Updated: 2025-07-15

TaxCycle is certified by the Canada Revenue Agency (CRA) for the Express NOA service. This service allows preparers to view the result of an assessment immediately after filing a return (if available).

The notice of assessment provides an account summary with the result of the assessed return showing a refund, a zero balance, or a balance owing, tax assessment summary, explanation of changes and other information, and RRSP/PRPP deduction limit statement. It may also contain the Home Buyers’ Plan statement and Lifelong Learning Plan statement. This is the full notice of assessment or reassessment that your client would normally receive by mail, or through their My Account online mail.

To learn more about the Express NOA service, see the CRA's page about Express NOA.

Authorization to Use Express NOA

To use the Express NOA service as an authorized representative, you must:

When a Taxpayer Chooses Express NOA...

- The CRA will not send a paper copy of the notice of assessment or reassessment to either the taxpayer or the preparer.

- If the taxpayer is registered to receive online mail, the notice of assessment will be made available electronically to the electronic filer and the taxpayer will receive an email notification to inform them that there is online mail available to view in My Account.

- If the taxpayer is getting a tax refund and they have not signed up for direct deposit, the notice will be made available to the electronic filer and the refund cheque will be mailed to the taxpayer. (If the return is being discounted, the refund and notice of assessment will be sent to the discounter.)

- This authorization is valid for current tax year re/assessments only, and will not affect all other correspondence.

- Be aware that tax returns that are filed electronically are assessed so quickly that any payments sent in with the tax return are not likely to show up on the notice of assessment. This means that the payment would also not show up in the Express NOA service.

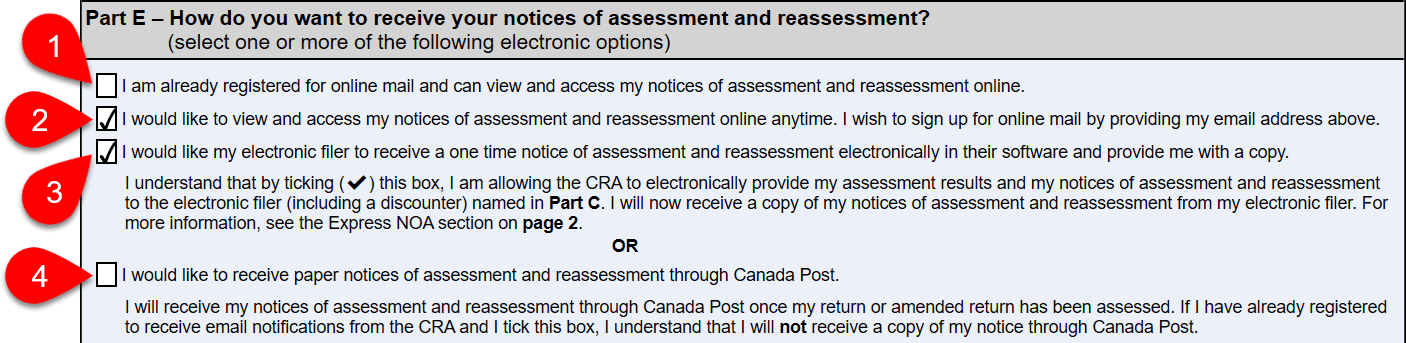

Express NOA on the T183

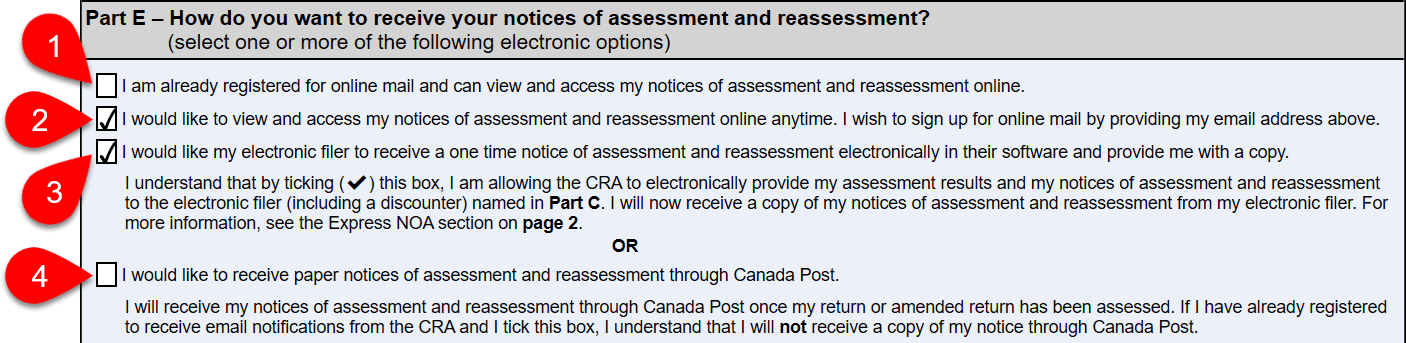

This section allows the taxpayer to indicate how they wish to receive their notices of assessment and reassessment and register for online mail.

You must make at least one selection from the following options:

- If the taxpayer is already registered for online mail, their notice of re/assessment, and any future correspondence eligible for online delivery are currently not printed and mailed to them. Auto-fill my return (AFR) data includes a flag to indicate whether a taxpayer is registered for online mail. You cannot choose “already registered for online mail” and “receive paper copies by Canada Post.” Selecting both triggers a review message in TaxCycle.

- Sign up to receive online mail flows the taxpayer’s email address on the Info worksheet to the T183 form. They will receive an email when mail is waiting for to them—such as their notice of assessment—and will then need to log in to the CRA My Account for Individuals to view it. They will no longer receive their notice of re/assessment, and any future correspondence eligible for online delivery by paper mail. You cannot sign a taxpayer up for online mail and check the box for them to receive paper copies by Canada Post. TaxCycle will show a warning message if you do so.

- Authorize the electronic filer/preparer to collect the taxpayer’s notice of assessment in their software using Express NOA. If a taxpayer chooses Express NOA:

- The CRA will not send the taxpayer a paper copy of the notice of assessment or reassessment.

- If the taxpayer is registered to receive online mail, the notice of assessment is made available electronically to the electronic filer and the taxpayer will receive an email notification to inform them that online mail is available to view in My Account. (We recommend the taxpayer be registered for online mail if you make this selection.)

- If the taxpayer is getting a tax refund and they have not signed up for direct deposit, the notice is made available to the electronic filer and the refund cheque will be mailed to the taxpayer. (If the return is being discounted, the refund and notice of assessment will be sent to the discounter.)

- This authorization is valid for current tax year re/assessments only, and will not affect all other correspondence.

- Receive paper copies by letter mail. You cannot select this option if the taxpayer is registered or registering for online mail. TaxCycle will show a warning message if you do so.

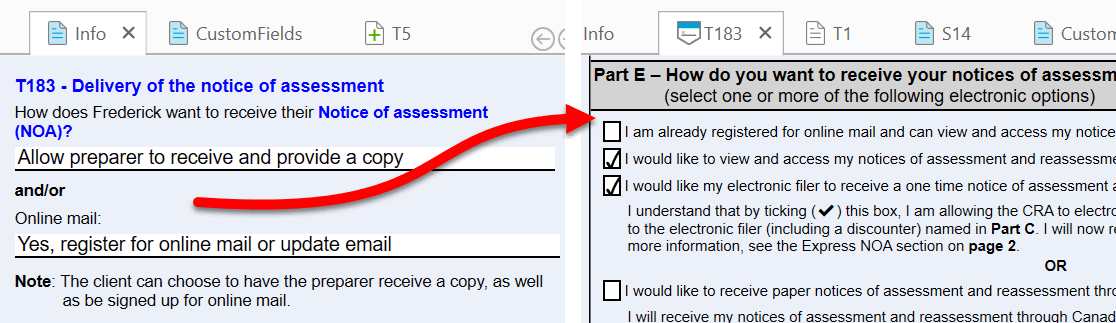

Default Options Online Mail and NOA

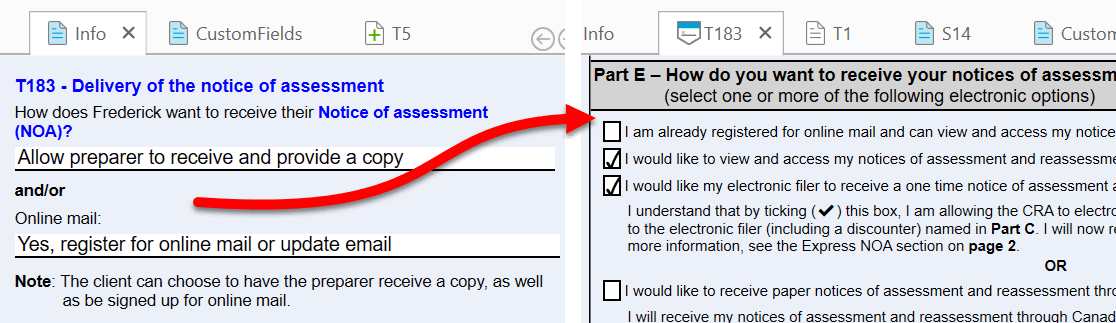

The questions in Part E of the T183 share their responses in the Filing section of the Info worksheet. If you change the answers on the Info worksheet, they are reflected on the T183 and vice-versa:

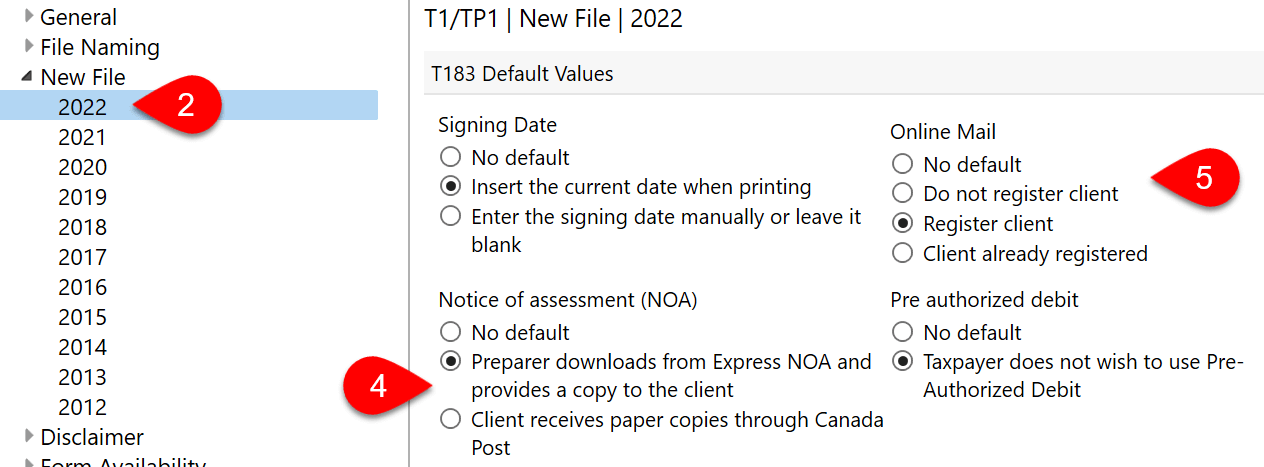

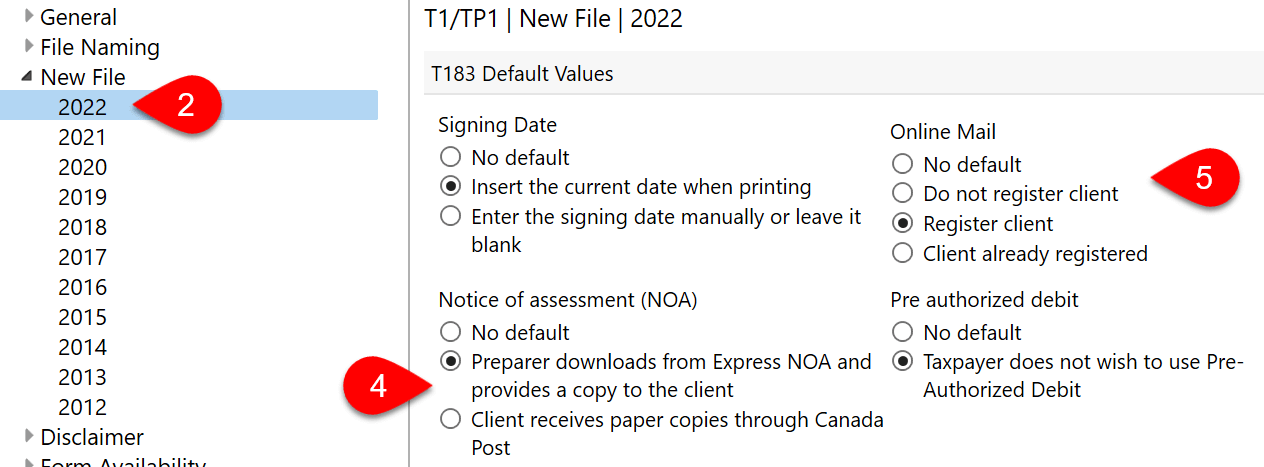

You can set default values for these fields in New File options:

- To open options, go to the File menu, then Options. Or, if you are on the Start screen, click Options in the blue bar on the left.

- On the left, expand T1/TP1 and click on New File to apply the settings to all years. To set different options for a specific year, expand the section and click on a year.

- On the right, scroll down to the T183 Default Values section.

- Under Notice of assessment (NOA), choose whether the preparer will download the notice of assessment or whether the client will receive the paper copy from Canada Post. If you choose No default, you must make this selection in each file.

- Under Online Mail, choose whether to register the client, do not register the client, or whether to mark the client as already registered. If you choose No default, you must make this selection in each file.

Download a Notice of Assessment

After successfully filing a T1 return:

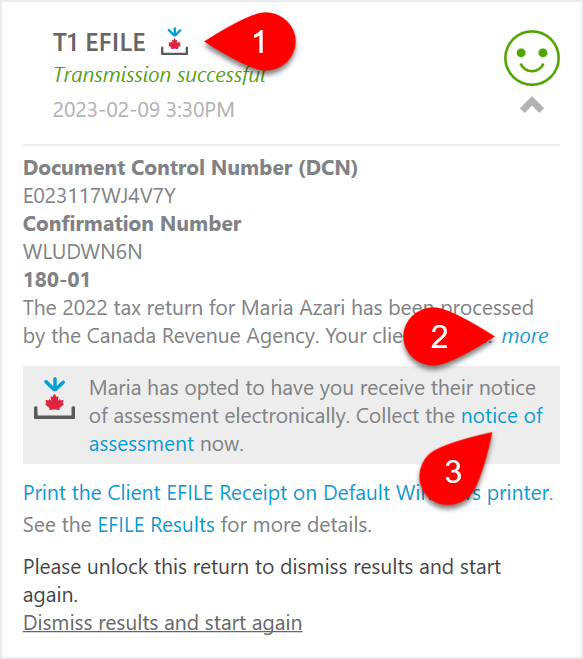

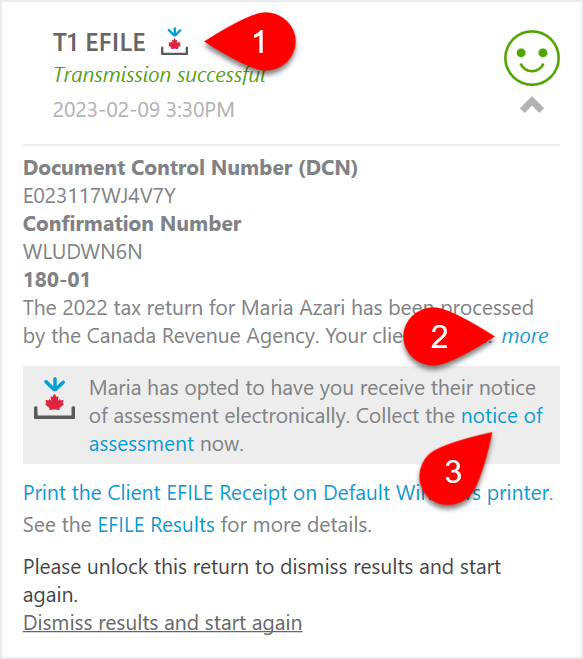

- If the response from the CRA says that a NOA will be made available, TaxCycle displays an additional icon and message in the T1 EFILE box in the Transmit sidebar.

- Click the more link to see the full message from the CRA.

- Click the link in the grey box to collect the notice of assessment.

- TaxCycle also displays a bulletin across the top of the form to remind you that an assessment may be available.

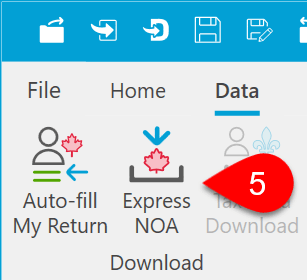

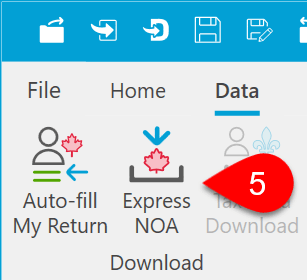

- If you don't see the link, click the Express NOA button in the Data menu.

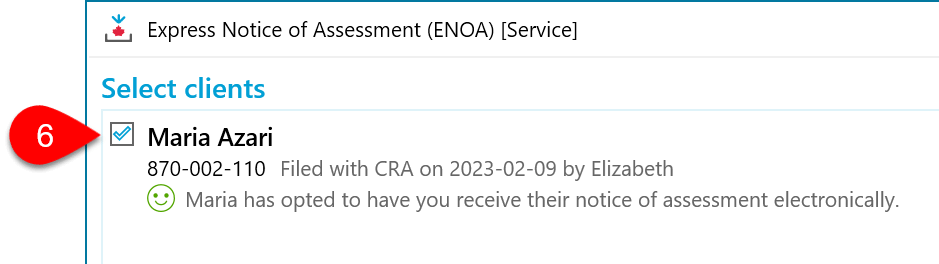

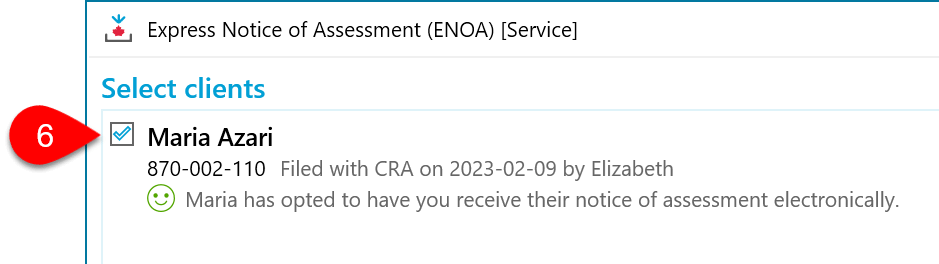

- In the Express NOA dialog box, select the clients for whom to download the assessment information. Providing you have authorization from each taxpayer, you can request assessments for up to ten people at the same time, as long as all of them have returns in the same TaxCycle file.

- Click Next to launch your web browser and connect to the CRA.

- The CRA Login page will display. Enter your CRA User ID and Password and click Login.

- The Express NOA request confirmation page will display, listing the SIN for each requested taxpayer. Click Next.

- The CRA page to log into the tax information web service will display. Choose your usual option—Sign-In Partner or CRA user ID and password—for accessing Represent a Client and enter your credentials.

- The request confirmation page will display, listing the SIN for each requested taxpayer. Click Next.

- As the download begins, a message displays to prompt you to close your browser window or tab. If you intend to return to download more information within the next few minutes (your login will remain open for 18 minutes), you do not need to log out. If you are done with downloads for the time being, click the link to logout from CRA before you close the window.

- After you close the window, you will return to the Express NOA dialog box and any notices of re/assessment will appear there.

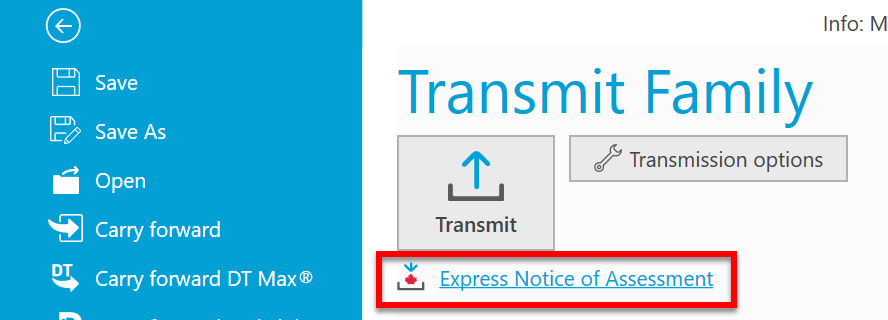

Express NOA after Family Transmit

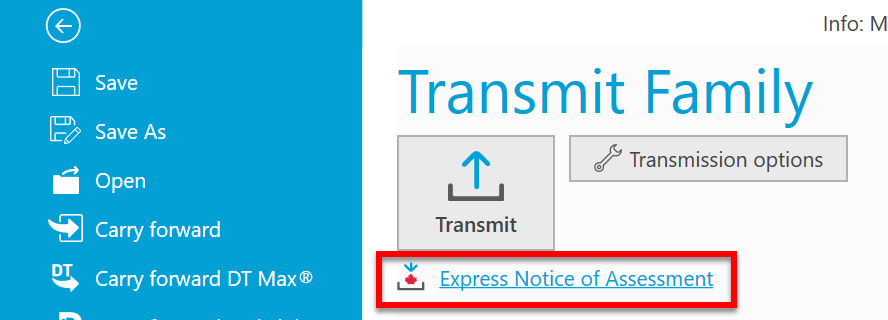

If you use Transmit Family to file all family members' returns at the same time, you can launch the Express NOA process from that screen to check for assessment results. Click the Express Notice of Assessment link under the Transmit button to launch the process.

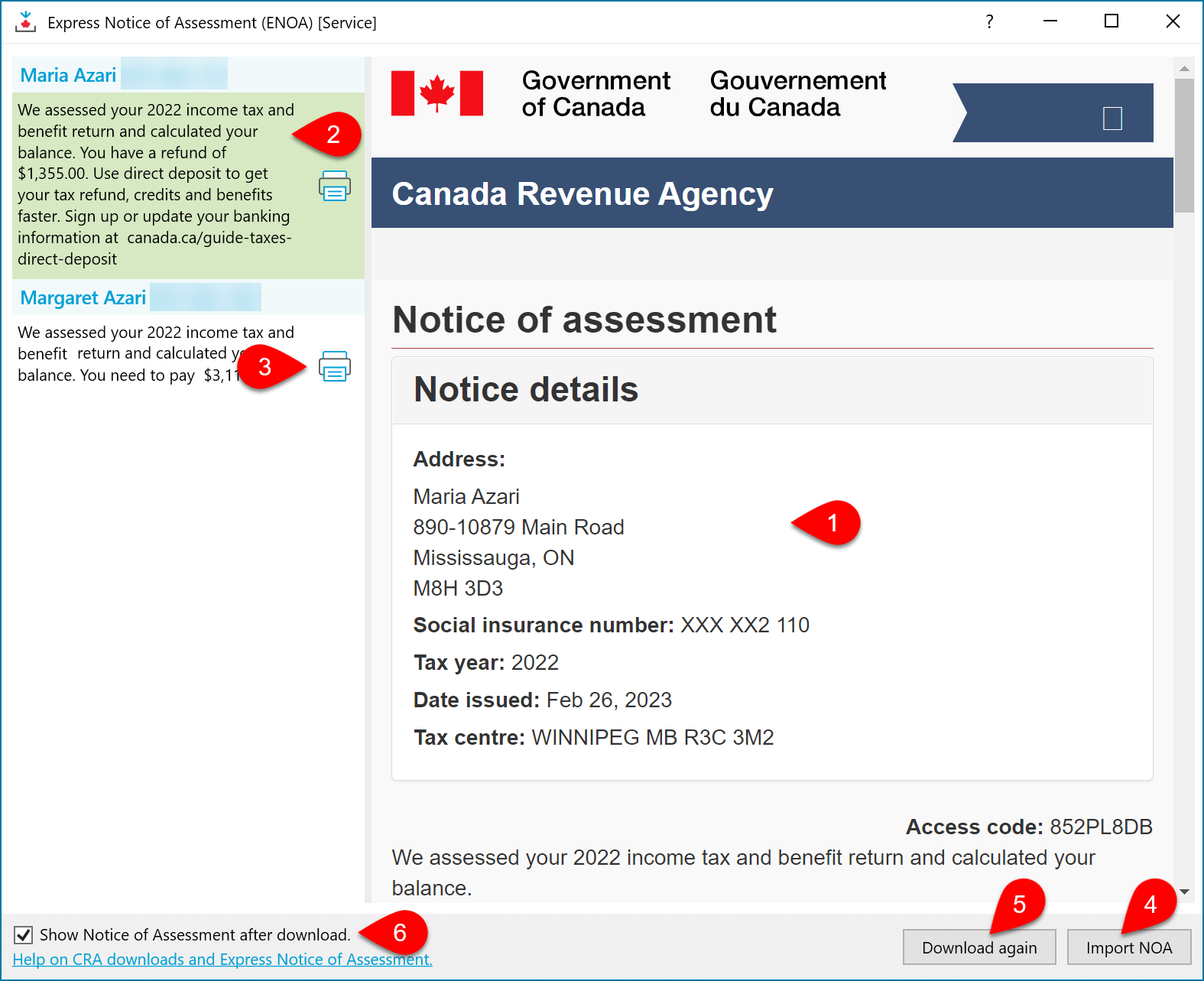

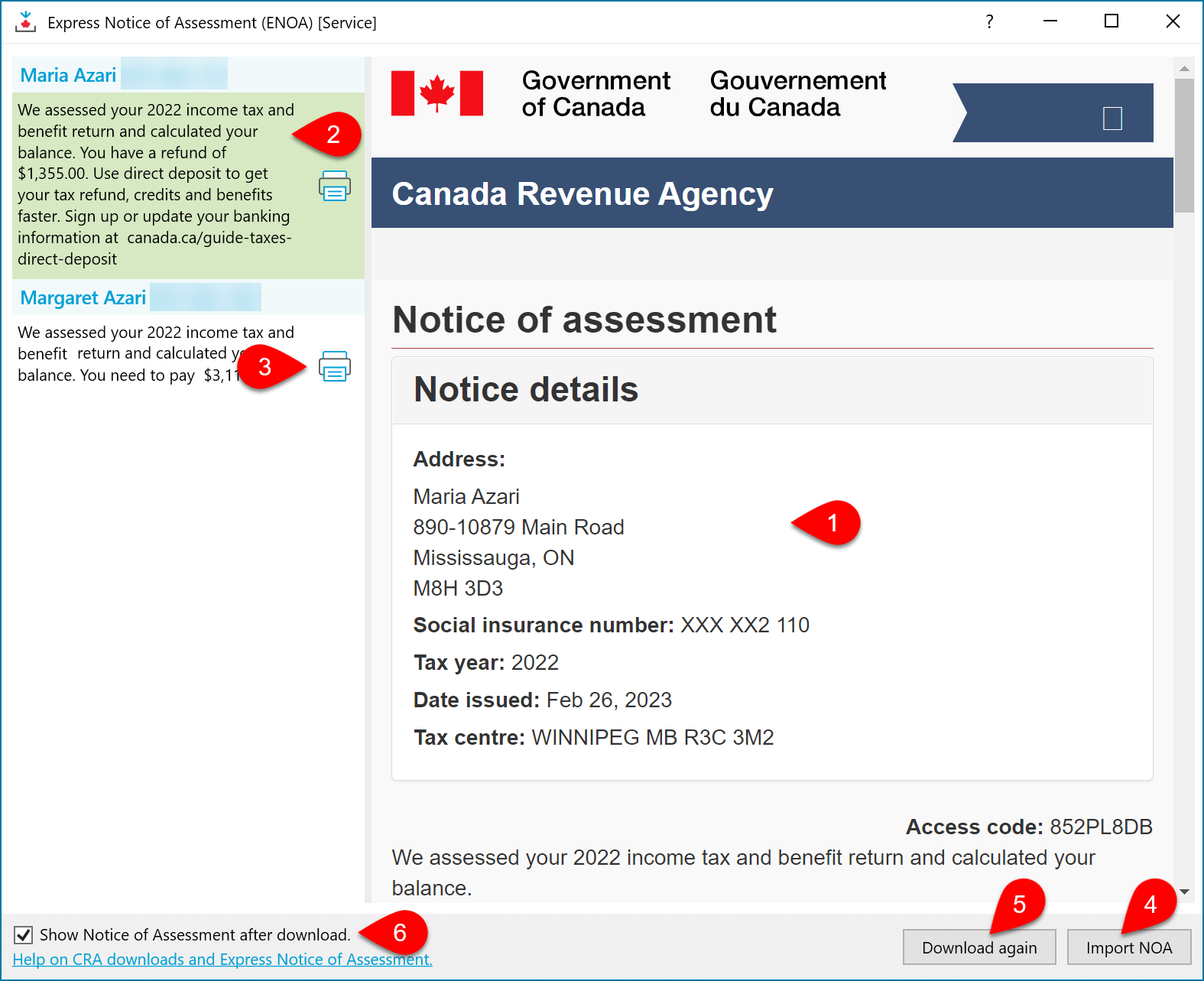

Results of an Express NOA Download

- After downloading, you will return to the Express NOA dialog box and see the downloaded notice(s) of assessment.

- Each taxpayer's results appear separately. If you're downloading assessments for multiple family members, click on a message on the left side of the window to view their assessment message or notice of assessment on the right.

- Click the Print button to print a NOA.

- Click Import NOA to bring the downloaded data into the file, on the ExpressNOA worksheet and the NOA form.

- Click the Download Again button to return to the start of the download process. Assessment information is not usually updated throughout the day. To check for new information, try again the following day.

- Check the Show Notice of Assessment after download box, to automatically open this ExpressNOA worksheet after you close the window. For more information on the worksheet, see the "Express NOA worksheet" section, below.

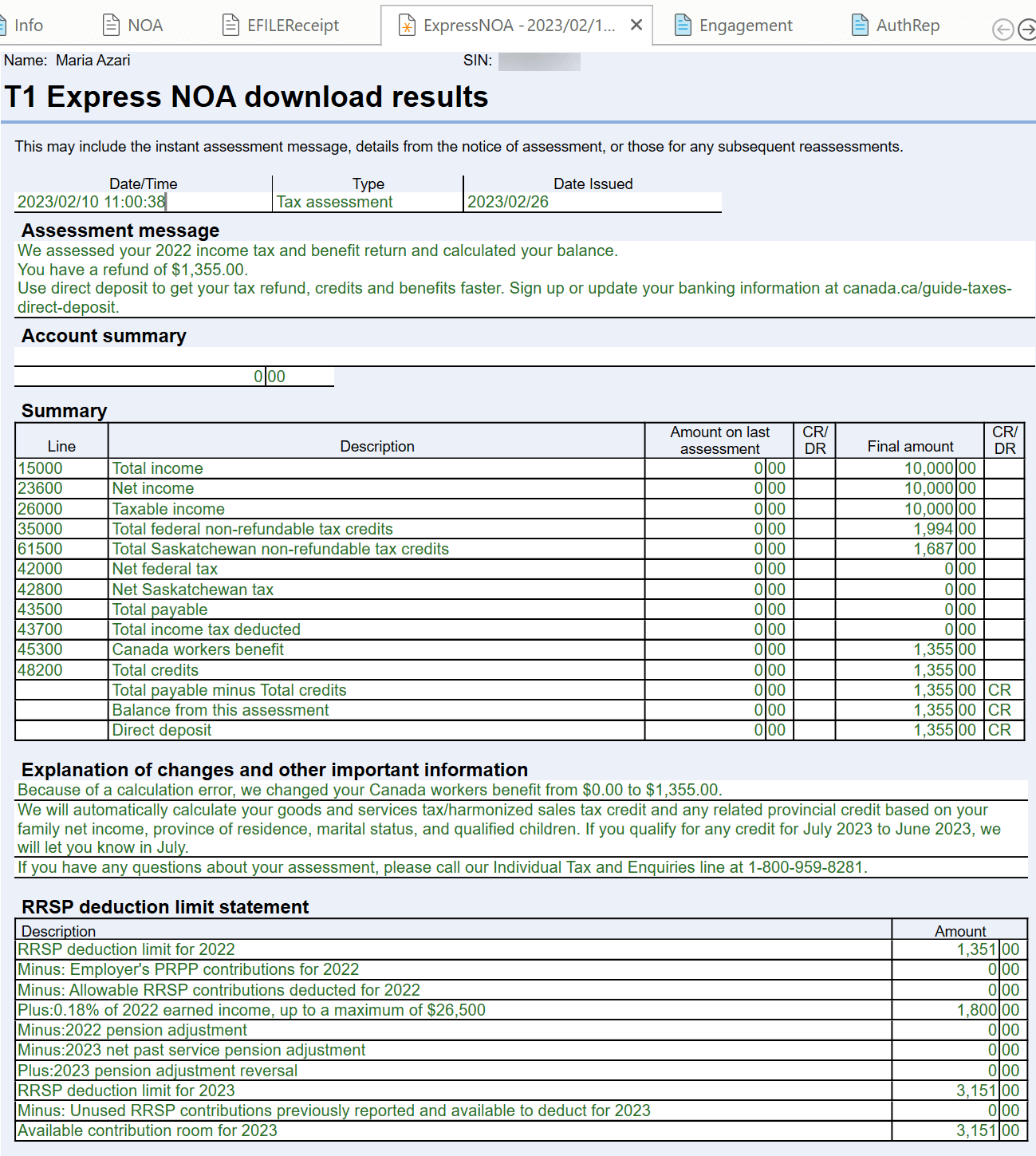

ExpressNOA Worksheet

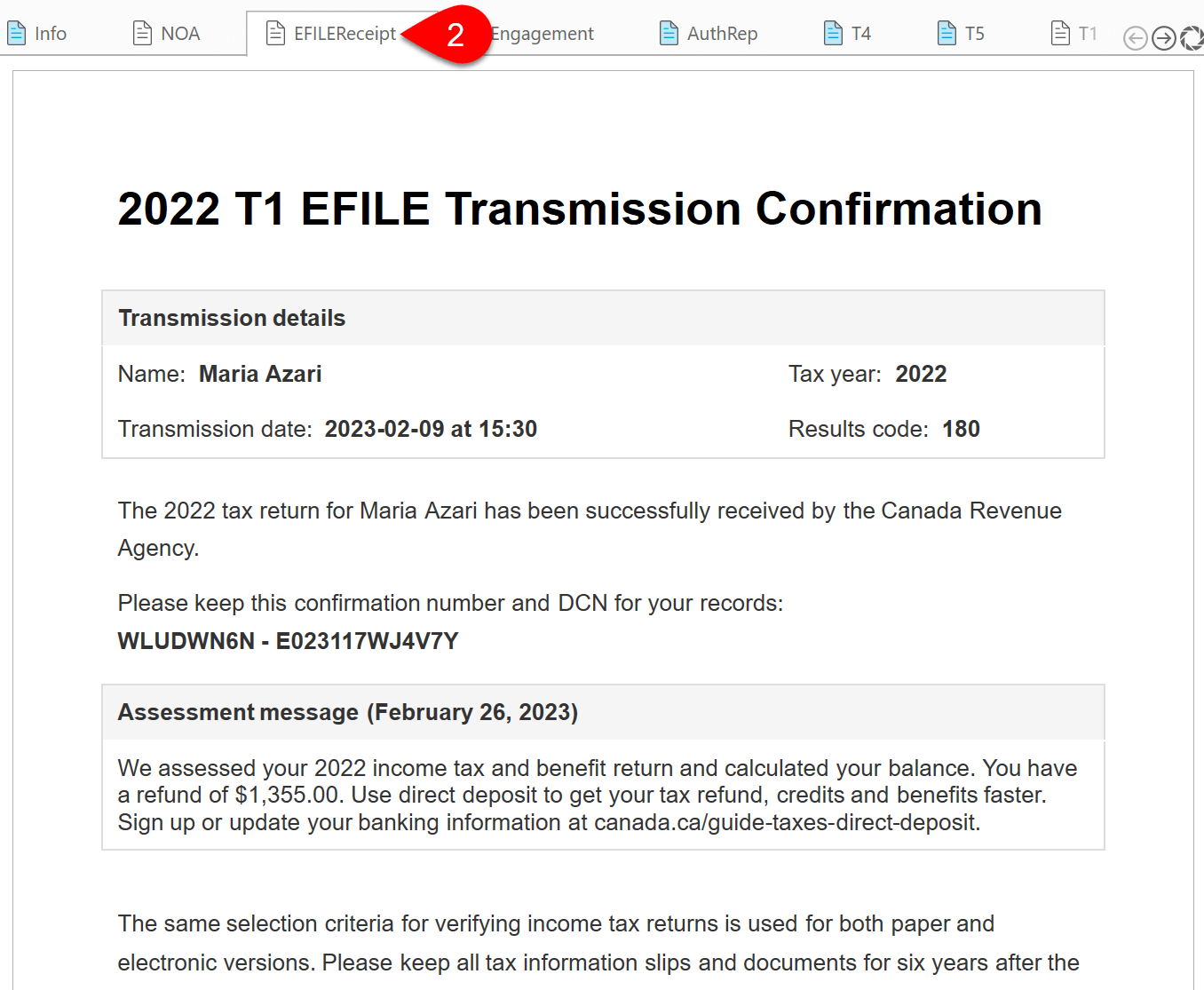

TaxCycle records the downloaded data on the ExpressNOA worksheet and uses it in places in the return. For example, on the EFILEReceipt template.

You may see more than one in the return worksheet if you download a reassessment issued on a different date.

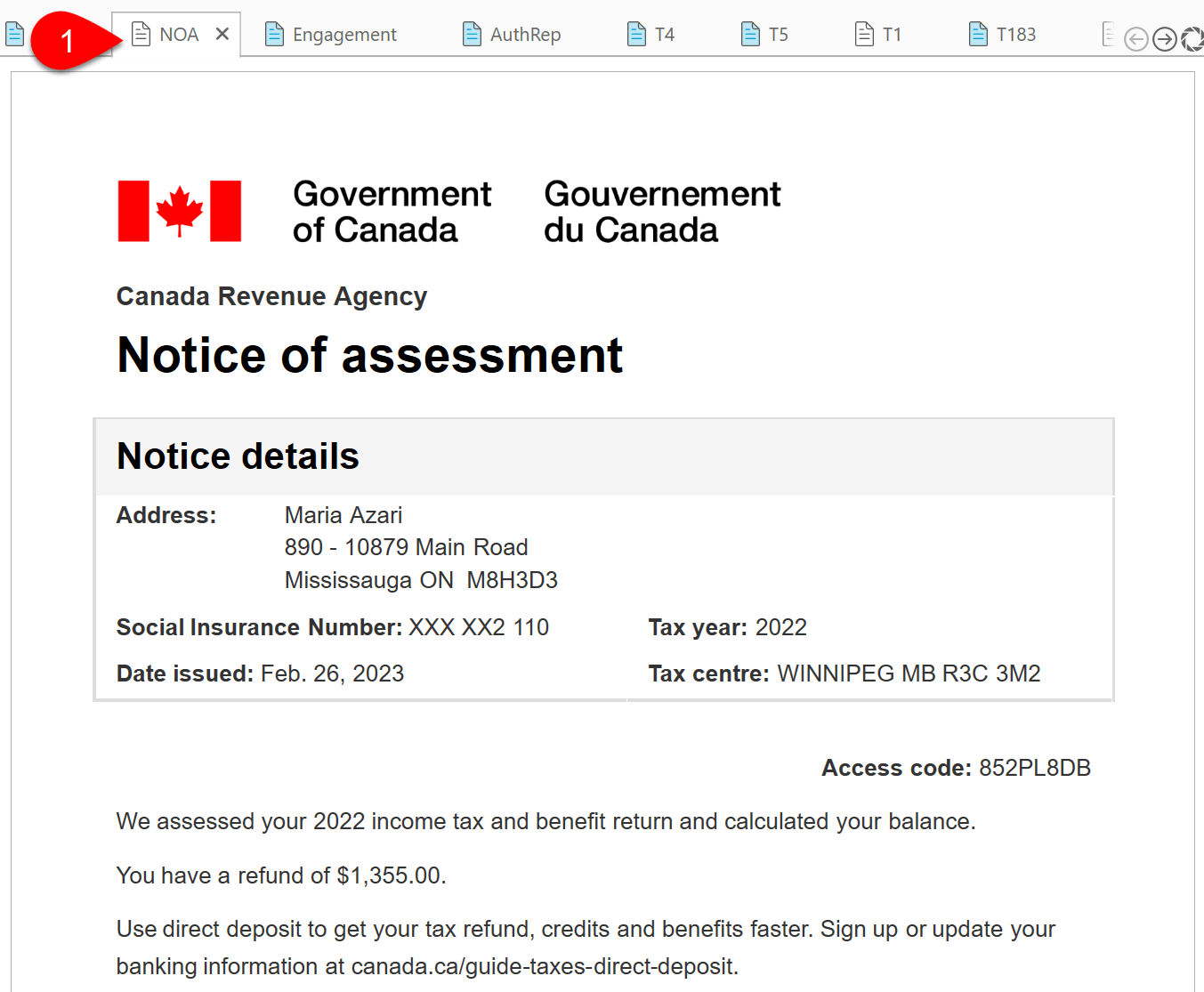

View or Print a NOA

- To print a copy of the notice of assessment for your client, print the NOA form.

- The EFILEReceipt also contains the assessment message from any ExpressNOA worksheets in the file.

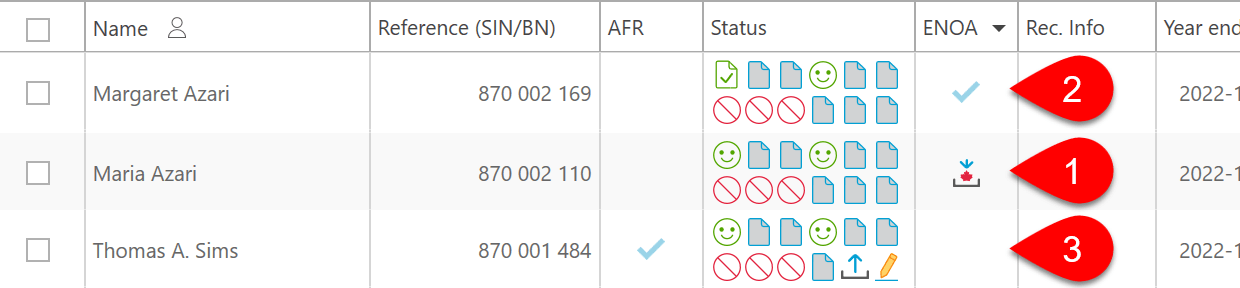

Client Manager

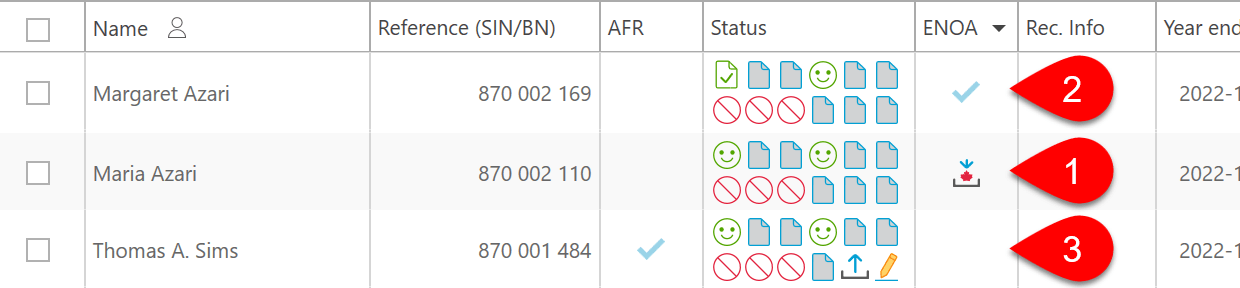

The ENOA column in the Client Manager shows the status:

- If a row contains the Express NOA logo, the client signed up for Express NOA and an assessment may be available for download.

- If the column has a check mark, the notice of assessment was collected.

- If you dismiss the EFILE transmission and start again, or initiate a ReFILE transmission for an amended return, the column returns to a blank state.

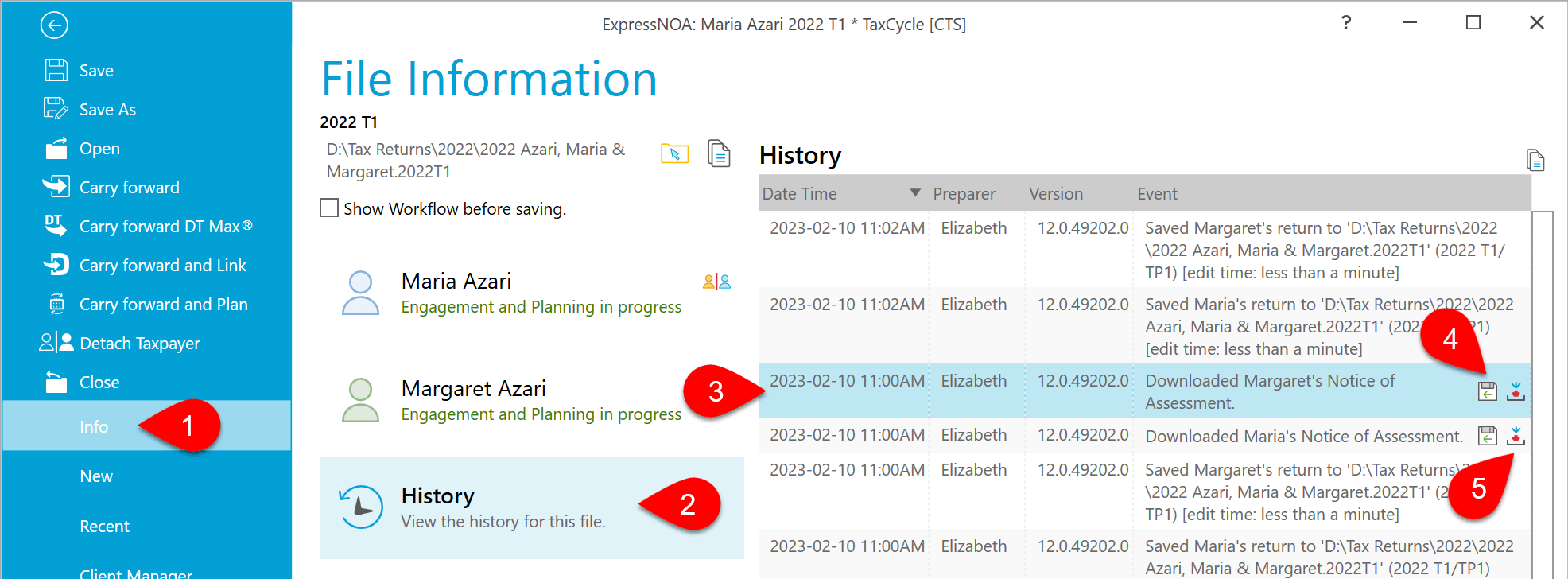

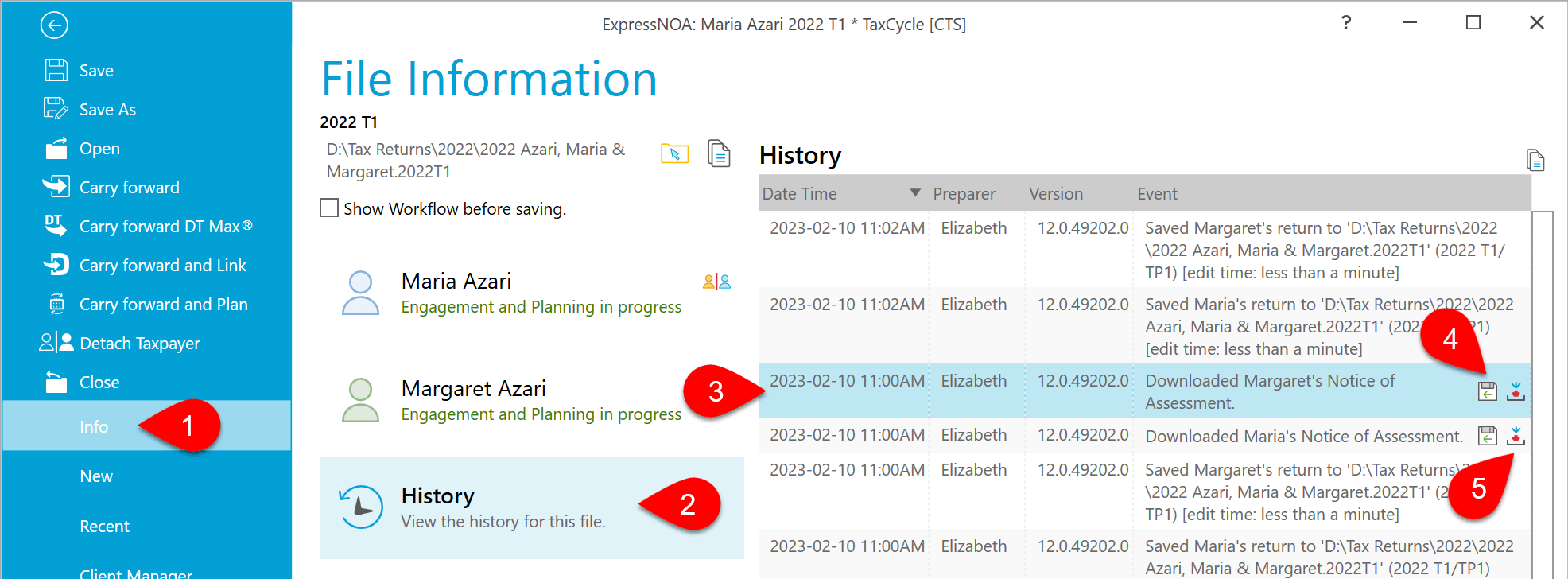

History and Workflow

Each download of a notice of assessment is recorded in the history for the client, and is tracked in the taxpayer's workflow status.

- Go to the File menu, then click on Info.

- Click on History.

- Find the record of the download in the list.

- Click the save button to save a copy of the XML file that was downloaded from the CRA.

- Click the Express NOA button to download the HTML copy of the notice of assessment.

- TaxCycle also updates the workflow information for the taxpayer. See the Workflow Groups and Tasks help topic.