Updated: 2024-08-16

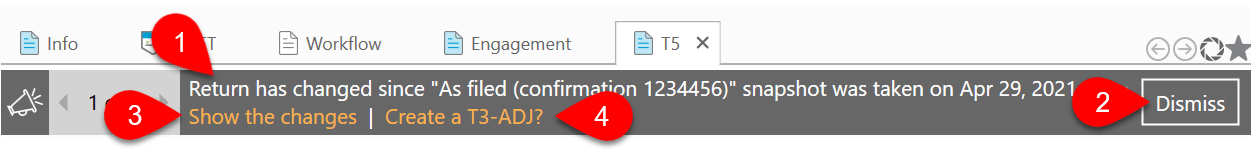

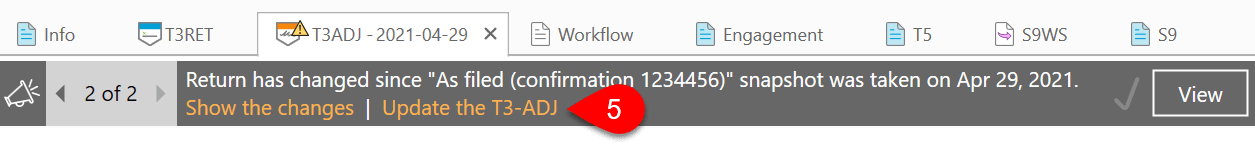

TaxCycle T3 helps you file a T3-ADJ form to adjust a T3 return. If you make changes to a completed T3 return, TaxCycle automatically prompts you to create and file a T3-ADJ form.

This feature is available for tax returns filed from TaxCycle T3 2021 and onward.

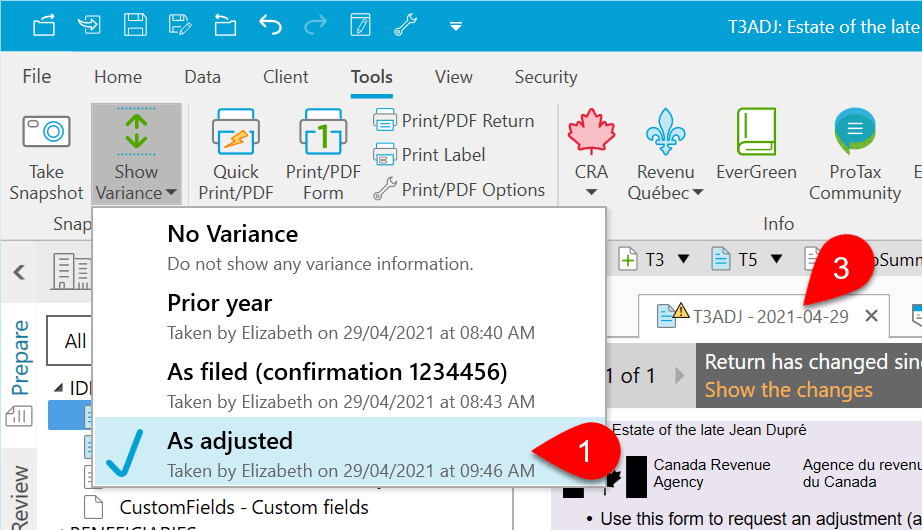

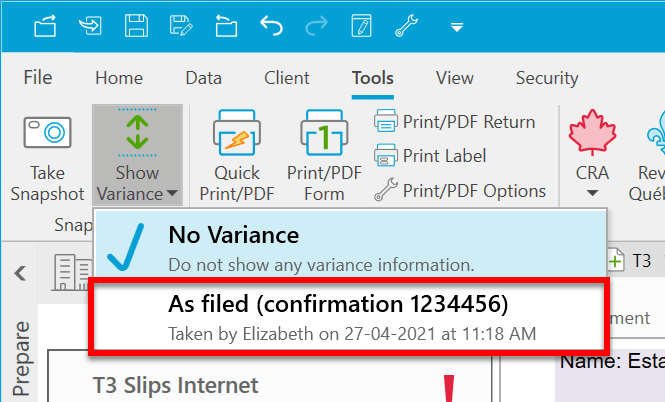

To automatically complete the T3-ADJ form, you must have an As filed snapshot in the file.

TaxCycle automatically creates an As filed snapshot when you successfully transmit a return or print the return for filing on paper.

If you need to create this type of snapshot, see the Snapshots and Variance help topic.

If you need to make another adjustment and need to file another T3-ADJ: