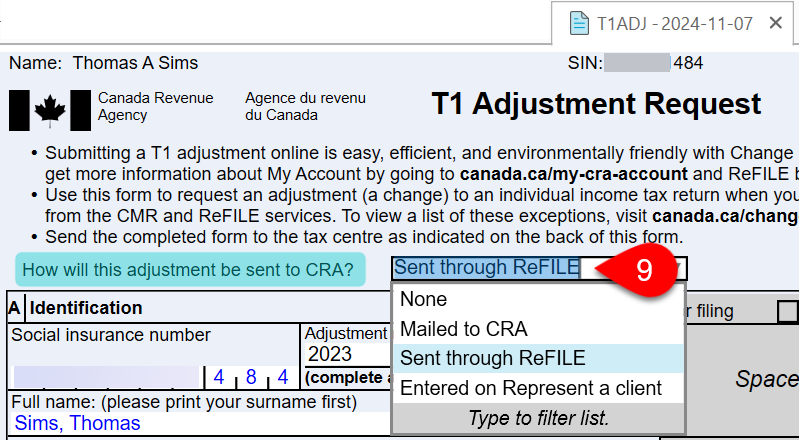

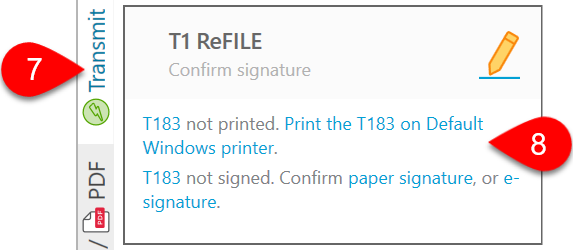

The original return must have been

electronically transmitted to the Canada Revenue Agency (CRA) using

T1 EFILE. If the original return was paper-filed, you

cannot use ReFILE and must send the T1-ADJ to the CRA by mail.

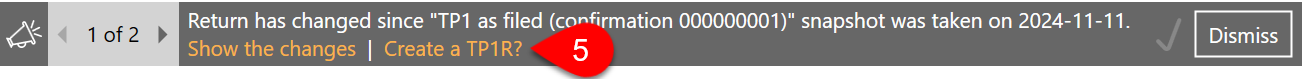

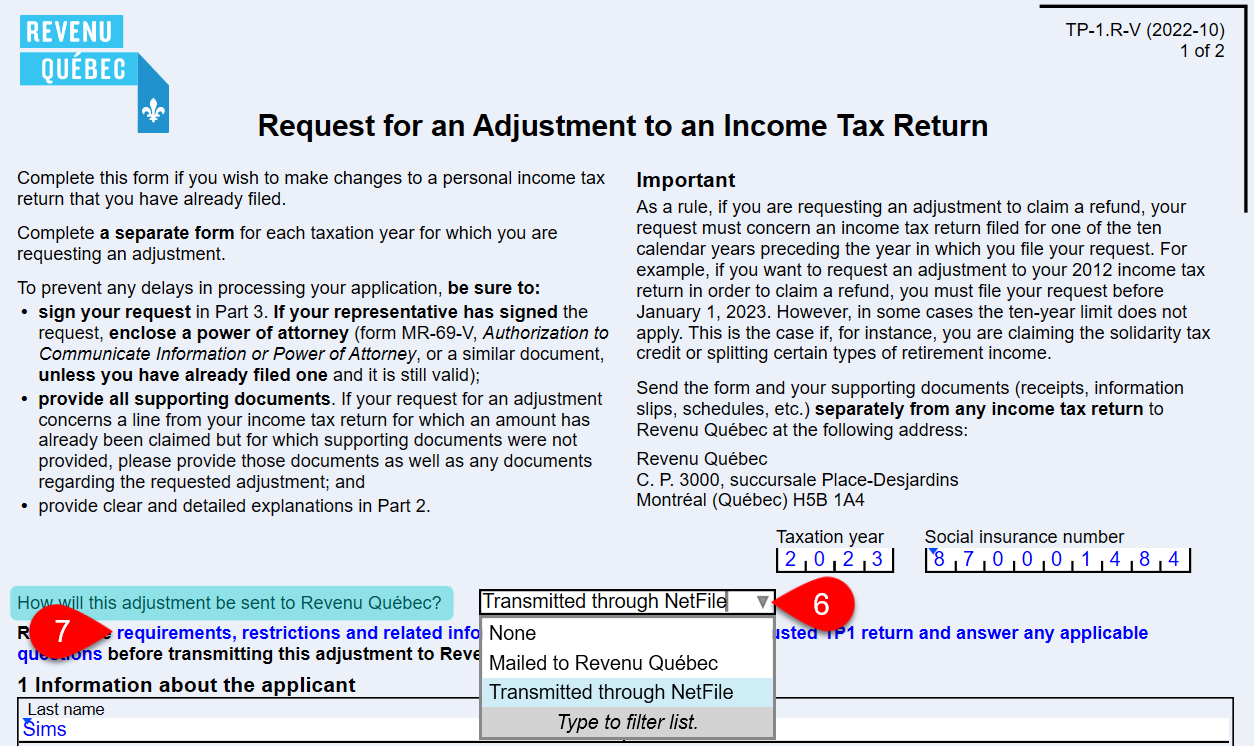

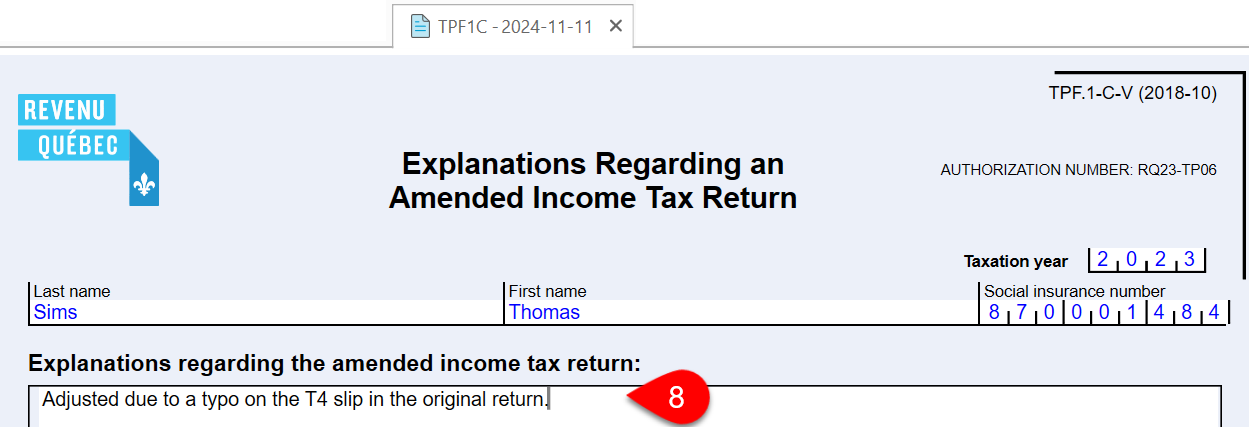

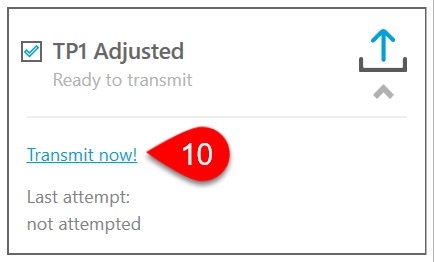

Both the CRA and Revenu Québec require the submission of the

complete adjusted return when transmitting an adjusted return, as they compare it with the original return to identify the differences resulting from the adjustment. Read the

ReFILE and T1-ADJ and

TP1 NetFile for Adjusted Returns help topics to learn more.

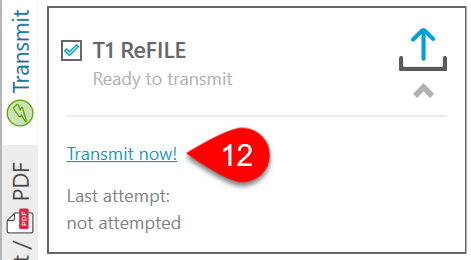

To create and ReFILE a T1-ADJ for a return filed by another preparer or the taxpayer themselves:

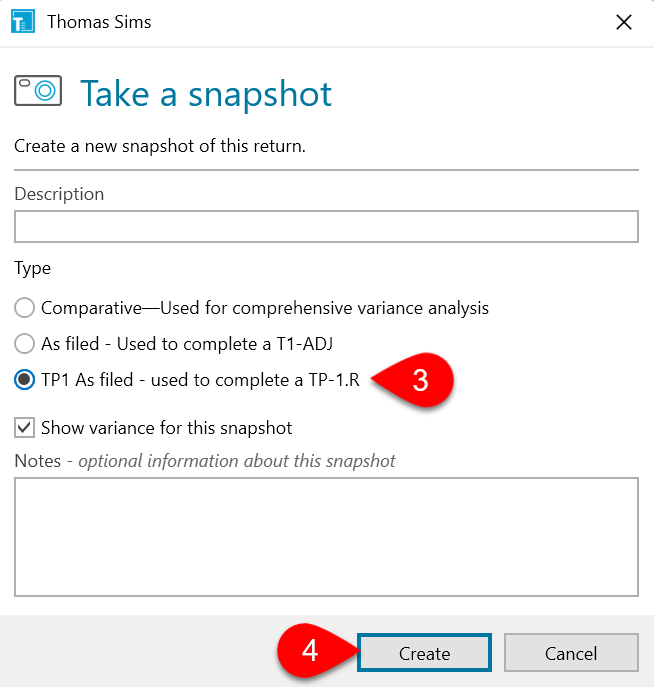

To file an adjusted TP1 through NetFile for a return filed by another preparer or the taxpayer themselves: