Updated: 2025-01-17

Each year during slips filing season, we receive a lot of questions about the Account Number and Web Access Code (WAC) used for filing with the Canada Revenue Agency (CRA) Internet File Transfer (XML) and where to enter credentials in TaxCycle to transmit Québec RL slips.

What is a Web Access Code (WAC)?

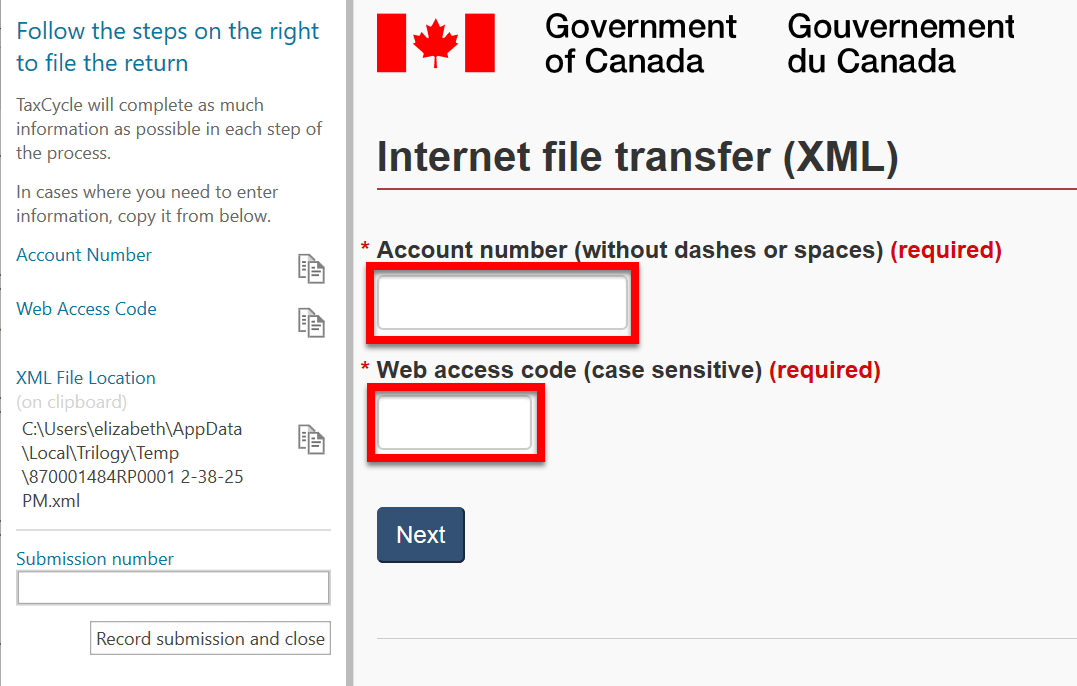

The CRA uses a combination of an Account Number and a Web Access Code (WAC) to allow you to access the system for uploading slips information returns to the CRA. These are used to log in to the transmission website and must be related to one another.

You can use the preparer’s Account Number and WAC, or the slip issuer’s Account number and WAC, provided they are a pair.

Where do I get a Web Access Code (WAC)?

If you or your clients don’t have a Web Access Code, you can request one online from the CRA website. Visit the CRA website to request a Web Access Code (WAC).

You will need to provide an account number, a return type and financial information from the last original return filed for the previous tax year. (Or, if no return was filed, the date of registration.)

Where does my WAC go in TaxCycle Options?

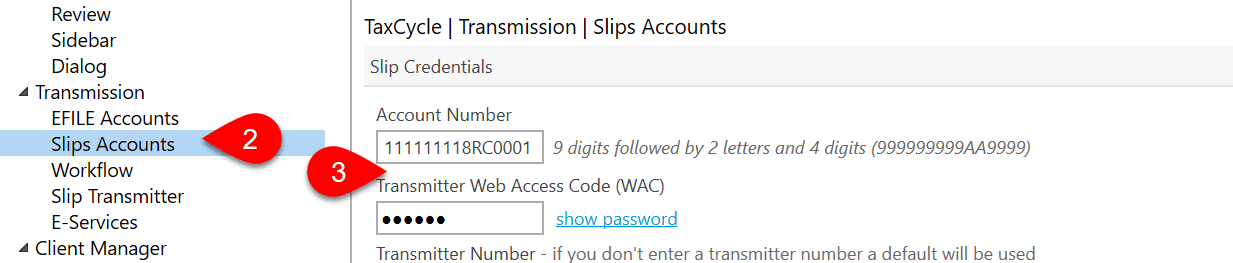

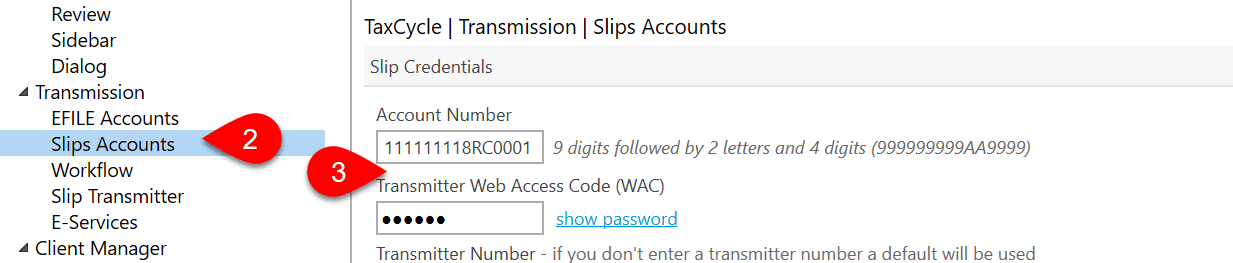

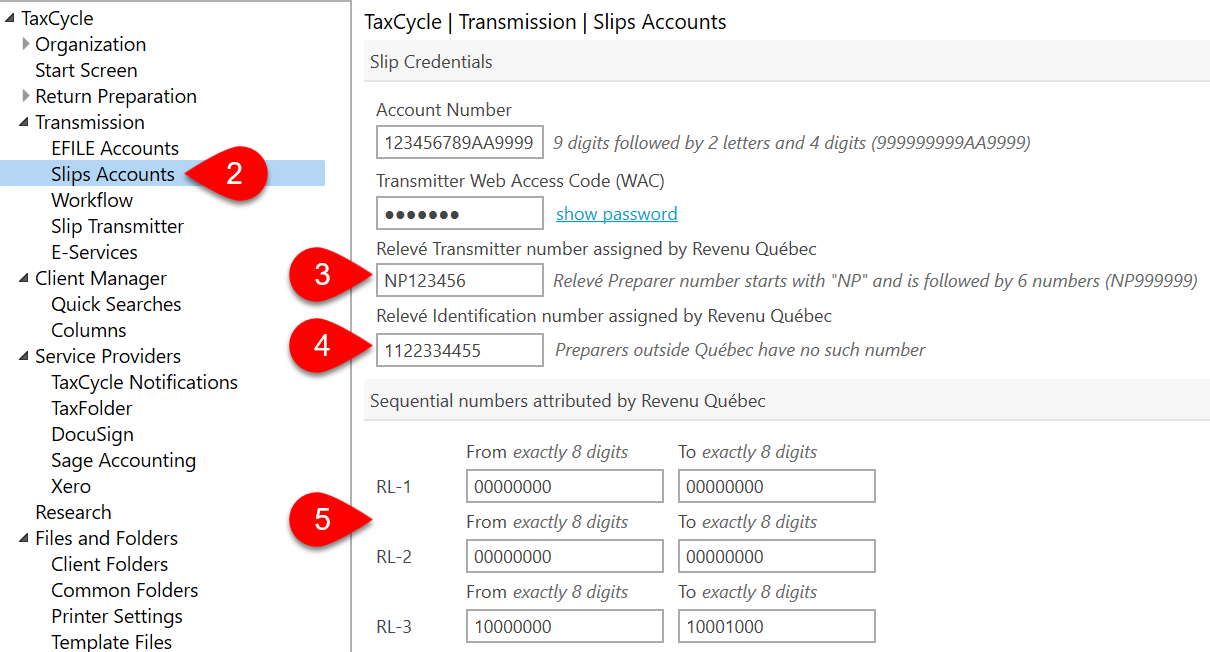

- To open Options from the Start screen, click Options in the blue bar on the left side. If you have a file open, go to the File menu, then click Options.

- On the left side of the screen, expand the section for Transmission and click on Slips Accounts.

- Enter a CRA Account Number and Transmitter Web Access Code (WAC). These are used to log in to the transmission website and must be related to one another. You can use Account Number and WAC as a preparer, or the slip issuer’s Account number and WAC, providing they relate to each other. But, if you use the issuer’s WAC, you must change it for each client in Options.

- Click OK or Apply to save the options.

As a preparer, I have an Account Number and WAC, but so does my client. Which one do I use when filing?

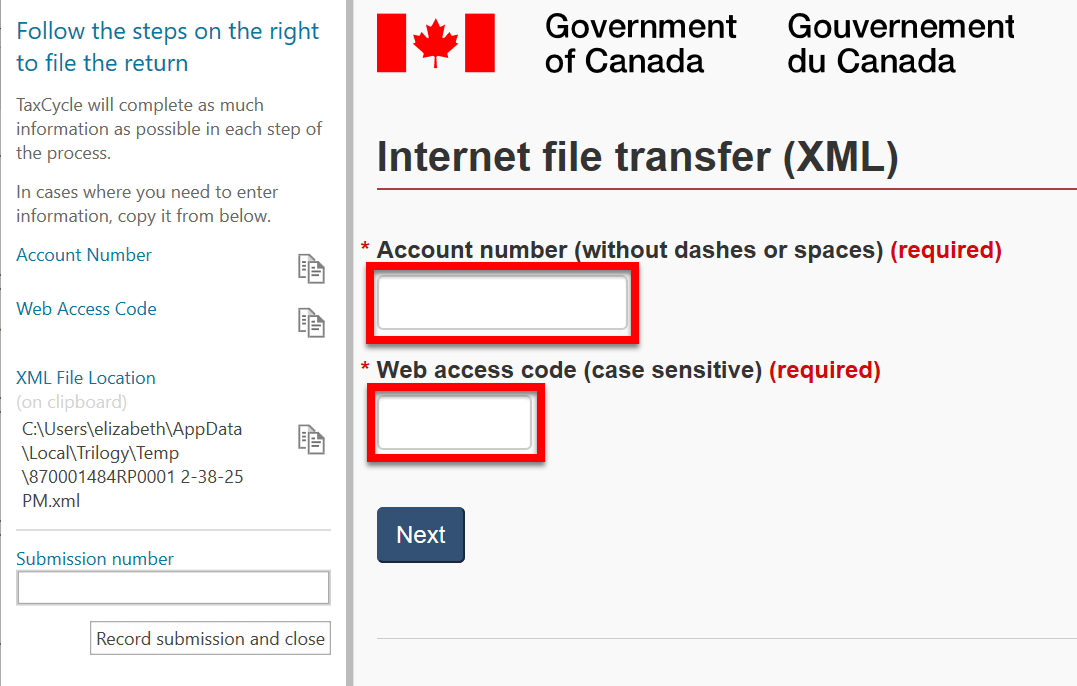

You can use either your WAC or your client’s WAC to file a return. The key is to always make sure to use an Account Number and Web Access Code that go together. This combination serves as the gatekeeper to let you into the online filing system before you upload files.

The Account Number and WAC you enter in Options are automatically inserted into the CRA web page when you start the filing process. Make sure the transmitter number entered on the Engagement worksheet matches the transmitter number used to sign in and transmit the return, as the CRA will validate the T619 transmitter information in the XML file to ensure it matches the sign-in information.

I also file Québec RL slips. What credentials do I need?

Before you can transmit, you must enter your credentials in TaxCycle Options:

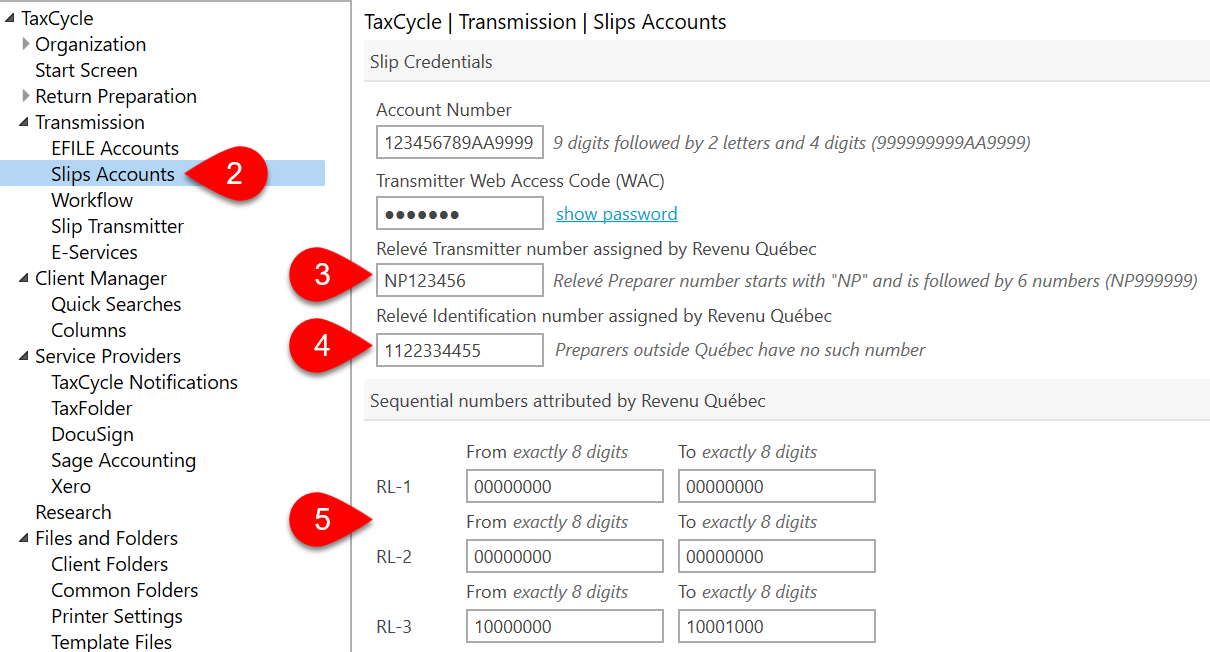

- To open Options from the Start screen, click Options in the blue bar on the left side. If you have a file open, go to the File menu, then click Options.

- On the left side of the screen, expand the section for Transmission and click on Slips Accounts.

- Enter the Relevé Transmitter number assigned by Revenu Québec.

- Enter Relevé Identification number assigned by Revenu Québec. (Leave blank if you are a preparer outside Québec and have not been assigned a number.)

- Complete the Sequential numbers attributed by Revenu Québec. (If you do not have sequential numbers for the RL slips you are filing, you must request them from Revenu Québec.)

- Click OK or Apply to save the options.

Where can I learn more about filing slips in TaxCycle?

- Read the Internet File Transfer (XML) for Slips and Summaries help topics to learn how to electronically transmit slips to the CRA.

- Read the Internet File Québec Relevés help topic to learn about transmitting slips to Revenu Québec.