Updated: 2024-01-05

Create a TaxCycle T4/T4A file to prepare T4 and/or T4A slips. Start a file by carrying forward a slips return from the prior year or by creating a new file from the Start screen.

Next, complete the Info worksheet to enter the issuer information and filing details. See the T4/T4A Info Worksheet help topic to learn more.

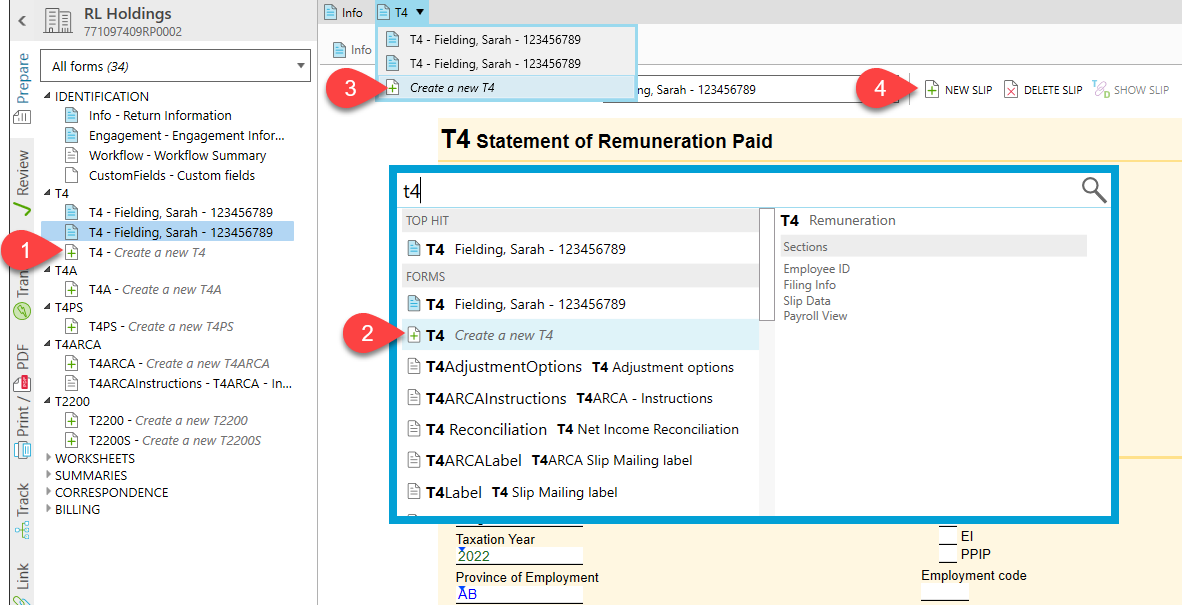

To create a new slip, use one of the following ways. The example below is for a T4 slip, but the same steps apply to whichever slip type you create.

On the blank slip, begin entering recipient information. As soon as you complete the first field, TaxCycle inserts the default information as entered on the Info worksheet.

You can import slips from an Excel® spreadsheet, or from the XML used to file the return. Learn how in the Excel® Import Slips help topic.

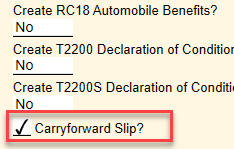

When you create a slip in any of the slips modules, you can choose whether to carry forward a slip to next year.

By default, the Carryforward Slip? box is checked on each slip so that they each carry forward to the following year.

Simply clear this check box if you do not want a slip to carry forward. For example, if you know an employee has left and you will not need to complete their T4 in the following year.

You can enter T4 slips with reduced Employment Insurance (EI) rates in TaxCycle without creating a separate file. Learn how in the T4 Reduced EI help topic.

If you complete the default Other Information fields on the Info worksheet, they are used as soon as you enter any information on a new slip. These boxes appear in the Other information section on each slip.

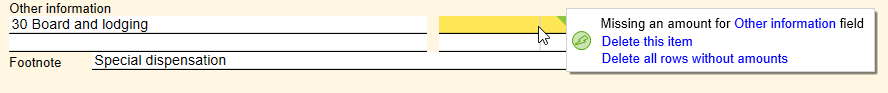

You can add more boxes as needed on the individual slips. If you don't need all the default boxes on a particular slip, complete only those you do. Hover over any unneeded boxes and a review message will give you the option to Delete this item or to Delete all rows without amounts:

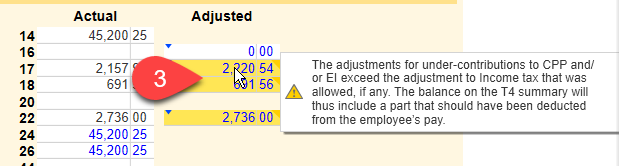

The T4Summary and T4ASummary bring all the slip information into one summary to report the total source deductions and employer contributions. Before filing, review the employer contributions remitted over the year to accurately reflect any balance due or refund.

If you filed slips for T4 Reduced EI, you will see a separate T4Summary for these slips. Learn how in the T4 Reduced EI help topic.