Updated: 2025-03-12

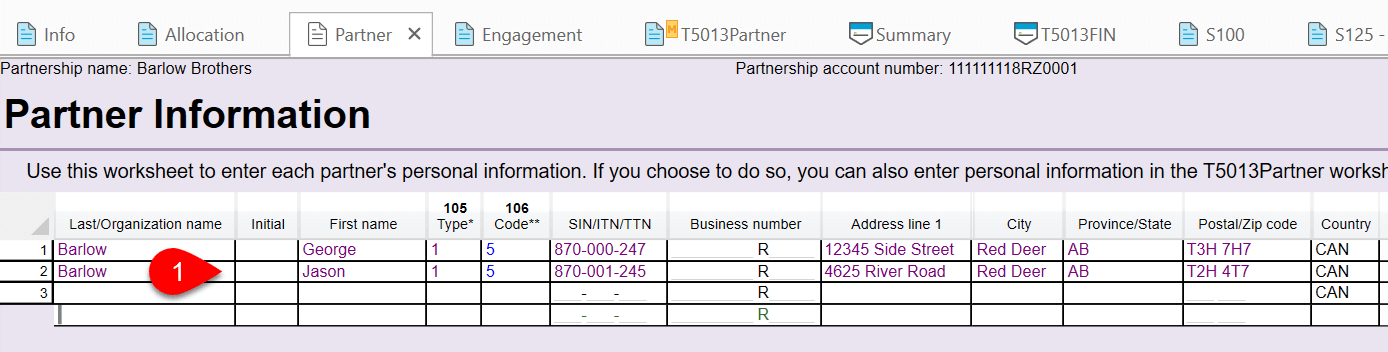

New to preparing partnership returns in TaxCycle? Follow this step-by-step checklist to complete and file the federal T5013 return and slips, as well as Québec TP-600 and RL-15 slips.

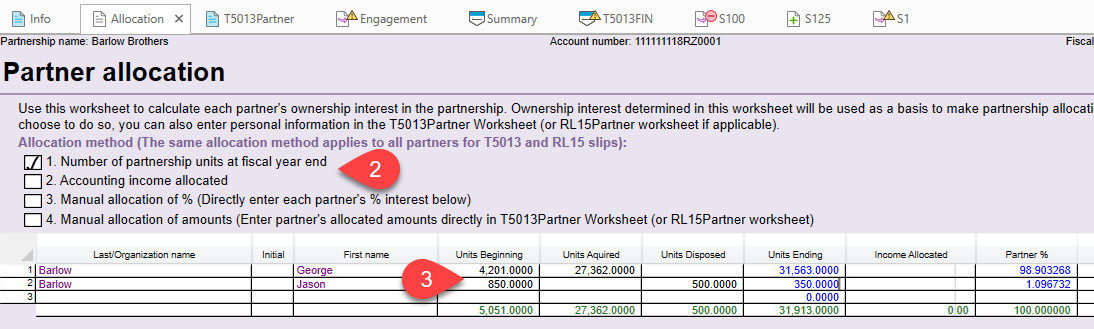

For the federal T5013, complete the following schedules:

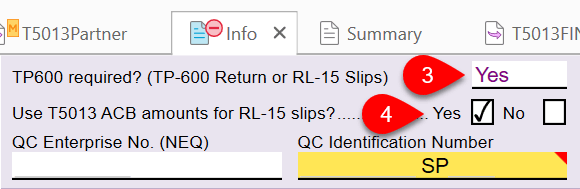

For the Québec TP-600, complete sections 1, 2 and 3 of the TPD Member Corporation’s Shares of Paid-Up Capital. Section 4 calculates automatically from data on the RL-15 slips.

Go to the S8Asset worksheet and enter details of assets owned by the partnership. For more information on completing the S8Asset worksheet and capital cost allowance (CCA) schedule, read the Schedule 8 CCA and Assets help topic.

If the partnership owned foreign property at any time during the fiscal period with a total cost of more than $100,000, complete the T1135 Foreign Income Verification Statement. See the T1135 EFILE help topic to learn about filing this statement.