Updated: 2024-04-09

TaxFolder stores and uses the client’s phone number and email address in a few different places. If you need to update or change this information for a client, it is important to understand where to make the change.

Please review each section on this page to ensure that you make the changes in the correct location.

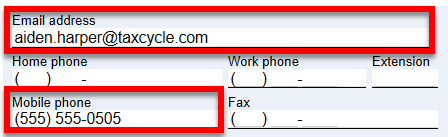

When you create a signature request from TaxCycle, it ALWAYS sends the notifications and verification codes using the email address and mobile phone number in the client’s TaxCycle file. It does this even if the client already has a record in TaxFolder.

Make sure you have the correct email address and mobile phone number for the client on the Info worksheet in TaxCycle:

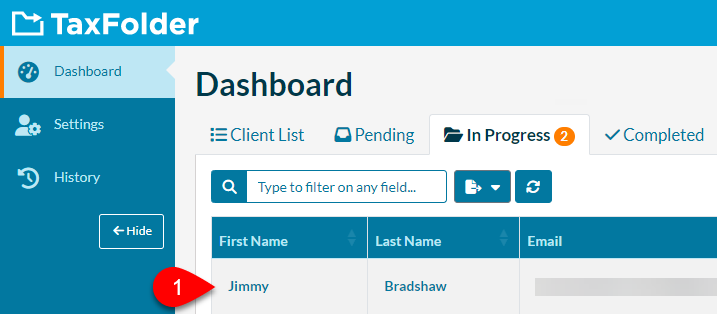

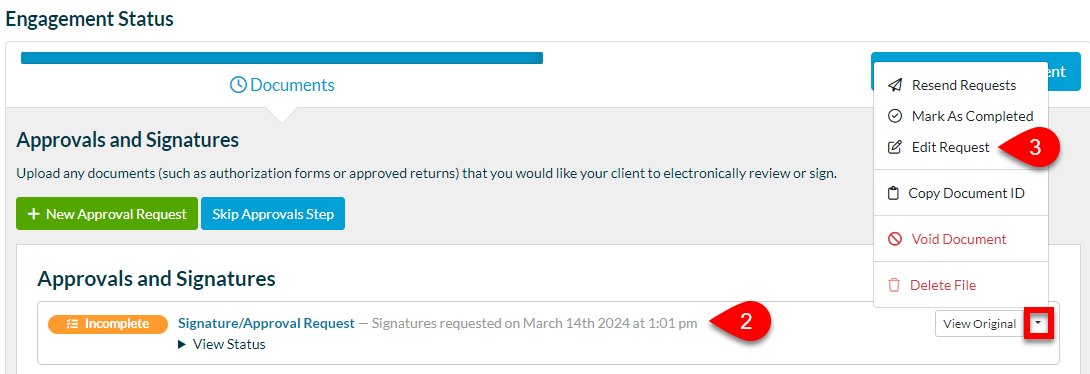

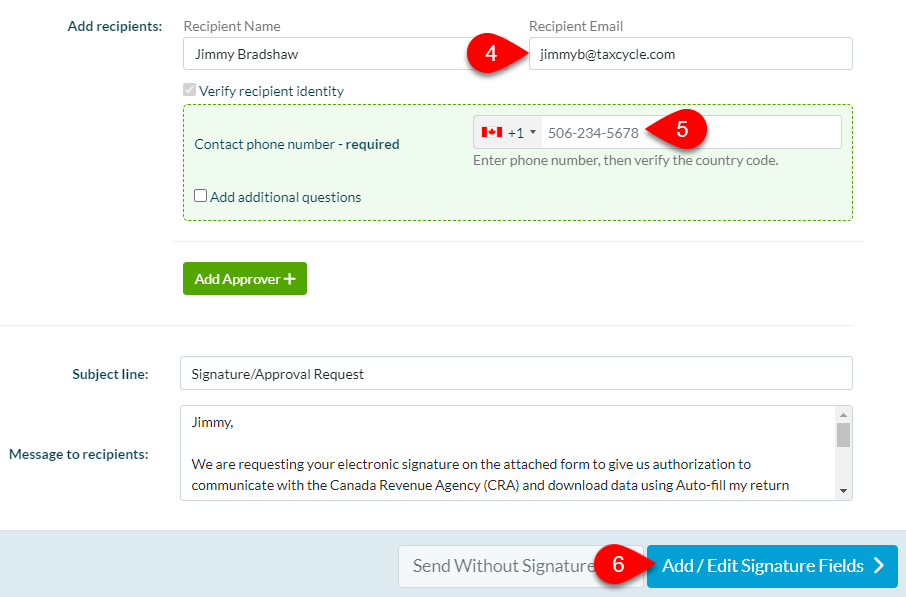

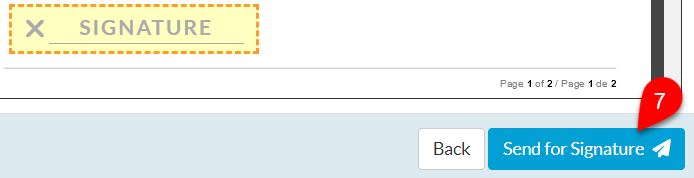

You can change the email address or phone number used for a pending signature or approval request from the TaxFolder engagement. Changing the email address and phone number here DOES NOT affect the client record (see below).

Changing the email address in the TaxCycle file or in the TaxFolder client record does not affect the client’s TaxFolder Account. This is the email address they use to sign in to TaxFolder for uploading and accessing documents.

Your client must change their email address in their TaxCycle Account themselves. If you are changing their email address for sending them documents in TaxFolder, we recommend you advise them to change their email address in their account too to prevent confusion when requesting a password reset.

For instructions on how to change the email address for a TaxCycle Account, please see How to Change the Email Address Associated with Your TaxCycle Account.

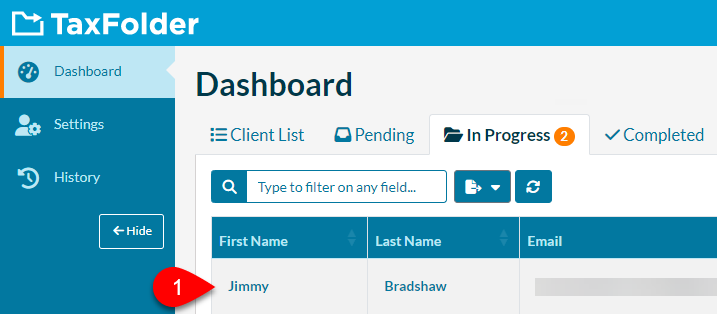

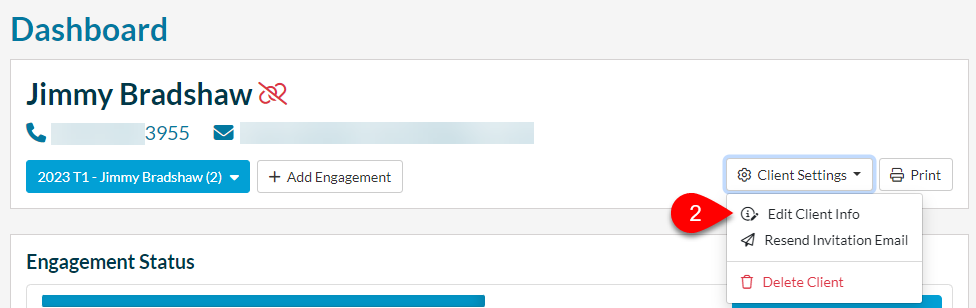

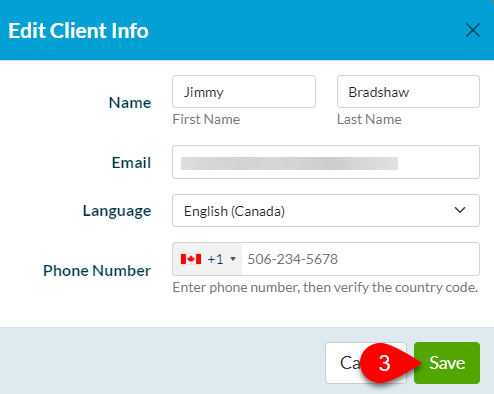

Updating the email address and phone number on the Client Record in TaxFolder will change the email address and phone that appear in the Preparer Dashboard in TaxFolder.

After changing the email address and phone number, TaxFolder will use the updated information for new engagements and approval/signature requests made from TaxFolder. The change will not affect pending signature requests and approvals or new requests made from TaxCycle (see above).