Updated: 2025-03-28

The Underused Housing Tax Act received royal assent on June 9, 2022, and was deemed to come into force on January 1, 2022. This act implements a 1% annual tax on underused or vacant housing.

While the act targets non-resident owners, it includes provisions that may require Canadian owners to file the UHT-2900 Underused Housing Tax Return and Election Form, even if they are exempt from paying the Underused Housing Tax (UHT). This includes many Canadian corporations (including CCPCs), trustees of a trust and partners in a partnership.

We have included the UHT-2900 in the TaxCycle Forms module. You can electronically transmit the UHT-2900 using the Special Elections and Returns (SERs) transmission service in TaxCycle Forms.

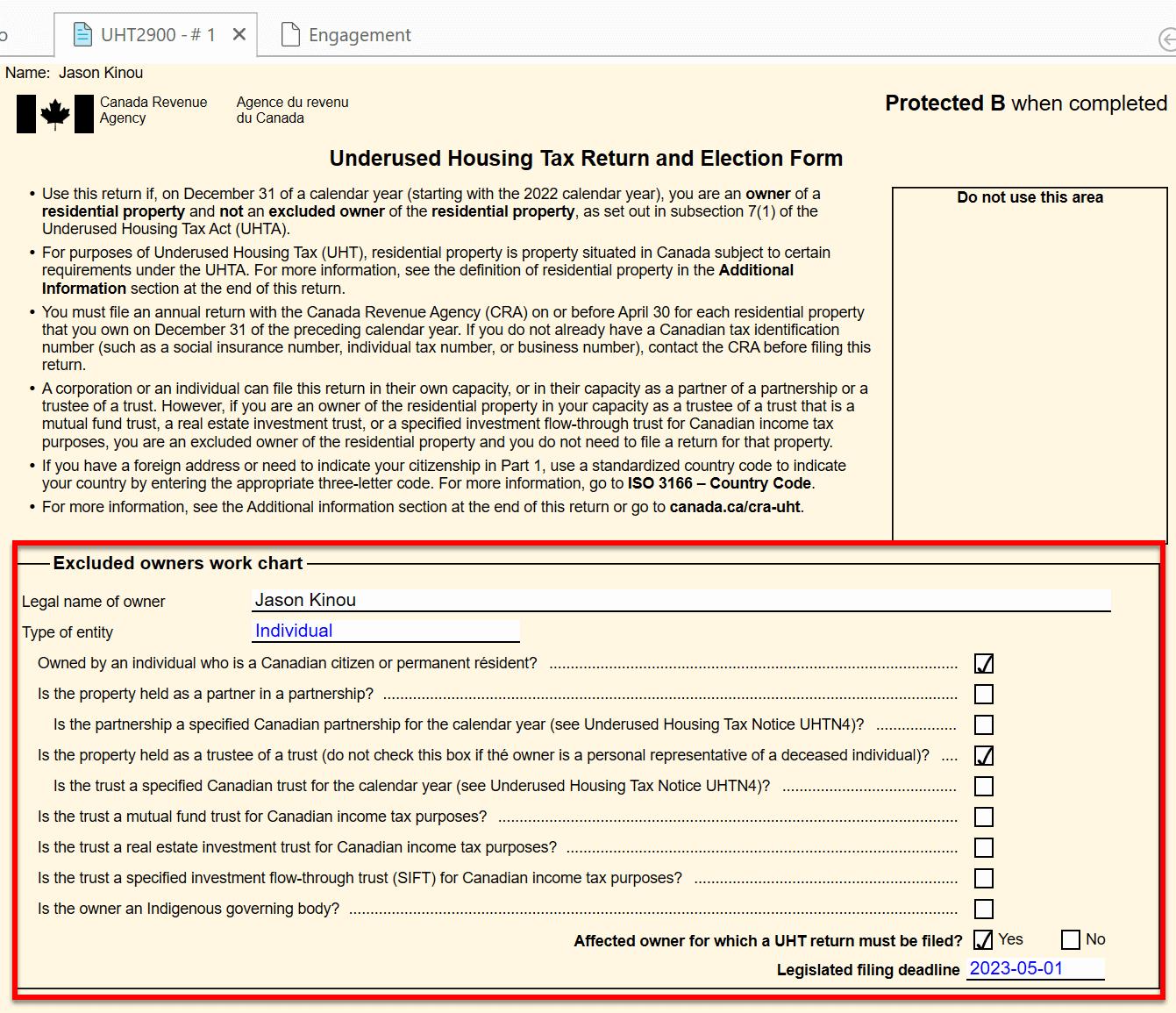

In TaxCycle, we have added an excluded owners work chart at the top of form UHT-2900 to help you determine whether the taxpayer generally meets the definition of:

The checklist does not cover all situations. It is a general guide only. Please refer to the Canada Revenue Agency’s Underused Housing Tax Notice UHTN1 for detailed definitions.

The deadline for filing and payment of any UHT owing is April 30 and is based on the property owned at December 31 of the calendar year. However, since that date falls on a Sunday this year, the deadline this year is May 1, 2023.

An affected owner may qualify for certain exemptions, in which case no tax would be payable on the property, but a return must still be filed.

This year, the Minister of National Revenue is providing transitional relief to affected owners. Although the deadline for filing the UHT return and paying the UHT payable is still April 30, 2023, no penalties or interest will be applied for UHT returns and payments that the CRA receives before November 1, 2023.

The CRA also noted that you do not need to report the assessed values and most recent market price on lines 280 and 285 if a tax exemption applies and the return is filed before the end of the following calendar year (that is, December 31, 2023, for 2022 UHT returns).

For example, if three individuals jointly own three separate properties as partners of a partnership, each partner is required to file three returns, a total of nine returns.

Please refer to the Canada Revenue Agency’s technical guidance in the Underused Housing Tax Notice UHTN1 for detailed definitions of what qualifies as a residential property, and who is considered an owner, excluded owner or affected owner.

If you are filing a UHT return for a corporation, you must register for an Underused Housing Tax program account (RU) with the CRA.

You can use the CRA’s Business Registration Online (BRO) service to register for a program account and apply for a Business Number (BN) if you don’t already have one; you need a BN to register for a program account.

Read How to register for a business number or Canada Revenue Agency program account from the CRA’s website to learn more.

The CRA has confirmed that handwritten signatures, block signatures and electronic signatures are all acceptable on UHT returns.

Significant penalties apply for failure to file a return, even if an exemption applies and no taxes are owing.

Penalties start at $5,000 for affected owners who are individuals, or $10,000 for affected owners that are not individuals (such as corporations).

There is also no limit for CRA to assess the penalties and interest with respect to the property for the calendar year.