Updated: 2024-02-08

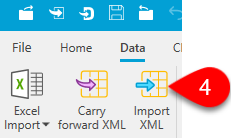

If you can’t carry forward your slips return from the prior year, you can use the XML file created by your old software for transmitting to the CRA to populate a current-year TaxCycle return with the issuer and recipient information.

Depending on the software package you used last year, the file is saved in different places.

Create a new slips return. There is no need to enter any information in the return.

Create a new slips return. There is no need to enter any information in the return.