- Tax Modules

- TaxCycle T1

- Québec TP1

- TaxCycle T2

- TaxCycle T3

- TaxCycle T5013

- TaxCycle T4/T4A

- TaxCycle T5

- TaxCycle T5018

- TaxCycle T2202

- TaxCycle NR4

- TaxCycle RL

- TaxCycle T3010

- TaxCycle Forms

- Compare tax suites

- Productivity Tools

- TaxFolder

- DoxCycle

- Integrations

- Xero

- Caseware

- Remitian

- See all integrations

- Core Features

- Auto-fill My Return

- EFILE

- Family Returns

- Prior-Year Returns

- Review Tools

- Smart Copy/Paste

- SlipSync

- Client Manager

- Template Editor

- Data Mining

- Time-saving toolkit

- Why Choose TaxCycle

- Unparalleled Support

- Integrated Tax Suite

- File Conversions

- Easy Onboarding

- Flexible Payment Plans

- Satisfaction Guarantee

- How to Switch

- Download a Trial

- Watch an Intro Webinar

- Book a demo

- Customer Stories

- Customer stories

- Referral Program

- Help Centre

- Visit the Help Centre

- Help Topics

- Search all topics

- Video Library

- Keyboard Shortcuts

- Training

- Upcoming Webinars

- Webinar Recordings

- Onboarding

- Get Started

- Initial Configuration

- Preparing Your First Return

- TaxFolder Start Guide

- Training Workbook

- Onboarding Videos

- Latest Releases

- Find Answers

- Known Issues

- Help Centre

- Get Support

- Contact Support

- Remote Help

- Visit ProTaxCommunity.com

- Install and Update

- Download

- Release Notes

- Auto-Update Files

- System Requirements

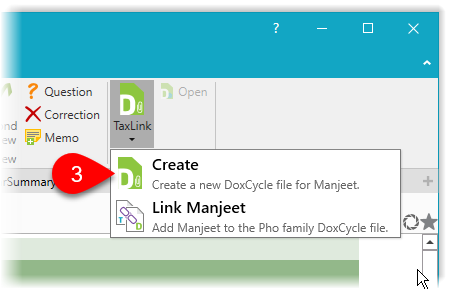

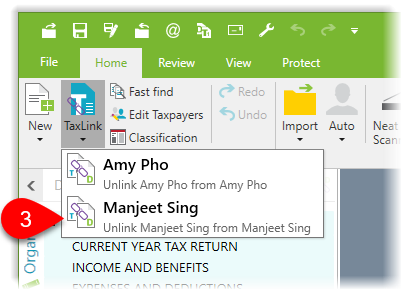

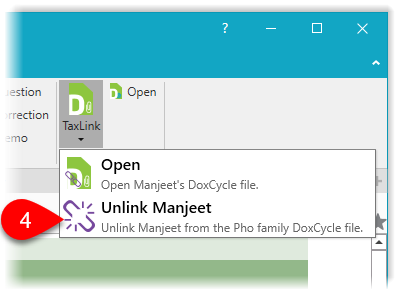

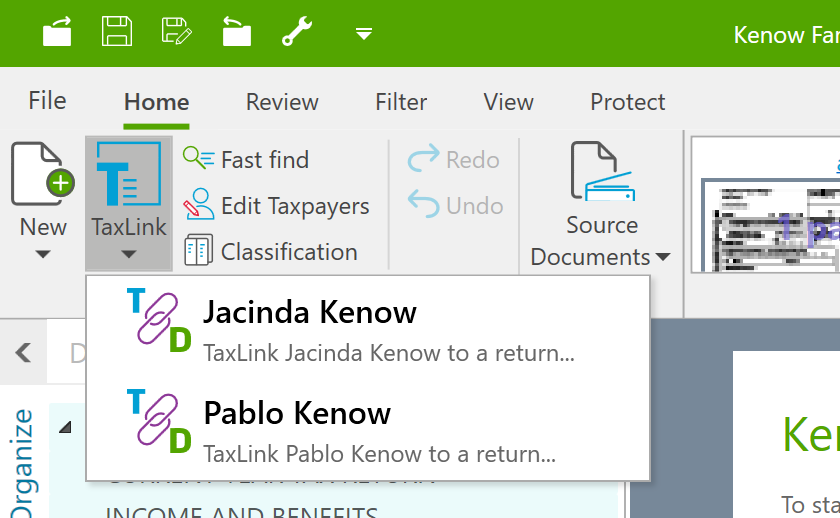

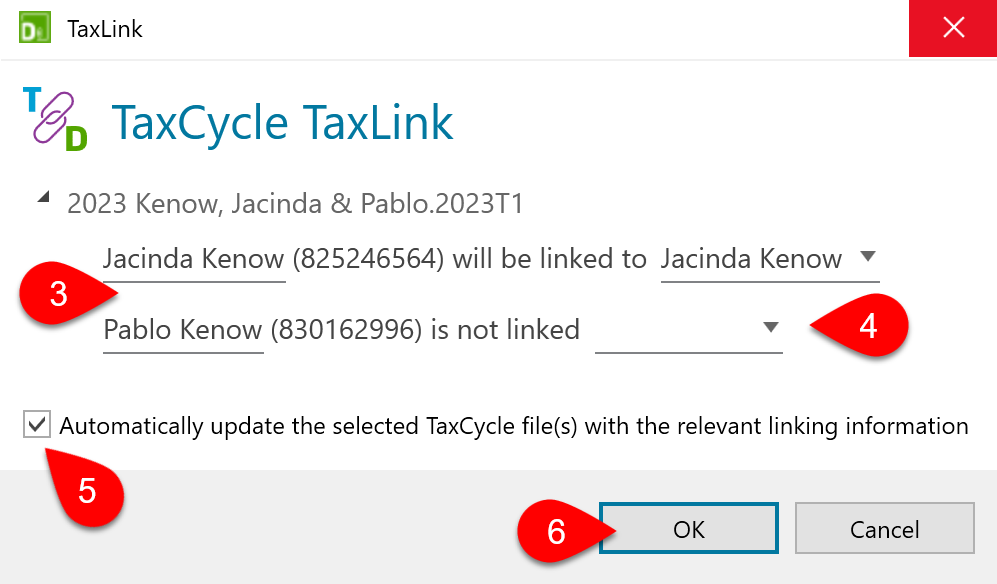

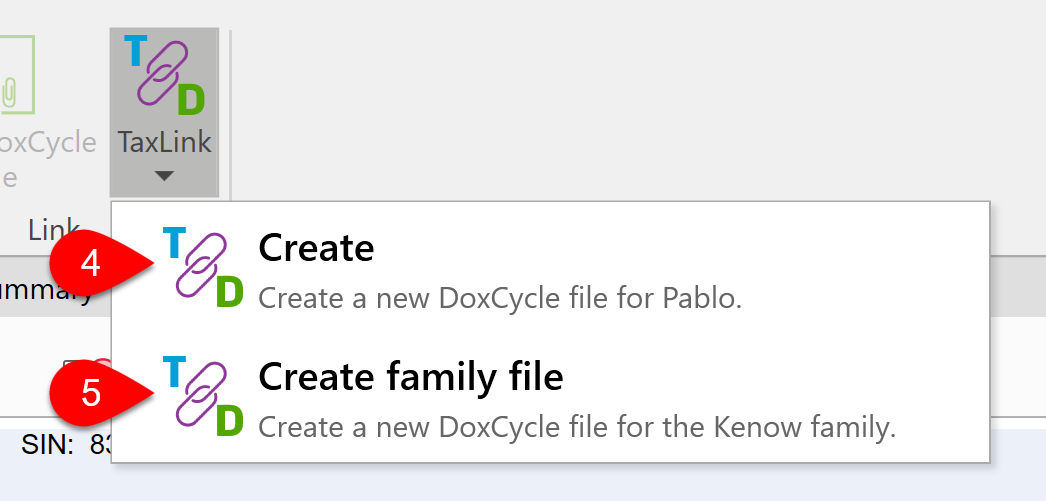

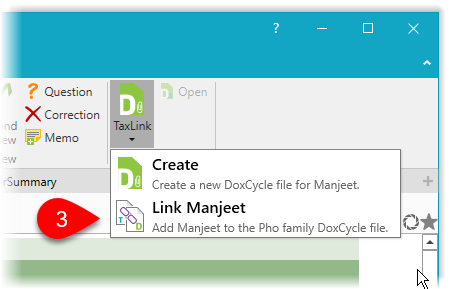

Depending on how you first created the DoxCycle PDF, it may occur that you have linked DoxCycle and TaxCycle files for one taxpayer (such as the principal taxpayer), but then still wish to link in other taxpayers (such as a spouse or dependant) to the same DoxCycle PDF.

Depending on how you first created the DoxCycle PDF, it may occur that you have linked DoxCycle and TaxCycle files for one taxpayer (such as the principal taxpayer), but then still wish to link in other taxpayers (such as a spouse or dependant) to the same DoxCycle PDF.