Updated: 2026-02-18

Bill C-15 (“An Act to implement certain provisions of the budget tabled in Parliament on November 4, 2025”) introduced a new measure called Reaccelerated Investment Incentive Property (RIIP).

The RIIP measure reinstates the Accelerated Investment Incentive Property (AIIP) rule originally introduced in 2018 and which was set to expire after 2027. In essence, in the year of acquisition, the RIIP measure provides enhanced capital cost allowance (CCA) for qualifying properties acquired on or after January 1, 2025.

Under the RIIP rule, the mechanics of the enhanced CCA calculation are very similar to those under AIIP. When a RIIP is acquired and added to a CCA class, the undepreciated capital cost (UCC) is adjusted by the product of acquisition amount multiplied by relevant factors. You can download the listing of relevant factors here. This list is also available within TaxCycle on the S8Note in TaxCycle T2 and T5013, and the RIIPNote in T1 and T3.

At the time of writing this topic, Bill C-15 has not received Royal Assent. However, the Canada Revenue Agency (CRA) has indicated that its systems are scheduled for an update in May 2026 to process RIIP in Schedule 8.

In the meantime, we have outlined instructions below for manually modifying Schedule 8 to apply RIIP measures to your TaxCycle client files. Please note, however, that the CRA is not yet equipped to process or assess T2 returns containing RIIP calculations. We are sharing these instructions should you wish to apply RIIP measures to your clients’ files in advance.

We will update this page once we receive more information from the CRA. Stay tuned to the TaxCycle news feed for the latest developments

See the examples below to learn how to apply RIIP in TaxCycle T2. While the examples provided are for T2 returns, they can easily be adapted for T1, T3 or T5013.

General Rule

Property eligible for reaccelerated CCA is called “Reaccelerated Investment Incentive Property” (RIIP). RIIP is a depreciable property acquired by the taxpayer after 2024 and becomes available for use before 2034. As with AIIP, the half-year rule is suspended for RIIP and, in general, CCA for RIIP is equal to three times the normal first-year CCA (when CCA was subject to the half-year rule).

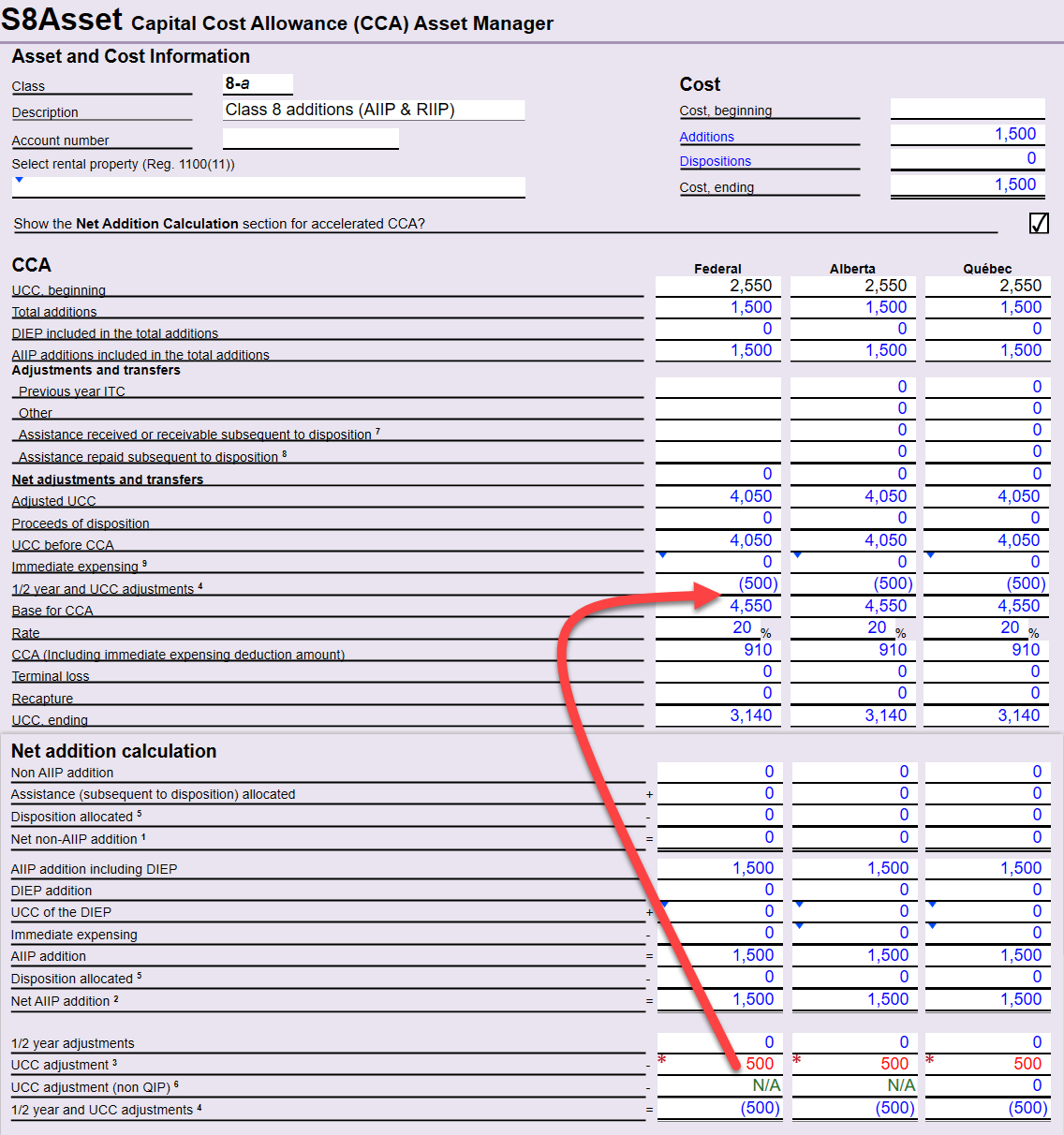

Example: General Rule

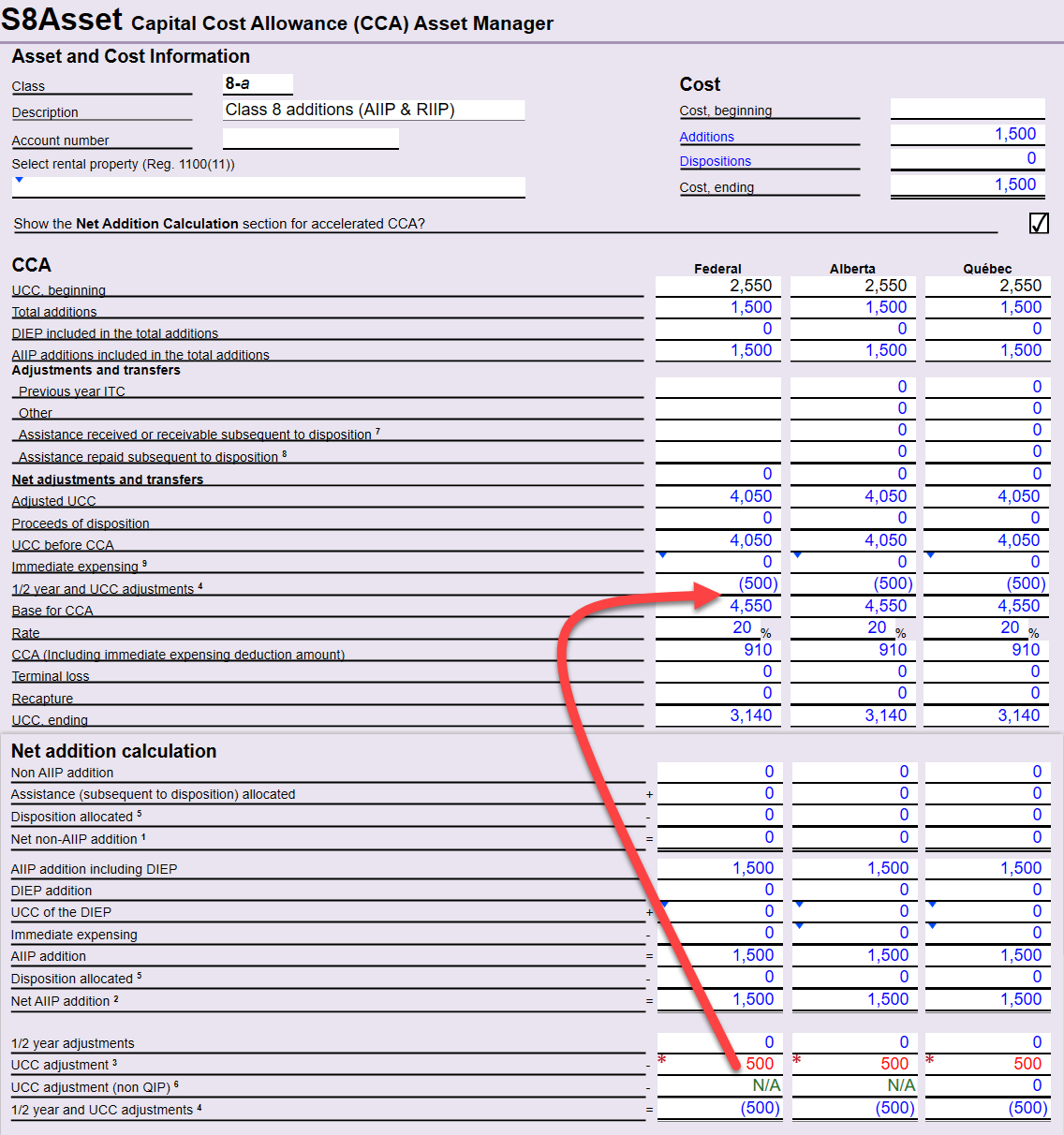

Applicable to all classes except classes 12, 13, 14, 15, 43.1, 43.2, 53, 54, 55, 56, 59 or in class 43 (14.1 for Québec).

Tax year: July 1, 2024, to June 30, 2025

Class 8 addition on December 31, 2024 (AIIP): $500

Class 8 AIIP multiplier for 2024: 0 (Please refer to S8Note)

Class 8 addition on January 1, 2025 (RIIP): $1,000

Class 8 RIIP multiplier for 2025: 0.5 (Please refer to S8Note)

Opening UCC: $2,550 |

| Normal CCA |

Reaccelerated CCA |

| Opening UCC |

$2,550 |

$2,550 |

| AIIP addition |

$500 |

$500 |

| RIIP addition |

$1,000 |

$1,000 |

| Adjusted UCC |

$4,050 |

$4,050 |

| Half-year adjustment |

$750 |

- |

| UCC adjustment |

n/a |

($500)1 |

| UCC base for CCA |

$3,300 |

$4,550 |

| CCA rate |

20% |

20% |

| CCA |

$660 |

$910 |

| Ending UCC |

$3,390 |

$3,140 |

Note:

1 UCC adjustment (shown as a negative amount but added to adjusted UCC)

Class 8 AIIP addition: $500 × multiplier 0 = $0

Class 8 RIIP addition: $1,000 × multiplier 0.5 = $500

Total UCC adjustment: $0 + $500 = $500 |

In the S8AssetManager, override the UCC adjustment in the Net addition calculation section as shown below and the UCC adjustment will be used to calculate a revised amount of “Base for CCA.”

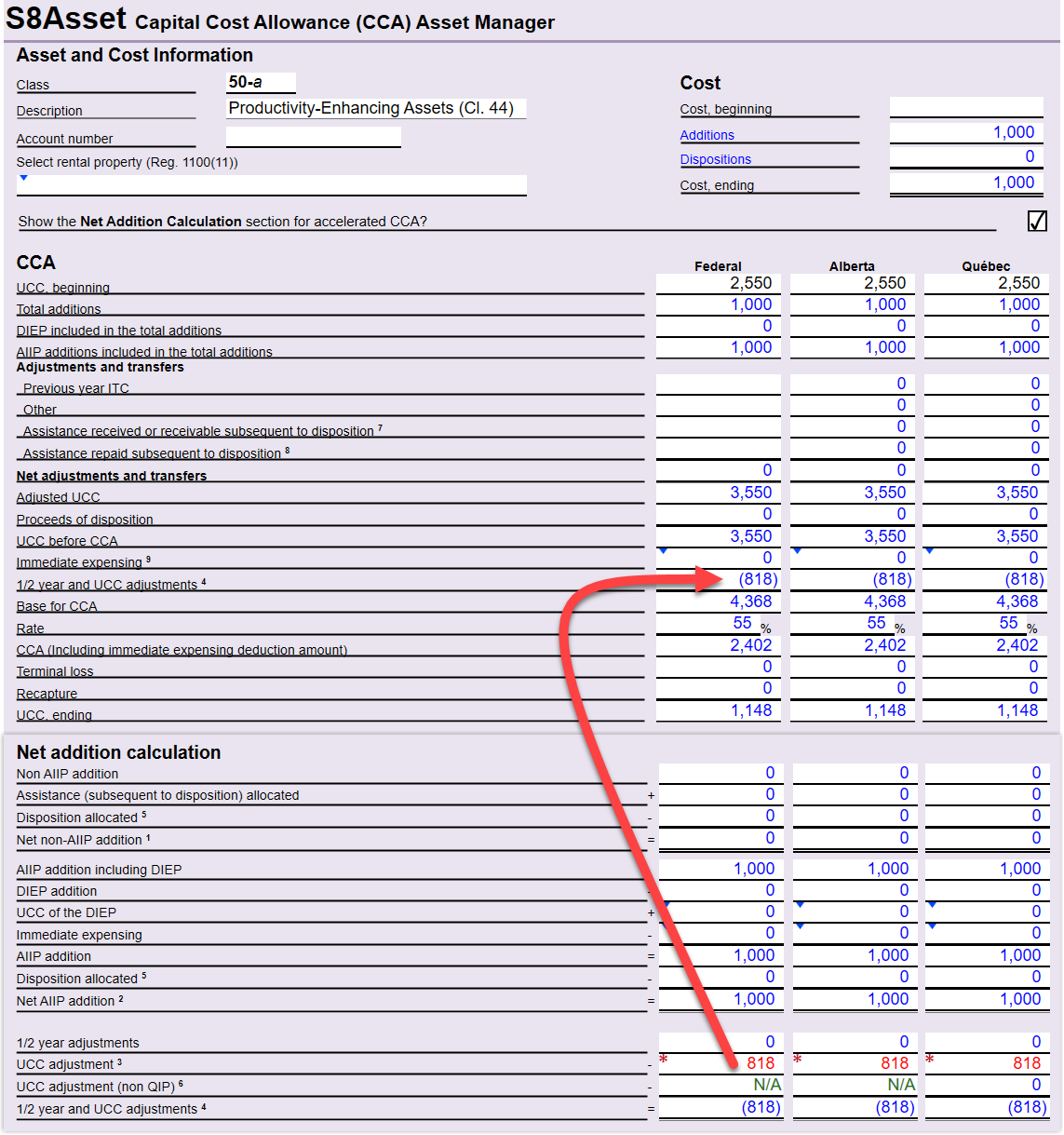

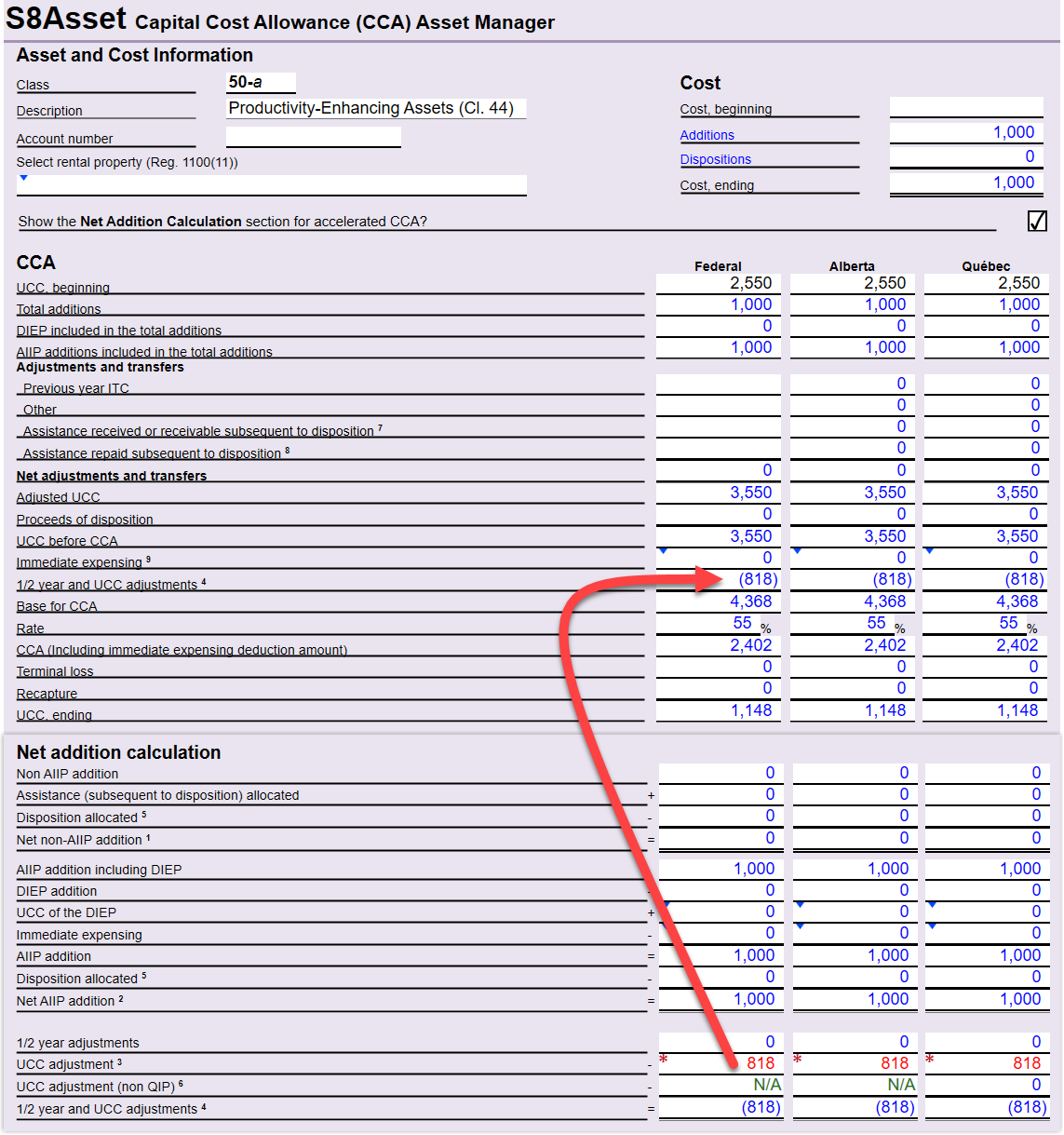

Productivity-Enhancing Assets (Classes 44, 46 and 50)

In the April 2024 federal budget, the Department of Finance announced an accelerated CCA measure for “productivity-enhancing assets.” The proposed measure states that the CCA for classes 44, 46 and 50 will be fully written off for additions made after April 15, 2024, by grossing the UCC of the additions using multipliers of 3, 7/3 and 9/11, respectively. While this measure was not enacted at the time, Budget 2025 is reinstating the measure which applies retroactively to capital assets acquired on or after April 16, 2024.

Example: Productivity-Enhancing Assets (Classes 44, 46 and 50)

Tax year: January 1, 2025, to December 31, 2025

Class 50 addition on January 1, 2025 (RIIP): $1,000

Class 50 RIIP multiplier for 2025: 9/11 (Please refer to S8Note)

Opening UCC: $2,550 |

| Normal CCA |

Reaccelerated CCA |

| Opening UCC |

$2,550 |

$2,550 |

| RIIP addition |

$1,000 |

$1,000 |

| Adjusted UCC |

$3,550 |

$3,550 |

| Half-year adjustment |

$500 |

- |

| UCC adjustment |

n/a |

($818)1 |

| UCC base for CCA |

$3,050 |

$4,368 |

| CCA rate |

55% |

55% |

| CCA |

$1,678 |

$2,403 |

| Ending UCC |

$1,873 |

$1,148 |

Note:

1 UCC adjustment (shown as a negative amount but added to adjusted UCC)

UCC adjustment for Class 50 RIIP addition: $1,000 × multiplier 9/11 = $818 |

In the S8AssetManager, override the UCC adjustment in the Net addition calculation section as shown below and the UCC adjustment will be used to calculate a revised amount of “Base for CCA.”

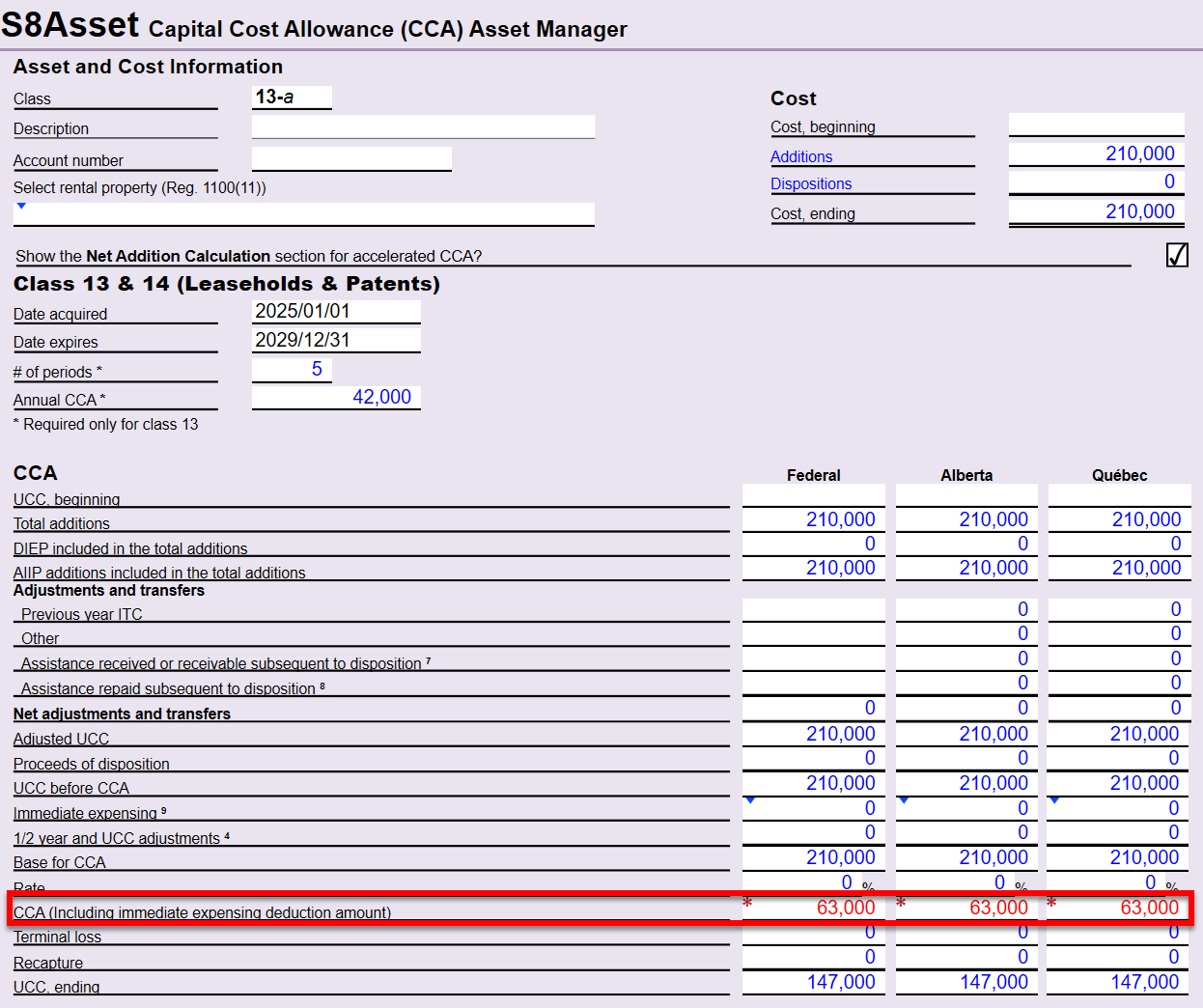

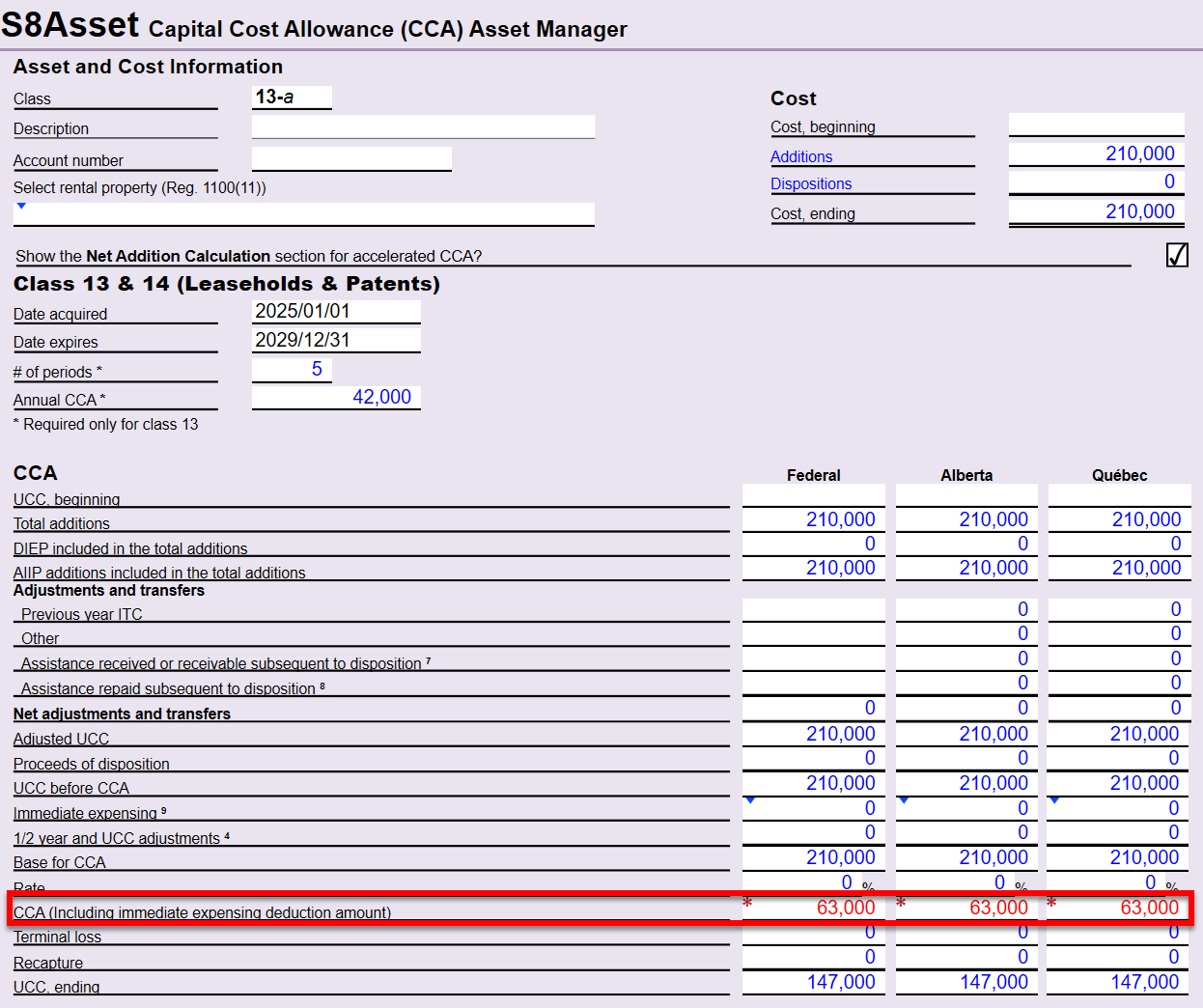

Class 13

In the year of acquisition, a new leasehold acquired after 2024 and before 2029 is eligible for 150% of the amount calculated in accordance with Schedule III of the Income Tax Act Regulation, and the half-year rule is suspended.

Example: Class 13

Tax year: January 1, 2025, to December 31, 2029

Leasehold interest: $210,000

Lease term: January 1, 2025, to December 31, 2030 (Please refer to S8Note)

Class 13 multiplier: 150% × annual CCA (or times the normal first-year CCA)

(Five 12-month periods at an annual CCA of $42,000) |

| Normal CCA |

Reaccelerated CCA |

| RIIP addition |

$210,000 |

$210,000 |

| Half-year adjustment |

n/a |

n/a1 |

| UCC adjustment |

n/a |

n/a |

| UCC base for CCA |

$210,000 |

$210,000 |

| CCA rate |

n/a |

n/a |

| CCA |

$21,002 |

$63,0003 |

| Ending UCC |

$189,000 |

$147,000 |

Notes:

1 Half-year adjustment made directly to CCA.

2 $210,000/5 periods × half-year rule = $21,000

3 $210,000/5 periods × 150% = $63,000 (half-year rule suspended) |

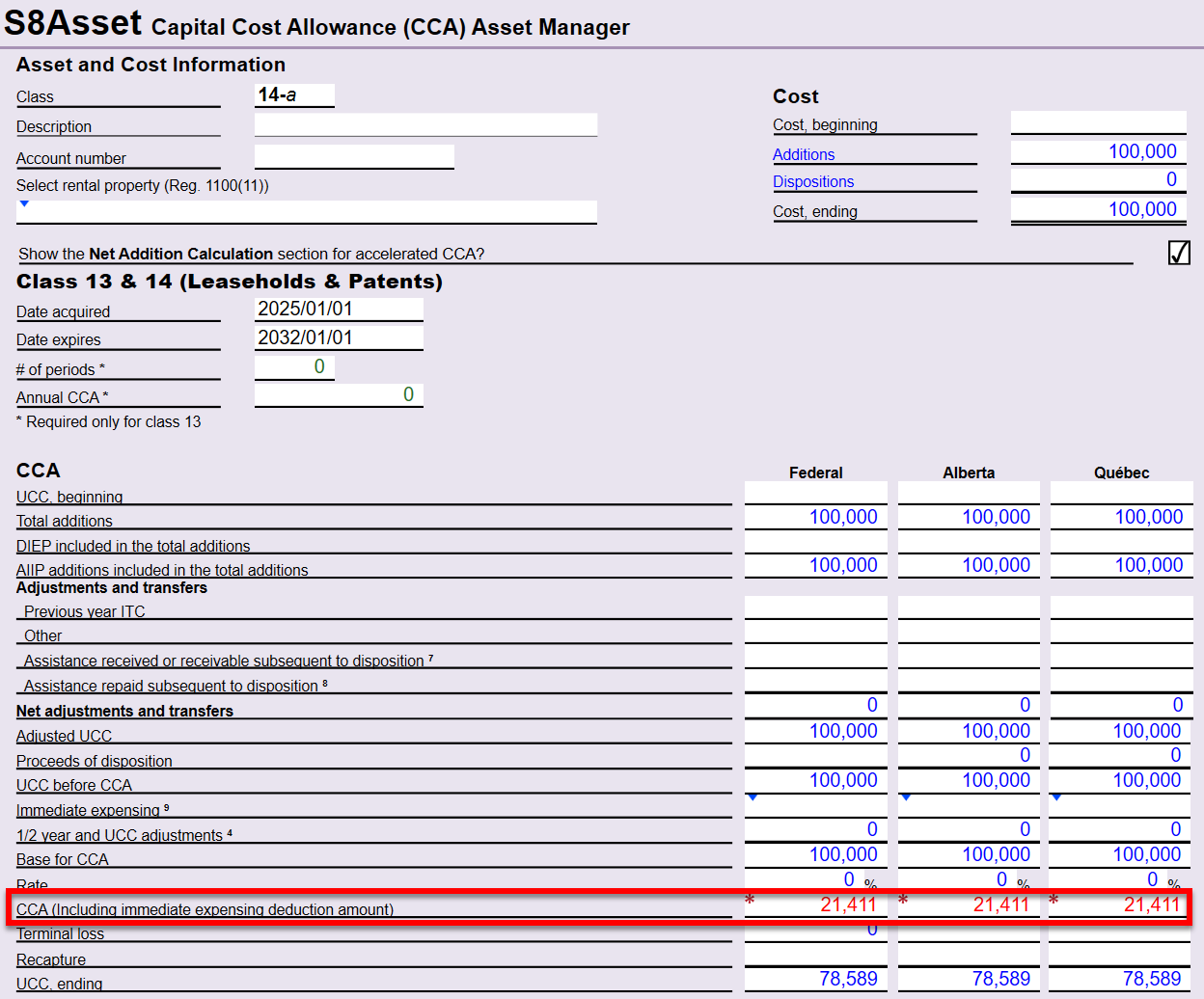

In the case of class 13, override the CCA calculation directly in the S8AssetManager as shown below.

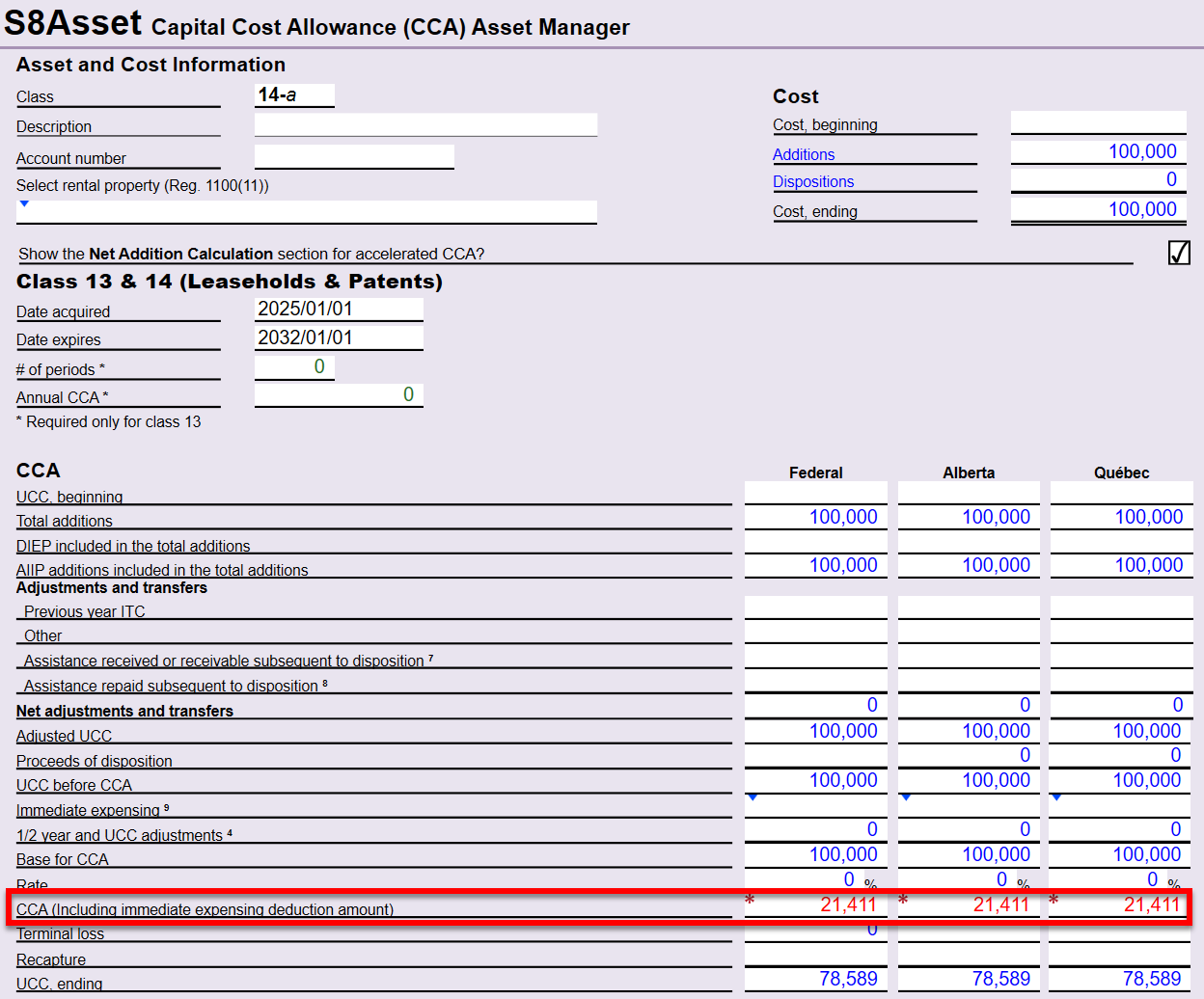

Class 14

In the year of acquisition, a taxpayer is eligible for an additional 50% CCA for an intangible asset acquired after 2024 and before 2032. Class 14 is not subject to the half-year rule.

Example: Class 14

Tax year: January 1, 2025, to December 31, 2025

Class 14 addition on January 1, 2025: $100,000

Life of the intangible asset: January 1, 2025, to January 1, 2032 (2557 days)

2025 Class 14 multiplier: 150% × annual CCA |

| Normal CCA |

Reaccelerated CCA |

| RIIP addition |

$100,000 |

$100,000 |

| Half-year adjustment |

n/a |

n/a1 |

| UCC adjustment |

n/a |

n/a |

| UCC base for CCA |

$100,000 |

$100,000 |

| CCA rate |

n/a |

n/a |

| CCA |

$14,2752 |

$21,4123 |

| Ending UCC |

$85,725 |

$78,588 |

Notes:

1 Half-year adjustment does not apply to class 14.

2 $100,000/2557 days × 365 days = $14,275

3 $100,000/2557 days × 365 days × 150% = $21,411 |

In the case of class 14, override the CCA calculation directly in the S8AssetManager as shown below.

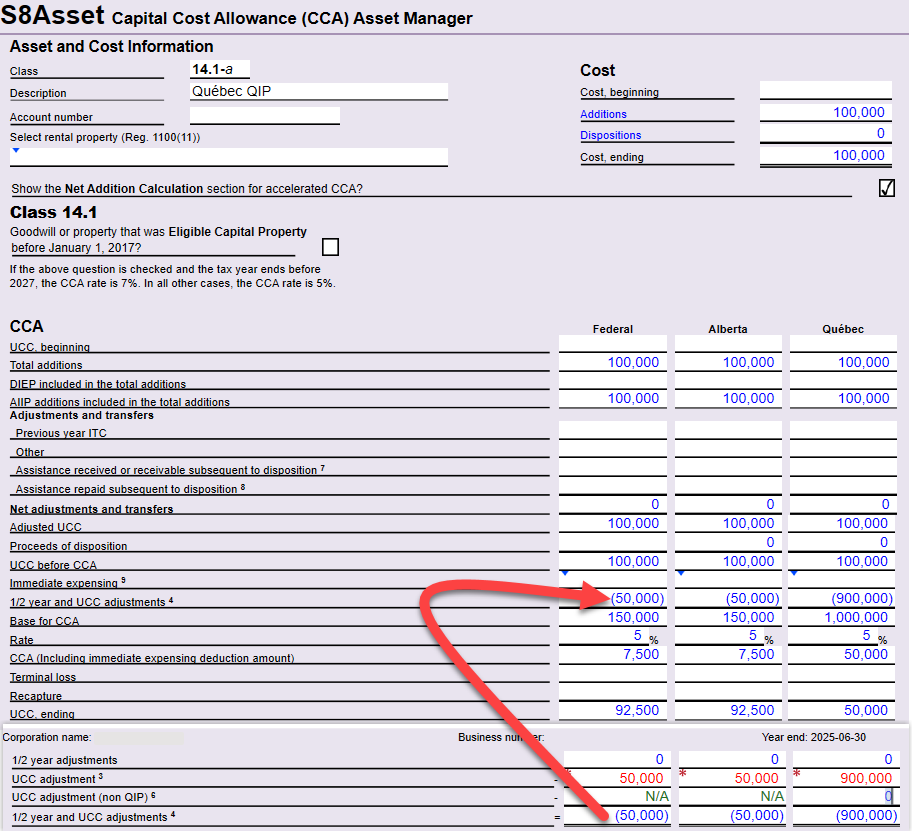

Québec Special Carve-Out Rule for Qualifying Intellectual Property (Class 14.1)

As per the March 2025 Québec budget, the extension of the Accelerated Investment Incentive will NOT apply to property that is a qualifying intellectual property (QIP) included in Class 14.1 of Schedule B of the Regulation respecting the Québec Taxation Act, and which becomes available for use before 2026. Such a property is carved out from the federal RIIP measure and will continue to benefit from the tax treatment granted under the Québec tax system. Refer to page A.97 of the Québec budget for more information.

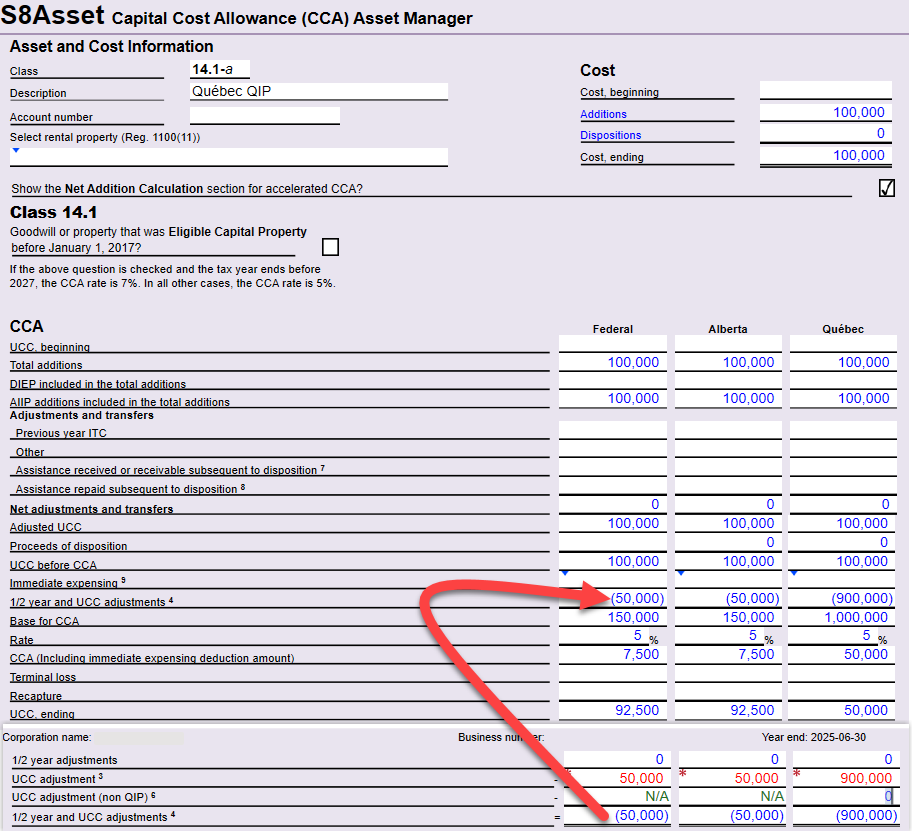

Example: Class 14.1 for Québec—Qualified Intellectual Property (QIP)

Tax year: January 1, 2025, to December 31, 2025

Class 14.1 addition on January 1, 2025 (RIIP, QIP): $100,000

Class 14.1 RIIP Federal multiplier for 2025: 0.5 (Please refer to S8Note)

Class 14.1 RIIP Québec multiplier for 2025: 9 (Please refer to S8Note) |

| Normal CCA |

Québec QIP

Reaccelerated CCA |

| RIIP addition |

$100,000 |

$100,000 |

| Adjusted UCC |

$100,000 |

$100,000 |

| Half-year adjustment |

$50,000 |

n/a |

| UCC adjustment |

n/a |

($900,000)1 |

| UCC base for CCA |

$50,000 |

$1,000,000 |

| CCA rate |

5% |

5% |

| CCA |

$2,500 |

$50,000 |

| Ending UCC |

$97,500 |

$50,000 |

Note:

1 UCC adjustment (shown as a negative amount but added to adjusted UCC)

Québec UCC adjustment for Class 14.1 RIIP addition: $100,000 x multiplier 9 = $900,000 |