Updated: 2023-02-10

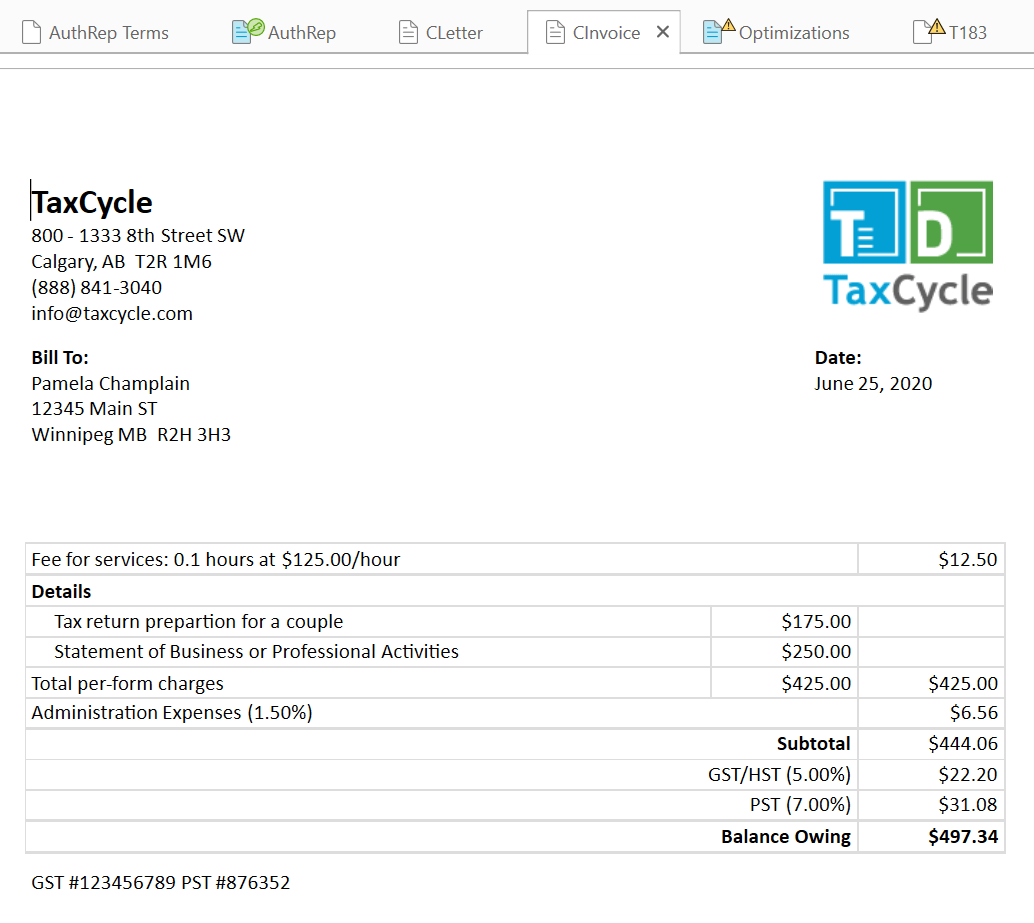

TaxCycle includes invoice templates for sending to your client.

This template uses the same letterhead, signature and logo configured for your client letters. You can also use the Template Editor to modify these invoices, or to copy these and create your own custom template.

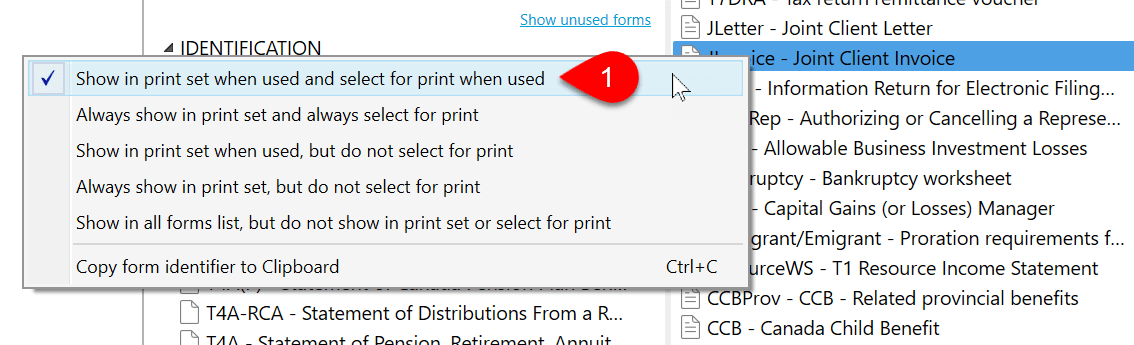

To generate an invoice for your clients:

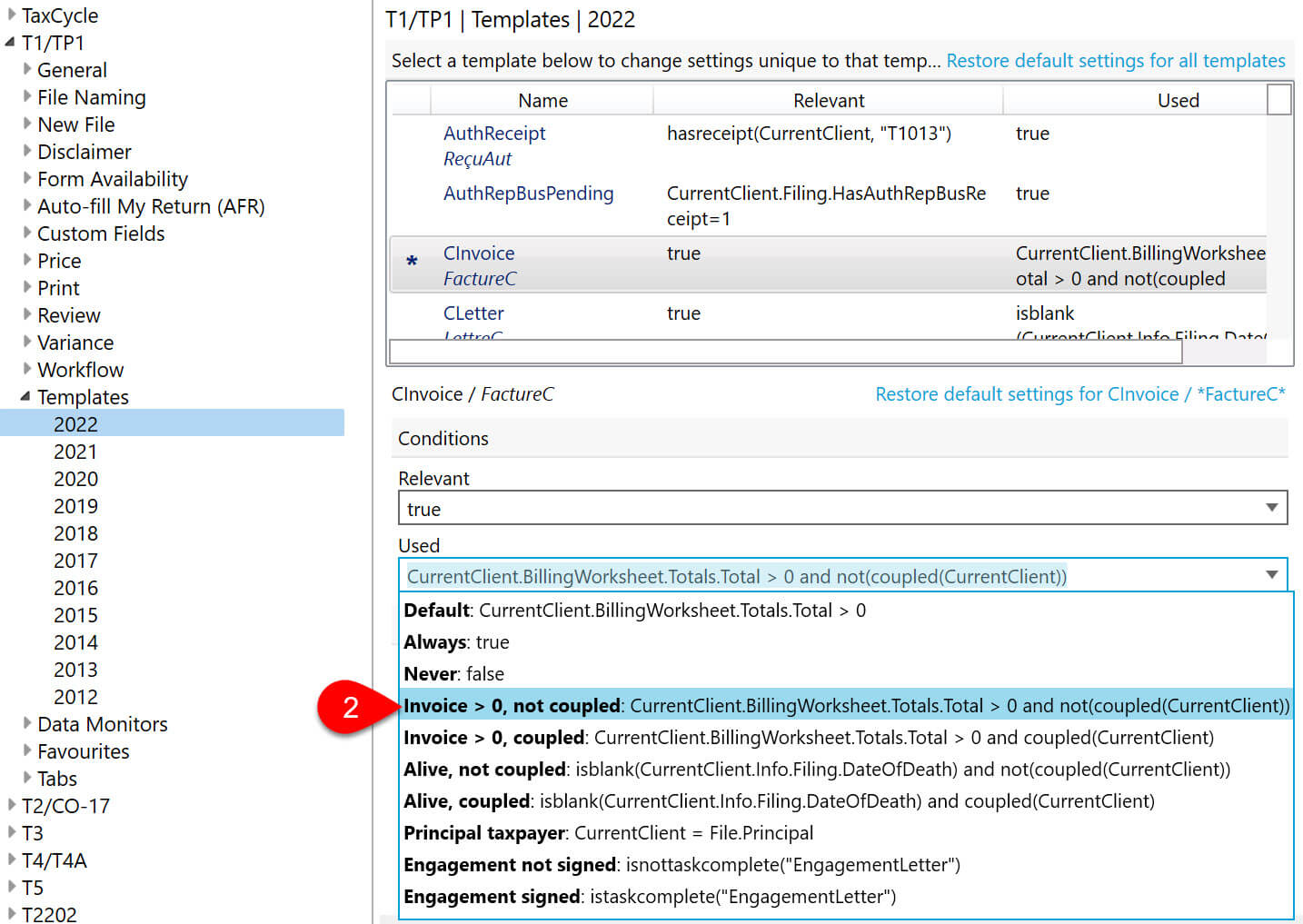

Default settings:

What to change:

CurrentClient.BillingWorksheet.Totals.Total > 0 and not(coupled(CurrentClient))