TaxCycle 13.2.53840.0—2024 T1/TP1 and T5013/TP-600 Modules (Revised)

This release adds the 2024 T1/TP1 module with forms in preview mode, rates and calculations for 2024 personal tax returns. It also updates the T5013/TP-600 module for 2024.

To install this version immediately, download the full installer from our website or request a free trial. Once we enable the automatic update for this version, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options. (To deploy auto-update files from your network, see the Auto-Update Files page.)

Release Highlights

Revisions

We originally released version 13.2.53809.0 on June 27, 2024, with the changes below. On July 3, 2024, we released version 13.2.53840.0 to resolve the following issues:

- Customer Reported Data Mining—Resolved an issue where the text in the drop-down list of examples defaulted to show "bankruptcy-related filings", as reported on ProTaxCommunity. The forward slash was also removed from the default file name when exporting a query so it is accepted by Windows®.

- T1—Added a Preview watermark on all forms in the T1 2024 module with the exception of some authorization forms and summaries.

- T1—Fixed an issue where TaxCycle did not properly carry forward the T1134 and T1134Supp to the T1 2024 module.

2024 T1/TP1 Preview Rates and Forms

The new TaxCycle T1/TP1 2024 module includes forms in preview mode, along with rates and calculations for 2024 personal tax returns. Use this module for planning and evaluation purposes only.

The government forms you see in the TaxCycle T1/TP1 2024 module are the 2023 forms. The amounts and rates are those already announced or that we have estimated based on information we have at this time, as well as those announced in the federal and provincial/territorial 2024 budgets.

What you need to know:

- You can carry forward 2023 T1/TP1 returns from TaxCycle. Carryforwards from ProFile®, Taxprep® and DT Max® will become available is a subsequent release. All carry forward conversions are currently under review and will be updated before the next tax season. We do not recommend batch carryforward at this time.

- Files you create now will continue to work after the module receives certification from the CRA. EFILE is not available for 2024 tax returns until February 2025.

- The CRA has not yet certified TaxCycle T1/TP1 2024 for electronic or paper-filing. However, you may use it to prepare and file a deceased taxpayer’s 2024 return.

- All forms show a Preview watermark on screen and when printing, except those used for authorization and some summaries.

- If you have already purchased a 2024 TaxCycle license, you may enter a date of death in 2024, or a date of bankruptcy in 2024 and select pre-bankruptcy as the type, to remove the Preview watermark from forms. This allows you to print and paper-file the T1Condensed (the bar code will not show on the form) before we release a filing version next December or January if you need to.

The following measures announced in the 2024 budget will be added in a future TaxCycle release:

- Revisions to the capital gains inclusion rate, the capital gains deduction and other related deductions.

- Revision of the Alternative Minimum Tax (AMT) calculation.

- Adjustments to the Motor Vehicle Worksheet to take into account the 2024 accelerated investment incentive properties (AIIP) multiplier.

To learn how to create planning files, review the following help topics:

Rollover of T5013/TP-600 to 2024

The new module for TaxCycle T5013 allows you to begin data entry for 2024 federal and Québec partnership returns. Please note the following:

- You can carry forward 2023 T5013 returns from TaxCycle, including the creation of stub period returns. Please wait to carry forward competitor files.

- You can use this module to file partnership returns with fiscal year ends in 2024.

- The government forms are the 2023 forms updated to include 2024 indexed amounts and budget changes announced or estimated based on the information we have at this time. A review message appears on the year-end date field and in a bulletin at the top of the forms to remind you of this.

- This module permits CRA Internet File Transfer (XML) and transmission of RL slips to Revenu Québec.

- The T1135 and T1134 in this module are certified for filing for year ends on or before October 31, 2024.

T5013/TP-600 Updates

- T5013 and Slips modules—Made the following changes to the Engagement worksheet:

- Removed the Language of correspondence field as it already exists on the Info worksheet.

- Added a Client since field to track how long the client has been a client of your firm.

- Added a Salutation field to determine the name TaxCycle will use in templates, and updated templates to use the new salutation field.

- Moved the question about whether filing a UHT-2900 return is required from the Info worksheet to the Other Engagements section of the Engagement worksheet.

- Added the option to select the Japanese yen (JPY) as a functional currency from the drop-down list on the T1134 and T1135.

- Customer Request Added automatic allocation of capital account amounts for all partners. To do this, enter all partner totals on the S1 Allocation Worksheet (S1WS) and check the box to Automatically allocate capital account amounts based on selected allocation method. If you do not check this box, TaxCycle will require you to manually enter amounts for each partner.

- Also updated related calculations for the TPFWS and RL-15 allocations.

- Updated the T1134 to show as not eligible for electronic transmission if all T1134Supp forms are for dormant or lower-tier foreign affiliates. In this case, the T1134 must be paper-filed.

- Customer Reported Updated line 115 on the S1WS to be editable.

Other Updates

- T1—Added Correspondence Name and Joint Correspondence Name fields to the Engagement worksheet to generate clients’ names for use in templates. These fields take into account the use of the Nickname/preferred name field on the Info worksheet and handle situations where someone does not have a legal first name. We will update all 2024 T1 templates to use these fields in a subsequent release and will provide additional documentation to help you adjust any custom templates you have at that time.

- E-signatures—For taxpayers who do not have a first name entered on the T1 Info worksheet, TaxCycle now uses the contents of the Nickname/preferred name field for the first name when creating a client in TaxFolder or sending an envelope through Docusign®. This applies only to 2024 T1 files.

- T1 2024—You can now create an electronic signature request for a Legal Representative of a living individual in the 2024 module.

- T2—Renamed the T183SER form to T2183, and updated the form to the latest version.

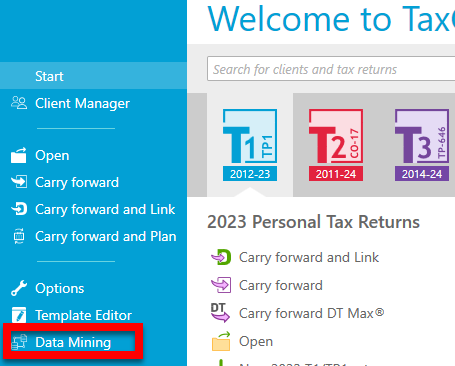

- Added a Data Mining button to the blue bar on the left of the Start screen.

Resolved Issues