Updated: 2020-07-22

Create a TaxCycle T5 file to prepare T5 slips. Start a file by carrying forward from the prior year, creating a new file from the Start screen. See the Create or carry forward a slips return help topic to learn how to do this.

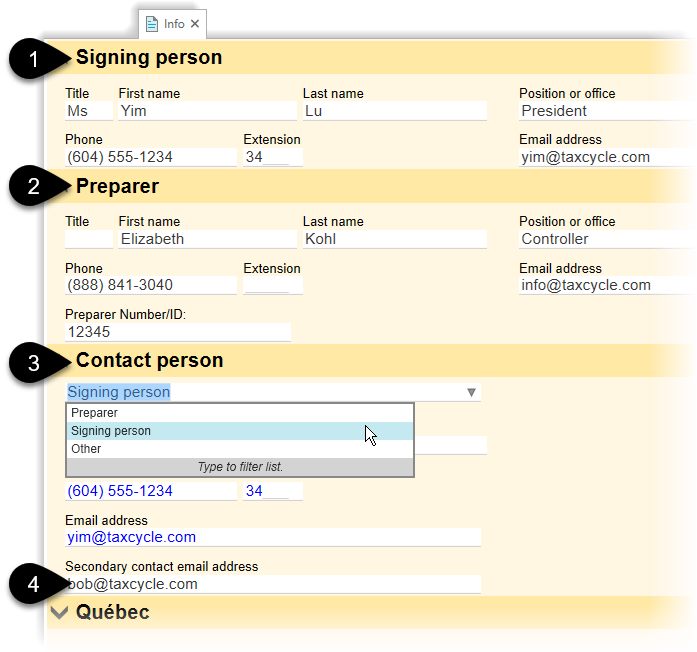

Use the Info worksheet to enter details about the slip issuer, filing information and the default information that appears on slip new slips.

In the Issuer section, enter the business number, and the name and address of the slip issuer. This information appears on the individual T5 slips and the final summary return that is submitted to the CRA.

A check box on the Info worksheet lets you default the city and province for all new slips to the same as the issuer information. This saves you time when preparing individual slips.

Complete the fields in the Filing section to set information for filing the slips and summary.

| Taxation year | This is defaulted to the same year as the slips module you are preparing. However, if you need to prepare slips for a year for which the module is not yet available, you can override this field to prepare them early. |

| Language of correspondence | Choose the language of correspondence of the issuer. |

| Has filed a T5 before? | Answer Yes or No to tell the CRA whether the issuer has filed a T5 before. This is filing information required by the CRA. |

| Default recipient type |

Choose a default recipient type for new slips: Individual; Corporation; Association, trust, club or partnership; Government, government enterprise, or international organization. Any new slips you create will have this recipient type set at the very top of the slip. You can change this on any slip without overriding. |

| Footnote to include on every printed slip | Enter a footnote here to show on all T5 slips. Unlike the per-slip footnotes, this will not be visible in the footnote field on an individual slip, but will appear on the print/PDF copy of the slip. When you have a slip open on screen, scroll down to preview the printed copy. |

| Signing date | Set the signing date of the return. This date flows to the T5Summary. |

| Paper file this return? | Choose Yes to opt for paper filing this return. The CRA strongly encourages you to file over the Internet using Internet file transfer. However, you can still file up to 50 slips on paper. |

| Is this return for an additional T5 Summary? |

Answer Yes if you are preparing more than one T5 return and the returns are for the same filer with the same filer identification number; and for the same year. This reponse flows to the related box on the T5Summary. |

Information in the Transmitter section on the Info worksheet flows from Options. From there, it is used to file the return.

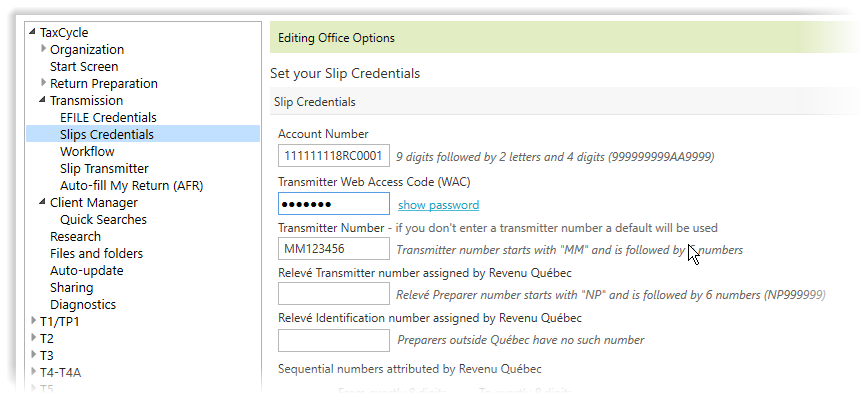

Learn how to set this information on the Slip options help page.