- Tax Modules

- TaxCycle T1

- Québec TP1

- TaxCycle T2

- TaxCycle T3

- TaxCycle T4/T4A

- TaxCycle T5

- TaxCycle T5013

- TaxCycle T5018

- TaxCycle T2202

- TaxCycle NR4

- TaxCycle RL

- TaxCycle T3010

- TaxCycle Forms

- Compare tax suites

- Productivity Tools

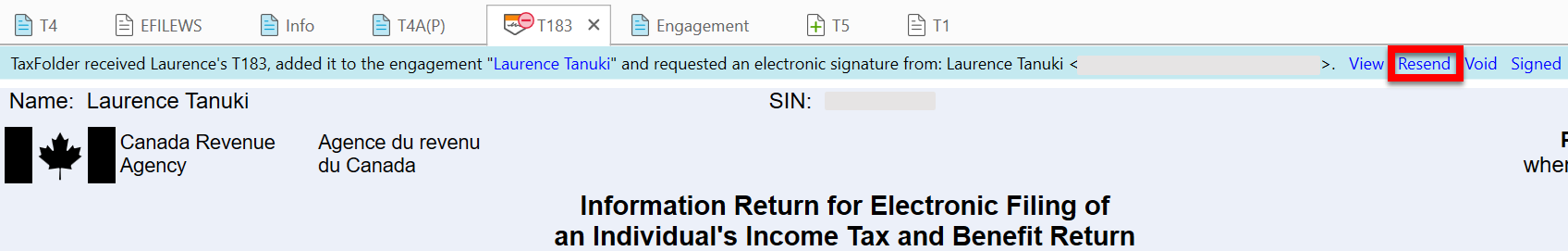

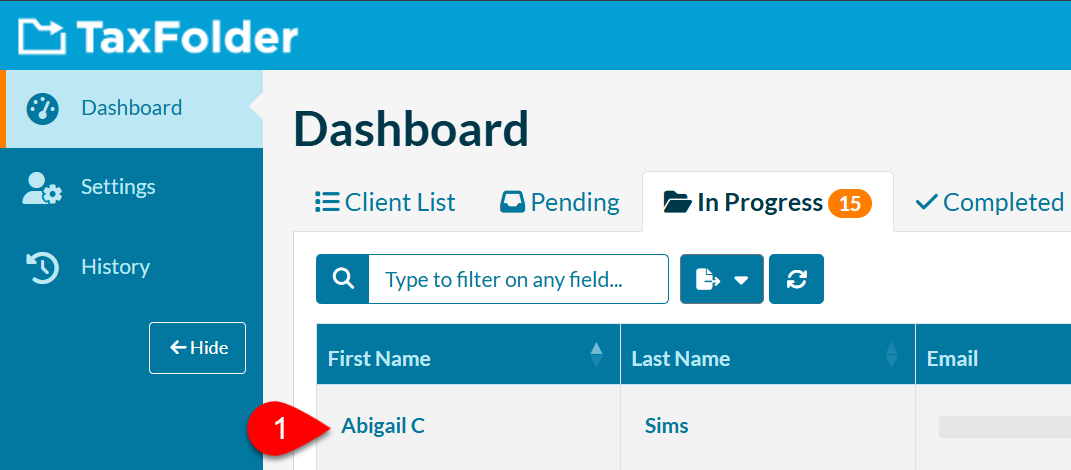

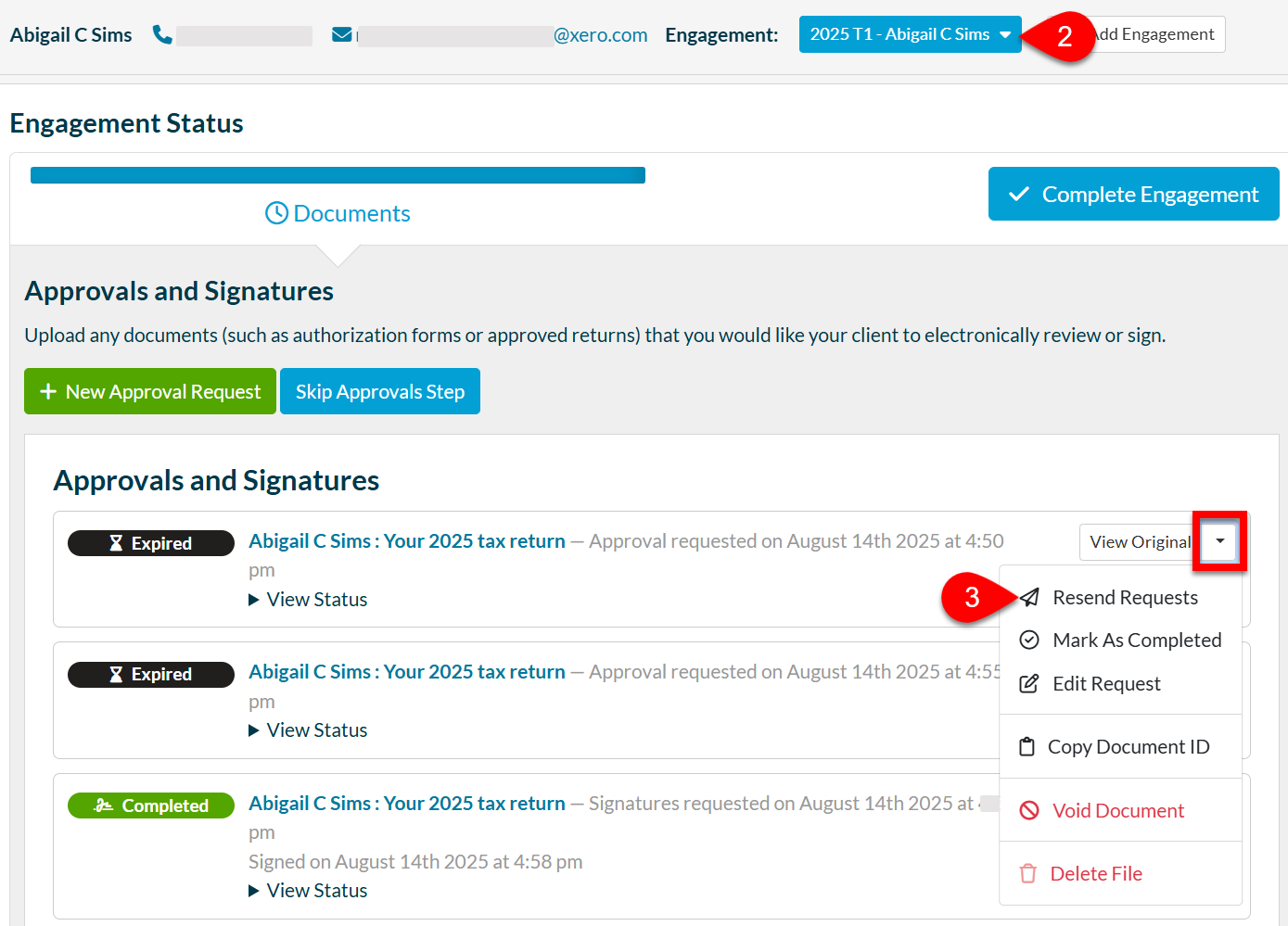

- TaxFolder

- DoxCycle

- Integrations

- Xero

- Caseware

- Remitian

- See all integrations

- Core Features

- Auto-fill My Return

- EFILE

- Family Returns

- Prior-Year Returns

- Review Tools

- Smart Copy/Paste

- SlipSync

- Client Manager

- Template Editor

- Data Mining

- Time-saving toolkit

- Why Choose TaxCycle

- Unparalleled Support

- Integrated Tax Suite

- File Conversions

- Easy Onboarding

- Flexible Payment Plans

- Satisfaction Guarantee

- How to Switch

- Download a Trial

- Watch an Intro Webinar

- Book a demo

- Customer Stories

- Customer stories

- Referral Program

- Help Centre

- Visit the Help Centre

- Help Topics

- Search all topics

- Video Library

- Keyboard Shortcuts

- Training

- Upcoming Webinars

- Webinar Recordings

- Onboarding

- Get Started

- Initial Configuration

- Preparing Your First Return

- TaxFolder Start Guide

- Training Workbook

- Onboarding Videos

- Latest Releases

- Find Answers

- Known Issues

- Help Centre

- Get Support

- Contact Support

- Remote Help

- Visit ProTaxCommunity.com

- Install and Update

- Download

- Release Notes

- Auto-Update Files

- System Requirements

- News Feed

- Go to News Feed

- Recent Articles

- Urgent Update: Revert to DoxCycle Version 14.1.57280.0 2026-02-12

- Known Issue: T2 Transmission Rejected Due to Systems Maintenance 2026-02-12

- Switching to TaxCycle? A Crucial CRA EFILE Update for a Smooth Tax Season 2026-02-12

- Categories

- Known Issues

- Release Notes

- EFILE

- CRA

- TaxFolder