Updated: 2023-05-16

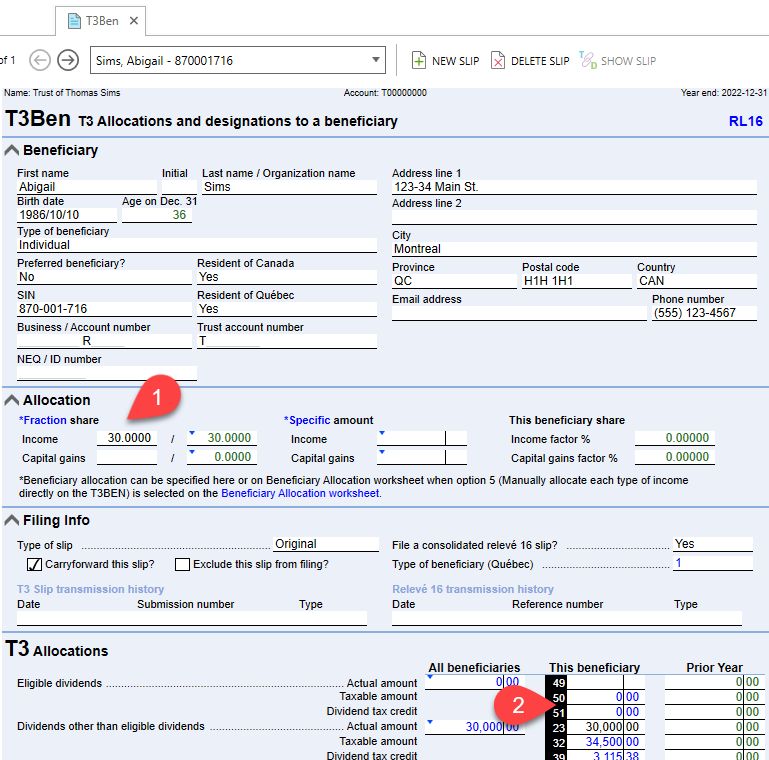

In TaxCycle, much of the T3 Trust return is similar to a T1 personal tax return. Many of the forms look and behave the same. However, one area that is unique to TaxCycle T3 (and likely different from your old tax software) is the flexibility you have in entering beneficiary information and in allocating income to beneficiaries.

Enter the name(s) and contact information for beneficiaries on any of the following worksheets or slips. Information flows automatically between them:

The type of information available on each form differs slightly. The Beneficiary worksheet provides fields to enter the address and contact information, as does the T3Ben slip. The T3 Allocation worksheet only allows you to enter and edit the name of the beneficiary. If you spot a typo or change your mind about a piece of beneficiary information, you don’t need to chase down the source field. Make the change where and when you see it.

The Preferred Beneficiary Election is available per ITA 104 (14) to a beneficiary of a trust who meets the definition of a “preferred beneficiary” as defined in ITA 108 (1). This allows the Trust and the Preferred Beneficiary to elect jointly, as prescribed by section 2800 of the Income Tax Regulations, to designate a portion of the Trust’s Accumulating Income to be taxed in the hands of the Preferred Beneficiary for the taxation year.

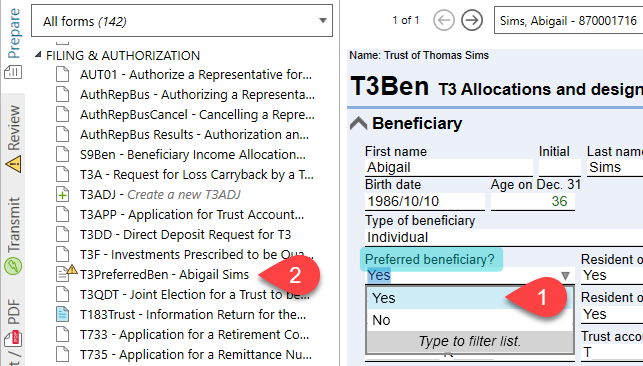

To designate a Preferred Beneficiary: