You Helped Make TaxCycle More Beautiful in 2021-22

This is the time of year when we like to look back at what the previous tax season brought to TaxCycle. From legislative changes and new services from the Canada Revenue Agency (CRA), to great ideas from our customers. Whether it’s your suggestions in webinars, on the support lines or in posts on ProTax Community, we couldn’t do it without you.

In case you didn’t read each set of release notes in detail, here’s the list of what you helped create in TaxCycle this year. (Can you spot your idea?)

Significant CRA and Provincial Initiatives

Many CRA changes require additional research and design to implement them well in TaxCycle, and make them available quickly as well as easy-to-use. Worth noting this year are the following:

TaxCycle T1

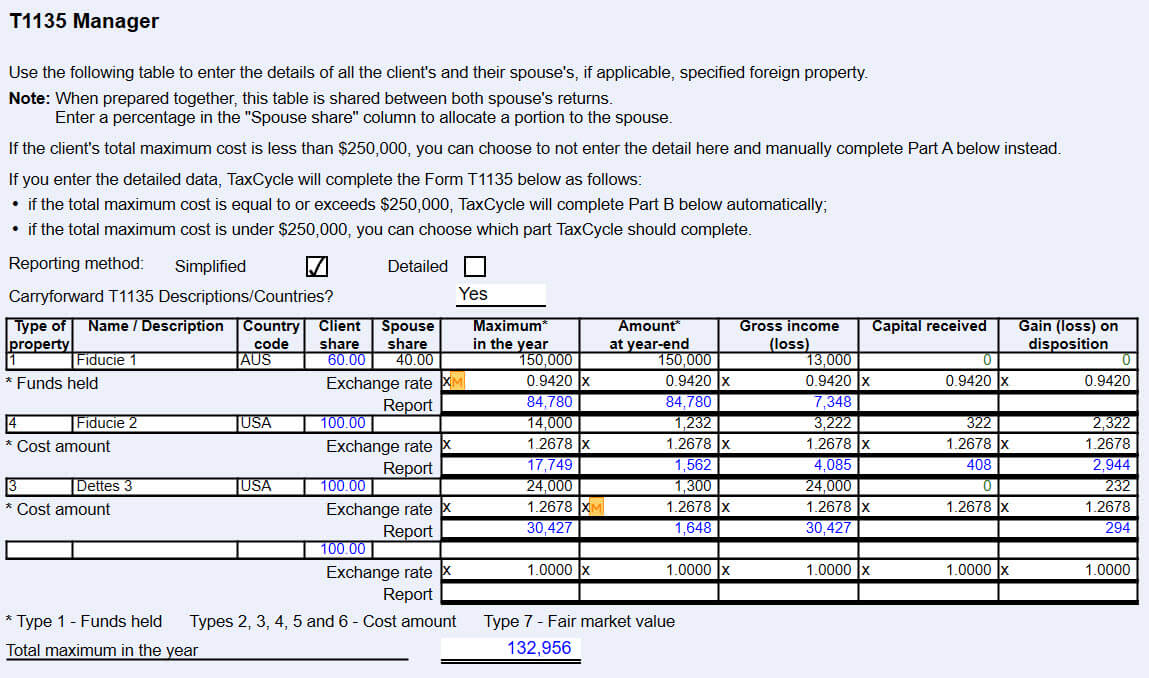

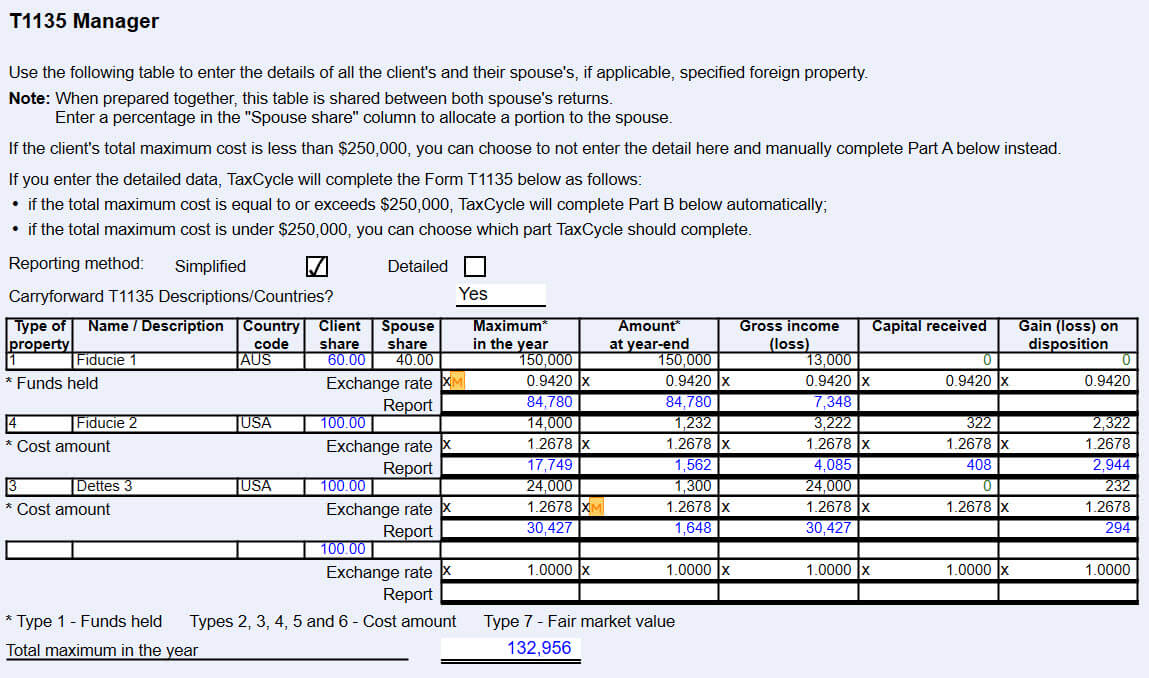

- A new T1135 Manager at the top of the T1135 form that allows for splitting and sharing of foreign investments between spouses, while retaining the applied foreign exchange rates.

- A message to highlight when AFR data on capital losses claimed in prior years does not match the data entered in the table at the top of the T657, with a Quick Fix solution to copy the AFR data.

- The supplemental information form for Saskatchewan participants in the AgriStability program which must be submitted directly to SCIC.

- Carryforward of the legal representative email address and phone number.

TaxCycle T2

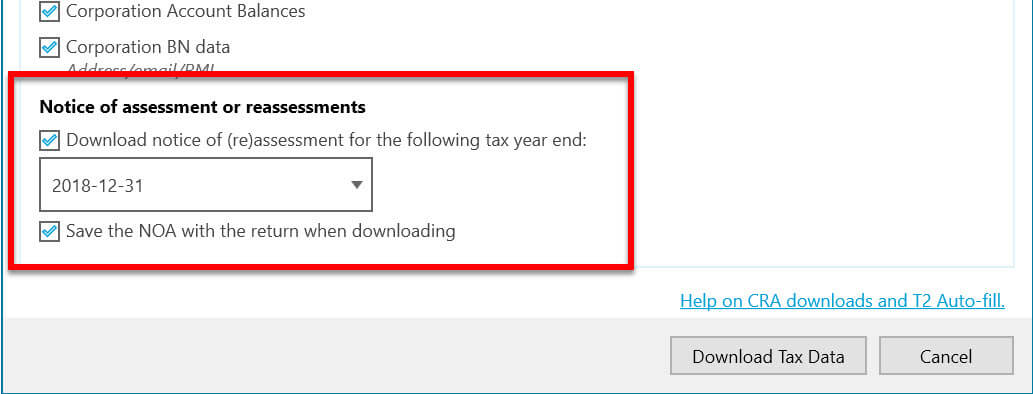

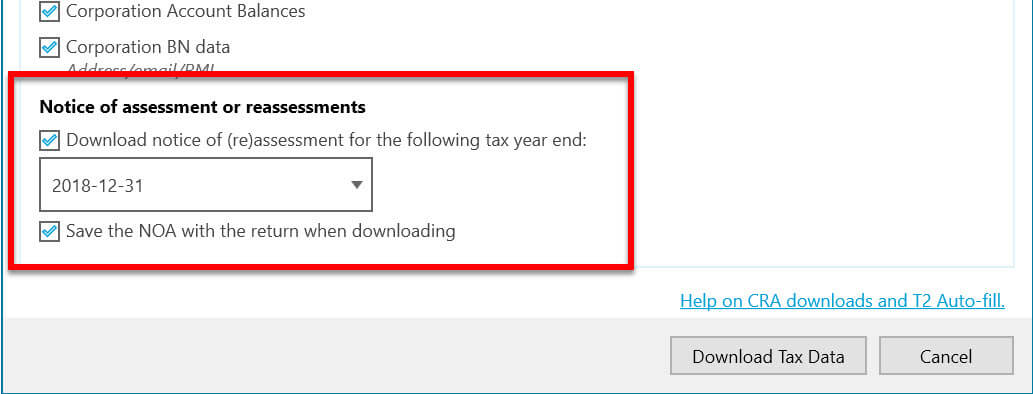

- Download of T2 notices of (re)assessment (NOA) in T2 Auto-fill. When selecting tax data to download, choose the tax year end for the NOA you need. You may only download one year at a time.

- S1FinancingWS worksheet to calculate the deduction under Income Tax Act (ITA) 20(1)(e). The deduction amount then flows to Schedule 1, line 395.

- S8AssetSummary, AS13AssetSummary and QC8AssetSummary to show a list of the assets entered in the T2, AT1 and CO-17 returns, respectively.

- Unspecified class for Timber limits and cutting rights to the class drop-down on Schedule 8 and the S8Asset.

- Fields to allow you to exclude T2 T106Slip from filing or include it in carry forward.

- Three new questions for the election under ITA 89(11), in the Filing section of the T2 Info worksheet, to help you keep track of elections made in a previous year or revoked in the current tax year or in a previous tax year.

- Carry forward of T2 Schedules 19, 29 and 30 carry forward from Taxprep® to TaxCycle.

- Prior year column fields in the Other deductions and Other additions sections on T2SCH1 Net Income (Loss) for Income Tax Purposes.

- Québec forms CO-156.TZ, COZ-1179 and COZ1179Subcontractor.

- Support for selecting CCPC as the type of corporation for line 040 in the T2 jacket for credit unions or cooperative corporations. (On the Info worksheet, select 1. Canadian controlled private corporation, CCPC for the corporation type at the end of the tax year. Also select 5. Credit union as the special corporation status.)

- Background colours to help identify corporate linking the data source on the CGI worksheet. Light green for fields where data comes from the “source” file and light blue when it comes from the “target” file.

- More detail from S511 shared on the CGI worksheet and included in Corporate Linking. See Corporate Group Information—Schedule ON511 on the ProTax Community.

TaxCycle T3

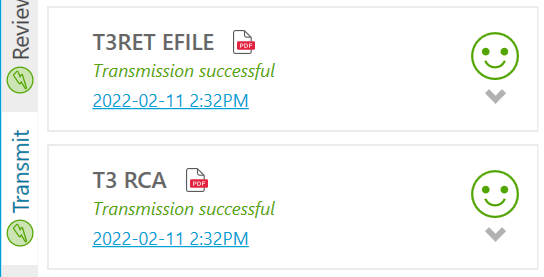

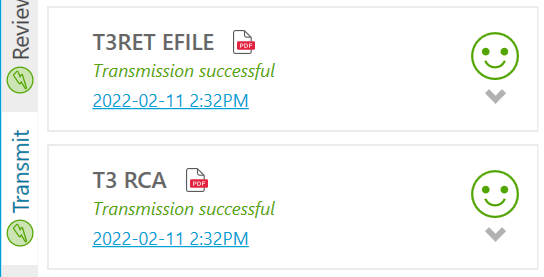

- EFILE for T3 Trust Income Tax and Information Return (T3RET) and T3 Retirement Compensation Arrangement (RCA) Part XI.3 Tax Return (T3RCA)

- TaxConstants worksheet that allows you to adjust trust return rates and limits as soon as legislation changes, or for planning purposes.

- T3PreferredBen worksheet for each designated preferred beneficiary that must complete beneficiary information related to the Preferred Beneficiary Election, per ITA 104(14) and ITA 108(1).

- Date of birth field on T3 beneficiary forms for easier reference when determining when a beneficiary will receive trust amounts.

TaxCycle T5013

- Automated calculation of TP-600 Schedule D (TP-600.D-V) paid-up capital of member corporations partner share, reported on the RL-15 at lines 24a, 24b and 24c.

- A field in the at-risk calculation section of the T5013Partner worksheet for an ACB adjustment to the at-risk amount under ITA section 96(2.3). This includes carrying forward these amounts from ProFile® and Taxprep®.

- Automated footnote for the T5013 and RL-15, where ITA 40(3.1) applies to a limited partner with a negative Adjusted Cost Basis (ACB) reported as a deemed capital gain.

- Partner ID field on the T5013Partner worksheet (and RL-15) and adding the Partner ID to the slip name in the Prepare sidebar and the slip drop-down menu.

- Option on the Allocation worksheet to copy federal amounts to the RL-15 when using manual allocation of amounts for the T5013.

- Fields for lines 300 through 350 and beginning/ending adjusted cost base (ACB) to show the totals for the partnership for all partners in the relevant sections on T5013Partner and RL15Partner slips.

- Automatic transfer of amounts entered on the T5013Partner slip to the At-risk section of the RL15Partner slip.

- Expanded Capital Account section on the T5013Partner that includes partner drawings from the Schedule 1 amounts for salaries and wages, cost of products consumed by the partner and personal expenses paid by the partnership.

- Capital Account section to the RL15Partner, with amounts shared from the federal capital account.

- Making line 410 on the T5013Partner and line P on the RL-15Partner into calculated fields when using the manual allocation method.

- Summaries for T5013 Schedule 50 and ACB, and TP-600 Schedule A and ACB, named S50Summary and TPASummary, respectively.

- Boxes 26 (at-risk amount) and 43 (return of capital) on the RL-15 slips summary.

- Review message for partner identification numbers that only contains zeros.

- Section to calculate ACB on withdrawal and related deemed capital gains (losses) of a partner for the following: dissolution of the partnership, retired partner (income interest), retirement of a partner (residual interest).

- Larger columns on Schedule 6 to accommodate dollar amounts that are over seven digits.

TaxCycle Forms

- Improvements to the Contact and Authorization section on the Info worksheet to support electronic signatures.

- Email address fields for individuals on the Info worksheet.

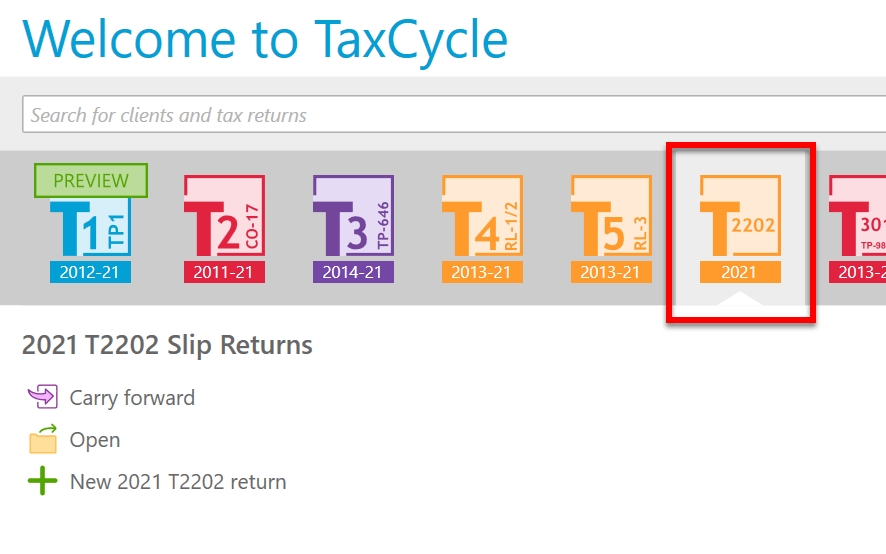

TaxCycle T2202

This year, we introduced the TaxCycle T2202 module and included it in any license of the Complete Paperless Tax Suite. This module allows you to prepare and file the federal T2202 Tuition and Enrolment Certificate for 2021.

TaxCycle T4, T5, NR4, T5018 and T3010

- Support for requesting TaxFolder and DocuSign® e-signatures on the T4, T5, NR4 and T5018 slip summaries.

- Import of current-year XML files into T5018.

- A new question to the top of the T3010 jacket to help you determine whether to complete Section D or Schedule 6 of the T3010. It shares fields with the same question on the Info worksheet, so you can answer it in either place.

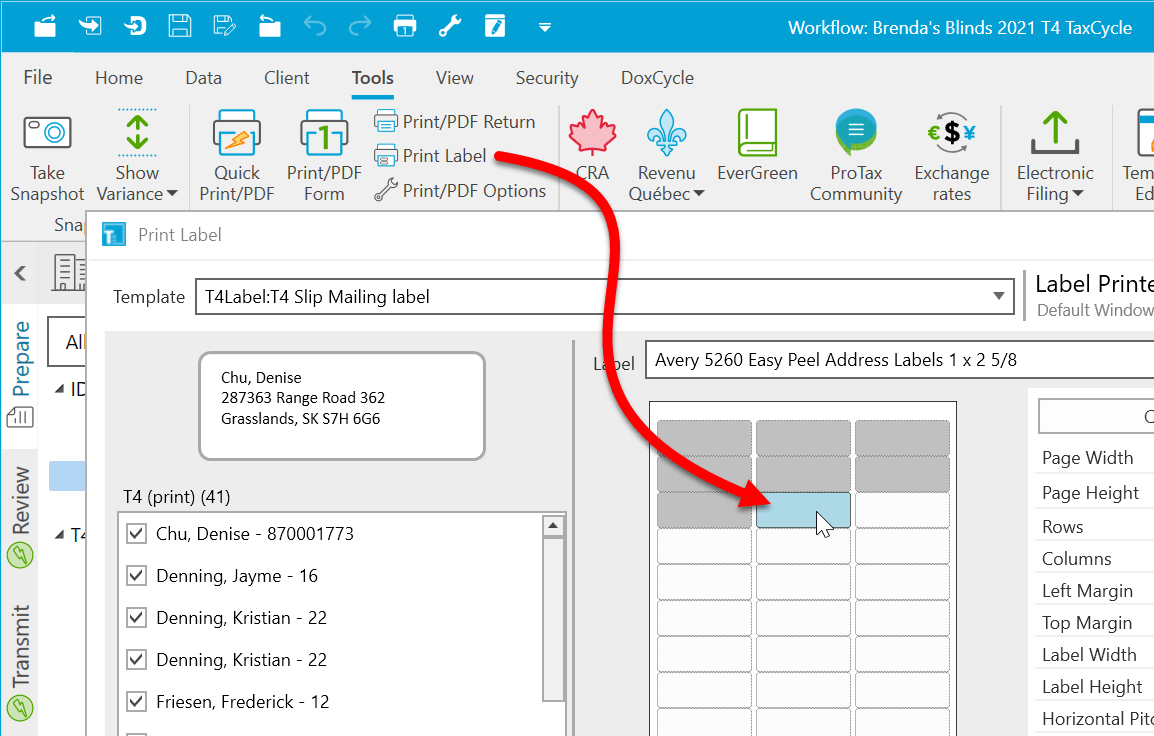

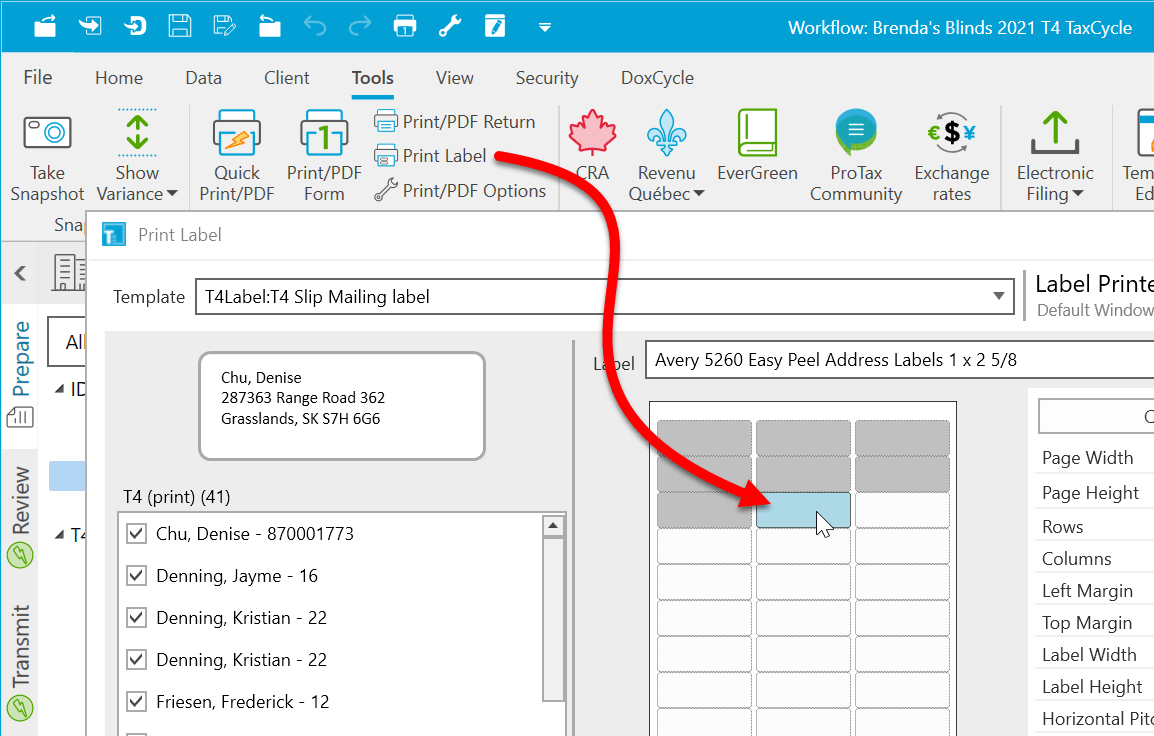

Label Printing for Slips

In response to a recent request on ProTaxCommunity, we added label printing for individual slips to TaxCycle. If you wish to send multiple slips in a larger envelope, you can quickly print labels for all recipients in a slips return. To learn how to get started, read the Print Labels for Slip Recipients help topic.

Workflow

- Standardized workflow task and status wording and date formats across all modules and years.

- Included the field for Return Purpose on the Engagement worksheet in all modules.

- Added a Not Filing state to the Return Purpose field that automatically completes the related Not Filing task in the workflow and displays the return in dark grey in the Client Manager.

- Added workflow tasks for RL-24 slips to TaxCycle RL.

- Added new workflow items for importing GIFI from Sage or from Xero.

- Updated the T1 workflow to allow you to set individual taxpayers within the same T1 file as Not Filing. The Not Filing state now appears in a separate check box on the Engagement worksheet.

Client Manager

- Added the Client Manager Quick Search name under the search box, when it applies to the search results.

- Added a new tool to help you choose applicable form names and print sets when batch printing.

- Added a column for “client since” to the Client Contact layout and search options.

- Improved performance when searching and displaying workflow information in the Client Manager.

- Added an option to filter by legislated filing deadline in the Client Manager.

- Updated the Client Manager client details preview to show a check mark (✔) for completed workflow items and an X to those pending completion.

- Improvements the indexing and logging into the Client Manager process. These changes should improve the speed of indexing a large volume of files.

Templates

- T1 client letter templates (CLetter, JLetter and DLetter)

- Simplified the medical expenses paragraph to remind taxpayers to retain receipts in case the CRA requests them. See the related thread on ProTaxCommunity.com for details.

- Improved the wording in the donations carryforward paragraph and added an extra condition to hide the Québec donations sentence when not applicable.

- Added quarterly breakdown of payments for the Climate Action Incentive (CAI), as requested in this topic in protaxcommunity.com.

- Added mention that clients must sign form T1032 before filing.

- Changed the wording to “sale or disposition” of a principal residence.

- Added title to the Tuition transfer section.

- Updated the field code used to display tuition transfers from a supporting person so that the paragraph also shows for tuition transfers between spouses.

- Added a paragraph to remind residents of Ontario to save receipts from travel expenses in Ontario during 2022.

- Added a condition to hide the RRSP contribution paragraph for taxpayers who are over 71.

- Removed the reference to sign form TX19 when paper-filing a return from the client letters (CLetter and JLetter).

- Enhanced the HTML and CSS code to keep headings with the following paragraph. This makes the headings compatible with the Keep with next paragraph property in the template editor and helps prevent page breaks appearing after a heading and before the related paragraph.

- T1 pre-season and post-season letters (PreSeason, JPreSeason, FPreSeason, PostSeason, JPostSeason and FPostSeason).

- Improved and expanded the content. See the related discussion on ProTaxCommunity.com.

- Added an item to the checklist in the 2021 post-season letters to provide receipts for travel expenses in Ontario during 2022 (in the 2021 PostSeasonDocs snippet).

- Added email subject lines.

- Updated the field codes to use the legislated filing deadline from the Engagement worksheet in pre-season letters.

- T1 joint and family client invoices (JInvoice and FInvoice)—Adjusted the layout to allow more rows to fit on page one.

- T2—Adjusted the margins and layout of signature fields on the Engagement Letter (ELetter) to help it print on one page rather than two. (Please keep in mind, this depends on the height of the letterhead and logo for the letter.)

- T2 and CO-17—Added the transmission number and the confirmation number to the transmission receipts.

- T1, T2 and T3—Updated the Interest and Penalties paragraph in the client letters (CLetter and JLetter) and deceased client letter (DLetter) to specify the individual amounts related to penalties, interest and other penalties.

- T3 client letter (CLetter)

- Removed mention of attaching a cheque to the return when filing and added a mention of making a payment to the CRA online or mailing a cheque to the CRA.

- Added sections to support T1135 EFILE.

- T3—Added a Remittance template to provide details of a payment to the CRA made by cheque.

- T3 and T5013—Added address snippets to and used those snippets to create an address label, and in the client and engagement letters.

- T2, T3, T5013 and Forms—Added the AdobeSignatureEmail cover letter email template to TaxCycle T2 (back to 2017), TaxCycle T3 (back to 2017), TaxCycle T5013 (back to 2019) and TaxCycle Forms (2021).

- T5018—Fixed the display of the business name in the missing slips template (MLetter) in 2021.

- Template Editor—Added a “text” formatting function

{{format (CurrentClient.Info.Residency.ProvinceDec31Field,"text")}} to display the province of residence with the space in the name when required. For example, this changes NewBrunswick to New Brunswick.

- Template Editor—Added new

{{ upper(...) }} and {{ lower(...) }} functions to transform text to uppercase or lowercase when pulled from a field in TaxCycle. For example, {{upper(CurrentClient.Info.ID.FirstName)}} prints the client’s first name in uppercase in the template regardless of how it shows in the field on the form.

Options

- Added a new check box on the print configuration dialog box to include review marks when printing a form.

- Added a new Start Screen option to control the maximum number of files displayed in the recent files list. Lowering this maximum reduces the number of files TaxCycle scans through on start-up, improving start-up time and responsiveness. If you use a virtual drive, like Google Drive or OneDrive, this reduces the number of files TaxCycle must download and read to display status details in the recent files list.

TaxFolder

The following list includes enhancements in TaxCycle to support its integration with TaxFolder.

- A new check box on the Printer and PDF Output Options dialog box allows you to invite a new client to TaxFolder.

- New items on the Client menu allow quick access to TaxFolder and sidebar functions.

- Including the subject line and body of the TaxCycle cover letter email template when selecting the Share Documents check box on the printer/output options.

- A new TaxFolder page in options allows you to show or hide check boxes on Printer and PDF Output Options. These new options work with the Notification Settings in TaxFolder. To disable invitation emails for all new clients, regardless of what you set in options or when printing, change the setting in TaxFolder.

Of course, there were MANY more enhancements made to TaxFolder itself. Read the Enhancements From TaxFolder's Second Year article to find out what changed there.

Xero® Integration

TaxCycle integration with Xero® accounting software for importing GIFI data from your clients’ Xero® accounts and exporting invoices from TaxCycle to Xero®. Your feedback after the initial release has helped both integrations evolve.

Interface Changes

- Added views to the Review sidebar to allow you to show only fields with a First review check mark or Second review check mark. (This is in addition to the First or second review view that was already there.)

- Improved colour contrast and visibility of icons.

DoxCycle

- Allowed importing and extraction of zip files by drag-and-drop or the Import button. DoxCycle extracts the documents from the zip file and adds them to the DoxCycle PDF.

What about other years?

Curious about enhancements in prior years. Check out these news articles: