Updated: 2024-02-20

The Canada Carbon Rebate (CCR) returns the proceeds from the fuel charge to residents of the provinces who use the federal system of carbon pollution pricing.

For the most recent information, see the CRA page Canada Carbon Rebate (CCR).

For 2018 through 2020 tax returns, residents of eligible provinces applied for the Climate Action Oncentive (CAI) as a refundable tax credit on Schedule 14 when preparing their T1 personal tax return. TaxCycle T1 calculated and optimized these payments on the S14 and transferred the amount to line 449 of the T1 jacket. The Optimizations worksheet also included fields to indicate who was claiming the CAI in a coupled return.

For 2021 tax returns, the government changed the program to deliver Climate Action Incentive Payments (CAIP) on a quarterly basis, at the beginning of each quarter. The CRA determines the actual payments for each quarter based on the information they have on file at the time.

In 2024, CRA changed the name to the Canada Carbon Rebate (CCR).

See the Government announces Canada Carbon Rebate amounts for 2024-25 news release from the Department of Finance.

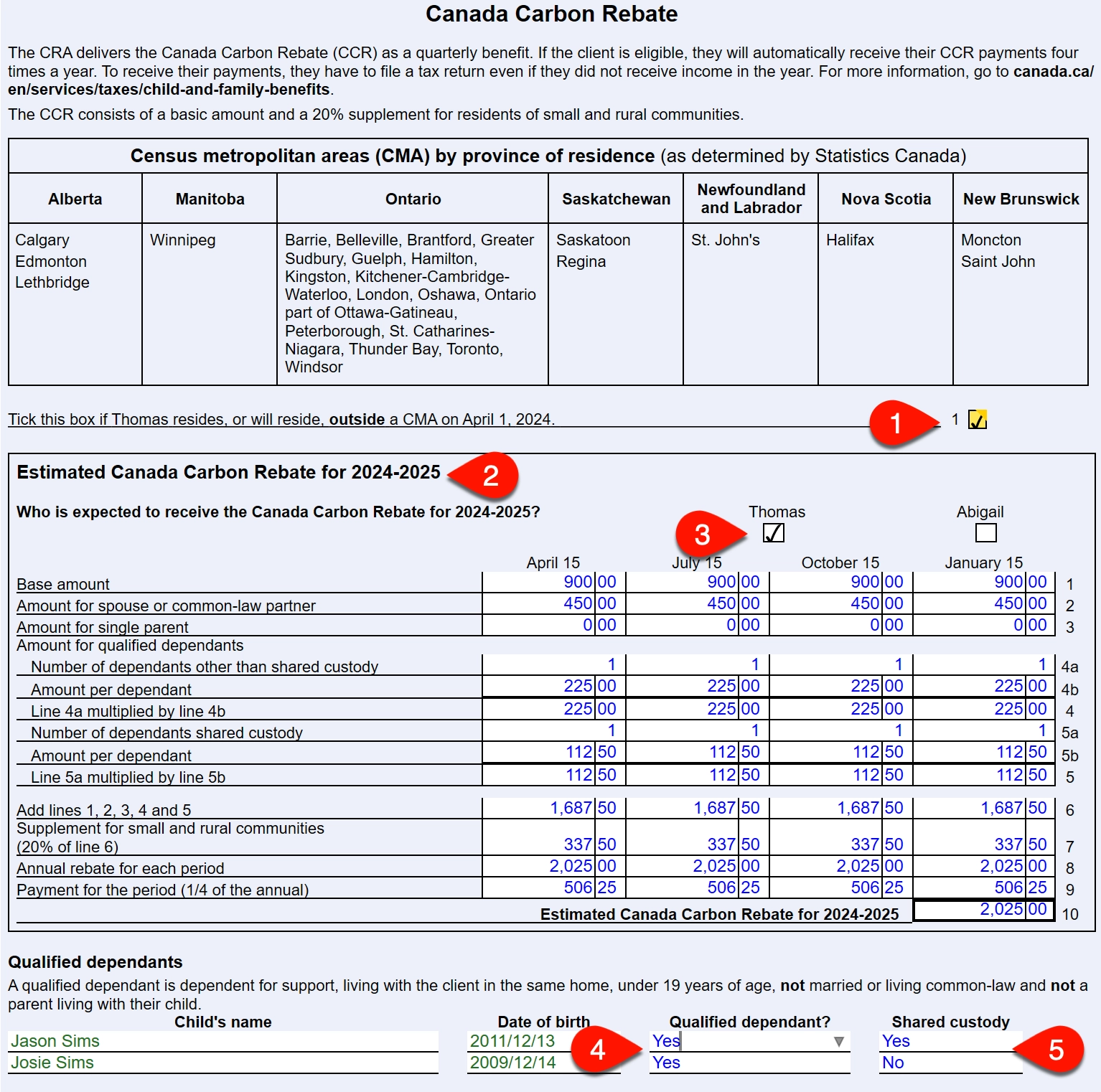

The CCR includes a supplement for residents of small and rural communities. The supplement applies only to residents of Alberta, Saskatchewan, Manitoba, Ontario, Newfoundland and Labrador, New Brunswick and Nova Scotia whose primary residence is outside a Census Metropolitan Area (CMA). This supplement increases the baseline amount by 20%.

All CCR recipients of Prince Edward Island are eligible for the rural supplement and it is included in their basic amount.

For the purpose of the supplement for residents of small and rural communities, individuals must have resided outside of CMA on December 31 of the tax year, and they must expect to continue to reside outside the same CMA on April 1 of the following year.

For a full list and map to help confirm whether a person resides in a CMA, visit the CRA’s page Find out if you qualify for the supplement for residents of small and rural communities or call 1-800-959-8281.

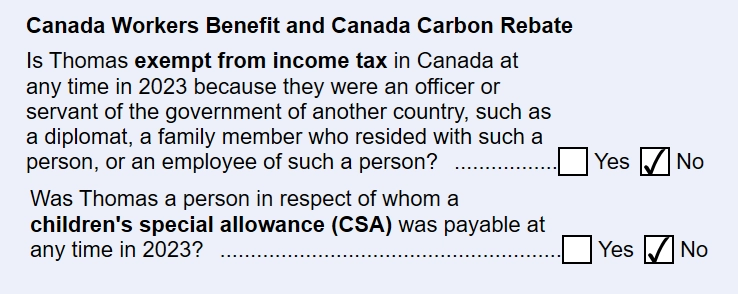

If the taxpayer is a resident of one of the applicable provinces, additional questions appear in the Credits section on the Info worksheet. These questions must be completed to determine the eligibility of the taxpayer and spouse to claim the CCR.

TaxCycle automatically activates the Climate worksheet for residents of the applicable provinces.