (Name of individual, legal representative, or authorized person) to line 961 (Position or office of the legal representative or authorized person).

- Customer Request T2058, T2059 and T2060—You can now edit partner names on these forms instead of selecting partners from the “Contact and filing” section of the Info worksheet. We also added a check box on these forms so you can still select partners from the Info worksheet.

- Customer Reported UHT-2900—Added masking support for individual tax number (ITN) on the client copy of the UHT.

- Customer Reported UHT-2900—Adjusted calculation of check box at line 110 to allow for overrides.

Template Changes

- T1 and T2 2023—Added template “cheat sheets” (*T1Code and *T2Code) to the Template Editor. These templates were presented at the Templates—Part 2 webinar and can be used to help you code your own templates.

Resolved Issues

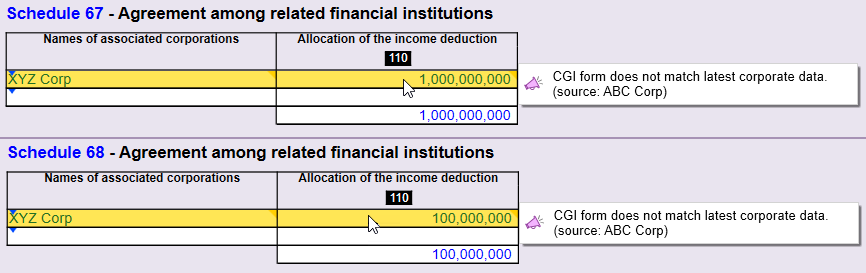

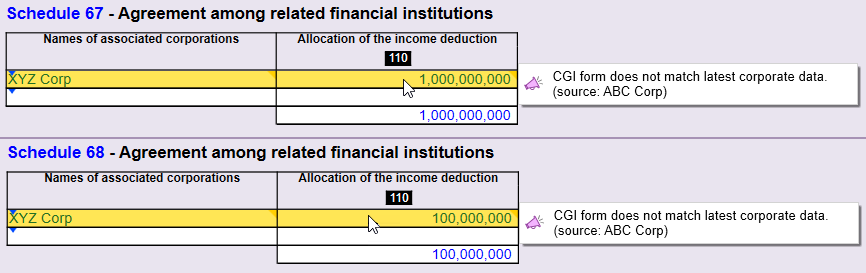

- T2—Resolved an issue where TaxCycle erroneously displayed a review message indicating that the CGI form does not match latest corporate data on the Schedule 67 (S67) and Schedule 68 (S68) tables of the CGI worksheet. This message appeared after linking two returns through corporate linking, even though the S67 and S68 did not apply to the corporation.

- T2—Known Issue: T2 Automatic File Locking.