Updated: 2023-01-16

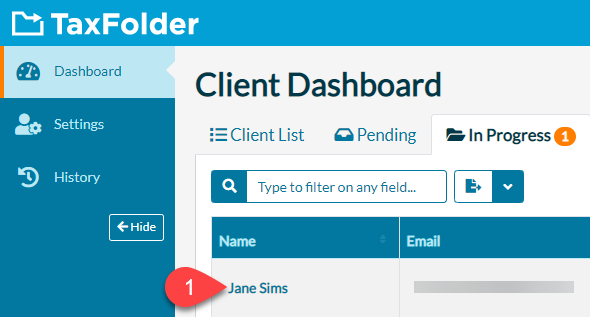

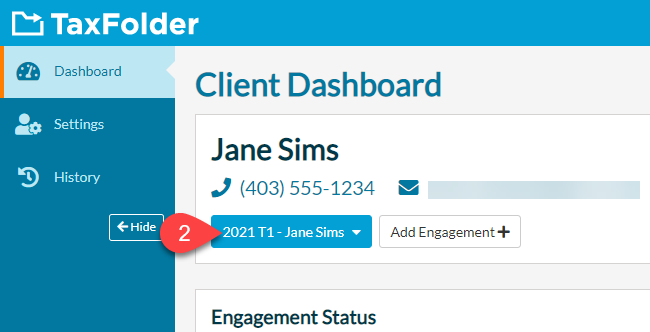

If you need to resend the signature request email to a client, you can do this from TaxCycle or TaxFolder.

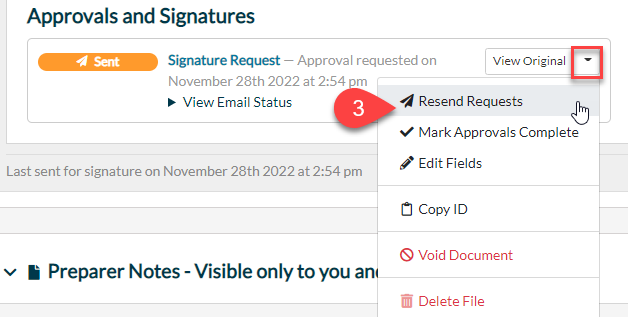

This resends the ORIGINAL package another time, without changes to the client's email address or phone number. To send the package to a different email address or phone, start a new request from TaxCycle or use the Edit Fields option to edit the signature request email address and send again from TaxFolder.

Note: changing the client email address in TaxFolder does not update the email or phone number in any pending requests.

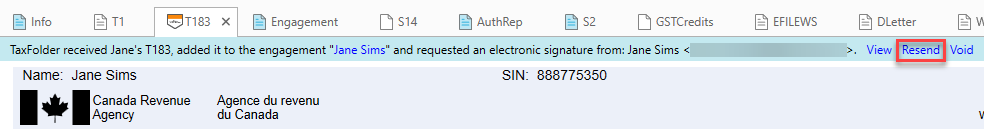

Open the form or letter in TaxCycle. In the blue bar at the top of the form, click the Resend link.