Updated: 2024-03-01

T2200 and T2200S Forms

To calculate employee home office expenses (workspace-in-the-home and supplies) while working at home between 2020 and 2022 due to the COVID-19 pandemic, see the Working at Home Due to COVID-19 help topic.

If the employee pays for expenses other than home office expenses, do not use the T2200S. Instead, complete form T2200, Declaration of Conditions of Employment.

If you are filling T4 slips for an organization, you can create T2200 and T2200S forms for their employees along with the T4 slips. See the T2200 Conditions of Employment help topic.

You can also add details from these forms to the return in TaxCycle T1. However, TaxCycle will not use the amounts from these forms in calculating the tax return. Keep the employee’s original form in case the CRA requests it.

T777WS Employment Expenses Worksheet

Use the T777WS to calculate an employment expense claim. Amounts from this worksheet flow to related schedules, T777, T777S, TP-59-V and TP-59.S-V. Amounts also flow to the GST370 if the taxpayer is claiming the GST/HST rebate on the expenses.

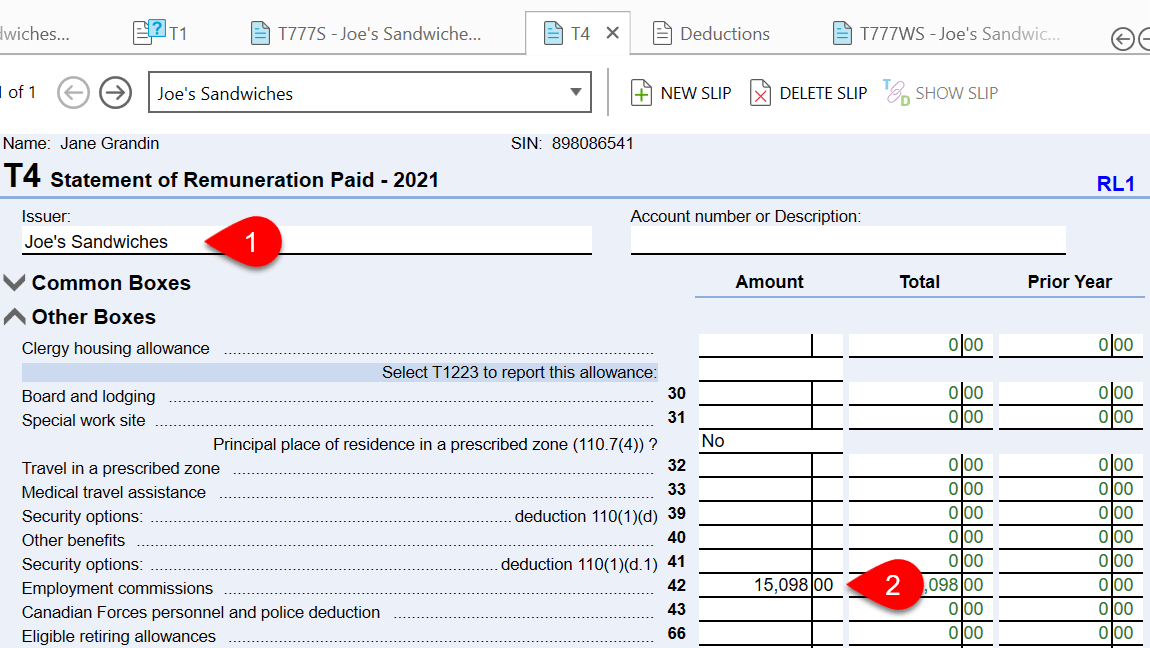

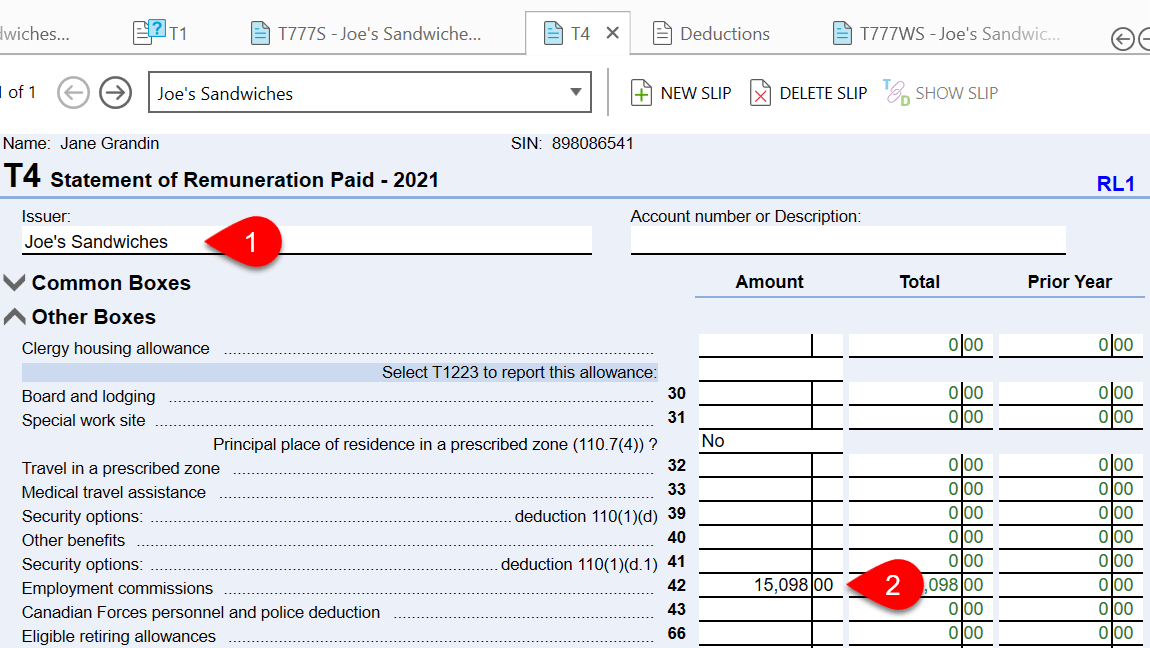

- Each T777WS has an associated T4 slip. First create the T4 slip and the slip first and enter the employment income and source deductions.

- Make sure to enter any commissioned income in box 42 on the T4 slip.

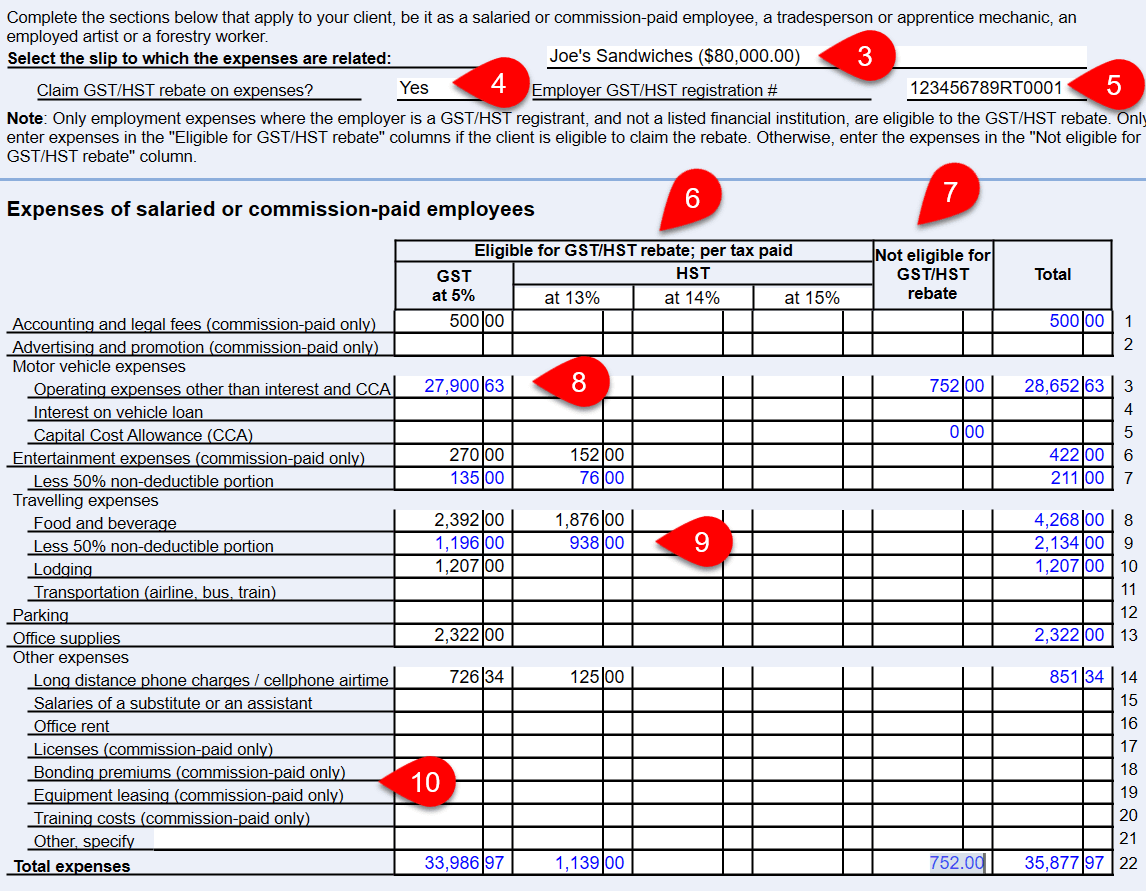

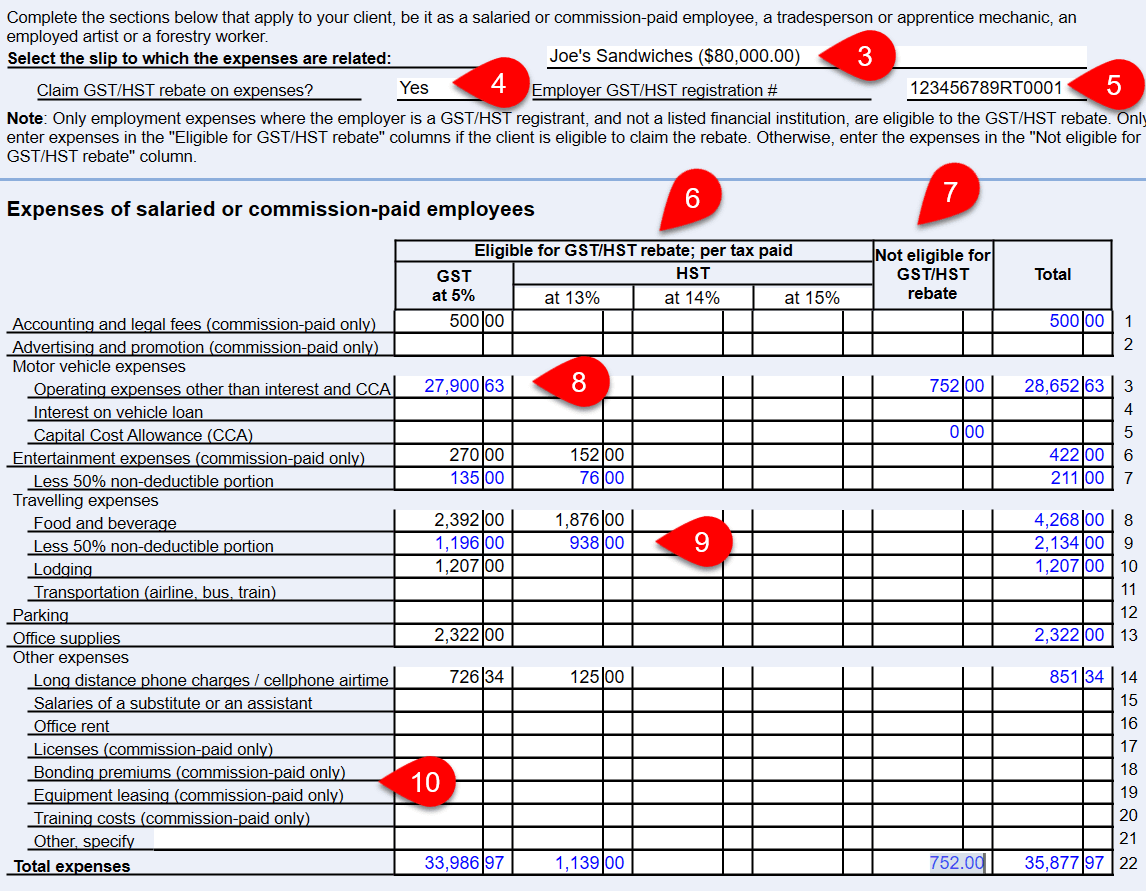

- Select the related T4 slip at the top of the T777WS.

- Indicate whether the employee is eligible for the GST/HST rebate.

- If the employee is claiming the GST/HST rebate, enter the employer GST/HST registration number.

- Enter expenses in the table provided. If the employee is claiming the GST/HST rebate, enter the amounts, including tax, in the appropriate column. If the expenses were incurred in multiple provinces, or the tax rate changed, split the expenses into separate columns.

- Use the Not eligible column if the employee is not claiming the GST/HST rebate.

- Enter motor vehicle expenses on the Motor Vehicle worksheet and allocate the kilometrage to the T777WS on that form. Amounts will automatically flow to the T777WS. See the Motor Vehicle Expenses help topic.

- For entertainment, food and beverage, enter the full amount. TaxCycle automatically calculates the 50% non-deductible portion.

- Some expenses only apply to commission-paid employees. If your client did not earn commissions, you can ignore these rows.

- Scroll down the form to enter expenses for workspace in the home, tools for tradespeople or apprentice mechanics, employed artists and forestry workers.

Claim Calculation

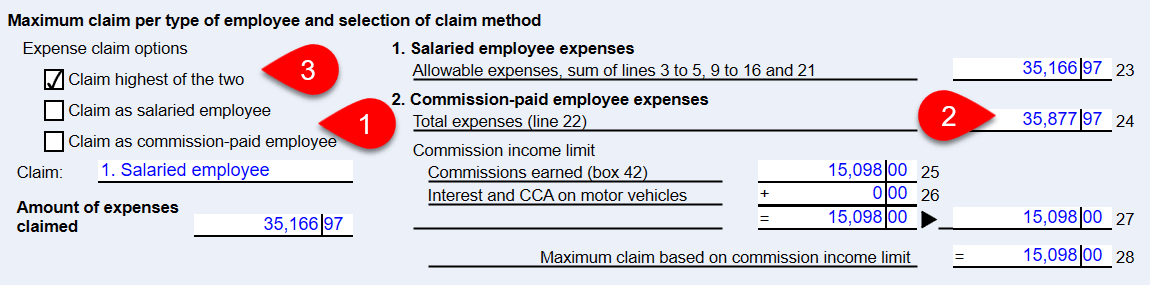

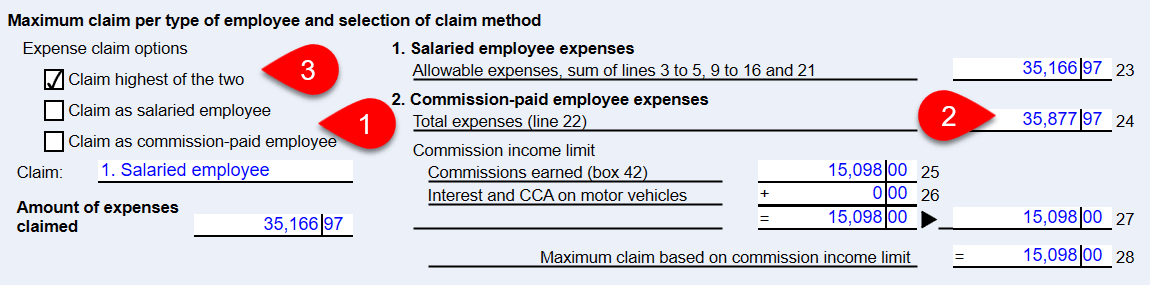

TaxCycle calculates the maximum claim for salaried and commission-paid employees based on the information entered on the T777WS and on the T4 slip.

- You can choose how to calculate the claim: as salaried employee (default) or as commission-paid employee. The calculation of each type appears on the right so you can compare the results.

- If box 42 on the T4 slip is zero, TaxCycle does not calculate commission-paid expense claim.

- If the employee has both salary and commission income, you can check the box to claim the higher of the two amounts.

CCA Claims for Expenses of Employed Artists

Go the CCA table in the Expenses of employed artists section:

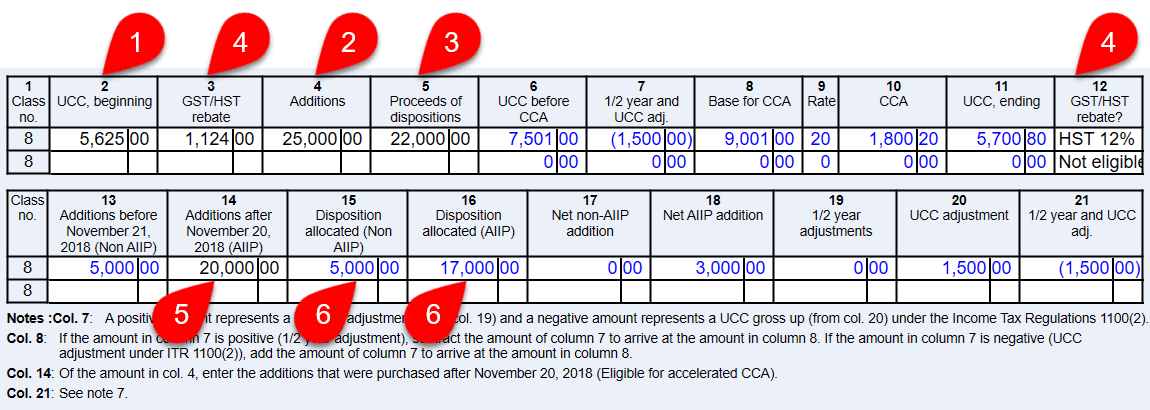

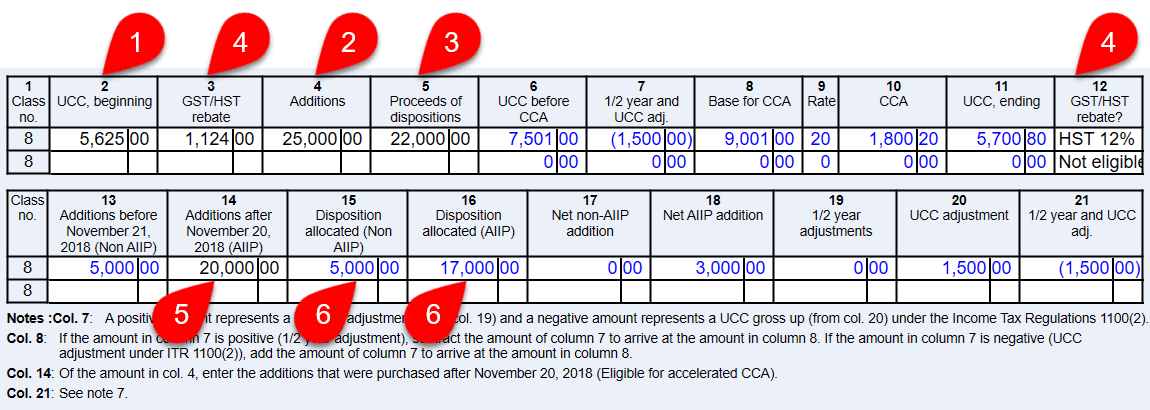

- Enter the undepreciated capital cost (UCC) in column 2. If available, TaxCycle will carry forward this amount from the previous year.

- Enter any additions made during the year in column 4.

- Enter the proceeds of dispositions in column 5.

- If the expense is eligible for the GST/HST rebate, enter the amount of the GST/HST rebate in column 3 and select the tax rate from the menu in column 12.

- In column 14, enter the portion of the amount from column 4 acquired after November 20, 2018. This amount is then used to calculation the accelerated CCA. To learn more about accelerated CCA calculations read the Accelerated CCA help topic.

- When you enter a disposition, TaxCycle first applies the amount to any Non AIIP dispositions in column 15. Any remaining disposition amount is applied to AIIP dispositions in column 16.