Updated: 2023-04-11

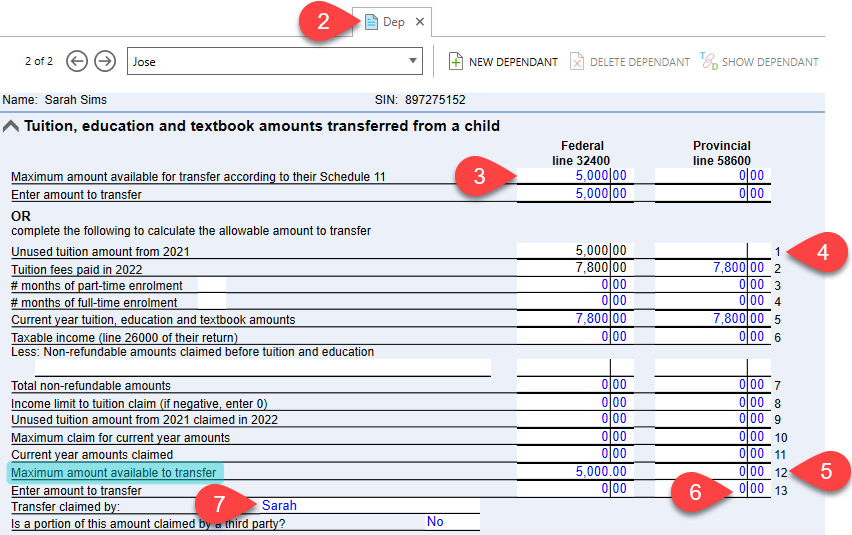

Where you enter the tuition amounts transferred from a dependant depends on whether you are preparing a full return for the dependant (see the Dependant and Family Returns help topic), or whether you are completing just the Dependant worksheet (see the Dependant Tax Credits help topic).

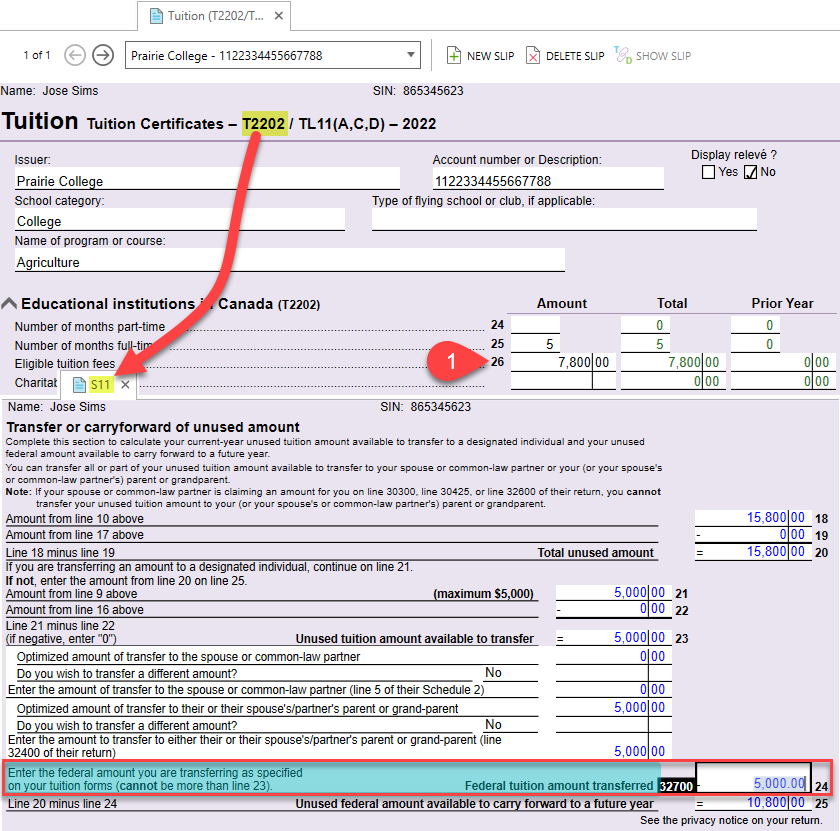

Use these steps if you are preparing a return for the dependant AND that return is part of a family’s return. To learn how to link dependants into a family return, read the Dependant and Family Returns help topic.

If you are not preparing a full return for the dependant, but you still need to enter tuition amounts transferred from the dependant: