| FILE CARRYFORWARD |

| TaxCycle T2 |

|

| ProFile® T2 |

|

| Cantax® T2 |

|

| Taxprep® T2 |

|

| DT Max® T2 |

|

| ELECTRONIC FILING & SERVICES |

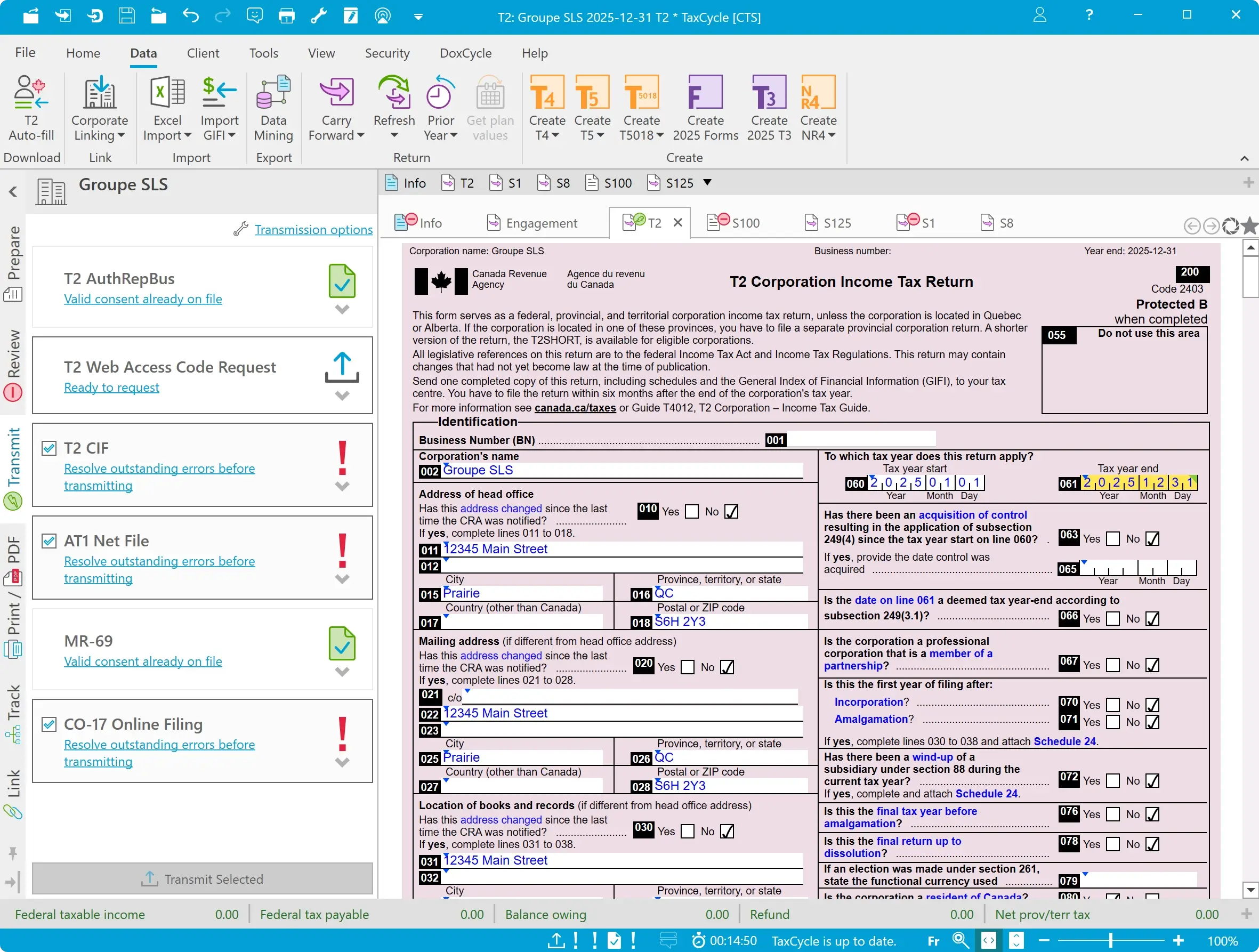

| T2 Corporation Internet Filing (including amended returns) |

|

| T2 Auto-fill |

|

| T2 Attach-a-doc |

|

| Request a Web Access Code (WAC) |

|

| T2 Pre-Validation |

|

| Business Authorization/Cancellation Request (formerly RC59 and RC59X) |

|

| T1135 EFILE |

|

| T106 EFILE |

|

| T1134 EFILE |

|

| FRRMS Submit e-Documents Services (T106, T1134, T1135) |

|

| RC4649 Country-by-Country Report |

|

| T2 AGRI EFILE |

|

| Electronic filing of Special Elections and Returns (SERs) |

|

| Québec CO-17 Online Filing (including amended returns) |

|

| Québec MR-69 |

|

| AT1 Net File (including amended returns) |

|

| DATA IMPORT/EXPORT |

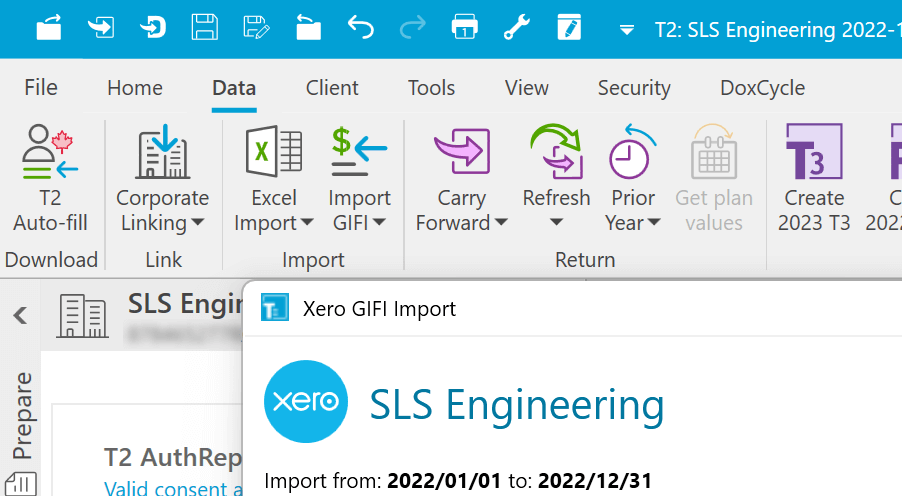

| General Index of Financial Information (GIFI) import from Xero, CaseWare®, QuickBooks®, CCH Engagement, Sage® and CSV |

|

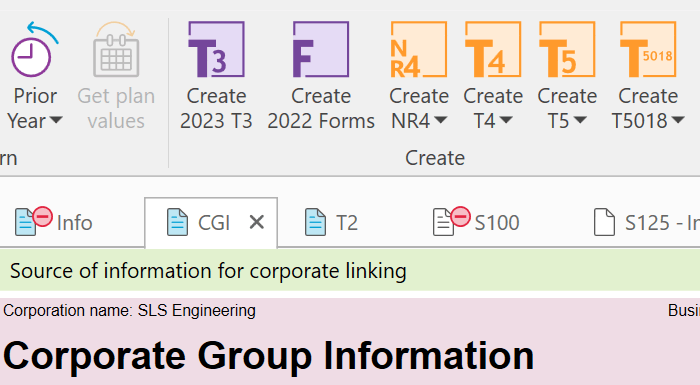

| Corporate Linking |

|

| Microsoft Excel® import into any form |

|

| Create T4, T5, T5018, NR4 and Forms files from a T2 return |

|

| GENERAL INDEX OF FINANCIAL INFORMATION (GIFI) |

| S100 – Balance Sheet Information |

|

| S101 – Opening Balance Sheet Information |

|

| S125 – Income Statement Information |

|

| S140 – Summary Statement |

|

| S141 – Notes Checklist |

|

| Notes to Financial Statements |

|

| FEDERAL JACKET AND SCHEDULES |

| T2 – Corporation Income Tax Return |

|

| T2-ADJ – Adjustment Motes |

|

| T2Barcode – T2 Barcode |

|

| Schedule 1 – Net Income (Loss) for Income Tax Purposes |

|

| Schedule 2 – Charitable Donations and Gifts |

|

| Schedule 3 – Dividends Received, Taxable Dividends Paid, and Part IV Tax Calculation |

|

| Schedule 4 – Corporation Loss Continuity and Application |

|

| Schedule 5 – Tax Calculation Supplementary |

|

| Schedule 6 – Summary of Dispositions of Capital Property |

|

| Schedule 7 – Calculation of Aggregate Investment Income and Active Business income |

|

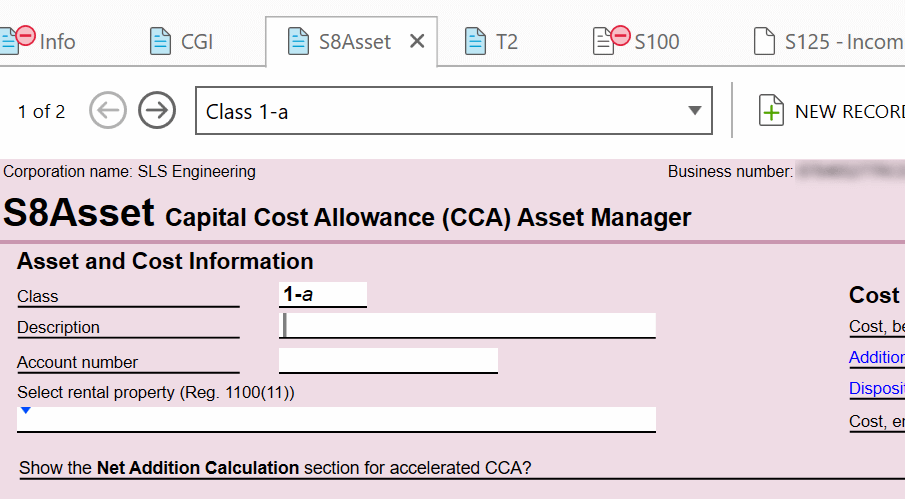

| Schedule 8 – Capital Cost Allowance (CCA) |

|

| Schedule 9 – Related and Associated Corporations |

|

| Schedule 10 – Cumulative Eligible Capital Deduction |

|

| Schedule 11 – Transaction with Shareholders, Officers, or Employees |

|

| Schedule 12 – Resource-related Deductions |

|

| Schedule 13 – Continuity of Reserves |

|

| Schedule 14 – Miscellaneous Payments to Residents |

|

| Schedule 15 – Deferred Income Plans |

|

| Schedule 16 – Patronage Dividend Deduction |

|

| Schedule 17 – Credit Union Deductions |

|

| Schedule 18 – Federal and Provincial or Territorial Capital Gains Refund |

|

| Schedule 19 – Non-resident Shareholder Information |

|

| Schedule 20 – Part XIV Additional Tax on Non-resident Corporations |

|

| Schedule 21 – Federal and Provincial or Territorial Foreign Income Tax Credits and Federal Logging Tax Credit |

|

| Schedule 22 – Non-resident Discretionary Trust |

|

| Schedule 23 – Agreement Among Associated Canadian-Controlled Private Corporations to Allocate the Business Limit |

|

| Schedule 24 – First-time Filer after Incorporation, Amalgamation or Winding-up of a Subsidiary into a Parent |

|

| Schedule 25 – Investment in Foreign Affiliates |

|

| Schedule 27 – Calculation of the Canadian Manufacturing and Processing Profits Reduction |

|

| Schedule 28 – Election Not to Be an Associated Corporation |

|

| Schedule 29 – Payments to Non-residents |

|

| Schedule 30 (T1263) – Third-party Payments for SR&ED |

|

| Schedule 31 – Investment Tax Credit – Corporations |

|

| Schedule 32 – T661 SR&ED Expenditures Claim |

|

| Schedule 33 – Taxable Capital Employed in Canada – Large Corporations |

|

| Schedule 34 – Taxable Capital Employed in Canada – Financial Institutions |

|

| Schedule 35 – Taxable Capital Employed in Canada – Large Insurance Corporations |

|

| Schedule 37 – Calculation of Unused Surtax Credit |

|

| Schedule 38 – Part VI tax on Capital of Financial Institutions |

|

| Schedule 39 – Agreement among related Financial Institutions - Part VI tax |

|

| Schedule 42 – Calculation of Unused Part I Tax Credit |

|

| Schedule 43 – Calculation of Parts IV.1 and VI.1 Taxes |

|

| Schedule 44 – Non-arm's Length Transactions |

|

| Schedule 45 – Agreement Respecting Liability for Part VI.1 Tax |

|

| Schedule 47 (T1131) – Canadian Film or Video Production Tax Credit |

|

| Schedule 48 (T1177) – Film or Video Production Services Tax Credit |

|

| Schedule 49 – Agreement Among Associated CCPCs to Allocate the Expenditure Limit |

|

| Schedule 50 – Shareholder Information |

|

| Schedule 53 – General Rate Income Pool (GRIP) Calculation |

|

| Schedule 54 – Low Rate Income Pool (LRIP) Calculation |

|

| Schedule 55 – Part III.1 Tax on Excessive Eligible Dividend Designations |

|

| Schedule 56 – Part II.2 Tax on Repurchases of Equity |

|

| Schedule 58 – Canadian Journalism Labour Tax Credit |

|

| Schedule 59 – Information Return for Non-qualified Securities |

|

| Schedule 60 (T661 Part 2) – SR&ED Expenditures Claim |

|

| Schedule 61 (T1145) – Agreement to Allocate Assistance for SR&ED Between Persons Not Dealing at Arm's Length |

|

| Schedule 62 (T1146) – Agreement to Transfer Qualified Expenditures Incurred in Respect of SR&ED Between Persons not Dealing at Arm's Length |

|

| Schedule 63 – Return of Fuel Charge Proceeds to Farmers Tax Credit |

|

| Schedule 65 – Air Quality Improvement Tax Credit |

|

| Schedule 67 – Canada Recovery Dividend |

|

| Schedule 68 – Additional Tax on Banks and Life Insurers |

|

| Schedule 71 – Income Inclusion for Corporations that are Members of Single-tier Partnerships |

|

| Schedule 72 – Income Inclusion for Corporations that are Members of Multi-tier Partnerships |

|

| Schedule 73 – Income Inclusion Summary for Corporations that are Members of Partnerships |

|

| Schedule 75 – Clean Technology Investment Tax Credit |

|

| Schedule 76 – Clean Technology Manufacturing Investment Tax Credit |

|

| Schedule 78 – Carbon Capture, Utilization, and Storage Investment Tax Credit |

|

| Schedule 88 – Internet Business Activities |

|

| Schedule 89 – Request for Capital Dividend Account Balance Verification |

|

| Schedule 91 – Information Concerning Claims for Treaty-based Exemptions |

|

| Schedule 97 – Additional Information on Non-resident Corporations in Canada |

|

| Schedule 130 – Excessive Interest and Financing Expenses Limitation |

|

| Schedule 150 – Net Income (loss) for Income Tax Purposes for Life Insurance Companies (2023 and later tax years) |

|

| Schedule 151 – Investment Revenue From Designated Insurance Property for Insurance Companies (2023 and later tax years) |

|

| WORKSHEETS |

| Info – Corporate Information |

|

| CGI – Corporate Group Information |

|

| Optimizations |

|

| MotorVehicle – Motor vehicle Worksheet |

|

| Rental – Rental Income |

|

| RentalSummary – Summary of Rental Income |

|

| S1FinancingWS – Deduction of Financing Expenses Worksheet |

|

| S1InducementRefundWS – S1 Inducement Refund Worksheet |

|

| S2WS – S2 Donations Worksheet |

|

| S3DividendPaidWS – S3 Dividend Paid Worksheet |

|

| S4LossCB – Loss Carryback Worksheet |

|

| S4WS – Loss Continuity Worksheet |

|

| S6M – Capital Property Disposition Manager |

|

| S7WS – Adjusted Aggregate Investment Income (AAII) |

|

| S8Asset – Capital Cost Allowance |

|

| S8AssetSummary – Asset Summary |

|

| S8Claim – CCA Claim |

|

| S8Note – Variables for Accelerated Investment Incentive Property (AIIP) |

|

| S8RecWS – Fixed Asset Reconciliation Worksheet |

|

| S13WS – Financial Statements Reserve Worksheet |

|

| S21 – Provincial/Territorial Foreign Tax Credit Worksheet |

|

| S31WS – Financial Statements Reserve Worksheet |

|

| S32PPACapWS – T661 Overall Cap on Prescribed Proxy Amount |

|

| S32WS – T661 Government Assistance Worksheet |

|

| S53WS – S53 General Rate Income Pool (GRIP) Adjustment Worksheet |

|

| S54WS – S54 Low Rate Income Pool (LRIP) Calculation Worksheet |

|

| CDACurrentYearWS – T2054 Current Year |

|

| CDANextYearWS – T2054 Next Year |

|

| CDAPriorYearWS – T2054 Prior Year |

|

| TaxConstants – Tax Constants Worksheet |

|

| FederalInstalments – Federal Instalment Payments |

|

| TaxPaymentWS – Tax Payments Made Worksheet |

|

| T2PaymentDueDateWS – Payment Due Date Worksheet |

|

| Interest – Interest and Late-filing penalties |

|

| Engagement – Client Engagement Information |

|

| Billing – Billing Worksheet |

|

| CustomFields – Custom Fields |

|

| PROVINCIAL RETURNS, SCHEDULES AND WORKSHEETS |

| Alberta AT1 Return (see below) |

|

| British Columbia: S421, S422, S423, S425, S427, S428, S429, S430, S432, BCLoggingTax |

|

| Manitoba: S380, S381, S383, S384, S385, S387, S388, S389, S390, S392, S394 |

|

| New Brunswick: S360, S362, S365, S366, S367 |

|

| Newfoundland and Labrador: S300, S301, S302, S303, S305, S306, S307, S308, S309, S310, S311 |

|

| Northwest Territories: S460, S461 |

|

| Nova Scotia: S340, S341, S343, S344, S345, S346, S347, S348, S349, S350, S351, S352, S353, S360, S366, S367 |

|

| Nunavut: S480, S481 |

|

| Ontario: S500, S501, S502, S504, S506, S507, S508, S508WS, S510, S511, S512, S513, S514, S515, S516, S517, S524, S525, S550, S554, S556, S558, S560, S564, S566, S568, S569, S570, S572 |

|

| Prince Edward Island: S320, S321, S322 |

|

| Québec CO-17 Return (see below) |

|

| Saskatchewan: S400, S402, S403, S404, S410, S411, SCT1 |

|

| Yukon: S440, S441, S442, S443, S444 |

|

| FILING AND AUTHORIZATION |

| AuthRepBus – Authorization Request |

|

| AuthRepBusCancel – Cancelling a Representative |

|

| AuthRepBusResults – Authorization or Cancellation Requests Results |

|

| MBAuth – Authorization or Cancellation of a Representative (Manitoba) |

|

| MR-69 – Power of Attorney, Authorization to Communicate Information, or Revocation |

|

| MR69Results – MR-69 Attachments and Results |

|

| AT4930 – Alberta Consent form |

|

| T183 – Information Return for Corporations Filing Electronically |

|

| T2CIFDeclaration – T2 CIF Terms and Conditions |

|

| T2OnlineMailTerms – T2 Online Mail Terms of Use |

|

| T2CIFWS – Internet Filing Worksheet |

|

| AttachADoc – Attach-a-doc for Electronically-filed T2 Corporation Income Tax Returns |

|

| PreValidation – Filing Pre-validation |

|

| CO-1000.TE – Online Filing of the Corporation Income Tax Return |

|

| T106 – Slip |

|

| T106S – Summary of Information Return of Non-Arm's Length Transaction With Non-residents |

|

| T106TransmissionWS – T106 Electronic Transmission Worksheet |

|

| T1044 – Non-profit organization (NPO) Information Return |

|

| T1044WS – NPO Information Return Worksheet |

|

| T1134 – Information Return Relating to Controlled and Not-controlled Foreign Affiliates |

|

| T1134TransmissonWS – T1134 Electronic Transmission Worksheet |

|

| T1134Sup – T1134 Supplement |

|

| T1135 – Foreign Income Verification Statement |

|

| T1135TransmissonWS – T1135 Electronic Transmission Worksheet |

|

| T2DD – Direct Deposit (RC366) |

|

| AGRI – AgriStability/AgriInvest Statement A/B |

|

| AGRIInv – Farming inventory Adjustment |

|

| AgriEfileResults – AgriStability Electronic Transmission Results |

|

| SCT1 – Saskatchewan Corporation Capital Tax Return |

|

| TX19 — Asking for a Clearance Certificate |

|

| QUÉBEC CO-17 FORMS and WorksheetS |

| CO-17 – Corporation Income Tax Return |

|

| CO-17.SP – Information and Income Tax Return for Non-profit Corporations |

|

| CO-17.A.1 – Net Income for Income Tax Purposes |

|

| QC1Addition – CO17.A.1 Taxable Tax Credits |

|

| QC1AdditionOther – CO17.A.1 Taxable Tax Credits |

|

| QC1Deduction – CO17.A.1 Non-Taxable Tax Credits |

|

| QC1DeductionsAdditional – CO17.A.1 Additional Deductions |

|

| QC1DeductionOther – CO17.A.1 Other Deductions |

|

| CO-17.B – Adjustment of Income from One or More Partnerships |

|

| CO-17.B.1 – Amount to be Included in the Income of a Corporation that is a Member of a Single-tier Partnership |

|

| CO-17.B.2 – Amount to be Included in the Income of a Corporation that is a Member of a Multi-tier Partnership |

|

| CO-17.CE – Internet Business Activities |

|

| CO-17S.2 – Charitable Donations and Other Gifts |

|

| QC2WS – Québec Donations Worksheet |

|

| CO-17S.3 – Dividends Received and Taxable Dividends Paid |

|

| CO-17S.4 – Corporation Loss Continuity and Application |

|

| QC4WS – Québec Loss Continuity Worksheet |

|

| CO-130.A – Capital Cost Allowance |

|

| CO-130.AD – Capital Cost Allowance in Respect of Immediate Expensing Property |

|

| CO-130.B – Deduction Respecting Incorporeal Capital property |

|

| CO-17S.8 – List of Investments |

|

| CO-17S.8.CS – List of Investments for Certain Corporations |

|

| CO-17S.9 – Related and Associated Corporations |

|

| CO-17S.10 – Transactions with Shareholders, Officers, or Employees |

|

| CO-17S.10A – Non-arm's Length Transactions |

|

| CO-17S.11 – Continuity of Reserves |

|

| CO-17S.12 – Royalty Payments or Fees, or Other similar Payments |

|

| CO-17S.14 – Non-resident Shareholder Information |

|

| CO-17S.21 – Foreign Tax Credit |

|

| CO-17S.28 – Election not to be an Associated Corporation through a third Corporation |

|

| CO-17S.36 – First-time Filer after Incorporation, Amalgamation, or Winding-up of a Subsidiary into a Parent |

|

| CO-17S.50 – Shareholder Information |

|

| CO-17S.232 – Summary of Dispositions of Capital Property |

|

| CO-130.A – Capital Cost Allowance |

|

| QC8AssetSummary – Asset Summary for Québec |

|

| CO-156.EN – Agreement Concerning Regional Ceilings Respecting the Additional Deduction for Transportation Costs of Small and Medium-sized Manufacturing Businesses |

|

| CO-156.TR – Additional Deduction for Transporting Costs of Small and Medium-sized Manufacturing Businesses |

|

| CO-156.TZ – Deduction for Transporting Costs of Small and Medium-sized Businesses Located in a Special Remote Area |

|

| CO-400 – Resource-related Deductions |

|

| CO-502 Current Year – Election in Respect of a Dividend Paid out of a Capital Dividend Account |

|

| CO-502 Next Year – Election in Respect of a Dividend Paid out of a Capital Dividend Account |

|

| CO-771 – Calculation of the Income Tax of a Corporation |

|

| CO-771.2.1.2 – Income of a Corporation That Is a Member of a Partnership from an Eligible Business Carried on in Canada by the Corporation |

|

| CO-771.2.1.AT – Business limit Allocated to a Corporation that is Designated Member of a Partnership |

|

| CO-771.1.3 – Associated Corporations' Agreement Respecting the Allocation of the Business Limit |

|

| CO-771.1.3.AJ – Adjust Business Limit |

|

| CO-771.1.3.AT – Business Limit Allocated to a Corporation that has Specific Corporate Income |

|

| CO-771.R.3 – Breakdown of Business Carried on in Québec and Elsewhere |

|

| CO-771.R.14 – Proportion of Business Carried on in Québec and Elsewhere by an Insurance Corporation |

|

| CO-771.CH – Election Concerning the Number of Employee Remunerated hours for Purposes of Calculating the Small Business Deduction |

|

| CO771WS – Small Business Deduction, Normalized Paid Hours Calculation |

|

| CO-786 – Patronage Dividend Deduction |

|

| QC16WS – CO-786 Patronage Dividend Election Worksheet |

|

| CO-1012 – Application by a Corporation to Carry Back a Loss |

|

| CO1012LossCB – CO-1012 Québec Loss CarryBack Worksheet |

|

| COZ-1027.P – Payment of Income Tax, Capital Tax, Registration Fee or Compensation Tax of a Corporation |

|

| CO-1027.VE – Instalments Made and Balance Paid by a Corporation |

|

| CO-1027Instalments – Calculation of Instalments for Corporations |

|

| CO-1027InstalmentsPaymentschedule – Québec Instalment Payment Schedule |

|

| CO-1029.8.33.6 – Tax Credit for an On-the-job Training Period |

|

| CO-1029.8.33.13 – Tax Credit for Reporting Tips |

|

| CO-1029.8.33.CS – Tax Credit for Small and Medium-sized Businesses that Employ Persons with a Severely Limited Capacity for Employment |

|

| CO-1029.8.33.TE – Tax Credit for Small and Medium-sized Businesses to Foster the Retention of Experienced Workers |

|

| CO-1029.8.33.TF – Agreement Concerning the Tax Credit for Small and Medium-sized Businesses to Foster the Retention of Experienced Workers |

|

| CO-1029.8.35 – Tax Credit for Québec Film Productions |

|

| CO-1029.8.36.5 – Tax Credit for a Design Activity Carried out by an Outside Consultant |

|

| CO-1029.8.36.7 – Tax Credit for an In-house Design Activity |

|

| CO-1029.8.36.DA – Tax Credit for the Development of an E-business |

|

| CO-1029.8.36.DC – Election Respecting the Tax Credit for the Development of an E-business |

|

| CO-1029.8.36.EM – Tax Credit Relating to Resources |

|

| CO-1029.8.36.FO – Employee training Tax Credit for Small and Medium-sized Businesses |

|

| CO-1029.8.36.ID – Cumulative Limit Allocation Agreement for the Tax Credit for Investment |

|

| CO-1029.8.36.II – Tax Credit for Investment and Innovation |

|

| CO-1029.8.36.IK – Cumulative limit Allocation Agreement for the Tax Credit for Investment and Innovation |

|

| CO-1029.8.36.IN – Investment Tax Credit |

|

| CO-1029.8.36.PS – Tax Credit to Support Print Media Companies |

|

| CO-1029.8.36.SM – Tax Credit for the Production of Performances |

|

| CO-1029.8.36.TM – Tax Credit for Multimedia Titles |

|

| CO-1136 – Calculation of Paid-up Capital |

|

| CO-1136.CS – Paid-up Capital for Purposes of Calculating the Income Tax of Certain Corporations |

|

| CO1136DeductionsWS – Deduction from Paid-up Capital |

|

| CO-1137.A – $1 Million Deduction |

|

| CO-1137.E – Agreement Respecting the $1 Million Deduction |

|

| CO-1138.1 – Associated Corporations' Agreement Election Respection the Deduction for Farming Corporations and Fishing Corporations |

|

| CO-1140 – Calculation of the Paid-up Capital of a Financial Institution |

|

| CO-1140.A – Paid-up Capital to Be Used for Purposes Other than the Calculation of the Tax on Capital |

|

| CO-1159.2 – Compensation Tax for Financial Institutions |

|

| CO-1167 – Insurance Corporations: Calculation of Premiums Payable, Taxable Premiums and Tax on Capital Respecting Marine Insurance |

|

| CO-1175.4 – Life Insurance Corporation: Calculation of the Tax on Capital |

|

| COZ-1179 – Logging Operations Return |

|

| FM-220.3 – Property Tax Refund for Forest Producers |

|

| RD-222 – Deduction Respecting Scientific Research and Experimental Development Expenditures |

|

| RD-1029.7 – Tax Credit for Salaries and Wages |

|

| RD-1029.7.8 – Agreement Between Associated Corporations Regarding the Expenditure Limit (for RD-1029.7) |

|

| RD-1029.7.8 – Agreement Between Associated Corporations Regarding the Expenditure Limit (for RD-1029.8.6) |

|

| RD-1029.8.6 – Tax Credit for University Research or Research Carried out by a Public Research Centre or a Research Consortium |

|

| TP-21.4.39 – Cryptoasset Return |

|

| TP-130.EN – Immediate Expensing Limit Agreement |

|

| TP-997.1 – Information Return for Tax-exempt Entities |

|

| TP-1086.R.23.12 – Cost Incurred for Work on an Immovable |

|

| CO17Deductions – Details of Various Deductions |

|

| CO17NonRefundable – Details of Various Non-refundable Credits |

|

| CO17OnlineWS – CO-17 Online Filing Worksheet |

|

| CO17Refundable – Details of Various Refundable Credits |

|

| CO17SpecialTax – Detail of Special Taxes Payable or Amounts Written Off |

|

| QC1Meal – QC1 Meal |

|

| COR-17.U – Income Tax Return Data |

|

| COR-17.W – Keying Summary |

|

| COR-17.X – Keying Summary |

|

| COR-17.Y – Keying Summary |

|

| COR-17.Z – Keying Summary |

|

| IN417 – Information for Users of Software for Generating Corporation Income Tax Forms |

|

| ALBERTA AT1 FORMS and WorksheetS |

| AT1 – Alberta Corporate Income Tax Return |

|

| AT1Exempt – Alberta Filing Exemption |

|

| AT1RSI – Return Schedule and Information |

|

| AlbertaInstalments – Alberta Instalments Worksheet |

|

| AT1NetFileDeclaration – AT1 Net File Declaration |

|

| AT1NetFileWS – AT1 Net File Worksheet |

|

| AS1 – Alberta Small Business Deduction |

|

| AS2 – Alberta Income Allocation Factor |

|

| AS3 – Alberta Other Tax Deductions and Credits |

|

| AS4 – Alberta Foreign investment Income Tax Credit |

|

| AS8 – Alberta political contributions Tax Credit |

|

| AS9 – Alberta SR&ED Tax Credit |

|

| AS9Project – Listing of SR&ED projects Claimed in Alberta |

|

| AS9Step – AS9 SR&ED Two-step Calculation |

|

| AS9Supplemental – Alberta SR&ED Tax Credit Supplemental |

|

| AS10 – Alberta Loss CarryBack Application |

|

| AS10LossCB – Alberta Loss CarryBack Worksheet |

|

| AS12 – Alberta Income/Loss Reconciliation |

|

| AS13 – Capital Cost Allowance (CCA) |

|

| AS13AssetSummary – Asset Summary |

|

| AS15 – Alberta Resource Related Deductions |

|

| AS16 – Alberta Scientific Research Expenditures |

|

| AS17 – Alberta Reserves |

|

| AS18 – Alberta Dispositions of Capital Property |

|

| AS20 – Alberta Charitable Donations and Gifts Deduction |

|

| AS20WS – Alberta Donations Worksheet |

|

| AS21 – Alberta Calculation of Current Year Loss and Continuity of Losses |

|

| AS21WS – Alberta Loss Continuity Worksheet |

|

| AS29 – Alberta Innovation Employment Grant (IEG) |

|

| AS29Project – AT4970 Listing of Innovation Employment Grant (IEG) Projects Claimed in Alberta |

|

| AS29Step – AS29 Innovation Employment Grant (IEG) Two-step Calculation |

|

| AT1S5 – Alberta Royalty Tax Deduction |

|

| AT1S6 – Alberta Royalty Tax Credit |

|

| AT1S7 – Alberta Royalty Tax Credit/Deduction Supplemental Information |

|

| SUMMARIES |

| T2Summary – T2 Summary |

|

| 5YearComp – 5 Year comparative Summary |

|

| 5YearComp S1 – 5 Year comparative Summary for Schedule 1 |

|

| CO17Summary – CO-17 Return |

|

| CO17SPSummary – CO17-SP Summary |

|

| 5YearComp CO17 – 5 Year Comparative CO-17 |

|

| 5YearComp CO17SP – 5 Year Comparative CO17-SP |

|

| T2 Auto-fill (AFR) – T2 Auto-fill from Represent a Client |

|

| Memos – Memo Summary |

|

| Tapes – Tape Summary |

|

| Workflow – Workflow Summary |

|

| TEMPLATES and CORRESPONDENCE |

| ELetter – Engagement Letter |

|

| CLetter – Client Letter |

|

| CInvoice – Client Invoice |

|

| EngagementEmail – Engagement Cover Email |

|

| ESignatureEmail – E-Signature Cover Email |

|

| ClientCopyEmail – Client Copy Cover Email |

|

| T183Email – T183 Cover Email |

|

| AuthEmailBus – Business Authorization Cover Email |

|

| CO1000Email – CO-1000 Cover Email |

|

| AT4930Email – AT4930 Cover Email |

|

| T2CIFReceipt – CIF Receipt |

|

| T2AuthRepBusReceipt – Client AuthRepBus Receipt |

|

| T2AuthRepBusCancelReceipt – Client AuthRepBusCancel Receipt |

|

| T2AttachADocReceipt – Attach-a-doc Receipt |

|

| CO17Receipt – CO-17 Online Filing Receipt |

|

| AT1Receipt – AT1 Net File Receipt |

|

| MR69Receipt – Client MR-69 Receipt |

|

| T106Receipt – T106 Receipt |

|

| T106FRRMSReceipt – T106 FRRMS Submit e-Doc Receipt |

|

| T1134FRRMSReceipt – T1134 FRRMS Submit e-Doc Receipt |

|

| T1134Receipt – T1134 Receipt |

|

| T1135Receipt – T1135 Receipt |

|

| T1135FRRMSReceipt – T1135 FRRMS Submit e-Doc Receipt |

|

| AGRIReceipt – AGRI Receipt |

|

| ALabel – Avery Mailing Label (2 3/8 x 1) |

|

| Notes – File Notes |

|

| Electronic SIGNATURES (TaxFolder and DocuSign®) |

| AuthRepBus signature page |

|

| AuthRepBusCancel signature page |

|

| MR-69 – Authorization to Communicate Information or Power of Attorney |

|

| AT4930 – Alberta Consent Form |

|

| T183CORP – Information Return for Corporations Filing Electronically |

|

| CO-1000.TE – Online Filing of the Corporation Income Tax Return by an Accredited Person (Québec) |

|

| AT1 – Alberta Corporate Income Tax Return |

|

| T106 – Information Return of Non-Arm's Length Transactions with Non-residents |

|

| T1134 – Information Return Relating to Controlled and Not-Controlled Foreign Affiliates |

|

| T1135 – Foreign Income Verification Statement |

|

| T2054 – Election for a Capital Dividend under subsection 83(2) |

|

| CO-1029.836.DA – Tax Credit for the Development of E-Business |

|

| ELetter – Engagement Letter |

|