Updated: 2023-03-31

Disability Amount Transfer From a Dependant

TaxCycle can automatically calculate and claim a transfer of the disability amount from a dependant, if you complete a full return for the dependant within a family return (learn how to do this in the Dependant and Family Returns help topic). Otherwise, you will need to enter information directly on the Dep worksheet in the supporting taxpayer's return.

New Canada Caregiver Credit (CCC)

For 2017, the new Canada caregiver credit (CCC) replaces three previous credits: the caregiver credit, the family caregiver credit, and the credit for infirm dependants age 18 or older. However, unlike the previous caregiver credit, it does not apply to people supporting a parent or grandparent, who is 65 years of age or older, living with them, and who does not have a physical or mental impairment. For full details on eligibility for the CCC, read the topic Canada caregiver credit on the CRA's website.

Preparing a Full Return for the Dependant?

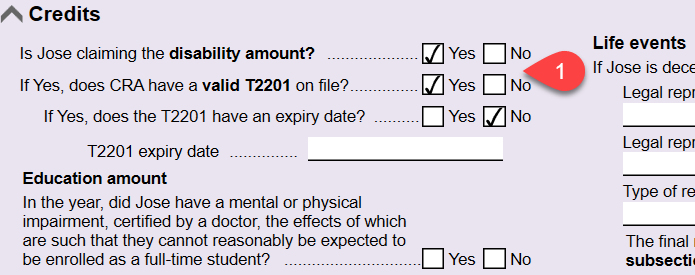

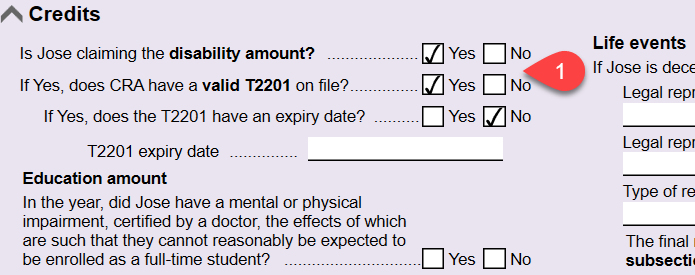

- If you are preparing a full return for the dependant, complete the Info worksheet in the dependant's return. Pay special attention to the disability-related questions in the Credits section on the worksheet, including whether there is a valid T2201 on file and its expiry date. These flow to the Dep worksheet in the supporting taxpayer's return.

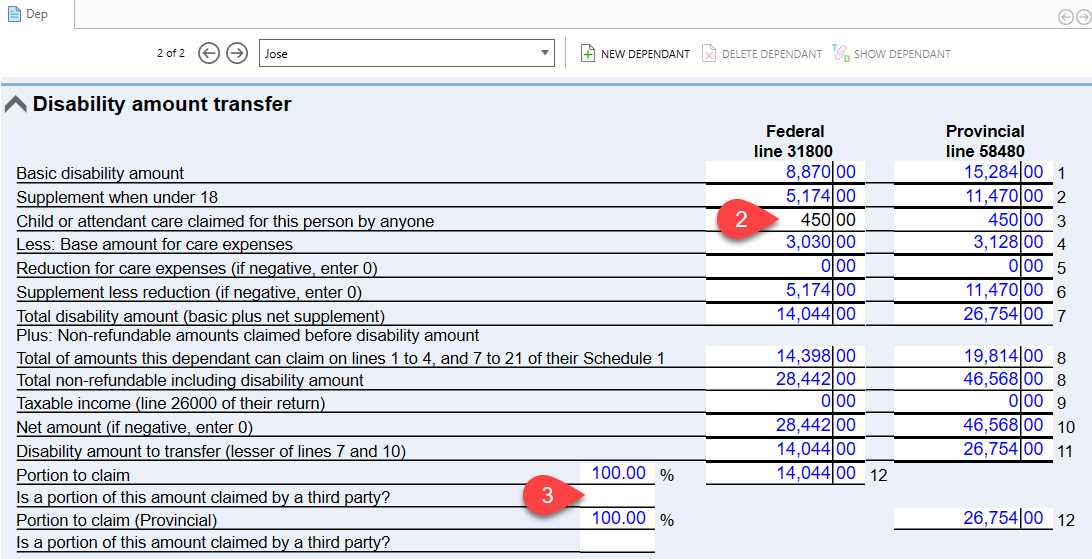

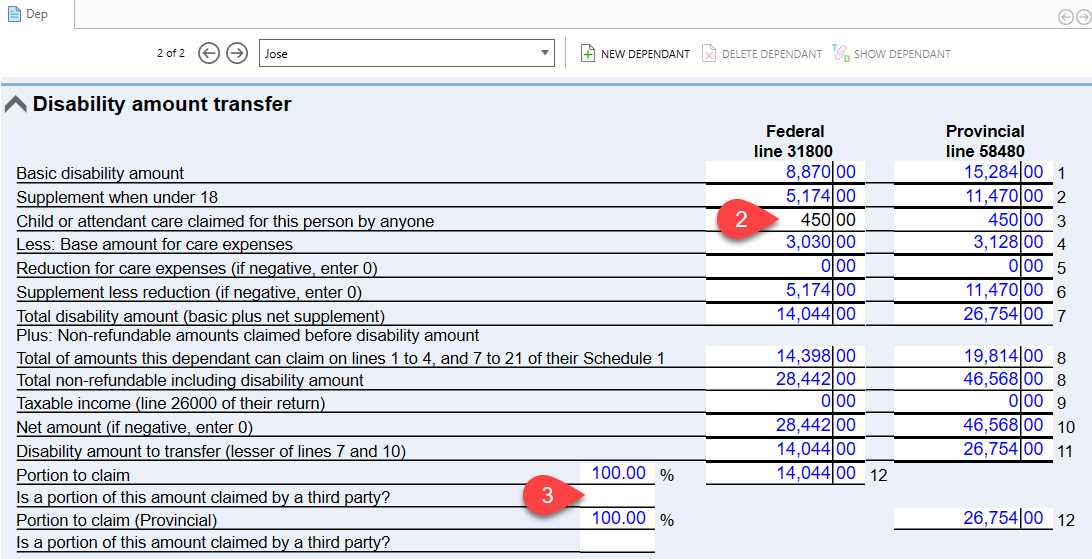

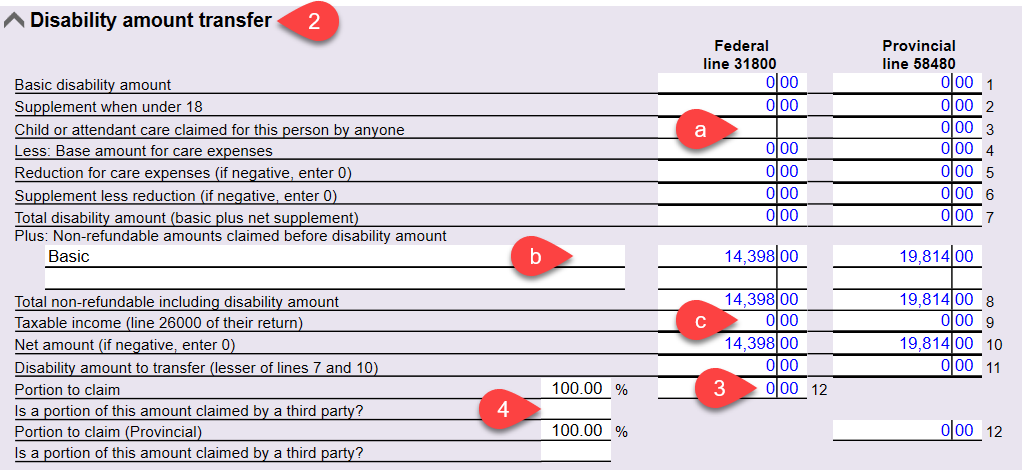

- On the Dep worksheet in the supporting taxpayer's return, review the Disability amount transfer section. Most amounts will transfer from the dependant return, such as taxable income. Remember to enter any Child or attendant care claimed for this person by anyone for the dependant.

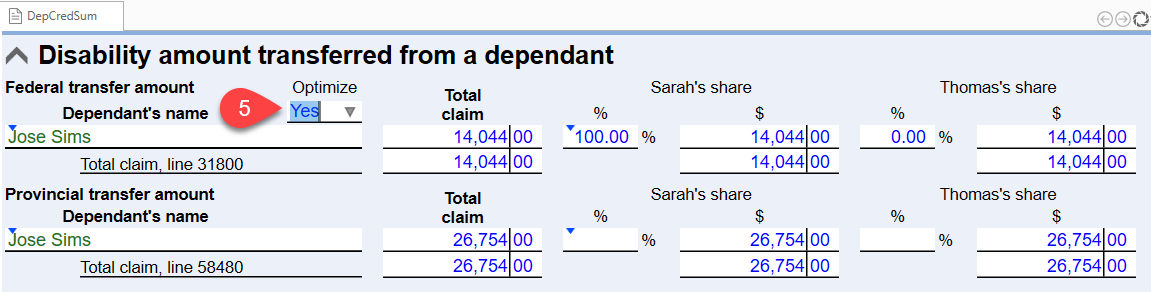

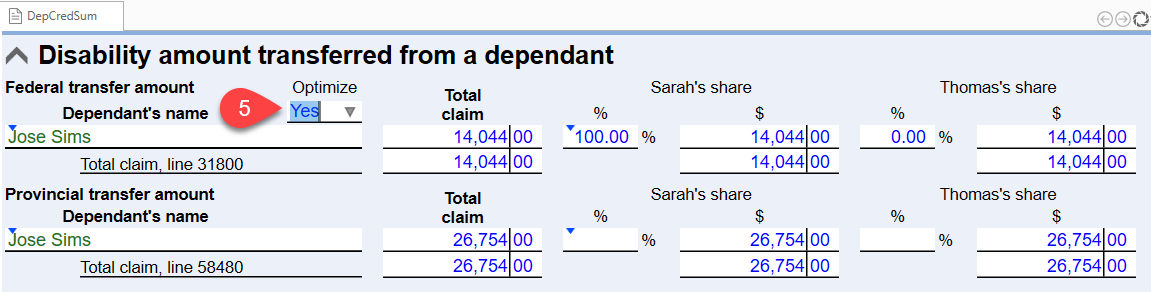

- In coupled returns, these amounts may be optimized so that either the principal taxpayer or the spouse claims a portion and not the entire amount. You can see the way they are divided between spouses on the DepCredSum worksheet. If your clients prefer that it all be applied to one person, override the Optimize drop-down by entering No on that worksheet. The percent fields will then become editable so that you can assign the full amount to one person. (You will need to sign off on this override before filing the return.)

Need to Enter Just the Amounts? (Not Preparing a Full Return for the Dependant?)

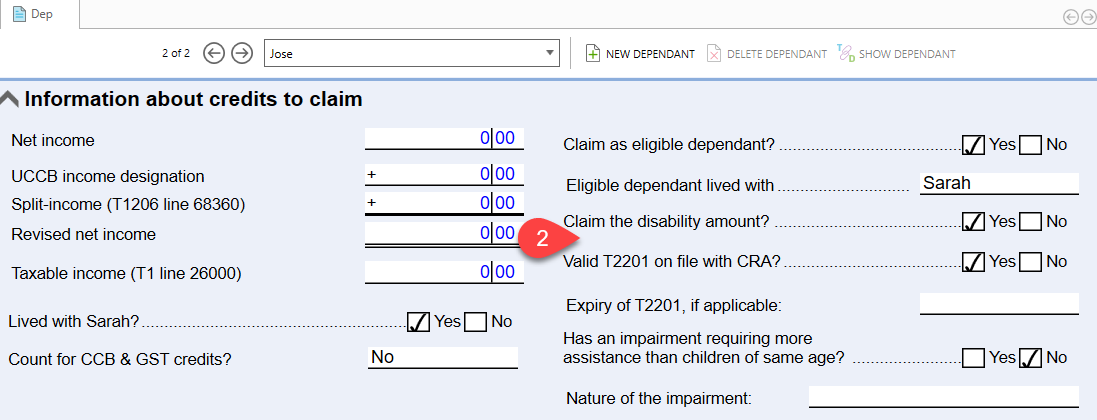

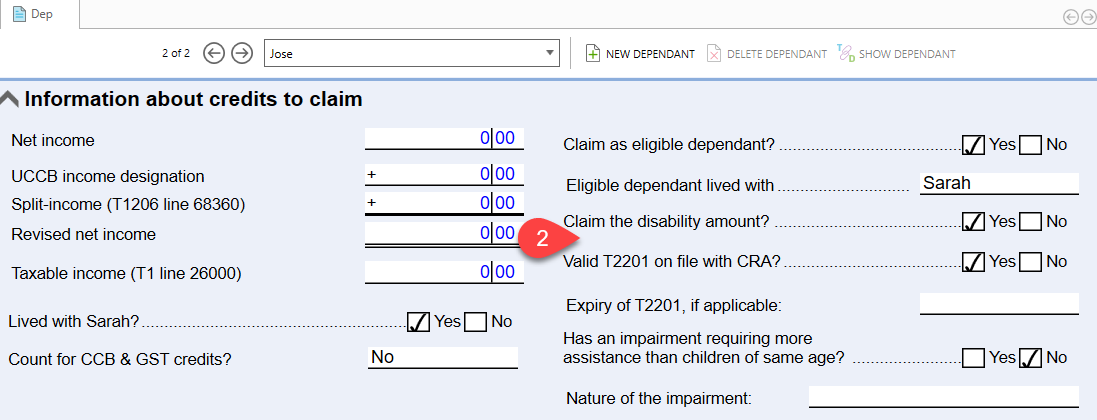

- If you are not preparing a full return for the dependant, complete this information on the Dep worksheet. In the Information about credits to claim section near the top of the worksheet, check the boxes related to disability and impairment of the dependant that apply: whether to claim the disability amount for the dependant, whether there is a valid T2201 on file and its expiry date, etc.

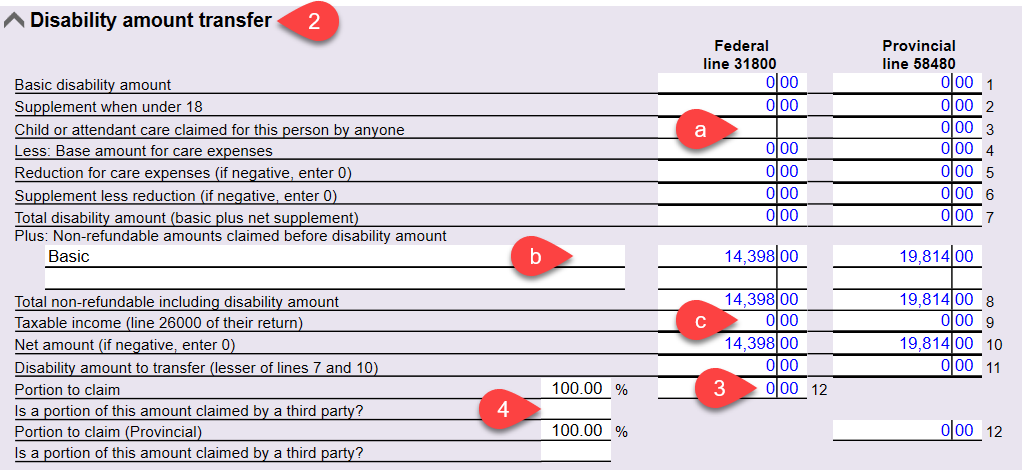

- On the Dep worksheet, review the Disability amount transfer section:

- Enter any Child or attendant care claimed for this person by anyone for the dependant.

- Select the applicable Non-refundable amounts that the dependant claimed. TaxCycle fills in the Basic amount when you select it. Each time you select and enter an amount, TaxCycle adds another line for a new credit.

- Enter the Taxable income from line 2600 of the dependant's return.

- The provincial and federal amounts claimed appear on line 12.

- In coupled returns, these may be optimized so that either the principal taxpayer or the spouse claims a portion and not the entire amount.

- You can see the way they are divided between spouses on the DepCredSum worksheet. If your clients prefer that it all be applied to one person, override the Optimize drop-down by entering No on that worksheet. The percent fields will then become editable so that you can assign the full amount to one person. (You will need to sign off on this override before filing the return.)

EFILE and the Disability Tax Credit

The CRA will accept a return submitted through EFILE that includes the disability amount (for the taxpayer or a transfer from a spouse or dependant) even if there is no valid T2201 on file with the CRA.

However, you will notice the following extra text within the acceptance message:

There is no approved Form T2201, Disability Tax Credit Certificate on record for this taxpayer with the Canada Revenue Agency for this tax year. The claim for the disability amount will be reviewed before we assess this return. This may cause delays.

The CRA may contact the preparer, or the client, if no T2201 can be found, either on file or in processing. If your client has only recently obtained the necessary T2201 from their doctor, be sure to have it sent to the CRA as soon as possible. The return will not be processed until the T2201 has been received but may be adjusted to exclude the claim if the T2201 is not received in a timely manner.