Updated: 2025-03-07

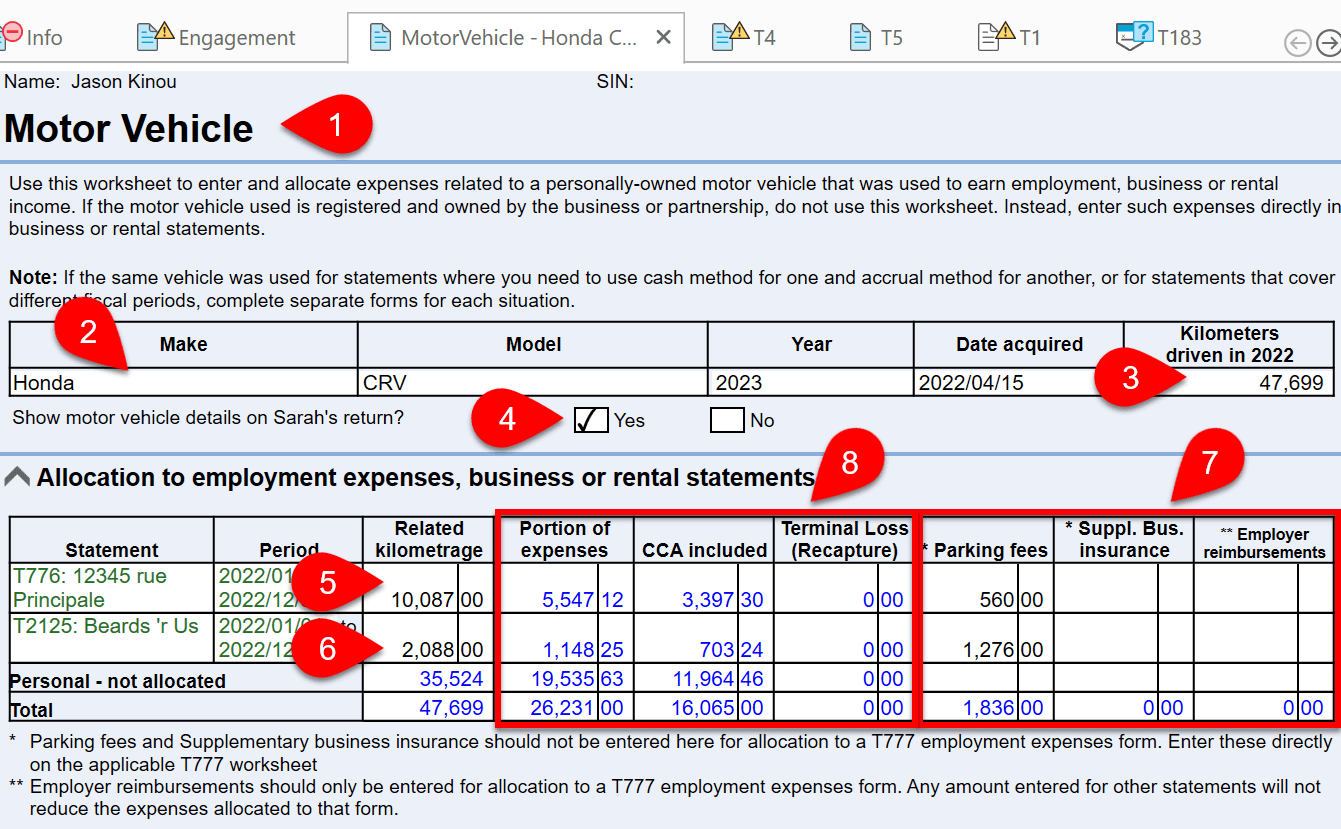

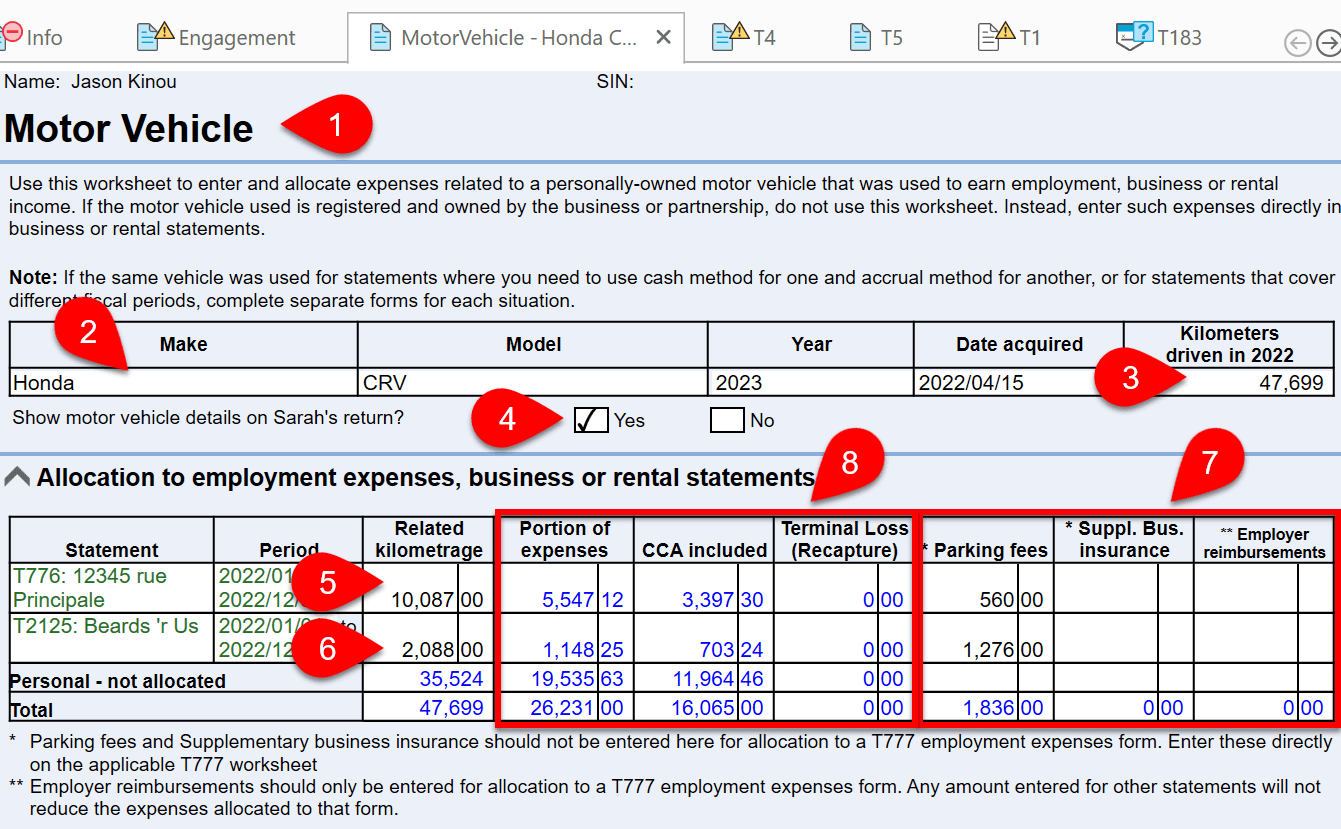

Use the MotorVehicle worksheet to enter details of vehicle expenses and associate them with an income statement (T776, T2125, T2121, T2042, T1163) or employment expenses claim (T777WS).

Allocation to Income Statements

Before starting a Motor Vehicle worksheet, create at least one income statement with which you want to associate those expenses. This allows you to allocate kilometres to the correct statement.

Generally, if the motor vehicle was used for both personal and business trips, enter expenses on a Motor Vehicle worksheet and TaxCycle will calculate the business-use portion of the expenses. If the vehicle was used 100% for the business, you may enter the expenses directly on the income statement.

- Create one MotorVehicle worksheet for each vehicle used in the return. You can then search for a vehicle by make and model.

- Enter the make, model, year and date acquired for the vehicle at the top of the worksheet.

- Enter the total kilometres driven during the tax year.

- If the spouse or partner will also claim expenses from this vehicle on their return, check the box to show the worksheet in the other person's return.

- Allocate a portion of the kilometres driven in the year to earn employment, business or rental income to an income statement.

- If the return contains more than one income statement, they all appear on the worksheet, making it possible to share the expenses with multiple income statements by allocating kilometres to each statement. When doing this, always ensure that the total allocated kilometres does not exceed the total kilometres driven in the year.

- Enter parking fees, supplemental business insurance and employer reimbursements applicable to each income in this table.

- TaxCycle calculates the portion of expenses, including CCA and terminal loss for each income statement based on details provided further down the worksheet.

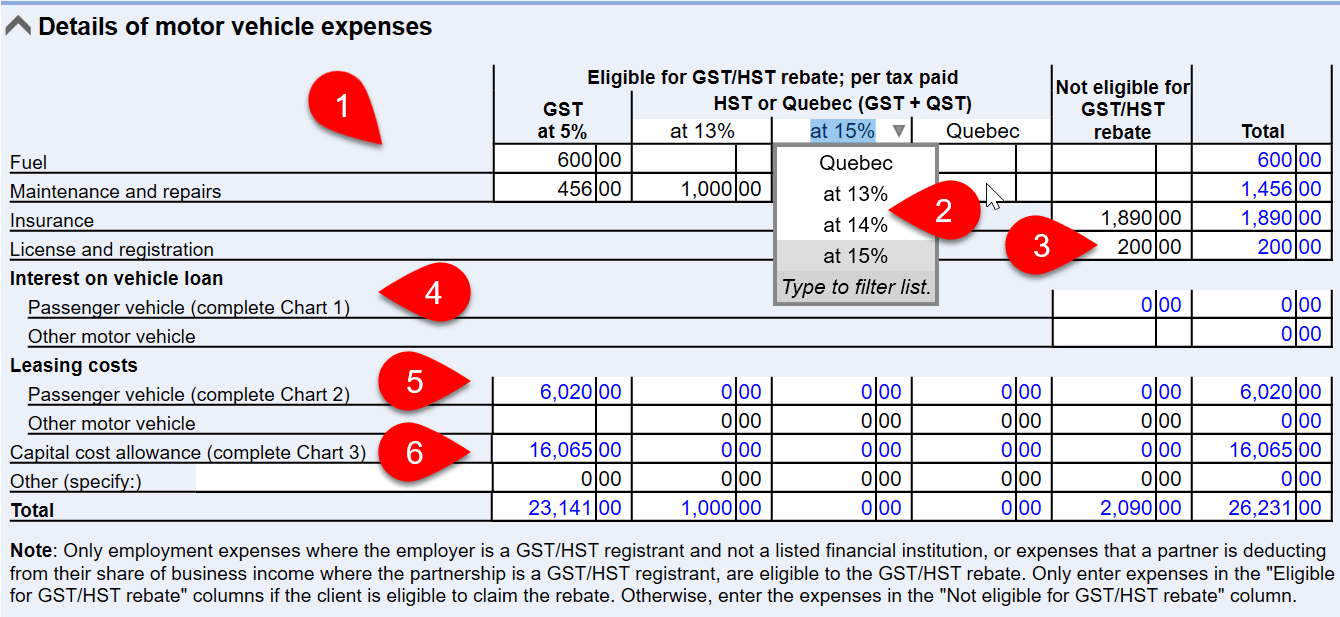

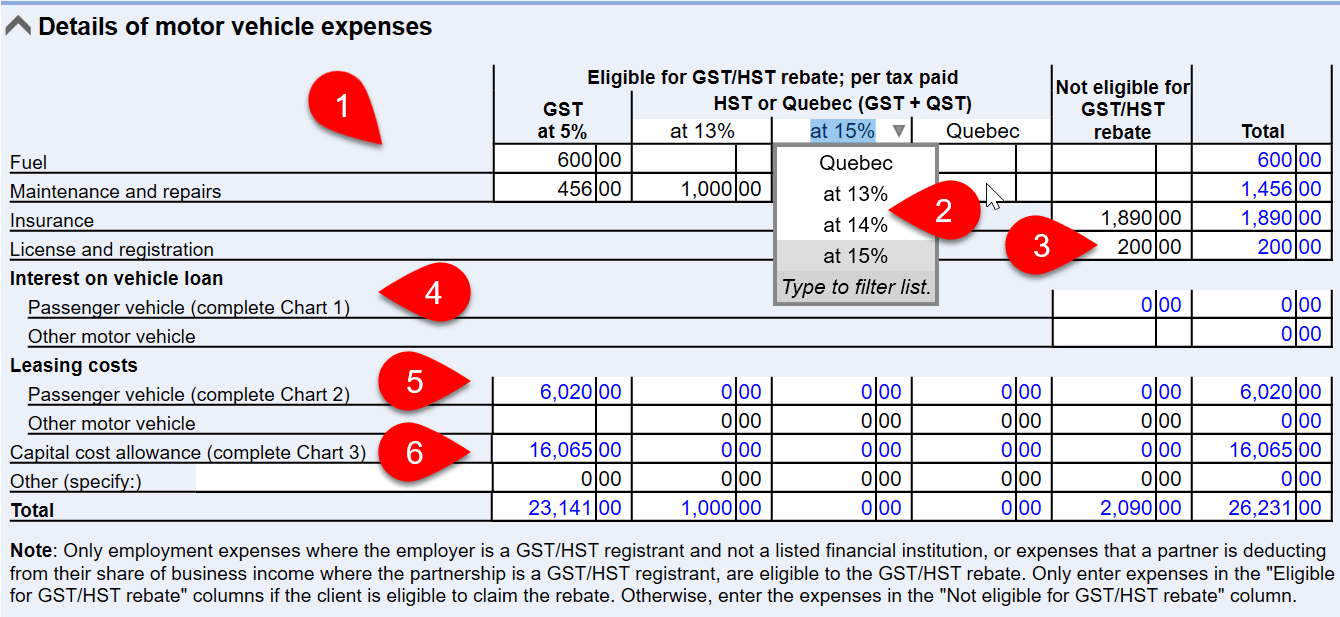

Detailed Expenses

- Enter fuel, maintenance and other expenses in the Details of motor vehicle expenses table.

- If eligible, split expenses that qualify for the GST/HST rebate into separate columns. You can select a different rate in the column heading.

- If the taxpayer is not applying for the GST/HST rebate, enter the expense in the Not eligible column.

- Interest on a vehicle loan for a passenger vehicle flows from chart 1. For other motor vehicles, enter the amounts here.

- Leasing costs for a passenger vehicle flow from chart 2. For other motor vehicles, enter the amount here.

- Vehicle capital cost allowance (CCA) flows from chart 2. For other motor vehicles, enter the amount here.

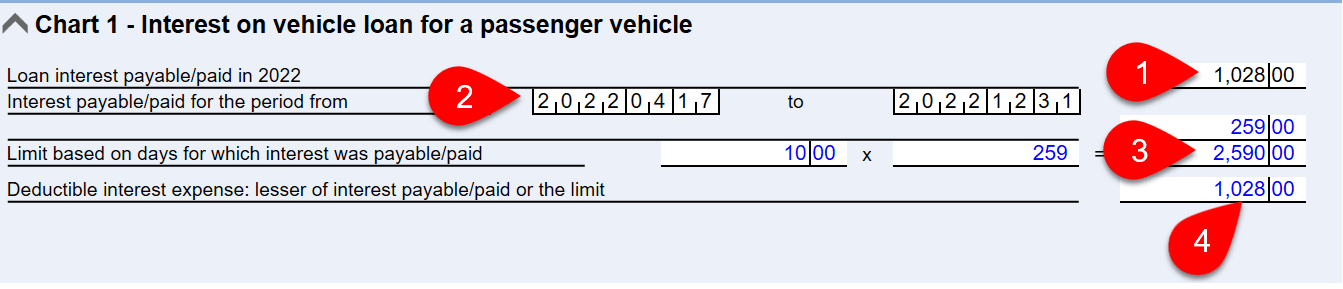

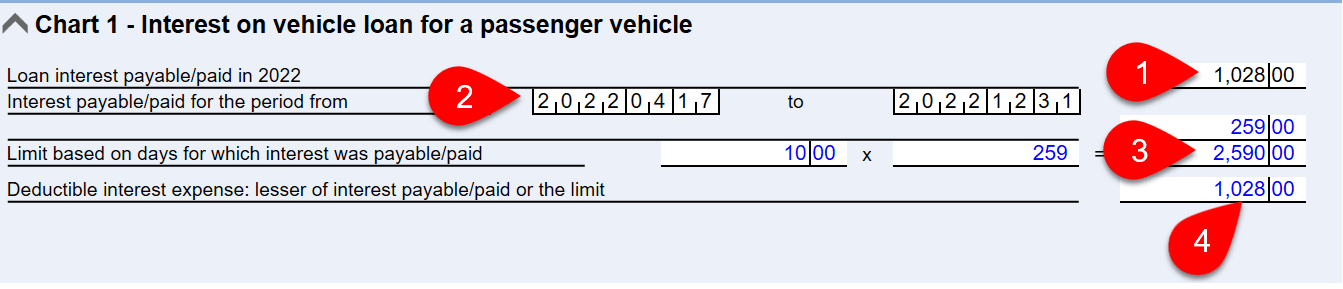

Chart 1: Interest on Vehicle Loan

For passenger vehicles, enter the details of loan interest in Chart 1. For other motor vehicles, enter the amount in the Details of motor vehicle expenses table.

- Enter the total interest paid or payable during the year.

- Enter the start and end date interest was paid or payable.

- TaxCycle calculates the limit for the deductible interest.

- The claimable amount flows back to the Details of motor vehicle expenses table to allocate it to the income statements.

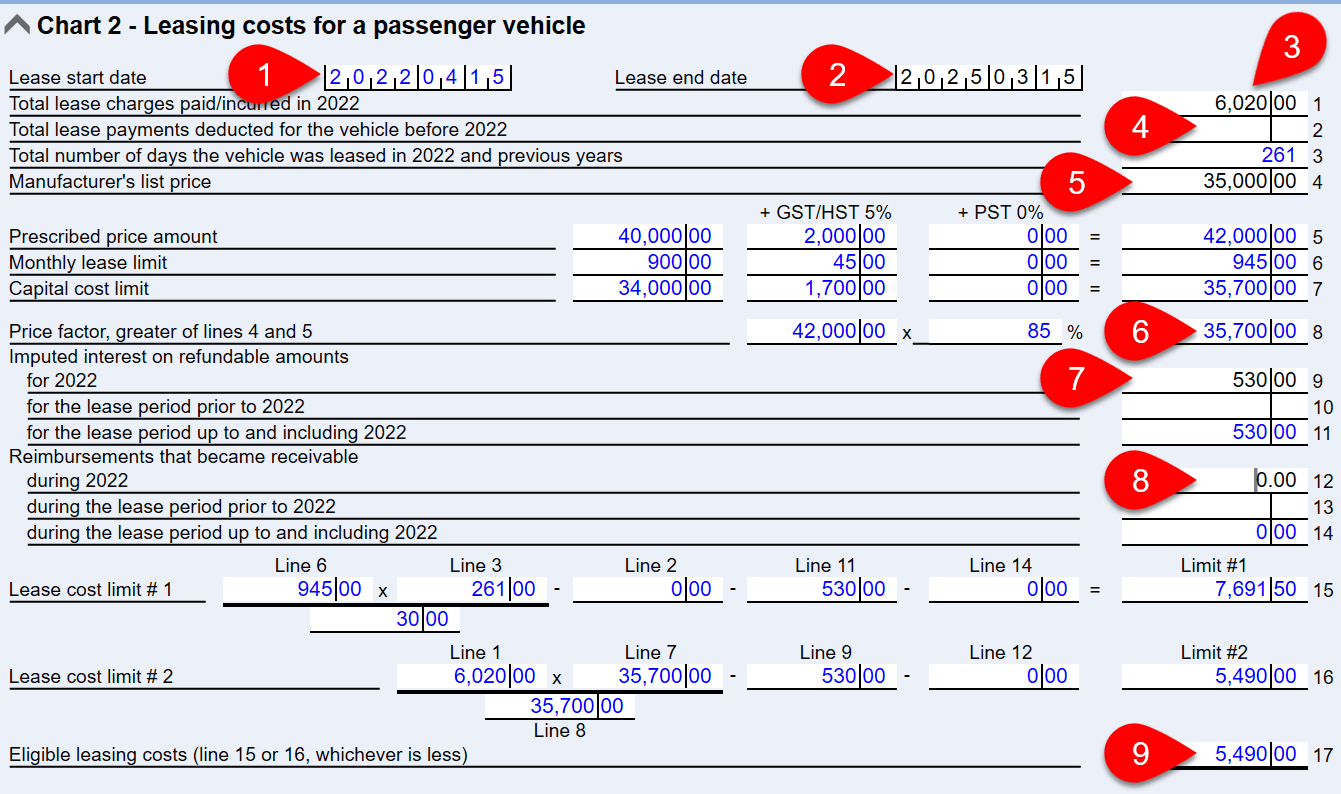

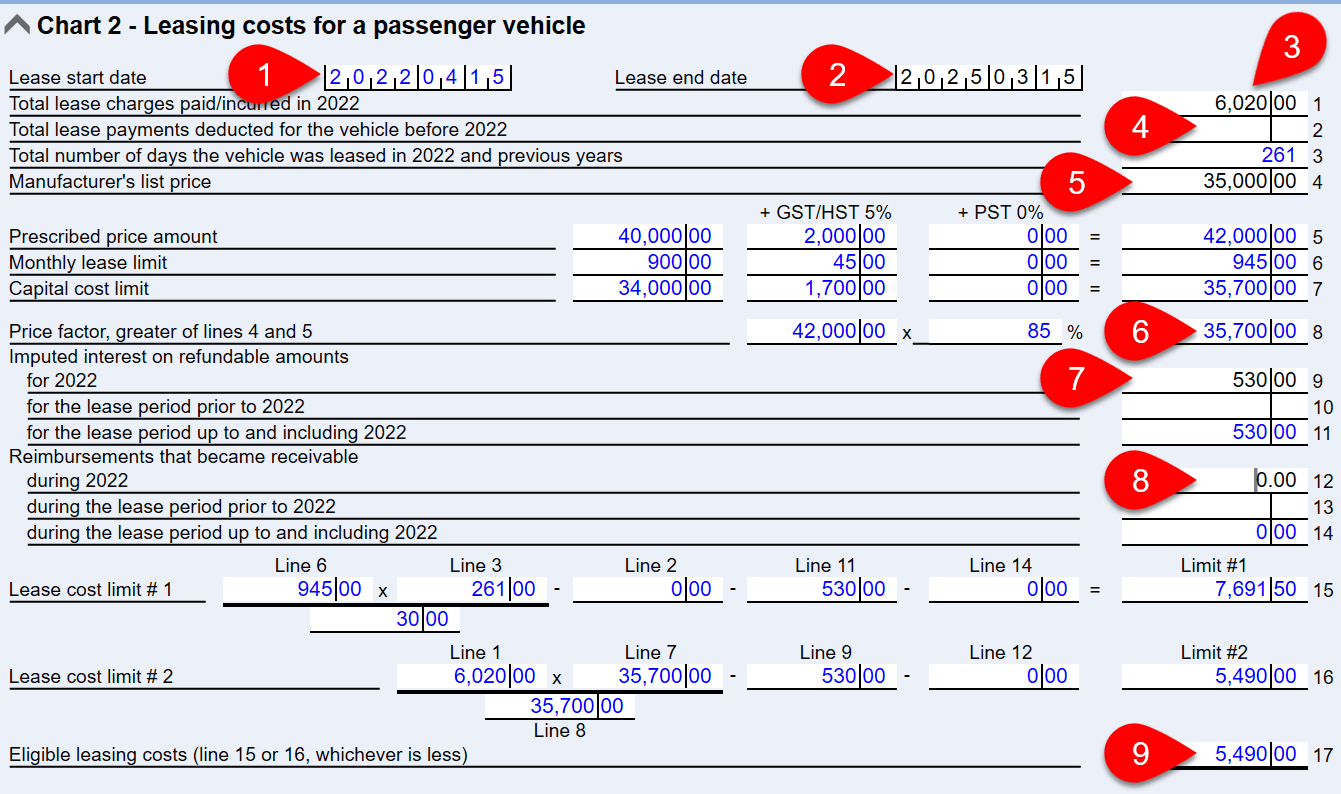

Chart 2: Leasing Costs

For passenger vehicles, enter the details of the lease in Chart 2. For other motor vehicles, enter the amount in the Details of motor vehicle expenses table.

- The lease start date flows from the acquisition date on the first page of the worksheet.

- Enter the lease end date.

- Enter the total lease charges during the year.

- Enter total lease payments deducted in prior years.

- Enter the manufacturers list price.

- TaxCycle calculates GST/HST and any PST, and the price factor.

- Enter any interest on refundable amounts.

- Enter any reimbursements that became receivable.

- TaxCycle calculates and selects the applicable lease cost limit and flows that amount back to the Details of motor vehicle expenses table to allocate it to the income statements.

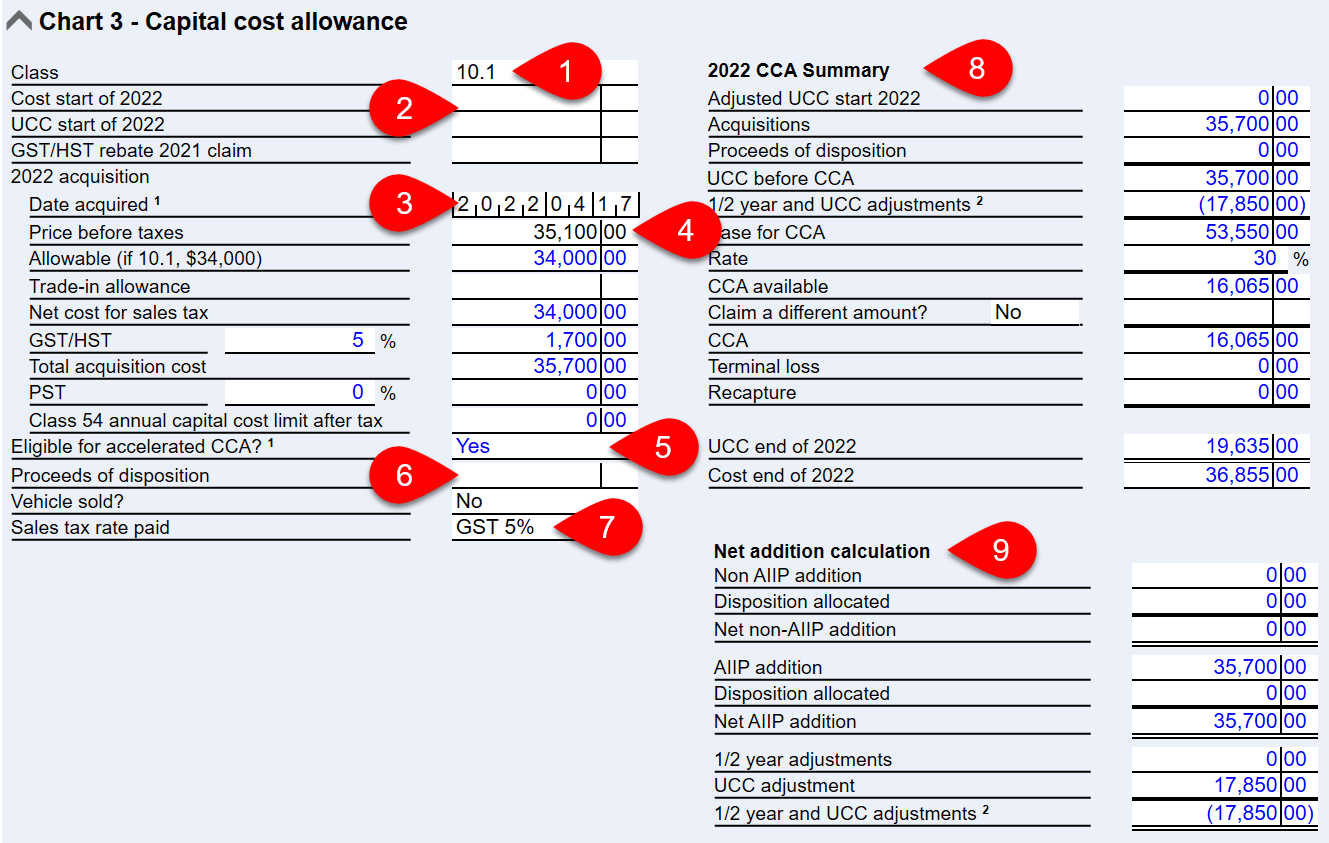

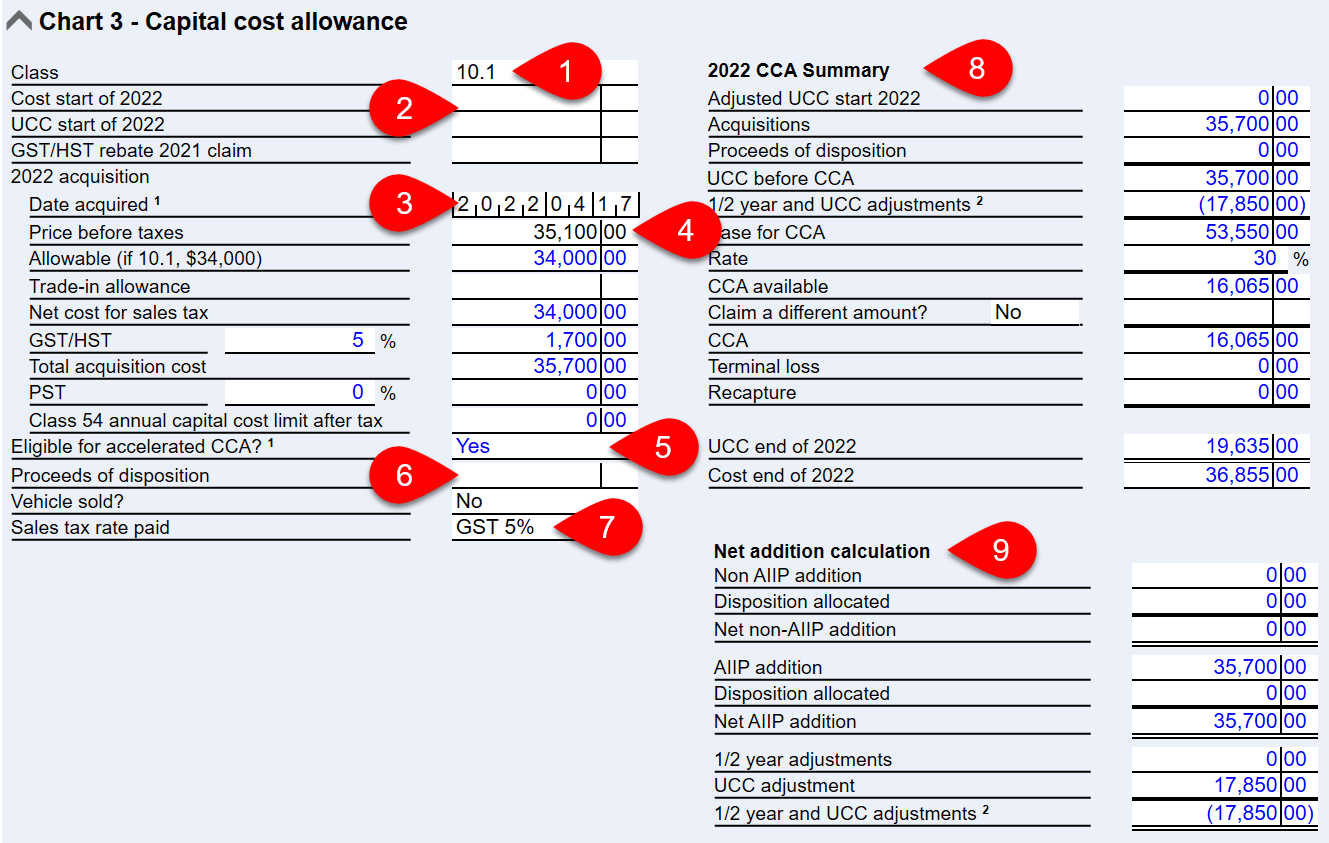

Chart 3: Vehicle CCA

Scroll down to Chart 3 to calculate the capital cost allowance (CCA). Calculated amounts flow back to the table at the top of the worksheet, then to the CCA Worksheet and to the income statement.

- Select the applicable vehicle CCA class.

- Enter the cost and the undepreciated capital cost (UCC) at the start of the year. If you carried forward the return, TaxCycle inserts these amounts.

- For any current-year additions, enter the acquisition date.

- Enter the price before taxes.

- TaxCycle uses the acquisition date to automatically determine eligibility for Accelerated CCA.

- If the vehicle was sold during the year, enter the proceeds of the disposition and answer Yes to the vehicle sold question.

- If you need to change the sales tax rate for the transaction, select a different rate from the drop-down menu.

- TaxCycle calculates the applicable CCA and flows that amount back to the Details of motor vehicle expenses table to allocate it to the income statements.

- Details of Accelerated CCA calculations show in the Net addition calculation table, when applicable.