TaxCycle 13.1.52339.0—T1 EFILE, T3 and T5013 Certification

The Canada Revenue Agency (CRA) and Revenu Québec have certified TaxCycle T1/TP1, T3 and T5013/TP-600 for filing 2023 returns when EFILE systems open on Monday, February 19, 2024.

To install this version immediately, download the full installer from our website or request a free trial. Once we enable the automatic updates for this version, TaxCycle will prompt you to install it according to the priority set in your TaxCycle Options. (To deploy auto-update files from your network, see the Auto-Update Files page.)

Release Highlights

T1 2023 Ready for EFILE

The Canada Revenue Agency (CRA) has certified TaxCycle T1 2023 for electronic filing when the systems reopen on February 19, 2024. As of that date, you can use TaxCycle T1 to access the following electronic services:

The following forms still show the Preview watermark:

- T2203, Provincial and Territorial Taxes for Multiple Jurisdictions and provincial 428MJ forms.

- TP-22, Income Tax Payable by an Individual Who Carries on a Business in Canada, Outside Québec

- TP-25, Income Tax Payable by an Individual Resident in Canada, Outside Québec, Who Carries on a Business in Québec

All other T1/TP1 forms are final.

TP1 2023 Ready for NetFile

Revenu Québec has certified TaxCycle TP1 2023. You can use TaxCycle TP1 to access the following electronic services:

Other T1 Updates

- Added a new question to the Info worksheet about bare trust filing to track whether a client is required to file a T3. This triggers a paragraph in the client letter and can also be searched in the Client Manager.

New Returns to EFILE in 2023

The CRA intends to allow the following returns to be transmitted through EFILE for 2023. However, they are not yet available to transmit as the CRA is completing the implementation in their systems.

- Non-residents of Canada filing a return under Section 116

- Deemed residents of Canada filing a return under section 250

- Emigrants (those who have departed Canada in the tax year)

Climate Action Incentive

We have updated the Climate Action Incentive estimated benefits calculation to use the amounts announced by the Department of Finance on February 14, 2024, and to adjust the rural supplement to 20% as per Bill C-59, which was introduced on November 20, 2023, but is still awaiting a second reading in the House of Commons.

For residents of New Brunswick who indicate that they were residents outside of the Moncton or Saint John census metropolitan areas on April 1, 2023, the CRA will add the supplement for 2023-24 to the first payment of the incentive for the 2024-25 payment year, which will be issued once the CRA processes their 2023 returns.

Part of the announcement included the rebranding of the incentive to the Canada Carbon Rebate (CCR). We will update the name on the worksheet as well as on any summaries or in any letters, as applicable, in a future TaxCycle release.

T1 Planner

We have updated the T1 Planner worksheet for 2024 to use the tax rates and amounts to those announced by the CRA, or that we have estimated. This includes an update of the Minimum Tax section to reflect the changes announced in the 2023 budget, as well as in draft legislation released by the Department of Finance in August 2023 and by the Ministère des Finances du Québec in an information bulletin in December 2023.

T2 Schedule 63

We have updated the T2 Schedule 63, Return of Fuel Charge Proceeds to Farmers Tax Credit to add the new 2023 payment rates, as well as four new designated provinces in which these rates will apply.

To learn more, refer to this page on the CRA website: Tax Credit Payment Rates to Return Fuel Charge Proceeds to Farmers for 2023-24.

T3 and TP-646 for 2023

TaxCycle T3 is ready for electronic filing of T3 and TP-646 returns for 2023 with the Canada Revenue Agency (CRA) and Revenu Québec. Québec TP-646 returns may only be filed on paper. RL-16 slips can be filed online.

This version of TaxCycle T3 also includes the following changes:

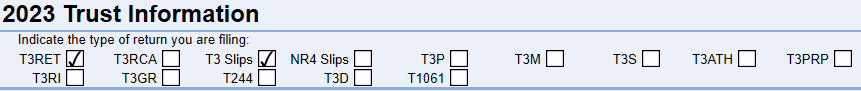

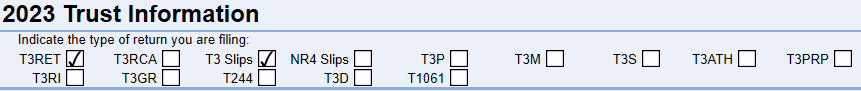

- New! You can now EFILE all the following T3 return types. Previously, some of these returns were not eligible for EFILE or were filed via Internet File Transfer (XML).

- T3D

- T3P

- T3RI

- T3GR

- T1061

- T3PRP

- T2000

- T3ATH-IND

- T3RET

- T3S

- T3M

- Section 216 Returns

- It is important to select the return type(s) you are filing at the top of the T3 Info worksheet, since TaxCycle activates specific warnings and review messages for fields applicable to those return types.

- The T3 EFILE worksheet now contains an updated exclusions list applicable for the 2023 tax year. TaxCycle will also record events and filing results at the bottom of the worksheet.

Forms Added

- T3D, Income Tax Return for Deferred Profit Sharing Plan (DPSP) or Revoked DPSP

- T3 Schedule 15, Beneficial Ownership Information of a Trust. We added this form in version 12.2.51186.0 for early data entry and planning, but you can now file the T3 Schedule 15 when EFILE opens on February 19. If you have multiple beneficial owners to report, you can import the data using Excel.

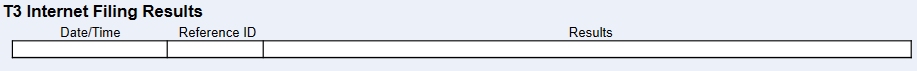

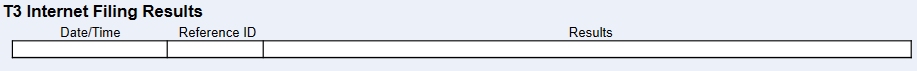

T3 Bare Trusts

- When selecting Bare Trust as the trust type on the T3 Info worksheet, TaxCycle will automatically remove caution messages that apply to other electronically filed return types.

- TaxCycle also displays a Quick Fix solution that will input commonly used default answers to the questions on the Info worksheet if you click the blue link to Answer Yes.

- If you ignore or sign off the message, you will still be required to answer questions 4, 13 and 14 on the T3 Info worksheet, as they are required to complete the T3 Schedule 15. TaxCycle will also suggest that you fill out lines 3 and 8 to provide the requested information.

We recommend that you carefully review any applicable questions on the T3 jacket for accuracy before electronically filing your return.

To learn more about filing a T3 bare trust return, refer to the instructions in the CRA’s T4013 T3 Guide and the Q&A about the new trust reporting requirements for T3 returns on the CRA’s website.

T5013 and TP-600 for 2023

TaxCycle T5013 is ready for electronic filing of T5013 and TP-600 returns for 2023 with the Canada Revenue Agency (CRA) and Revenu Québec.

This version of TaxCycle T5103 also includes the following changes:

- Updated all forms and slips to the latest version available from the CRA.

- Added electronic signature support for the T1135.

- New! TaxCycle T5013 now supports the T1134, which includes EFILE. See the T1134 EFILE help topic.

- New! You can now create a T3 return from a T5013 partnership return.

- Customer Request Added a field to designate the Country of residence for each partner on the T5013 slip if the country of residence is different from the mailing address.

- Customer Request Added a new review message related to the residency of the partnership for immediate expensing purposes.

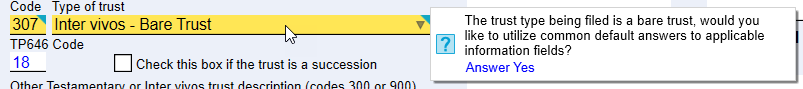

T5013 Schedule 8

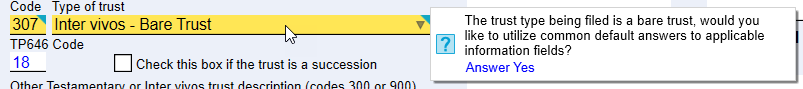

This version of TaxCycle adds Part 2 to the T5013 Schedule 8. Complete Part 2 to provide information on income earned from the source in which the designated immediate expensing property (DIEP) is used.

- Question 150 calculates from the same question answered on the Info worksheet.

- TaxCycle automatically checks the Yes box on Question 155 when there are at least two sources of income entered in the return (business, property income or a combination of both).

- To enter additional sources of income, add a new row to the table. Adding an amount in columns 165 and 170 will reduce the amounts from the first row to ensure that the totals in columns 165 and 170 agree to the totals in Schedule 1 net income before CCA and Schedule 8 Part 3 column, respectively.

- If you wish to complete Part 2 manually, answer No to the question Automatically calculate this table? and enter your data manually.

Template Changes

- Customer Request T1—Added information about T3 bare trusts to the pre-season (2023) and post-season (2022 and 2023) letters.

- T1—Added a paragraph about T3 bare trusts to the 2023 client and joint client letters (CLetter and JLetter). This paragraph is triggered when you answer the question about bare trusts on the Info worksheet.

- Customer Request T1—Added foreign slips to the list of documents in the pre-season and post-season letter.

- Customer Reported T1—Improved the client letter (CLetter, JLetter, DLetter) template so it still works when EFILE systems are closed. The letter now includes the EFILE open date if systems are closed, and the templates will show as eligible for EFILE instead of switching to paper filing when the system is not open yet.

- Customer Reported T5013—Updated the wording in the client letter to acknowledge that not all partners are individuals.

Resolved Issues

- T1—Added support in the Client Manager to allow for searching fields.

- T1—Corrected the French descriptions for the Family and Joint summaries.

- Customer Reported T5013—Resolved an issue where TaxCycle did not correctly allocate box 149 among corporate partners when using Option 3 to allocate based on the manually entered partner percentage.

- Customer Reported T5013—Fixed the legislated filing due date for returns where all partners in the partnership are corporations and the partnership has a non-calendar year end.

- Customer Reported T5013—Resolved an issue where TaxCycle blocked slips filing when there were excluded slips with no reportable amounts on the related slip.

- Customer Reported Resolved an issue where TaxCycle did not properly update the Favourites bar where favourites included a custom template not yet updated to include the current year.